-

Botswana warns diamond oversupply to hit growth

Botswana warns diamond oversupply to hit growth

-

Spaniard condemns 'ignorant drunks' after Melbourne confrontation

-

Philippines to end short-lived ban on Musk's Grok chatbot

Philippines to end short-lived ban on Musk's Grok chatbot

-

Police smash European synthetic drug ring in 'largest-ever' op

-

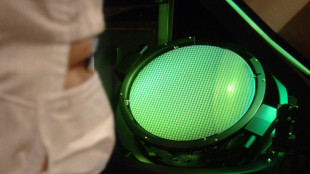

Japan to restart world's biggest nuclear plant Wednesday

Japan to restart world's biggest nuclear plant Wednesday

-

South Korean ex-PM Han gets 23 years jail for martial law role

-

Alcaraz, Sabalenka, Gauff surge into Australian Open third round

Alcaraz, Sabalenka, Gauff surge into Australian Open third round

-

Over 1,400 Indonesians left Cambodian scam groups in five days: embassy

-

Raducanu to 're-evaluate' after flat Australian Open exit

Raducanu to 're-evaluate' after flat Australian Open exit

-

Doncic triple-double leads Lakers comeback over Nuggets, Rockets down Spurs

-

Bangladesh will not back down to 'coercion' in India T20 World Cup row

Bangladesh will not back down to 'coercion' in India T20 World Cup row

-

Alcaraz comes good after shaky start to make Australian Open third round

-

Trump departs for Davos forum again after switching to new plane: AFP

Trump departs for Davos forum again after switching to new plane: AFP

-

Impressive Gauff storms into Australian Open third round

-

Dazzling Chinese AI debuts mask growing pains

Dazzling Chinese AI debuts mask growing pains

-

Medvedev battles into Melbourne third round after early scare

-

Denmark's Andresen upstages sprint stars to take Tour Down Under opener

Denmark's Andresen upstages sprint stars to take Tour Down Under opener

-

Turkey's Sonmez soaks in acclaim on historic Melbourne run

-

Sheppard leads Rockets to sink Spurs in Texas derby

Sheppard leads Rockets to sink Spurs in Texas derby

-

Sabalenka shuts down political talk after Ukrainian's ban call

-

Trump's plane returns to air base after 'minor' electrical issue: White House

Trump's plane returns to air base after 'minor' electrical issue: White House

-

Barcelona train crash kills 1 in Spain's second deadly rail accident in days

-

North produces enough nuclear material a year for 10-20 weapons: S. Korea president

North produces enough nuclear material a year for 10-20 weapons: S. Korea president

-

Japan ex-PM Abe's alleged killer faces verdict

-

Climate change fuels disasters, but deaths don't add up

Climate change fuels disasters, but deaths don't add up

-

Stocks stable after tariff-fuelled selloff but uncertainty boosts gold

-

What growth?: Taiwan's traditional manufacturers miss out on export boom

What growth?: Taiwan's traditional manufacturers miss out on export boom

-

'Super-happy' Sabalenka shines as Alcaraz gets set at Australian Open

-

With monitors and lawsuits, Pakistanis fight for clean air

With monitors and lawsuits, Pakistanis fight for clean air

-

Sabalenka sets up potential Raducanu showdown at Australian Open

-

Chile president picks Pinochet lawyers as ministers of human rights, defense

Chile president picks Pinochet lawyers as ministers of human rights, defense

-

Osaka says 'I'm a little strange' after Melbourne fashion statement

-

UN report declares global state of 'water bankruptcy'

UN report declares global state of 'water bankruptcy'

