-

Where does Iraq stand as US turns up heat on Iran?

Where does Iraq stand as US turns up heat on Iran?

-

Vietnam designer makes history as Paris Haute Couture wraps up

-

Denmark hails 'very constructive' meeting with US over Greenland

Denmark hails 'very constructive' meeting with US over Greenland

-

US border chief says not 'surrendering' immigration mission

-

EU to put Iran Guards on 'terrorist list'

EU to put Iran Guards on 'terrorist list'

-

Pegula calls herself 'shoddy, erratic' in Melbourne semi-final loss

-

All hands on deck: British Navy sobers up alcohol policy

All hands on deck: British Navy sobers up alcohol policy

-

Sabalenka says Serena return would be 'cool' after great refuses to rule it out

-

Rybakina plots revenge over Sabalenka in Australian Open final

Rybakina plots revenge over Sabalenka in Australian Open final

-

Irish Six Nations hopes hit by Aki ban

-

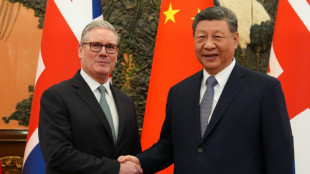

Britain's Starmer hails 'good progress' after meeting China's Xi

Britain's Starmer hails 'good progress' after meeting China's Xi

-

Parrots rescued as landslide-hit Sicilian town saves pets

-

Gold surges further, oil jumps on Trump's Iran threat

Gold surges further, oil jumps on Trump's Iran threat

-

No handshake as Sabalenka sets up repeat of 2023 Melbourne final

-

Iran's IRGC: the feared 'Pasdaran' set for EU terror listing

Iran's IRGC: the feared 'Pasdaran' set for EU terror listing

-

EU eyes migration clampdown with push on deportations, visas

-

Umpire call fired up Sabalenka in politically charged Melbourne clash

Umpire call fired up Sabalenka in politically charged Melbourne clash

-

Rybakina battles into Australian Open final against Sabalenka

-

Iran vows 'crushing response', EU targets Revolutionary Guards

Iran vows 'crushing response', EU targets Revolutionary Guards

-

Northern Mozambique: massive gas potential in an insurgency zone

-

Gold demand hits record high on Trump policy doubts: industry

Gold demand hits record high on Trump policy doubts: industry

-

Show must go on: London opera chief steps in for ailing tenor

-

UK drugs giant AstraZeneca announces $15 bn investment in China

UK drugs giant AstraZeneca announces $15 bn investment in China

-

US scrutiny of visitors' social media could hammer tourism: trade group

-

'Watch the holes'! Paris fashion crowd gets to know building sites

'Watch the holes'! Paris fashion crowd gets to know building sites

-

Power, pace and financial muscle: How Premier League sides are ruling Europe

-

'Pesticide cocktails' pollute apples across Europe: study

'Pesticide cocktails' pollute apples across Europe: study

-

Ukraine's Svitolina feels 'very lucky' despite Australian Open loss

-

Money laundering probe overshadows Deutsche Bank's record profits

Money laundering probe overshadows Deutsche Bank's record profits

-

Huge Mozambique gas project restarts after five-year pause

-

Britain's Starmer reports 'good progress' after meeting China's Xi

Britain's Starmer reports 'good progress' after meeting China's Xi

-

Sabalenka crushes Svitolina in politically charged Australian Open semi

-

Turkey to offer mediation on US–Iran tensions, weighs border measures

Turkey to offer mediation on US–Iran tensions, weighs border measures

-

Mali's troubled tourism sector crosses fingers for comeback

-

China issues 73 life bans, punishes top football clubs for match-fixing

China issues 73 life bans, punishes top football clubs for match-fixing

-

Ghana moves to rewrite mining laws for bigger share of gold revenues

-

South Africa drops 'Melania' just ahead of release

South Africa drops 'Melania' just ahead of release

-

Senegal coach Thiaw banned, fined after AFCON final chaos

-

Russia's sanctioned oil firm Lukoil to sell foreign assets to Carlyle

Russia's sanctioned oil firm Lukoil to sell foreign assets to Carlyle

-

Australian Open chief Tiley says 'fine line' after privacy complaints

-

Trump-era trade stress leads Western powers to China

Trump-era trade stress leads Western powers to China

-

