-

Dolphins star Hill suffers gruesome injury in Jets clash

Dolphins star Hill suffers gruesome injury in Jets clash

-

Paralympics' vote to lift Russian suspension 'bold step' as conflict rages: ex-IOC executive

-

Gazans say Trump's peace plan a 'farce'

Gazans say Trump's peace plan a 'farce'

-

UN Security Council to vote on future of foreign Haiti force

-

Far-right German MP's ex-aide faces verdict in China spy case

Far-right German MP's ex-aide faces verdict in China spy case

-

YouTube to pay $22 million in settlement with Trump

-

Internet outrage over Trump's AI conspiracy video

Internet outrage over Trump's AI conspiracy video

-

Coalition of states vows to protect access to abortion pill under Trump review

-

Trump meets Democrats without breakthrough on imminent shutdown

Trump meets Democrats without breakthrough on imminent shutdown

-

Muslim states join EU powers in backing Trump Gaza plan

-

California enacts AI safety law targeting tech giants

California enacts AI safety law targeting tech giants

-

Creator says AI actress is 'piece of art' after backlash

-

Nuno makes his point as West Ham rescue Everton draw

Nuno makes his point as West Ham rescue Everton draw

-

Slot challenges Liverpool players to 'give their all' against Galatasaray

-

Dodgers eye rare repeat as MLB playoffs get under way

Dodgers eye rare repeat as MLB playoffs get under way

-

Solanke surgery leaves Spurs struggling for strikers

-

Trump's Gaza peace plan wins Netanyahu backing

Trump's Gaza peace plan wins Netanyahu backing

-

New-look Paris Fashion Week kicks off with Saint Laurent

-

Anthropic launches new AI model, touting coding supremacy

Anthropic launches new AI model, touting coding supremacy

-

Trump announces Gaza peace plan, with Netanyahu backing

-

'Better, stronger' Wembanyama can't wait for NBA return

'Better, stronger' Wembanyama can't wait for NBA return

-

LeBron relishing 23rd season as retirement draws near

-

'Always a blue': Mourinho expects Chelsea fans to show respect

'Always a blue': Mourinho expects Chelsea fans to show respect

-

Michigan governor asks to 'lower the temperature' after church attack

-

S. Africa lose World Cup qualifying points over ineligible player

S. Africa lose World Cup qualifying points over ineligible player

-

Rugby chiefs open to R360 role in women's game after World Cup success

-

Inter Milan announce 35.4 million euro profits ahead of San Siro vote

Inter Milan announce 35.4 million euro profits ahead of San Siro vote

-

Madagascar protests reignite, UN says at least 22 dead

-

Taliban shut down communications across Afghanistan

Taliban shut down communications across Afghanistan

-

Serbia arrests 11 accused of stirring Jewish-Muslim hate in France, Germany

-

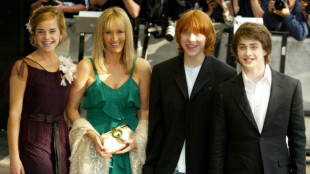

J.K. Rowling attacks 'ignorant' Harry Potter star Emma Watson

J.K. Rowling attacks 'ignorant' Harry Potter star Emma Watson

-

Electronic Arts to be bought by Saudi-led consortium for $55 bn

-

N.Korea vows at UN never to give up nuclear

N.Korea vows at UN never to give up nuclear

-

Hamilton reveals 'hardest decision' over dog's death

-

Springsteen denounces 'hatred' in America at biopic premiere

Springsteen denounces 'hatred' in America at biopic premiere

-

Stock markets shrug off US government shutdown fears

-

UK's Labour plans tougher rules on migrants to halt hard right

UK's Labour plans tougher rules on migrants to halt hard right

-

Trump 'very confident' of Gaza deal as he hosts Netanyahu

-

'High chance' of India winning Women's Cricket World Cup: captain Kaur

'High chance' of India winning Women's Cricket World Cup: captain Kaur

-

Trump meets Democrats in last-gasp talks before US government shutdown

-

No 'Angels': Bulgarians shake down Robbie Williams convoy

No 'Angels': Bulgarians shake down Robbie Williams convoy

-

German music body sues OpenAI alleging copyright breaches

-

Cannabis extract relieves chronic back pain: high-quality trial

Cannabis extract relieves chronic back pain: high-quality trial

-

African players in Europe: Sarr helps sink leaders Liverpool

-

Madagascar protests reignite as police launch tear gas

Madagascar protests reignite as police launch tear gas

-

German finds 15mn-euro winning lotto ticket in coat

