-

Starmer, Xi stress need for stronger UK-China ties to face global headwinds

Starmer, Xi stress need for stronger UK-China ties to face global headwinds

-

Senegal coach Thiaw gets five-match ban after AFCON final chaos

-

Phan Huy: the fashion prodigy putting Vietnam on the map

Phan Huy: the fashion prodigy putting Vietnam on the map

-

Hongkongers snap up silver as gold becomes 'too expensive'

-

Britain's Starmer meets China's Xi for talks on trade, security

Britain's Starmer meets China's Xi for talks on trade, security

-

Chinese quadriplegic runs farm with just one finger

-

Gold soars past $5,500 as Trump sabre rattles over Iran

Gold soars past $5,500 as Trump sabre rattles over Iran

-

China's ambassador warns Australia on buyback of key port

-

'Bombshell': What top general's fall means for China's military

'Bombshell': What top general's fall means for China's military

-

As US tensions churn, new generation of protest singers meet the moment

-

Venezuelans eye economic revival with hoped-for oil resurgence

Venezuelans eye economic revival with hoped-for oil resurgence

-

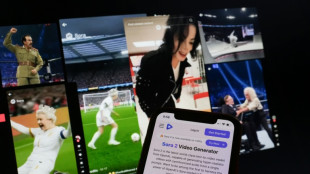

Online platforms offer filtering to fight AI slop

-

With Trump allies watching, Canada oil hub faces separatist bid

With Trump allies watching, Canada oil hub faces separatist bid

-

Samsung Electronics posts record profit on AI demand

-

Rockets veteran Adams out for rest of NBA season

Rockets veteran Adams out for rest of NBA season

-

Holders PSG happy to take 'long route' via Champions League play-offs

-

French Senate adopts bill to return colonial-era art

French Senate adopts bill to return colonial-era art

-

Allrounder Molineux named Australian women's cricket captain

-

Sabalenka faces Svitolina roadblock in Melbourne final quest

Sabalenka faces Svitolina roadblock in Melbourne final quest

-

Barcelona rout Copenhagen to reach Champions League last 16

-

Liverpool, Man City and Barcelona ease into Champions League last 16

Liverpool, Man City and Barcelona ease into Champions League last 16

-

Tesla profits tumble on lower EV sales, AI spending surge

-

Real Madrid face Champions League play-off after Benfica loss

Real Madrid face Champions League play-off after Benfica loss

-

LA mayor urges US to reassure visiting World Cup fans

-

Madrid condemned to Champions League play-off after Benfica loss

Madrid condemned to Champions League play-off after Benfica loss

-

Meta shares jump on strong earnings report

-

Haaland ends barren run as Man City reach Champions League last 16

Haaland ends barren run as Man City reach Champions League last 16

-

PSG and Newcastle drop into Champions League play-offs after stalemate

-

Salah ends drought as Liverpool hit Qarabag for six to reach Champions League last 16

Salah ends drought as Liverpool hit Qarabag for six to reach Champions League last 16