-

Trump heads for Davos maelstrom over Greenland

-

Ukraine's Oliynykova wants Russian, Belarusian players banned from tennis

Ukraine's Oliynykova wants Russian, Belarusian players banned from tennis

-

Kasatkina cannot wait to be back after outpouring of Melbourne support

-

Chile blaze victims plead for help from razed neighborhoods

Chile blaze victims plead for help from razed neighborhoods

-

Russian minister visits Cuba as Trump ramps up pressure on Havana

-

World order in 'midst of a rupture': Canada PM Carney tells Davos

World order in 'midst of a rupture': Canada PM Carney tells Davos

-

Senegal's 'historic' AFCON champs honoured with parade, presidential praise

-

Audi unveil new car for 2026 Formula One season

Audi unveil new car for 2026 Formula One season

-

Man City humiliated, holders PSG stumble, Arsenal remain perfect

-

Vinicius, Real Madrid need 'love' not whistles: Bellingham

Vinicius, Real Madrid need 'love' not whistles: Bellingham

-

Late Suarez winner stops Champions League holders PSG in Lisbon

-

Frank seeks Spurs 'momentum' after beating Dortmund

Frank seeks Spurs 'momentum' after beating Dortmund

-

Jesus' 'dream' brace at Inter fires Arsenal into Champions League last 16

-

US regulator appeals Meta's court victory in monopoly case

US regulator appeals Meta's court victory in monopoly case

-

Netflix shares fall as revenue appears to stall

-

Tottenham beat 10-man Dortmund to hand Frank stay of execution

Tottenham beat 10-man Dortmund to hand Frank stay of execution

-

Mbappe, Vinicius help Real Madrid thrash Monaco in Champions League

Stocks tepid on uncertainty over earnings, tech rally, US rates

Global stock markets marked time Monday as traders awaited key earnings reports, notably from chip giant Nvidia, amid concerns the US Federal Reserve could hold off on further rate cuts this year.

On Wall Street the Dow was flat two hours into the session while the tech-heavy Nasdaq had added a paltry 0.2 percent. The broader-based S&P 500 Index was off by just under of 0.1 percent.

Europe lacked inspiration with the DAX closing off 1.2 percent while London and Paris lost marginal ground.

Major Asian indices had earlier finished down amid simmering tensions between China and Japan which hit tourism and retail firms on Tokyo's exchange.

Besides Nvidia, which was off 1.1 percent, US retailers including Home Depot, Target and Walmart are also set to release their earnings reports.

Those will be monitored for signs of how consumers are faring as President Donald Trump's international trade tariffs bite.

Traders are also awaiting US government data on how the labour market fared in September. The numbers are due for publication Thursday, after the end of the longest government shutdown in US history.

"It'll be the first glimpse of some macro news" that could provide hints on the Fed's preferred path for interest rates moving forward, said Peter Cardillo from Spartan Capital Securities.

Among companies, he added: "It's all up to Nvidia, whether or not it can turn the souring negative sentiment on the AI sector."

The tepid mood on trading floors dragged on the crypto sector, with bitcoin briefly erasing all its gains this year -- just over a month after hitting a record high.

The European Union on Monday cut its eurozone growth forecast for 2026 as risks from international trade and geopolitical tensions weighed on Europe's economy.

Investors have in recent weeks reconsidered prospects for US rate cuts and the AI-fuelled tech rally that had lifted several markets to record highs.

Traders are keenly awaiting the release of several reports -- including on jobs and inflation -- that had been held up by the record US government shutdown that ended last week.

With data releases delayed, "chances are growing that the Fed will avoid changing monetary policy when the economic outlook remains murky", said Kathleen Brooks, research director at trading group XTB.

Federal Reserve boss Jerome Powell signalled last month that a December cut to borrowing costs was not assured, adding to uncertainty.

All eyes are on this week's release of earnings from chip titan Nvidia, the world's most valuable company, which late last month hit a market capitalisation of $5.0 trillion before slipping back.

Bitcoin suffered from the uncertain climate on trading floors, with the digital unit briefly dropping to $92,935.51.

It bounced back slightly to sit above $94,000 on Monday. The cryptocurrency had climbed to a record high of $126,251 on October 6, buoyed by Trump's pledges to ease regulation on the crypto sector.

- Key figures at around 1650 GMT -

New York - Dow: FLAT at 47,141.61 points

New York - S&P 500: UP 0.2 percent at 6,745.31

New York - Nasdaq Composite: UP 0.2 percent at 22,962.65

London - FTSE 100: DOWN 0.2 percent at 9,675.43 points (close)

Paris - CAC 40: DOWN 0.6 percent at 8,119.02 (close)

Frankfurt - DAX: DOWN 1.2 percent at 23,590.52 (close)

Tokyo - Nikkei 225: DOWN 0.1 percent at 50,323.91 (close)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 26,384.28 (close)

Shanghai - Composite: DOWN 0.5 percent at 3,972.03 (close)

Dollar/yen: UP at 155.19 yen from 154.55 yen on Friday

Euro/dollar: DOWN at $1.1598 from $1.1621

Pound/dollar: UP at $1.3174 from $1.3171

Euro/pound: DOWN at 88.01 pence from 88.22 pence

West Texas Intermediate: FLAT at $60.11 per barrel

Brent North Sea Crude: FLAT at $64.43 per barrel

M.Vogt--VB