-

North produces enough nuclear material a year for 10-20 weapons: S. Korea president

North produces enough nuclear material a year for 10-20 weapons: S. Korea president

-

Japan ex-PM Abe's alleged killer faces verdict

-

Climate change fuels disasters, but deaths don't add up

Climate change fuels disasters, but deaths don't add up

-

Stocks stable after tariff-fuelled selloff but uncertainty boosts gold

-

What growth?: Taiwan's traditional manufacturers miss out on export boom

What growth?: Taiwan's traditional manufacturers miss out on export boom

-

'Super-happy' Sabalenka shines as Alcaraz gets set at Australian Open

-

With monitors and lawsuits, Pakistanis fight for clean air

With monitors and lawsuits, Pakistanis fight for clean air

-

Sabalenka sets up potential Raducanu showdown at Australian Open

-

Chile president picks Pinochet lawyers as ministers of human rights, defense

Chile president picks Pinochet lawyers as ministers of human rights, defense

-

Osaka says 'I'm a little strange' after Melbourne fashion statement

-

UN report declares global state of 'water bankruptcy'

UN report declares global state of 'water bankruptcy'

-

Trump heads for Davos maelstrom over Greenland

-

Ukraine's Oliynykova wants Russian, Belarusian players banned from tennis

Ukraine's Oliynykova wants Russian, Belarusian players banned from tennis

-

Kasatkina cannot wait to be back after outpouring of Melbourne support

-

Chile blaze victims plead for help from razed neighborhoods

Chile blaze victims plead for help from razed neighborhoods

-

Russian minister visits Cuba as Trump ramps up pressure on Havana

-

World order in 'midst of a rupture': Canada PM Carney tells Davos

World order in 'midst of a rupture': Canada PM Carney tells Davos

-

Senegal's 'historic' AFCON champs honoured with parade, presidential praise

-

Audi unveil new car for 2026 Formula One season

Audi unveil new car for 2026 Formula One season

-

Man City humiliated, holders PSG stumble, Arsenal remain perfect

-

Vinicius, Real Madrid need 'love' not whistles: Bellingham

Vinicius, Real Madrid need 'love' not whistles: Bellingham

-

Late Suarez winner stops Champions League holders PSG in Lisbon

-

Frank seeks Spurs 'momentum' after beating Dortmund

Frank seeks Spurs 'momentum' after beating Dortmund

-

Jesus' 'dream' brace at Inter fires Arsenal into Champions League last 16

-

US regulator appeals Meta's court victory in monopoly case

US regulator appeals Meta's court victory in monopoly case

-

Netflix shares fall as revenue appears to stall

-

Tottenham beat 10-man Dortmund to hand Frank stay of execution

Tottenham beat 10-man Dortmund to hand Frank stay of execution

-

Mbappe, Vinicius help Real Madrid thrash Monaco in Champions League

-

Men's Fashion Week kicks off in Paris with Louis Vuitton show

Men's Fashion Week kicks off in Paris with Louis Vuitton show

-

Jesus fires Arsenal past Inter and into Champions League last 16

-

Muted anniversary: Trump marks first year back with grievances

Muted anniversary: Trump marks first year back with grievances

-

Humiliated Man City have to 'change the dynamic': Guardiola

-

Golden State's Butler out for season with ACL injury: agent

Golden State's Butler out for season with ACL injury: agent

-

Venezuela woos US oil majors with new investment czar

-

Wales Six Nations strike threat just 'speculation' for Tandy

Wales Six Nations strike threat just 'speculation' for Tandy

-

Syria government agrees new truce with Kurdish forces

-

Russian interior minister in Cuba, which faces pressure from Trump

Russian interior minister in Cuba, which faces pressure from Trump

-

US finalizes rule for deep-sea mining beyond its waters

-

Iran protest crackdown latest developments

Iran protest crackdown latest developments

-

Muted anniversary: Trump marks first year back with familiar grievances

-

Man City stunned by Bodo/Glimt in epic Champions League upset

Man City stunned by Bodo/Glimt in epic Champions League upset

-

Cooler temperatures offer respite for Chile firefighters

-

Scientists plan deep-sea expedition to probe 'dark oxygen'

Scientists plan deep-sea expedition to probe 'dark oxygen'

