-

Trump departs for Davos forum again after switching to new plane: AFP

Trump departs for Davos forum again after switching to new plane: AFP

-

Impressive Gauff storms into Australian Open third round

-

Dazzling Chinese AI debuts mask growing pains

Dazzling Chinese AI debuts mask growing pains

-

Medvedev battles into Melbourne third round after early scare

-

Denmark's Andresen upstages sprint stars to take Tour Down Under opener

Denmark's Andresen upstages sprint stars to take Tour Down Under opener

-

Turkey's Sonmez soaks in acclaim on historic Melbourne run

-

Sheppard leads Rockets to sink Spurs in Texas derby

Sheppard leads Rockets to sink Spurs in Texas derby

-

Sabalenka shuts down political talk after Ukrainian's ban call

-

Trump's plane returns to air base after 'minor' electrical issue: White House

Trump's plane returns to air base after 'minor' electrical issue: White House

-

Barcelona train crash kills 1 in Spain's second deadly rail accident in days

-

North produces enough nuclear material a year for 10-20 weapons: S. Korea president

North produces enough nuclear material a year for 10-20 weapons: S. Korea president

-

Japan ex-PM Abe's alleged killer faces verdict

-

Climate change fuels disasters, but deaths don't add up

Climate change fuels disasters, but deaths don't add up

-

Stocks stable after tariff-fuelled selloff but uncertainty boosts gold

-

What growth?: Taiwan's traditional manufacturers miss out on export boom

What growth?: Taiwan's traditional manufacturers miss out on export boom

-

'Super-happy' Sabalenka shines as Alcaraz gets set at Australian Open

-

With monitors and lawsuits, Pakistanis fight for clean air

With monitors and lawsuits, Pakistanis fight for clean air

-

Sabalenka sets up potential Raducanu showdown at Australian Open

-

Chile president picks Pinochet lawyers as ministers of human rights, defense

Chile president picks Pinochet lawyers as ministers of human rights, defense

-

Osaka says 'I'm a little strange' after Melbourne fashion statement

-

UN report declares global state of 'water bankruptcy'

UN report declares global state of 'water bankruptcy'