-

Injury retirements hit China Open but Sinner reaches semis unscathed

Injury retirements hit China Open but Sinner reaches semis unscathed

-

TotalEnergies to boost output, cut $7.5 bn in costs

-

World Rugby unfazed over England dominance of women's game

World Rugby unfazed over England dominance of women's game

-

Bruised Real Madrid still defining spirit, personality: Alonso

Stocks rise as Trump, Xi speak amid trade tensions

Wall Street stocks bounced higher Thursday after US President Donald Trump and Chinese leader Xi Jinping spoke amid their trade war, while the euro got a boost from the European Central Bank signalling an end to its rate-cut cycle.

Wall Street's major indices recovered from earlier losses after Trump posted that the call was positive.

"The call lasted approximately one and a half hours, and resulted in a very positive conclusion for both Countries," Trump said on Truth Social, adding that US and Chinese trade teams would hold a new meeting "shortly".

The call follows officials from the world's two biggest economies accusing each other of jeopardising a trade war truce agreed last month in Geneva.

City Index and FOREX.com analyst Fawad Razaqzada said "the markets were hoping that the direct line between Washington and Beijing could ease trade tensions, even if temporarily".

While he said that appears to have been the case, he added "it is super important that the Trump-Xi call now leads to some concrete movement".

After his return to the White House Trump launched a tariffs blitz, introducing a 10 percent minimum tariff and higher rates on many countries, with China subject to the highest rates.

Some of the higher rates have been suspended as negotiations are under way.

European stock markets closed mixed even though the ECB cut its key deposit rate a quarter point to two percent, as expected.

It was its eighth reduction since June last year when it began lowering borrowing costs.

But ECB President Christine Lagarde stated the central bank is "getting to the end" of the rate-cutting cycle, as inflation has largely dropped to its two percent target in the 20-nation currency bloc.

That sent the euro surging against the dollar and European stocks gave up earlier gains.

The ECB's series of cuts stands in contrast to the US Federal Reserve, which has kept rates on hold recently amid fears that Trump's levies could stoke inflation in the world's top economy.

Investors are now looking to the release on Friday of US non-farm payrolls data, which the Fed uses to help shape monetary policy.

Other data released this week has been mixed. April jobs openings data beat expectations, but according to payroll firm ADP private-sector jobs rose by only 37,000 last month.

This was a sharp slowdown from April's 60,000 and less than a third of the amount forecast in a Bloomberg survey.

Another survey showed activity in the US services sector contracted in May for the first time since June last year.

The readings stoked concerns that the world's number one economy was stuttering, with the Fed's closely watched "Beige Book" study noting that "economic activity has declined slightly".

The readings ramped up bets on a Fed cut, with markets pricing in two by the end of the year, starting in September.

Still, there is some concern that Trump's tariff blitz will ramp up inflation, which could put pressure on the US central bank to keep borrowing costs elevated.

- Key figures at around 1530 GMT -

New York - Dow: UP 0.3 percent at 42,559.64 points

New York - S&P 500: UP 0.4 percent at 5,996.55

New York - Nasdaq Composite: UP 0.7 percent at 19,602.62

Paris - CAC 40: DOWN 0.2 percent at 7,790.27 (close)

Frankfurt - DAX: UP 0.2 percent at 24,323.58 (close)

London - FTSE 100: UP 0.1 percent at 8,811.04 (close)

Tokyo - Nikkei 225: DOWN 0.5 percent at 37,554.49 (close)

Hong Kong - Hang Seng Index: UP 1.1 percent at 23,906.97 (close)

Shanghai - Composite: UP 0.2 percent at 3,384.10 (close)

Euro/dollar: UP at $1.1448 from $1.1417 on Wednesday

Pound/dollar: UP at $1.3593 from $1.3548

Dollar/yen: UP at 143.70 yen from 142.86 yen

Euro/pound: DOWN at 84.23 pence from 84.26 pence

Brent North Sea Crude: UP 1.1 percent at $65.57 per barrel

West Texas Intermediate: UP 1.2 percent at $63.57 per barrel

burs-rl/phz

G.Schmid--VB