-

Venezuelans eye economic revival with hoped-for oil resurgence

Venezuelans eye economic revival with hoped-for oil resurgence

-

Online platforms offer filtering to fight AI slop

-

With Trump allies watching, Canada oil hub faces separatist bid

With Trump allies watching, Canada oil hub faces separatist bid

-

Samsung Electronics posts record profit on AI demand

-

Rockets veteran Adams out for rest of NBA season

Rockets veteran Adams out for rest of NBA season

-

Holders PSG happy to take 'long route' via Champions League play-offs

-

French Senate adopts bill to return colonial-era art

French Senate adopts bill to return colonial-era art

-

Allrounder Molineux named Australian women's cricket captain

-

Sabalenka faces Svitolina roadblock in Melbourne final quest

Sabalenka faces Svitolina roadblock in Melbourne final quest

-

Barcelona rout Copenhagen to reach Champions League last 16

-

Liverpool, Man City and Barcelona ease into Champions League last 16

Liverpool, Man City and Barcelona ease into Champions League last 16

-

Tesla profits tumble on lower EV sales, AI spending surge

-

Real Madrid face Champions League play-off after Benfica loss

Real Madrid face Champions League play-off after Benfica loss

-

LA mayor urges US to reassure visiting World Cup fans

-

Madrid condemned to Champions League play-off after Benfica loss

Madrid condemned to Champions League play-off after Benfica loss

-

Meta shares jump on strong earnings report

-

Haaland ends barren run as Man City reach Champions League last 16

Haaland ends barren run as Man City reach Champions League last 16

-

PSG and Newcastle drop into Champions League play-offs after stalemate

-

Salah ends drought as Liverpool hit Qarabag for six to reach Champions League last 16

Salah ends drought as Liverpool hit Qarabag for six to reach Champions League last 16

-

Barca rout Copenhagen to reach Champions League last 16

-

Arsenal complete Champions League clean sweep for top spot

Arsenal complete Champions League clean sweep for top spot

-

Kolo Muani and Solanke send Spurs into Champions League last 16

-

Bayern inflict Kane-ful Champions League defeat on PSV

Bayern inflict Kane-ful Champions League defeat on PSV

-

Pedro double fires Chelsea into Champions League last 16, dumps out Napoli

-

US stocks move sideways, shruggging off low-key Fed meeting

US stocks move sideways, shruggging off low-key Fed meeting

-

US capital Washington under fire after massive sewage leak

-

Anti-immigration protesters force climbdown in Sundance documentary

Anti-immigration protesters force climbdown in Sundance documentary

-

US ambassador says no ICE patrols at Winter Olympics

-

Norway's Kristoffersen wins Schladming slalom

Norway's Kristoffersen wins Schladming slalom

-

Springsteen releases fiery ode to Minneapolis shooting victims

-

Brady latest to blast Belichick Hall of Fame snub

Brady latest to blast Belichick Hall of Fame snub

-

Trump battles Minneapolis shooting fallout as agents put on leave

-

SpaceX eyes IPO timed to planet alignment and Musk birthday: report

SpaceX eyes IPO timed to planet alignment and Musk birthday: report

-

White House, Slovakia deny report on Trump's mental state

-

Iran vows to resist any US attack, insists ready for nuclear deal

Iran vows to resist any US attack, insists ready for nuclear deal

-

Colombia leader offers talks to end trade war with Ecuador

-

Former Masters champ Reed returning to PGA Tour from LIV

Former Masters champ Reed returning to PGA Tour from LIV

-

US Fed holds interest rates steady, defying Trump pressure

-

Norway's McGrath tops first leg of Schladming slalom

Norway's McGrath tops first leg of Schladming slalom

-

Iraq PM candidate Maliki denounces Trump's 'blatant' interference

-

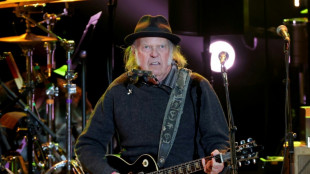

Neil Young gifts music to Greenland residents for stress relief

Neil Young gifts music to Greenland residents for stress relief

-

Rubio upbeat on Venezuela cooperation but wields stick

-

'No. 1 fan': Rapper Minaj backs Trump

'No. 1 fan': Rapper Minaj backs Trump

-

Fear in Sicilian town as vast landslide risks widening

-

'Forced disappearance' probe opened against Colombian cycling star Herrera

'Forced disappearance' probe opened against Colombian cycling star Herrera

-

Seifert, Santner give New Zealand consolation T20 win over India

-

King Charles III warns world 'going backwards' in climate fight

King Charles III warns world 'going backwards' in climate fight

-

Minneapolis activists track Trump's immigration enforcers

-

Court orders Dutch to protect Caribbean island from climate change

Court orders Dutch to protect Caribbean island from climate change

-

Sterling agrees Chelsea exit after troubled spell

Deutsche Bank asset manager DWS fined 25 mn euros for 'greenwashing'

Deutsche Bank's asset management arm DWS was hit Wednesday with a 25-million-euro ($27-million) fine over misleading advertising for supposedly sustainable products, with activists hailing one of the world's biggest ever "greenwashing" penalties.

The case has dogged the German financial firm for several years since a top executive came forward with "greenwashing" allegations, with investigators repeatedly raiding the asset manager's offices and DWS's boss forced to quit in 2022.

It has also highlighted growing worries about how to police a surge in "environmental, social and governance" (ESG) investing as companies and institutions seek to bring portfolios in line with climate targets.

Unveiling the penalty, prosecutors in the German financial capital Frankfurt said DWS had "extensively" advertised financial products which claimed to have ESG characteristics from 2020 to 2023.

But investigations, carried out by prosecutors and police, found that "statements in external communications, such as claiming to be a 'leader' in the ESG area or stating 'ESG is an integral part of our DNA' did not correspond to reality," they said.

While a "transformation process" was underway at the firm, it had not yet been completed, they said, adding: "Statements in external relations must not go beyond what can actually be implemented."

The asset manager said it accepted the fine, admitting that "in the past our marketing was sometimes exuberant" but insisting that improvements had already been made.

DWS had already been hit in 2023 with $19-million penalty by financial regulators in the United States over misleading green statements.

- 'Historically high' fine -

Greenpeace said it was the highest ever penalty imposed in Europe's biggest economy for a such an offence.

"This historically high penalty payment for greenwashing is a clear wake-up call for the entire industry: consumer deception is not a trivial offence but fraud," said Mauricio Vargas, a financial expert with the environmental advocacy group.

He accused DWS of scaling back its sustainable finance efforts in response to the allegations, which he described as a "slap in the face to its customers", and also of continuing to invest heavily in fossil fuels.

The "greenwashing" scandal first emerged at DWS after its former chief sustainability officer, Desiree Fixler, came forward with "greenwashing" allegations in 2021.

Several raids followed at the asset manager and Deutsche Bank's offices in Frankfurt, and DWS chief executive Asoka Woehrmann stepped down in June 2022, saying the allegations had become a "burden".

While ESG products have in recent years become a major asset class, critics worry about what they say is a lack of standardised data and criteria to prove such investments are truly sustainable.

The European Union's markets authority last year issued new rules to combat "greenwashing" in finance, laying out what criteria needed to be met for a fund to have "ESG" or "sustainable" in its name.

Troubles at its asset management arm are also another blow to Deutsche Bank, which has undergone a major restructuring in recent years after an aggressive shift in the early 2000s into investment banking drew it into multiple scandals.

P.Keller--VB