-

Howe calls on Newcastle to use spirit of Robson to inspire win over PSV

-

Massive US presence makes its mark on Davos

Massive US presence makes its mark on Davos

-

Ter Stegen to join Girona on loan: Barca coach Flick

-

France PM forces part of budget through parliament without vote

France PM forces part of budget through parliament without vote

-

Scotland boss Townsend picks veterans Gray and Cherry for Six Nations

-

Record try-scorer Penaud faces French axe for Six Nations

Record try-scorer Penaud faces French axe for Six Nations

-

UK approves plans for Chinese mega-embassy in London

US stocks gain momentum after tech-fueled Asia rout

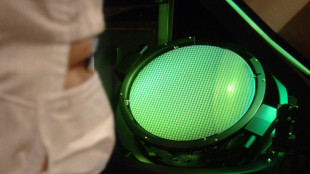

US markets advanced Friday while European counterparts marked time, in response to sharp losses in Asia at the end of a week which saw heightened fears of a bursting AI bubble.

A blockbuster earnings report from chip bellwether Nvidia on Wednesday seemed to soothe concerns that vast investments in the artificial intelligence sector may have been overdone.

But Nvidia shares closed one percent lower on Wall Street as warnings grew that the tech-led rally may have run its course across equities. This had seen several markets hit record highs and companies clock eye-watering capitalizations.

Adding to unease were mixed US September jobs data released Thursday that raised the possibility that the Federal Reserve could decide against cutting interest rates in December.

That unease spread to Asia, with Tokyo, Hong Kong and Shanghai all ending the week down almost 2.5 percent at the close.

The clouds began to clear to a degree, however, as the Dow climbed 1.1 percent by end-Friday, while the tech-heavy Nasdaq added 0.9 percent and the broader-based S&P 500 rose 1.0 percent.

"This week's sharp sell-off in US stocks and cryptocurrencies briefly stalled as Fed December rate cut expectations increased from 41 percent to 73 percent after New York Fed President John Williams suggested the Fed may cut rates again soon," said Axel Rudolph, senior technical analyst at IG.

But Angelo Kourkafas of Edward Jones added of the central bank: "The fact that we're not going to get some key data does not make their job easier."

This week, the US Bureau of Labor Statistics said it would not publish full employment and consumer inflation reports for the month of October -- while November figures will only be released after the next central bank interest rate meeting.

This adds to the fog that Fed officials have to navigate as they mull their next rate decision.

Europe lacked direction as London ended just a sliver in the green. Paris was flat -- although Ubisoft provided a glimmer of light -- while Frankfurt lost 0.8 percent.

French video game company Ubisoft resumed trading in Paris, a week after stunning investors by postponing its results announcement without an explanation, triggering speculation in the video gaming world.

The "Assassin's Creed" maker said Friday the move was due to a simple "restatement" of its half-yearly results after new auditors found problems with the way it had accounted for a partnership.

The rush from risk assets saw digital currrency bitcoin hit a seven-month low at $81,569.79 before pulling back to around $84,490 -- extending a sell-off suffered since its record high above $126,200 last month.

"The price action across markets has been prolific, and we've seen some truly impressive reversals in risk assets," said analyst Chris Weston at broker Pepperstone.

"Sentiment in so many markets remains highly challenged, and we've seen new evidence that managers are dumping their 2025 winners -- raising expectations that the path of least resistance is for risk to trade lower in the near-term," he added.

- Key figures at around 2105 GMT -

New York - Dow: UP 1.1 percent at 46,245.41 points (close)

New York - S&P 500: UP 1.0 percent at 6,602.99 (close)

New York - Nasdaq Composite: UP 0.9 percent at 22,273.08 (close)

London - FTSE 100: UP 0.1 percent at 9,539.71 (close)

Paris - CAC 40: FLAT at 7,982.65 (close)

Frankfurt - DAX: DOWN 0.8 percent at 23,091.87 (close)

Tokyo - Nikkei 225: DOWN 2.4 percent at 48,625.88 (close)

Hong Kong - Hang Seng Index: DOWN 2.4 percent at 25,220.02 (close)

Shanghai - Composite: DOWN 2.5 percent at 3,834.89 (close)

Dollar/yen: DOWN at 156.39 yen from 157.55 yen on Thursday

Euro/dollar: DOWN at $1.1519 from $1.1525

Pound/dollar: UP at $1.3107 from $1.3070

Euro/pound: DOWN at 87.88 from 88.18 pence

Brent North Sea Crude: DOWN 1.3 percent at $62.56 per barrel

West Texas Intermediate: DOWN 1.6 percent at $58.06 per barrel

T.Ziegler--VB