-

Trump heads for Davos maelstrom over Greenland

-

Ukraine's Oliynykova wants Russian, Belarusian players banned from tennis

Ukraine's Oliynykova wants Russian, Belarusian players banned from tennis

-

Kasatkina cannot wait to be back after outpouring of Melbourne support

-

Chile blaze victims plead for help from razed neighborhoods

Chile blaze victims plead for help from razed neighborhoods

-

Russian minister visits Cuba as Trump ramps up pressure on Havana

-

World order in 'midst of a rupture': Canada PM Carney tells Davos

World order in 'midst of a rupture': Canada PM Carney tells Davos

-

Senegal's 'historic' AFCON champs honoured with parade, presidential praise

-

Audi unveil new car for 2026 Formula One season

Audi unveil new car for 2026 Formula One season

-

Man City humiliated, holders PSG stumble, Arsenal remain perfect

-

Vinicius, Real Madrid need 'love' not whistles: Bellingham

Vinicius, Real Madrid need 'love' not whistles: Bellingham

-

Late Suarez winner stops Champions League holders PSG in Lisbon

-

Frank seeks Spurs 'momentum' after beating Dortmund

Frank seeks Spurs 'momentum' after beating Dortmund

-

Jesus' 'dream' brace at Inter fires Arsenal into Champions League last 16

-

US regulator appeals Meta's court victory in monopoly case

US regulator appeals Meta's court victory in monopoly case

-

Netflix shares fall as revenue appears to stall

-

Tottenham beat 10-man Dortmund to hand Frank stay of execution

Tottenham beat 10-man Dortmund to hand Frank stay of execution

-

Mbappe, Vinicius help Real Madrid thrash Monaco in Champions League

-

Men's Fashion Week kicks off in Paris with Louis Vuitton show

Men's Fashion Week kicks off in Paris with Louis Vuitton show

-

Jesus fires Arsenal past Inter and into Champions League last 16

-

Muted anniversary: Trump marks first year back with grievances

Muted anniversary: Trump marks first year back with grievances

-

Humiliated Man City have to 'change the dynamic': Guardiola

-

Golden State's Butler out for season with ACL injury: agent

Golden State's Butler out for season with ACL injury: agent

-

Venezuela woos US oil majors with new investment czar

-

Wales Six Nations strike threat just 'speculation' for Tandy

Wales Six Nations strike threat just 'speculation' for Tandy

-

Syria government agrees new truce with Kurdish forces

-

Russian interior minister in Cuba, which faces pressure from Trump

Russian interior minister in Cuba, which faces pressure from Trump

-

US finalizes rule for deep-sea mining beyond its waters

-

Iran protest crackdown latest developments

Iran protest crackdown latest developments

-

Muted anniversary: Trump marks first year back with familiar grievances

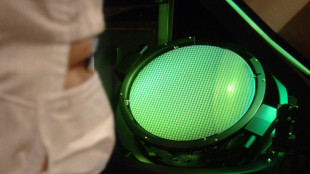

Most markets rise as Nvidia earnings override Fed rate concern

Most Asian markets rallied on Thursday after blowout earnings from chip powerhouse Nvidia cooled worries over an AI bubble and overshadowed a Federal Reserve report that dealt a blow to hopes for a December interest rate cut.

Global equities have struggled of late owing to warnings that valuations -- particularly in the tech sector -- have been overdone and are due a pullback, and possibly a sharp correction, following a record-breaking rally this year.

Wednesday's report from Nvidia -- one of the torchbearers of the AI revolution -- was therefore seen as a bellwether on the industry.

And it topped expectations on fierce demand for its sophisticated chips, with chief executive Jensen Huang brushing off the recent concerns.

"There's been a lot of talk about an AI bubble," he told an earnings call. "From our vantage point, we see something very different."

Shares in the firm -- which last month became the world's first $5 trillion stock -- rose more than five percent in post-market trade, while S&P 500 and Nasdaq futures also soared.

Tech firms led the gains in Asia. South Korea's Samsung and SK hynix, Taiwan's TSMC and Japanese investment giant SoftBank all enjoyed a strong day.

Among broader markets, Tokyo, Seoul and Taipei were up between 1.9 percent and 3.2 percent.

Sydney, Singapore, Wellington, Mumbai, Bangkok and Jakarta were also well up, though Hong Kong and Shanghai reversed their morning gains.

However, SPI Asset Management's Stephen Innes said: "Nvidia's latest forecast has, for now, dulled the sharpest edges of the AI-bubble anxiety that had gripped global markets.

"But make no mistake: this is still a market balancing on a wire stretched between AI euphoria and debt-filled reality.

"Nvidia's results may have bought the tape a reprieve, but they haven't rewritten the script -- they've simply reminded traders why they still cling to the idea that one last Santa-rally can be extracted from the AI supercycle."

The reading helped offset minutes from the Fed's October policy meeting suggesting officials are against cutting rates for the third time in a row next month.

Bets on a string of reductions going into 2026 have been part of the driver of this year's stocks rally -- helped by a softening labour market -- but the persistence of big price gains has started to take a toll.

"Many participants suggested that, under their economic outlooks, it would likely be appropriate to keep the target range unchanged for the rest of the year," the minutes said.

Fed boss Jerome Powell said after last month's decision that a December move was "not a foregone conclusion".

Thursday is expected to see the release of US jobs data for September, which was delayed by the government shutdown. However, the Bureau of Labor Statistics said it would not publish its October figures, instead rolling them into November's full report on December 16.

Rodrigo Catril at National Australia Bank said: "The question that follows is whether there will be enough information in December for Fed officials to make a decision."

He said the removal of the October report "leaves policymakers without a key piece of evidence for the December (policy meeting), prompting traders to sharply scale back expectations for a rate cut next month" to just 28 percent.

The pullback in US rate cut expectations saw the dollar rally to 157.73 yen, its strongest since January, spurring talk of an intervention by Japanese authorities.

Top government spokesman Minoru Kihara told reporters officials were "currently observing one-sided and rapid movements in the foreign exchange market, and we are concerned about it".

The yen was already under pressure from concerns about Japan's fiscal outlook before the expected release of a stimulus package by Prime Minister Sanae Takaichi.

Worries that she will push for more borrowing have hit the currency and sent bond yields to record highs.

- Key figures at around 0705 GMT -

Tokyo - Nikkei 225: UP 2.7 percent at 49,823.94 (close)

Hong Kong - Hang Seng Index: DOWN 0.4 percent at 25,736.84

Shanghai - Composite: DOWN 0.4 percent at 3,931.05 (close)

Dollar/yen: UP at 157.60 yen from 157.01 yen on Wednesday

Euro/dollar: DOWN at $1.1522 from $1.1526

Pound/dollar: UP at $1.3063 from $1.3048

Euro/pound: DOWN at 88.19 from 88.33 pence

West Texas Intermediate: UP 0.4 percent at $59.66 per barrel

Brent North Sea Crude: UP 0.2 percent at $63.66 per barrel

New York - Dow: UP 0.1 percent at 46,138.77 (close)

London - FTSE 100: DOWN 0.5 percent at 9,507.41 (close)

G.Schmid--VB