-

Kasatkina cannot wait to be back after outpouring of Melbourne support

Kasatkina cannot wait to be back after outpouring of Melbourne support

-

Chile blaze victims plead for help from razed neighborhoods

-

Russian minister visits Cuba as Trump ramps up pressure on Havana

Russian minister visits Cuba as Trump ramps up pressure on Havana

-

World order in 'midst of a rupture': Canada PM Carney tells Davos

-

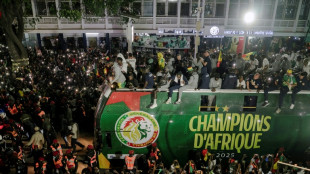

Senegal's 'historic' AFCON champs honoured with parade, presidential praise

Senegal's 'historic' AFCON champs honoured with parade, presidential praise

-

Audi unveil new car for 2026 Formula One season

-

Man City humiliated, holders PSG stumble, Arsenal remain perfect

Man City humiliated, holders PSG stumble, Arsenal remain perfect

-

Vinicius, Real Madrid need 'love' not whistles: Bellingham

-

Late Suarez winner stops Champions League holders PSG in Lisbon

Late Suarez winner stops Champions League holders PSG in Lisbon

-

Frank seeks Spurs 'momentum' after beating Dortmund

-

Jesus' 'dream' brace at Inter fires Arsenal into Champions League last 16

Jesus' 'dream' brace at Inter fires Arsenal into Champions League last 16

-

US regulator appeals Meta's court victory in monopoly case

-

Netflix shares fall as revenue appears to stall

Netflix shares fall as revenue appears to stall

-

Tottenham beat 10-man Dortmund to hand Frank stay of execution

-

Mbappe, Vinicius help Real Madrid thrash Monaco in Champions League

Mbappe, Vinicius help Real Madrid thrash Monaco in Champions League

-

Men's Fashion Week kicks off in Paris with Louis Vuitton show

-

Jesus fires Arsenal past Inter and into Champions League last 16

Jesus fires Arsenal past Inter and into Champions League last 16

-

Muted anniversary: Trump marks first year back with grievances

-

Humiliated Man City have to 'change the dynamic': Guardiola

Humiliated Man City have to 'change the dynamic': Guardiola

-

Golden State's Butler out for season with ACL injury: agent

-

Venezuela woos US oil majors with new investment czar

Venezuela woos US oil majors with new investment czar

-

Wales Six Nations strike threat just 'speculation' for Tandy

-

Syria government agrees new truce with Kurdish forces

Syria government agrees new truce with Kurdish forces

-

Russian interior minister in Cuba, which faces pressure from Trump

-

US finalizes rule for deep-sea mining beyond its waters

US finalizes rule for deep-sea mining beyond its waters

-

Iran protest crackdown latest developments

-

Muted anniversary: Trump marks first year back with familiar grievances

Muted anniversary: Trump marks first year back with familiar grievances

-

Man City stunned by Bodo/Glimt in epic Champions League upset

-

Cooler temperatures offer respite for Chile firefighters

Cooler temperatures offer respite for Chile firefighters

-

Scientists plan deep-sea expedition to probe 'dark oxygen'

-

Howe calls on Newcastle to use spirit of Robson to inspire win over PSV

Howe calls on Newcastle to use spirit of Robson to inspire win over PSV

-

Massive US presence makes its mark on Davos

-

Ter Stegen to join Girona on loan: Barca coach Flick

Ter Stegen to join Girona on loan: Barca coach Flick

-

France PM forces part of budget through parliament without vote

-

Scotland boss Townsend picks veterans Gray and Cherry for Six Nations

Scotland boss Townsend picks veterans Gray and Cherry for Six Nations

-

Record try-scorer Penaud faces French axe for Six Nations

-

UK approves plans for Chinese mega-embassy in London

UK approves plans for Chinese mega-embassy in London

-

Rosenior keen to build winning ties with 'world-class' Fernandez

-

Dakar delights in Senegal parade honouring AFCON champions

Dakar delights in Senegal parade honouring AFCON champions

-

UK comedian Russell Brand in court on two new rape charges

-

France set to face New Zealand with second-string squad

France set to face New Zealand with second-string squad

-

Eyeing China, EU moves to ban 'high-risk' foreign suppliers from telecoms networks

