-

Wallabies record-holder Slipper hints Perth could be final Test

Wallabies record-holder Slipper hints Perth could be final Test

-

Son brace fuels LAFC as Messi frustrated in Miami draw

-

US actress-singer Selena Gomez weds music producer Benny Blanco

US actress-singer Selena Gomez weds music producer Benny Blanco

-

Pakistani parents rebuff HPV vaccine over infertility fears

-

Women's cricket set for 'seismic' breakthrough at World Cup

Women's cricket set for 'seismic' breakthrough at World Cup

-

New Zealand fly-half Barrett out of Australia rematch

-

Moldovans torn between pro-EU and pro-Russia vote in tense polls

Moldovans torn between pro-EU and pro-Russia vote in tense polls

-

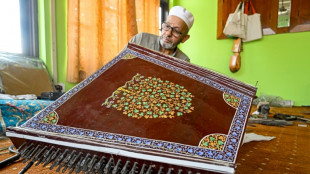

Strings of identity: Kashmir's fading music endures

-

'Clog the toilet' trolls hit Indian visa holders rushing to US

'Clog the toilet' trolls hit Indian visa holders rushing to US

-

Bradley: USA Ryder Cup disaster part of why crowds angry

-

Europe used 'anti-fragile mentality' to cope with Cup hecklers

Europe used 'anti-fragile mentality' to cope with Cup hecklers

-

Unbeaten McIlroy faces winless Scheffler in Ryder Cup singles

-

Sweeping UN sanctions return to hit Iran after nuclear talks fail

Sweeping UN sanctions return to hit Iran after nuclear talks fail

-

Messi, Miami frustrated in Toronto stalemate

-

Argentina protesters march for victims of live-streamed femicide

Argentina protesters march for victims of live-streamed femicide

-

Europe shrugs off intense abuse to reach brink of Ryder Cup win

-

Injury-hit PSG reclaim Ligue 1 top spot ahead of Barcelona clash

Injury-hit PSG reclaim Ligue 1 top spot ahead of Barcelona clash

-

Understrength PSG reclaim Ligue 1 top spot ahead of Barcelona clash

-

Argentina protesters seek justice for victims of live-streamed femicide

Argentina protesters seek justice for victims of live-streamed femicide

-

Palhinha rescues point for Tottenham against winless Wolves

-

Springbok Feinberg-Mngomezulu an 'incredible talent' - Erasmus

Springbok Feinberg-Mngomezulu an 'incredible talent' - Erasmus

-

Mitchell backs England to sustain dominance after World Cup triumph

-

Zaporizhzhia nuclear plant off grid; Russia, Ukraine trade blame

Zaporizhzhia nuclear plant off grid; Russia, Ukraine trade blame

-

McIlroy fires back at hecklers in intense Ryder Cup atmosphere

-

Two women die trying to cross Channel from France

Two women die trying to cross Channel from France

-

Huge Berlin protest urges end to Gaza war

-

Liverpool 'deserved' defeat to Crystal Palace, says Slot

Liverpool 'deserved' defeat to Crystal Palace, says Slot

-

Bottega Veneta shows off 'soft functionality' in Milan

-

Maresca blasts careless Chelsea after Brighton defeat

Maresca blasts careless Chelsea after Brighton defeat

-

Juve miss out on Serie A summmit with Atalanta draw

-

Guardiola salutes dynamic Doku as Man City run riot

Guardiola salutes dynamic Doku as Man City run riot

-

Russia warns West as Ukraine secures Patriot defenses

-

Ten-man Monaco miss chance to retake top spot in Ligue 1

Ten-man Monaco miss chance to retake top spot in Ligue 1

-

Feinberg-Mngomezulu scores 37 points as Springboks top table

-

Trump authorizes 'full force' troop deployment in Portland

Trump authorizes 'full force' troop deployment in Portland

-

Matthews at the double as England beat Canada to win Women's Rugby World Cup

-

Real Madrid 'hurting', deserved to lose derby: Alonso

Real Madrid 'hurting', deserved to lose derby: Alonso

-

Handshake spat bad for cricket, says Pakistan captain ahead of India final

-

England beat Canada in Women's Rugby World Cup final

England beat Canada in Women's Rugby World Cup final

-

Hezbollah says it refuses to be disarmed one year after leader's killing

-

Atletico thrash Liga leaders Real Madrid in gripping derby

Atletico thrash Liga leaders Real Madrid in gripping derby

-

