-

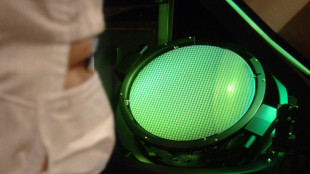

Japan to restart world's biggest nuclear plant Wednesday

Japan to restart world's biggest nuclear plant Wednesday

-

South Korean ex-PM Han gets 23 years jail for martial law role

-

Alcaraz, Sabalenka, Gauff surge into Australian Open third round

Alcaraz, Sabalenka, Gauff surge into Australian Open third round

-

Over 1,400 Indonesians left Cambodian scam groups in five days: embassy

-

Raducanu to 're-evaluate' after flat Australian Open exit

Raducanu to 're-evaluate' after flat Australian Open exit

-

Doncic triple-double leads Lakers comeback over Nuggets, Rockets down Spurs

-

Bangladesh will not back down to 'coercion' in India T20 World Cup row

Bangladesh will not back down to 'coercion' in India T20 World Cup row

-

Alcaraz comes good after shaky start to make Australian Open third round

-

Trump departs for Davos forum again after switching to new plane: AFP

Trump departs for Davos forum again after switching to new plane: AFP

-

Impressive Gauff storms into Australian Open third round

-

Dazzling Chinese AI debuts mask growing pains

Dazzling Chinese AI debuts mask growing pains

-

Medvedev battles into Melbourne third round after early scare

-

Denmark's Andresen upstages sprint stars to take Tour Down Under opener

Denmark's Andresen upstages sprint stars to take Tour Down Under opener

-

Turkey's Sonmez soaks in acclaim on historic Melbourne run

-

Sheppard leads Rockets to sink Spurs in Texas derby

Sheppard leads Rockets to sink Spurs in Texas derby

-

Sabalenka shuts down political talk after Ukrainian's ban call

-

Trump's plane returns to air base after 'minor' electrical issue: White House

Trump's plane returns to air base after 'minor' electrical issue: White House

-

Barcelona train crash kills 1 in Spain's second deadly rail accident in days

-

North produces enough nuclear material a year for 10-20 weapons: S. Korea president

North produces enough nuclear material a year for 10-20 weapons: S. Korea president

-

Japan ex-PM Abe's alleged killer faces verdict

-

Climate change fuels disasters, but deaths don't add up

Climate change fuels disasters, but deaths don't add up

-

Stocks stable after tariff-fuelled selloff but uncertainty boosts gold

-

What growth?: Taiwan's traditional manufacturers miss out on export boom

What growth?: Taiwan's traditional manufacturers miss out on export boom

-

'Super-happy' Sabalenka shines as Alcaraz gets set at Australian Open

-

With monitors and lawsuits, Pakistanis fight for clean air

With monitors and lawsuits, Pakistanis fight for clean air

-

Sabalenka sets up potential Raducanu showdown at Australian Open

-

Chile president picks Pinochet lawyers as ministers of human rights, defense

Chile president picks Pinochet lawyers as ministers of human rights, defense

-

Osaka says 'I'm a little strange' after Melbourne fashion statement

-

UN report declares global state of 'water bankruptcy'

UN report declares global state of 'water bankruptcy'

