-

Turkey to offer mediation on US–Iran tensions, weighs border measures

Turkey to offer mediation on US–Iran tensions, weighs border measures

-

Mali's troubled tourism sector crosses fingers for comeback

-

China issues 73 life bans, punishes top football clubs for match-fixing

China issues 73 life bans, punishes top football clubs for match-fixing

-

Ghana moves to rewrite mining laws for bigger share of gold revenues

-

South Africa drops 'Melania' just ahead of release

South Africa drops 'Melania' just ahead of release

-

Senegal coach Thiaw banned, fined after AFCON final chaos

-

Russia's sanctioned oil firm Lukoil to sell foreign assets to Carlyle

Russia's sanctioned oil firm Lukoil to sell foreign assets to Carlyle

-

Australian Open chief Tiley says 'fine line' after privacy complaints

-

Trump-era trade stress leads Western powers to China

Trump-era trade stress leads Western powers to China

-

Gold soars towards $5,600 as Trump rattles sabre over Iran

-

Russia's Petrosian skates in Valieva shadow at Milan-Cortina Olympics

Russia's Petrosian skates in Valieva shadow at Milan-Cortina Olympics

-

China executes 11 linked to Myanmar scam compounds

-

Germany to harden critical infrastructure as Russia fears spike

Germany to harden critical infrastructure as Russia fears spike

-

Colombia plane crash investigators battle poor weather to reach site

-

Serena Williams refuses to rule out return to tennis

Serena Williams refuses to rule out return to tennis

-

Vietnam, EU vow stronger ties as bloc's chief visits Hanoi

-

New glove, same fist: Myanmar vote ensures military's grip

New glove, same fist: Myanmar vote ensures military's grip

-

Deutsche Bank logs record profits, as new probe casts shadow

-

Thai foreign minister says hopes Myanmar polls 'start of transition' to peace

Thai foreign minister says hopes Myanmar polls 'start of transition' to peace

-

No white flag from Djokovic against Sinner as Alcaraz faces Zverev threat

-

Vietnam and EU upgrade ties as EU chief visits Hanoi

Vietnam and EU upgrade ties as EU chief visits Hanoi

-

Starmer, Xi stress need for stronger UK-China ties to face global headwinds

-

Senegal coach Thiaw gets five-match ban after AFCON final chaos

Senegal coach Thiaw gets five-match ban after AFCON final chaos

-

Phan Huy: the fashion prodigy putting Vietnam on the map

-

Hongkongers snap up silver as gold becomes 'too expensive'

Hongkongers snap up silver as gold becomes 'too expensive'