Liverpool's perfect start ended by Crystal Palace, Man Utd beaten at Brentford

-

Unbeaten Rahm sparks Europe to historic five-point Ryder Cup lead

Unbeaten Rahm sparks Europe to historic five-point Ryder Cup lead

-

Dortmund keep heat on Bayern with Mainz win

-

Under-fire Amorim accepts criticism as Man Utd crash at Brentford

Under-fire Amorim accepts criticism as Man Utd crash at Brentford

-

Sweeping UN sanctions loom for Iran after nuclear talks fail

-

Canadian Vallieres pulls off cycling world title surprise in Kigali hills

Canadian Vallieres pulls off cycling world title surprise in Kigali hills

-

Dakuwaqa outshines Bielle-Biarrey as Stade Francais beat Bordeaux-Begles

-

West Ham hire Nuno to replace sacked Potter

West Ham hire Nuno to replace sacked Potter

-

Amorim under pressure as Brentford stun Man Utd

Oil prices soar, stocks slide after Israel strikes Iran

Oil prices soared and stocks sank Friday after Israel launched strikes on nuclear and military sites in Iran, stoking fears of a full-blown war.

Oil futures rocketed more than 13 percent at one point, reaching the highest levels since January and reigniting worries about a renewed spike to inflation.

Fears of a higher-cost environment sent share prices sliding for a majority of companies across Asia and Europe.

Energy majors jumped, however, as despite a pullback heading into the Wall Street open, crude was still up by around 8.5 percent.

The dollar jumped, while gold -- viewed as a safe haven investment -- was close to its record high of above $3,500 an ounce set in April.

"Global markets are being rattled by an escalation of Middle East tensions," noted Richard Hunter, head of markets at trading group Interactive Investor.

"Asian markets were the first to react to the news overnight, with (stock market) declines across the board."

Europe followed suit, with almost all the continent's stock indices in negative territory nearing the half-way stage.

Iran called Israel's wave of strikes a "declaration of war", after the Israeli military hit about 100 targets including nuclear facilities and killed senior figures, among them military chiefs and top nuclear scientists.

US President Donald Trump told Fox News he had prior knowledge of the Israeli strikes, which Israel said involved 200 fighter jets.

Trump also stressed that Tehran "cannot have a nuclear bomb".

Iran's supreme leader Ayatollah Ali Khamenei warned Israel it faced a "bitter and painful" fate over the attacks, while the Iranian military said there were "no limits" to its response.

"The big fear for investors is that an escalation to the tensions will not only raise the risk of a prolonged conflict, but it could disrupt Iranian oil production," said Matthew Ryan, head of market strategy at global financial-services firm Ebury.

"We suspect that safe haven assets will be well supported in the coming days, as markets brace for additional retaliatory attacks and the possibility of a wider conflict."

Ryan added in a client note that "the spike in oil prices... has broader implications, as it could both weigh on the global growth outlook and keep inflationary pressures higher for longer, which complicates the easing cycle among the world's major central banks".

- Key figures at around 1045 GMT -

Brent North Sea Crude: UP 8.3 percent at $75.13 per barrel

West Texas Intermediate: UP 8.7 percent at $73.98 per barrel

London - FTSE 100: DOWN 0.4 percent at 8,846.17 points

Paris - CAC 40: DOWN 1.2 percent at 7,671.99

Frankfurt - DAX: DOWN 1.5 percent at 23,414.13

Tokyo - Nikkei 225: DOWN 0.9 percent at 37,834.25 (close)

Hong Kong - Hang Seng Index: DOWN 0.6 percent at 23,892.56 (close)

Shanghai - Composite: DOWN 0.8 percent at 3,377.00 (close)

New York - Dow: UP 0.2 percent at 42,967.62 (close)

Euro/dollar: DOWN at $1.1502 from $1.1583 on Thursday

Pound/dollar: DOWN at $1.3526 from $1.3605

Dollar/yen: UP at 144.36 yen from 143.56 yen

Euro/pound: DOWN at 84.95 pence from 85.11 pence

burs-bcp/rmb

A.Ruegg--VB