-

Trump heads for Davos maelstrom over Greenland

-

Ukraine's Oliynykova wants Russian, Belarusian players banned from tennis

Ukraine's Oliynykova wants Russian, Belarusian players banned from tennis

-

Kasatkina cannot wait to be back after outpouring of Melbourne support

-

Chile blaze victims plead for help from razed neighborhoods

Chile blaze victims plead for help from razed neighborhoods

-

Russian minister visits Cuba as Trump ramps up pressure on Havana

-

World order in 'midst of a rupture': Canada PM Carney tells Davos

World order in 'midst of a rupture': Canada PM Carney tells Davos

-

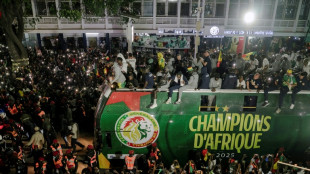

Senegal's 'historic' AFCON champs honoured with parade, presidential praise

-

Audi unveil new car for 2026 Formula One season

Audi unveil new car for 2026 Formula One season

-

Man City humiliated, holders PSG stumble, Arsenal remain perfect

-

Vinicius, Real Madrid need 'love' not whistles: Bellingham

Vinicius, Real Madrid need 'love' not whistles: Bellingham

-

Late Suarez winner stops Champions League holders PSG in Lisbon

-

Frank seeks Spurs 'momentum' after beating Dortmund

Frank seeks Spurs 'momentum' after beating Dortmund

-

Jesus' 'dream' brace at Inter fires Arsenal into Champions League last 16

-

US regulator appeals Meta's court victory in monopoly case

US regulator appeals Meta's court victory in monopoly case

-

Netflix shares fall as revenue appears to stall

-

Tottenham beat 10-man Dortmund to hand Frank stay of execution

Tottenham beat 10-man Dortmund to hand Frank stay of execution

-

Mbappe, Vinicius help Real Madrid thrash Monaco in Champions League

-

Men's Fashion Week kicks off in Paris with Louis Vuitton show

Men's Fashion Week kicks off in Paris with Louis Vuitton show

-

Jesus fires Arsenal past Inter and into Champions League last 16

-

Muted anniversary: Trump marks first year back with grievances

Muted anniversary: Trump marks first year back with grievances

-

Humiliated Man City have to 'change the dynamic': Guardiola

Stocks steadier before key Nvidia results

Stocks struggled to kickstart a recovery Wednesday following heavy losses triggered by worries over an AI-fuelled bubble.

Bitcoin held above $90,000, the dollar strengthened and oil prices dropped.

"Investors will breathe a sigh of relief that the market sell-off has lost momentum," noted Russ Mould, investment director at AJ Bell.

"Pockets of Europe and Asia were up... and futures prices imply a similar trend when Wall Street opens later today."

Mould said "the key question is whether this is simply the calm before the storm.

"Nvidia reports tonight and the slightest bit of news to disappoint investors has the potential to whip up a tornado across global markets."

Investors have endured a tough November as speculation has grown that the tech-led rally this year may have gone too far, and valuations have become frothy enough to warrant a stiff correction.

With the Magnificent Seven -- including Amazon, Meta, Alphabet and Apple -- powering recent record highs on Wall Street, there are worries that a change in sentiment could have huge ripple effects on markets.

The spotlight Wednesday turns on the earnings report from the biggest of the bunch: chip giant Nvidia, which last month became the first $5-trillion company.

Investors are nervous that any sign of weakness could be the pin that pops the artificial intelligence bubble, having spent months fearing that the hundreds of billions invested may have been excessive.

"The AI complex, once the undisputed locomotive of 2025's rally, now sounds like an engine with sand in the gears," said Stephen Innes at SPI Asset Management.

"This isn't a crash, or a panic, or even a proper correction; it's the unmistakable sensation of a market trading at altitude with borrowed oxygen, suddenly aware of how thin the air has become."

He added that four days of losses in Wall Street's S&P 500, the VIX "fear index" hitting 25 -- a level that causes traders concern -- and a tone shift were "all signs that investors are finally blinking at the speed and scale of the AI capex boom".

Meanwhile, a Bank of America survey of fund managers found that more than half thought AI stocks were already in a bubble and 45 percent thought that that was the biggest "tail risk" to markets, more so than inflation.

That came after the BBC released an interview with the head of Google's parent company Alphabet -- Sundar Pichai -- who warned every company would be impacted if the AI bubble were to burst.

- Key figures at around 1115 GMT -

London - FTSE 100: UP 0.1 percent at 9,559.89 points

Paris - CAC 40: DOWN 0.1 percent at 7,957.56

Frankfurt - DAX: UP 0.1 percent at 23,212.35

Tokyo - Nikkei 225: DOWN 0.3 percent at 48,537.70 (close)

Hong Kong - Hang Seng Index: DOWN 0.4 percent at 25,830.65 (close)

Shanghai - Composite: UP 0.2 percent at 3,946.74 (close)

New York - Dow: DOWN 1.1 percent at 46,091.74 (close)

Euro/dollar: DOWN at $1.1570 from $1.1580

Pound/dollar: DOWN at $1.3105 from $1.3146

Dollar/yen: UP at 156.28 yen from 155.53 yen on Tuesday

Euro/pound: UP at 88.27 from 88.09 pence

Brent North Sea Crude: DOWN 0.9 percent at $64.34 per barrel

West Texas Intermediate: DOWN 0.8 percent at $60.24 per barrel

A.Ruegg--VB