-

Struggling Suryakumar will not adapt style to find form before T20 World Cup

Struggling Suryakumar will not adapt style to find form before T20 World Cup

-

World stocks sink, gold hits high on escalating trade war fears

-

Easier said than done for US to apply tariffs on single EU states

Easier said than done for US to apply tariffs on single EU states

-

Canada military models response to US invasion: report

-

Salah returns to Liverpool training after AFCON

Salah returns to Liverpool training after AFCON

-

Milan menswear shows add bling with brooches

-

Scotland recall Gray, Cherry for Six Nations

Scotland recall Gray, Cherry for Six Nations

-

Scheib storms to Kronplatz giant slalom victory as Brignone impresses in World Cup return

Stock markets advance as odds for another Fed rate cut grow

Investors on Tuesday welcomed more dovish comments from Federal Reserve officials reinforcing hopes it will cut interest rates next month, while a tech-led rally on Wall Street soothed recent AI bubble worries.

After a swoon in recent weeks, optimism appeared to be returning to trading floors as the chances of a third successive reduction in US borrowing costs increases as a weakening labour market offsets stubbornly high inflation.

Fed governor Christopher Waller told Fox Business on Monday that inflation was not his main worry and that his "concern is mainly the labour market, in terms of our dual mandate" of the Fed to support jobs and keep a cap on prices.

"So I'm advocating for a rate cut at the next meeting."

His comments echoed those of San Francisco Fed president Mary Daly, who told the Wall Street Journal: "On the labour market, I don't feel as confident we can get ahead of it."

She added that the risk of a bust higher in inflation was a lower risk as the impact of US President Donald Trump's tariffs had been less than expected.

New York Fed boss John Williams said Friday that he still sees "room for a further adjustment" at the bank's December 9-10 policy meeting.

Analysts pointed out that the lack of pushback from the Fed on the remarks suggested boss Jerome Powell backed them and was preparing for another cut.

Traders now see about a 90 percent chance of a reduction, having been around 35 percent last week.

The prospect of lower borrowing rates pushed Wall Street sharply higher for a second successive day Monday, with the S&P 500 up around 1.6 percent.

The Nasdaq charged 2.7 percent higher thanks to a surge in market heavyweights including Alphabet, Meta and Amazon.

And the gains continued in Asia, which built on Monday's strong performance.

Tokyo, Hong Kong, Shanghai, Sydney, Seoul, Taipei, Mumbai, Bangkok and Jakarta all advanced, though there were pullbacks in Manila, Singapore and Wellington.

London, Paris and Frankfurt opened higher.

Tech firms have enjoyed a revival after suffering a period of selling in recent weeks, owing to concerns that the AI-led splurge this year may have pushed valuations too far and the huge investments made in the sector could take time to come to fruition.

While there is debate about whether the advance has more legs, observers say the outlook is more nuanced.

"AI remains one of the most powerful forces reshaping markets, but the tone is changing," wrote Saxo Markets' Charu Chanana.

"Strong earnings from leading chipmakers... reassure investors that demand is real, yet the sharp swings in market reaction show that enthusiasm now sits alongside questions around sustainability, profitability, and execution.

"The broad 'everything goes up' phase of the AI trade is fading. What replaces it is a more nuanced market: one that rewards fundamentals over narratives."

She added that investors now had to "separate the durable players from those caught up in the momentum".

Sentiment was also given a lift after Trump praised "extremely strong" US-China relations following a call with his Chinese counterpart Xi Jinping.

He also said he will visit China in April and that Xi will make a trip to Washington later in 2026.

However, he made no mention of the fact that they had spoken about the ever-sensitive issue of Taiwan. China's foreign ministry said Trump had told Xi the United States "understands how important the Taiwan question is to China".

The call came after the pair met in late October for the first time since 2019, engaging in closely watched trade talks between the world's top two economies.

- Key figures at around 0815 GMT -

Tokyo - Nikkei 225: UP 0.1 percent at 48,659.52 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 25,894.55 (close)

Shanghai - Composite: UP 0.9 percent at 3,870.02 (close)

London - FTSE 100: UP 0.1 percent at 9,542.56

Euro/dollar: UP at $1.1526 from $1.1523 on Monday

Pound/dollar: UP at $1.3125 from $1.3110

Dollar/yen: DOWN at 156.61 yen from 156.81 yen

Euro/pound: DOWN at 87.82 pence from 87.91 pence

West Texas Intermediate: DOWN 0.6 percent at $58.50 per barrel

Brent North Sea Crude: DOWN 0.6 percent at $62.99 per barrel

New York - Dow: UP 0.4 percent at 46,448.27 (close)

W.Huber--VB