-

US tariffs on lumber imports set for October 14

US tariffs on lumber imports set for October 14

-

Australia lose Maxwell for New Zealand T20s after freak net blow

-

India plans mega-dam to counter China water fears

India plans mega-dam to counter China water fears

-

Colombia manufactures its first rifles to replace Israeli weapons

-

Stocks rise, gold hits record as rate cuts and shutdown loom

Stocks rise, gold hits record as rate cuts and shutdown loom

-

Dolphins star Hill suffers gruesome injury in Jets clash

-

Paralympics' vote to lift Russian suspension 'bold step' as conflict rages: ex-IOC executive

Paralympics' vote to lift Russian suspension 'bold step' as conflict rages: ex-IOC executive

-

Gazans say Trump's peace plan a 'farce'

-

UN Security Council to vote on future of foreign Haiti force

UN Security Council to vote on future of foreign Haiti force

-

Far-right German MP's ex-aide faces verdict in China spy case

-

YouTube to pay $22 million in settlement with Trump

YouTube to pay $22 million in settlement with Trump

-

Internet outrage over Trump's AI conspiracy video

-

Coalition of states vows to protect access to abortion pill under Trump review

Coalition of states vows to protect access to abortion pill under Trump review

-

Trump meets Democrats without breakthrough on imminent shutdown

-

Muslim states join EU powers in backing Trump Gaza plan

Muslim states join EU powers in backing Trump Gaza plan

-

California enacts AI safety law targeting tech giants

-

Creator says AI actress is 'piece of art' after backlash

Creator says AI actress is 'piece of art' after backlash

-

Nuno makes his point as West Ham rescue Everton draw

-

Slot challenges Liverpool players to 'give their all' against Galatasaray

Slot challenges Liverpool players to 'give their all' against Galatasaray

-

Dodgers eye rare repeat as MLB playoffs get under way

-

Solanke surgery leaves Spurs struggling for strikers

Solanke surgery leaves Spurs struggling for strikers

-

Trump's Gaza peace plan wins Netanyahu backing

-

New-look Paris Fashion Week kicks off with Saint Laurent

New-look Paris Fashion Week kicks off with Saint Laurent

-

Anthropic launches new AI model, touting coding supremacy

-

Trump announces Gaza peace plan, with Netanyahu backing

Trump announces Gaza peace plan, with Netanyahu backing

-

'Better, stronger' Wembanyama can't wait for NBA return

-

LeBron relishing 23rd season as retirement draws near

LeBron relishing 23rd season as retirement draws near

-

'Always a blue': Mourinho expects Chelsea fans to show respect

-

Michigan governor asks to 'lower the temperature' after church attack

Michigan governor asks to 'lower the temperature' after church attack

-

S. Africa lose World Cup qualifying points over ineligible player

-

Rugby chiefs open to R360 role in women's game after World Cup success

Rugby chiefs open to R360 role in women's game after World Cup success

-

Inter Milan announce 35.4 million euro profits ahead of San Siro vote

-

Madagascar protests reignite, UN says at least 22 dead

Madagascar protests reignite, UN says at least 22 dead

-

Taliban shut down communications across Afghanistan

-

Serbia arrests 11 accused of stirring Jewish-Muslim hate in France, Germany

Serbia arrests 11 accused of stirring Jewish-Muslim hate in France, Germany

-

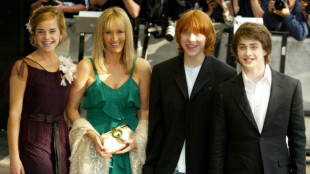

J.K. Rowling attacks 'ignorant' Harry Potter star Emma Watson

-

Electronic Arts to be bought by Saudi-led consortium for $55 bn

Electronic Arts to be bought by Saudi-led consortium for $55 bn

-

N.Korea vows at UN never to give up nuclear

-

Hamilton reveals 'hardest decision' over dog's death

Hamilton reveals 'hardest decision' over dog's death

-

Springsteen denounces 'hatred' in America at biopic premiere

-

Stock markets shrug off US government shutdown fears

Stock markets shrug off US government shutdown fears

-

UK's Labour plans tougher rules on migrants to halt hard right

-

Trump 'very confident' of Gaza deal as he hosts Netanyahu

Trump 'very confident' of Gaza deal as he hosts Netanyahu

-

'High chance' of India winning Women's Cricket World Cup: captain Kaur

-

Trump meets Democrats in last-gasp talks before US government shutdown