Gold soars towards $5,600 as Trump rattles sabre over Iran

-

Russia's Petrosian skates in Valieva shadow at Milan-Cortina Olympics

Russia's Petrosian skates in Valieva shadow at Milan-Cortina Olympics

-

China executes 11 linked to Myanmar scam compounds

-

Germany to harden critical infrastructure as Russia fears spike

Germany to harden critical infrastructure as Russia fears spike

-

Colombia plane crash investigators battle poor weather to reach site

-

Serena Williams refuses to rule out return to tennis

Serena Williams refuses to rule out return to tennis

-

Vietnam, EU vow stronger ties as bloc's chief visits Hanoi

-

New glove, same fist: Myanmar vote ensures military's grip

New glove, same fist: Myanmar vote ensures military's grip

-

Deutsche Bank logs record profits, as new probe casts shadow

Nations approve new UN rules on carbon markets at COP29

Governments at the COP29 talks approved Monday new UN standards for international carbon markets in a key step toward allowing countries to trade credits to meet their climate targets.

On the opening day of the UN climate talks in Azerbaijan, nearly 200 nations agreed a number of crucial ground rules for setting a market in motion after nearly a decade of complex discussions.

Other key aspects of the overall framework still need to be negotiated, experts said, but the decision brings closer a long-sought UN-backed market trading in high-quality credits.

"It's hugely significant," Erika Lennon, from the Center for International Environmental Law (CIEL), told AFP in Baku, saying it would "open the door" for a fully-fledged market.

Carbon credits are generated by activities that reduce or avoid planet-heating greenhouse gas emissions, like planting trees, protecting carbon sinks or replacing polluting coal with clean-energy alternatives.

One credit equals a tonne of prevented or removed heat-trapping carbon dioxide.

Since the Paris climate agreement in 2015, the UN has been crafting rules to allow countries and businesses to exchange credits in a transparent and credible market.

The benchmarks adopted in Baku will allow for the development of rules including calculating how many credits a given project can receive.

Once up and running, a carbon market would allow countries -- mainly wealthy polluters -- to offset emissions by purchasing credits from nations that have cut greenhouse gases above what they promised.

Purchasing countries could then put carbon credits toward achieving the climate goals promised in their national plans.

- 'Big step closer' -

"It gets the system a big step closer to actually existing in the real world," said Gilles Dufrasne from Carbon Market Watch, a think tank.

"But even with this, it doesn't mean the market actually exists," he added, saying further safeguards and questions around governance still remain unanswered.

An earlier UN attempt to regulate carbon markets under the Paris accord were rejected in Dubai in 2023 by the European Union and developing nations for being too lax.

Some observers were unhappy that the decision in Baku left unresolved other long-standing and crucial aspects of the broader crediting mechanism, known in UN terms as Article 6.

"It's not possible to declare victory," said a European diplomat, speaking on condition of anonymity.

There are hopes that a robust and credible UN carbon market could eventually indirectly raise the standards of the scandal-hit voluntary trade in credits.

Corporations wanting to offset their emissions and make claims of carbon neutrality have been major buyers of these credits, which are bought and exchanged but lack common standards.

But the voluntary market has been rocked by scandals in recent years amid accusations that some credits sold did not reduce emissions as promised, or that projects exploited local communities.

And the idea of offsetting as a whole faces deep scepticism from many.

"No matter how much integrity there is in the sort of the carbon markets, if what you are doing is offsetting ongoing fossil fuels with some sort of credit, you're not actually reducing anything," said Lennon.

G.Haefliger--VB