-

Barca rout Copenhagen to reach Champions League last 16

-

Arsenal complete Champions League clean sweep for top spot

Arsenal complete Champions League clean sweep for top spot

-

Kolo Muani and Solanke send Spurs into Champions League last 16

-

Bayern inflict Kane-ful Champions League defeat on PSV

Bayern inflict Kane-ful Champions League defeat on PSV

-

Pedro double fires Chelsea into Champions League last 16, dumps out Napoli

-

US stocks move sideways, shruggging off low-key Fed meeting

US stocks move sideways, shruggging off low-key Fed meeting

-

US capital Washington under fire after massive sewage leak

-

Anti-immigration protesters force climbdown in Sundance documentary

Anti-immigration protesters force climbdown in Sundance documentary

-

US ambassador says no ICE patrols at Winter Olympics

-

Norway's Kristoffersen wins Schladming slalom

Norway's Kristoffersen wins Schladming slalom

-

Springsteen releases fiery ode to Minneapolis shooting victims

-

Brady latest to blast Belichick Hall of Fame snub

Brady latest to blast Belichick Hall of Fame snub

-

Trump battles Minneapolis shooting fallout as agents put on leave

-

SpaceX eyes IPO timed to planet alignment and Musk birthday: report

SpaceX eyes IPO timed to planet alignment and Musk birthday: report

-

White House, Slovakia deny report on Trump's mental state

-

Iran vows to resist any US attack, insists ready for nuclear deal

Iran vows to resist any US attack, insists ready for nuclear deal

-

Colombia leader offers talks to end trade war with Ecuador

-

Former Masters champ Reed returning to PGA Tour from LIV

Former Masters champ Reed returning to PGA Tour from LIV

-

US Fed holds interest rates steady, defying Trump pressure

-

Norway's McGrath tops first leg of Schladming slalom

Norway's McGrath tops first leg of Schladming slalom

-

Iraq PM candidate Maliki denounces Trump's 'blatant' interference

Between new rivals and a distracted boss, Tesla suffers on Wall Street

Tesla lost a staggering two-thirds of its market value in 2022, a victim of fears about demand for electric vehicles, dismay at Elon Musk's tribulations as head of Twitter and the end of easy money on Wall Street.

On paper, everything was going well for the iconic electric vehicle maker that overcame supply problems and made nearly $9 billion in profit in the first three quarters of the year despite soaring costs.

But this is slower than the furious pace of growth that CEO Musk demands of his company with his stated ambition that Tesla unseat Apple as the world's most valued company.

Even if the share price is subject "to a lot of emotional elements... Tesla will be by my best guess the most valuable company in the world in less than five years," a defiant Musk told a forum on Twitter this month.

Blaming problems on "macroeconomic conditions" and high interest rates, Musk said he "can't say enough good things" about Tesla, asking his listeners to ignore his misadventures at Twitter where the mercurial CEO has captured headlines since taking over in October.

But to some analysts, the problems at Tesla are more serious and unrelated to Twitter -- mainly because the days where it was the sole player on the electric vehicle market are over.

The new year "is shaping up to be a 'reset' year for the EV market" with supply flooding the market, analyst Adam Jonas of Morgan Stanley said in a note.

"There are hurdles to overcome," added Jonas -- citing increasing competition and a worsening economy, with living costs sent soaring by inflation.

- Rare discounts -

In 2023, the quiet hum of EV motors will be coming from vehicles other than Teslas as traditional automakers roll out models at an unprecedented pace.

In Tesla's luxury car category, Mercedes-Benz, BMW, Audi, Polestar and Rivian have entered the fray and the change is coming fast for Tesla.

While Musk's Texas-based company still captured 65 percent of market share in the first nine months of the year, S&P Global analysts predicted Tesla's market share will shrink to just 20 percent by 2025.

The situation in China is also not helping matters: according to press reports, production is currently suspended in Tesla's Shanghai factory due to Covid-related issues.

To ramp up sales, Tesla has offered a rare $7,500 discount to US customers on the new Model 3 or Model Y, along with 10,000 miles of free fast charging.

- Twitter 'storm' -

Tesla, partly due to its superstar CEO, still has its diehard fans and Tesla is still seen as undisputed in terms of technology, cost management and scale in the fast-growing market.

The investment firm Robert W. Baird believes that the group is the "best positioned in the automotive market" and still recommends buying Tesla stock despite the crash.

Looming over everything is the shadow of Twitter, the influential social network bought in October by Musk -- who fired more than half its staff, inviting controversy.

Tesla needs "a CEO to navigate this Category 5 storm" and not a boss "focused on Twitter," said Wedbush's Dan Ives in a note published Tuesday.

The multi-billionaire sold several billion dollars of Tesla shares to finance his new venture, and has offloaded billions more since the $44-billion buyout -- in breach of pledges to stop selling the stock.

He also provoked critics by inviting Donald Trump and hundreds of other banned users back to Twitter and suspended certain journalists in an apparent fit of pique.

It has become "untenable" to separate the future of Tesla from Musk's erratic management of Twitter, said Colin Rusch, of Oppenheimer.

The events at Twitter are "too much for a majority of consumers to continue supporting Musk and Tesla," said Rusch, predicting the billionaire's antics would drive at least some buyers towards other EV options -- untainted by controversy.

The stock debacle comes after Tesla shares jumped by more than 700 percent in 2020 and 50 percent in 2021.

They have recovered nearly 12 percent in the last two days, but were still down 65 percent on Thursday evening compared to the beginning of the year.

O.Krause--BTB