Trump meets Democrats in last-gasp talks before US government shutdown

-

No 'Angels': Bulgarians shake down Robbie Williams convoy

-

German music body sues OpenAI alleging copyright breaches

German music body sues OpenAI alleging copyright breaches

-

Cannabis extract relieves chronic back pain: high-quality trial

-

African players in Europe: Sarr helps sink leaders Liverpool

African players in Europe: Sarr helps sink leaders Liverpool

-

Madagascar protests reignite as police launch tear gas

Stocks slide as Trump, Xi speak amid trade tensions

Stocks markets slid Thursday after US President Donald Trump and Chinese leader Xi Jinping spoke amid their trade war, while the European Central Bank signalled an end to its rate-cut cycle.

Wall Street's major indices rose modestly as trading got underway, but had trouble holding onto the gains and soon slid into the red.

Chinese state media reported that Xi had held a widely anticipated call with Trump, with investors hoping it could ease trade tensions -- but no details were provided.

The call follows officials from the world's two biggest economies accusing each other of jeopardising a trade war truce agreed last month in Geneva.

"The stock market has traded more timidly of late... mindful that there are a number of loose ends out there on the tariff front, not the least of which is the direction the US-China trade relationship is headed," said Briefing.com analyst Patrick O'Hare.

After his return to the White House Trump launched a tariffs blitz, introducing a 10 percent minimum tariff and higher rates on many countries, with China subject to the highest rates.

Some of the higher rates have been suspended as negotiations are underway.

European stock markets were also in the red even though the ECB cut its key deposit rate a quarter point to two percent, as expected.

It was its eighth reduction since June last year when it began lowering borrowing costs.

But ECB President Christine Lagarde stated the central bank is "getting to the end" of the rate cutting cycle, as inflation has largely dropped to its two percent target in the 20-nation currency bloc.

That sent the euro surging against the dollar and European stocks gave up gains.

The ECB's series of cuts stands in contrast to the US Federal Reserve, which has kept rates on hold recently amid fears that Trump's levies could stoke inflation in the world's top economy.

Investors are now looking to the release on Friday of US non-farm payrolls data, which the Fed uses to help shape monetary policy.

Other data released this week has been mixed. April jobs openings data beat expectations, but according to payroll firm ADP private-sector jobs rose by only 37,000 last month.

This was a sharp slowdown from April's 60,000 and less than a third of the amount forecast in a Bloomberg survey.

Another survey showed activity in the US services sector contracted in May for the first time since June last year.

The readings stoked concerns that the world's number one economy was stuttering, with the Fed's closely watched "Beige Book" study noting that "economic activity has declined slightly".

The readings ramped up bets on a Fed cut, with markets pricing in two by the end of the year, starting in September.

Still, there is some concern that Trump's tariff blitz will ramp up inflation, which could put pressure on the US central bank to keep borrowing costs elevated.

- Key figures at around 1345 GMT -

New York - Dow: DOWN 0.3 percent at 42,323.48 points

New York - S&P 500: DOWN 0.3 percent at 5,955.79

New York - Nasdaq Composite: DOWN 0.3 percent at 19,398.43

Paris - CAC 40: DOWN 0.4 percent at 7,777.50

Frankfurt - DAX: DOWN 0.1 percent at 24,247.64

London - FTSE 100: DOWN less than 0.1 percent at 8,793.07

Tokyo - Nikkei 225: DOWN 0.5 percent at 37,554.49 (close)

Hong Kong - Hang Seng Index: UP 1.1 percent at 23,906.97 (close)

Shanghai - Composite: UP 0.2 percent at 3,384.10 (close)

Euro/dollar: UP at $1.1486 from $1.1417 on Wednesday

Pound/dollar: UP at $1.3605 from $1.3548

Dollar/yen: UP at 142.92 yen from 142.86 yen

Euro/pound: UP at 84.42 pence from 84.26 pence

Brent North Sea Crude: UP 1.5 percent at $65.81 per barrel

West Texas Intermediate: UP 1.7 percent at $63.93 per barrel

burs-rl/lth

G.Schmid--VB