-

Britain's Starmer meets China's Xi for talks on trade, security

-

Chinese quadriplegic runs farm with just one finger

Chinese quadriplegic runs farm with just one finger

-

Gold soars past $5,500 as Trump sabre rattles over Iran

-

China's ambassador warns Australia on buyback of key port

China's ambassador warns Australia on buyback of key port

-

'Bombshell': What top general's fall means for China's military

-

As US tensions churn, new generation of protest singers meet the moment

As US tensions churn, new generation of protest singers meet the moment

-

Venezuelans eye economic revival with hoped-for oil resurgence

-

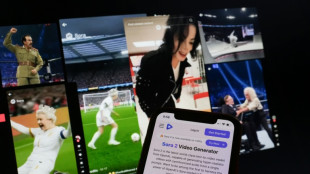

Online platforms offer filtering to fight AI slop

Online platforms offer filtering to fight AI slop

-

With Trump allies watching, Canada oil hub faces separatist bid

-

Samsung Electronics posts record profit on AI demand

Samsung Electronics posts record profit on AI demand

-

Rockets veteran Adams out for rest of NBA season

-

Holders PSG happy to take 'long route' via Champions League play-offs

Holders PSG happy to take 'long route' via Champions League play-offs

-

French Senate adopts bill to return colonial-era art

-

Allrounder Molineux named Australian women's cricket captain

Allrounder Molineux named Australian women's cricket captain

-

Sabalenka faces Svitolina roadblock in Melbourne final quest

-

Barcelona rout Copenhagen to reach Champions League last 16

Barcelona rout Copenhagen to reach Champions League last 16

-

Liverpool, Man City and Barcelona ease into Champions League last 16

-

Tesla profits tumble on lower EV sales, AI spending surge

Tesla profits tumble on lower EV sales, AI spending surge

-

Real Madrid face Champions League play-off after Benfica loss

-

LA mayor urges US to reassure visiting World Cup fans

LA mayor urges US to reassure visiting World Cup fans

-

Madrid condemned to Champions League play-off after Benfica loss

-

Meta shares jump on strong earnings report

Meta shares jump on strong earnings report

-

Haaland ends barren run as Man City reach Champions League last 16

-

PSG and Newcastle drop into Champions League play-offs after stalemate

PSG and Newcastle drop into Champions League play-offs after stalemate

-

Salah ends drought as Liverpool hit Qarabag for six to reach Champions League last 16

Ghana moves to rewrite mining laws for bigger share of gold revenues

Ghana is preparing to overhaul its mining laws to increase its share of the revenues generated by the surge in the precious metal's price, sparking concern among foreign mining companies in Africa's top gold producer.

By revising its mining code, which currently offers foreign mining firms favourable tax and royalty terms, leaving the state with a limited stake, Ghana is following in the footsteps of other African countries.

They are looking to tighten control over natural resources as global demand for gold and critical minerals such as cobalt soars.

Among those that have recently introduced new mining laws are the Democratic Republic of Congo, Mali and Tanzania.

Gold prices have skyrocketed recently, jumping more than 65 percent in 2025, climbing to fresh records above $5,100 on Monday.

"What we have since 2014 is a policy that has not been reviewed," Isaac Andrews Tandoh, acting chief executive officer of the Minerals Commission, told AFP.

"We had to do something to bridge this gap."

In Ghana, the world's sixth-largest gold producer, gold production is largely dominated by foreign companies such as the US's Newmont, South Africa's Gold Fields and AngloGold Ashanti and Australia's Perseus Mining.

Under proposed reforms expected to be presented to parliament by March, mining royalties would jump from the current three to five percent range to between nine and 12 percent, depending on global gold prices, Tandoh said.

Ghana's mining agreements typically freeze fiscal terms for between five and 15 years in exchange for investments that can exceed $500 million to build or expand mines.

But regulators say some companies renege on their commitments.

"We have seen companies with development agreements that refuse to develop the mine and instead use revenues from Ghana to acquire assets elsewhere," Tandoh said.

The reforms would scrap development agreements entirely and review stability clauses that shield investors from future policy changes, a move authorities say reflects Ghana's growing experience in managing the sector.

- 'Double-edged knife' -

As African governments increasingly seek a bigger share of mining revenues amid a surge in commodity prices, officials acknowledge the challenge of balancing investor confidence with national benefit.

Mining policy strategist Ing. Wisdom Gomashie said Ghana currently captures only about 10 percent of total mineral value through royalties, dividends and taxes.

"The thinking of government is right," Gomashie said. "But the approach should not be draconian."

He warned that stability agreements, while open to reform, are crucial for protecting long-term investments and securing external financing, particularly in countries perceived as politically risky.

"Scrapping them outright, while simultaneously increasing royalties, could become a double-edged knife," Gomashie said.

Industry groups have also voiced concern.

Ghana Chamber of Mines CEO Kenneth Ashigbey said miners were not opposed to the state seeking higher returns but warned that the current proposals risk undermining competitiveness.

"What we are advocating for is a sweet spot, one where government secures sustainable revenues while the industry can expand, reinvest and take advantage of high gold prices," Ashigbey told AFP.

Large-scale mining firms in Ghana already face a high tax burden, including a five percent royalty on gross revenue and a 35 percent corporate income tax, the chamber said.

Alongside fiscal reforms, Ghana has tightened gold trading rules, particularly in the small-scale sector, to curb smuggling and improve transparency.

Ghana's Gold Board spokesman, Prince Minkah said new licensing and tracking systems have helped formalise the trade and boost foreign exchange earnings.

"We now have the data to track when, where and how traders operate," Minkah told AFP.

Ghana recorded about $10.5 billion in gold export earnings last year.

The country's proposed mining reforms come as the country faces rising fiscal pressure.

It ended 2025 as Africa's fourth-largest IMF debtor, with $4.1 billion outstanding, and recently received a further $365 million under a bailout programme.

Public debt stood at 684.6 billion cedis ($55.1 billion) in September, intensifying the push for domestic revenue and economic stabilisation.

F.Mueller--VB