-

Can Arsenal handle Premier League weight of expectation?

Can Arsenal handle Premier League weight of expectation?

-

Ex-OPEC president's corruption trial sees start delayed

-

North Sea nations look to wind to resist Russian energy 'blackmail'

North Sea nations look to wind to resist Russian energy 'blackmail'

-

Europe's elite jostle for Champions League last-16 places

-

New Nepali political party fields LGBTIQ candidates

New Nepali political party fields LGBTIQ candidates

-

Nepal arrests six in tourist rescue fraud

-

Rampant Swiatek meets old foe Rybakina in Australian Open quarters

Rampant Swiatek meets old foe Rybakina in Australian Open quarters

-

Dollar sinks on yen intervention talk, gold breaks $5,100

-

Qualifier Inglis to splash out on toaster, kettle after Melbourne run

Qualifier Inglis to splash out on toaster, kettle after Melbourne run

-

Iran protest toll nears 6,000 dead as Tehran warns US against intervention

-

EU opens probe into Musk's Grok over sexual AI deepfakes

EU opens probe into Musk's Grok over sexual AI deepfakes

-

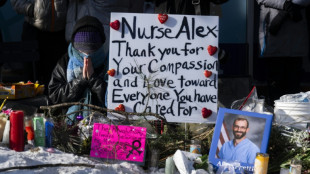

Minneapolis locals protest 'inhumane' US agents after second killing

-

World not ready for rise in extreme heat, scientists say

World not ready for rise in extreme heat, scientists say

-

Fan warning as Australian Open braces for 45C heatwave

-

Sinner races on, dethroned Keys eats pie as heatwave hits Melbourne

Sinner races on, dethroned Keys eats pie as heatwave hits Melbourne

-

German business morale still muted in January

-

African players in Europe: Mbeumo strikes as United stun Arsenal

African players in Europe: Mbeumo strikes as United stun Arsenal

-

Barca chief Laporta upset by impending Dro switch to PSG

-

Rights group says confirmed Iran protest toll nears 6,000

Rights group says confirmed Iran protest toll nears 6,000

-

Rampant Swiatek ends Inglis fairytale at Australian Open

-

Sinner races through in Melbourne as Djokovic looms into view

Sinner races through in Melbourne as Djokovic looms into view

-

Israel agrees to reopen Rafah crossing only for Gaza pedestrians

-

Israel agrees to reopen Rafah only for Gaza pedestrians

Israel agrees to reopen Rafah only for Gaza pedestrians

-

Anisimova primed to snap win drought against Pegula in Melbourne clash

-

Indonesia landslide death toll rises to 17, dozens missing

Indonesia landslide death toll rises to 17, dozens missing

-

Anisimova ensures 25-year Australian Open first for US women

-

Musetti vows to push Djokovic 'to his maximum' in Melbourne quarters

Musetti vows to push Djokovic 'to his maximum' in Melbourne quarters

-

Ferry sinking kills 18, leaves 24 missing in south Philippines

-

US military working with Nigeria as part of wider Islamic State pivot

US military working with Nigeria as part of wider Islamic State pivot

-

Australia Day protesters demand Indigenous rights

-

Anisimova silences Chinese fans to set up Pegula showdown in Melbourne

Anisimova silences Chinese fans to set up Pegula showdown in Melbourne

-

Greg Bovino, the face of Trump's 'turn and burn' migrant crackdown

-

Myanmar pro-military party declares victory in junta-run polls

Myanmar pro-military party declares victory in junta-run polls

-

Social media giants face landmark trial over addiction claims

-

US speed star Lindsey Vonn: Olympic timeline

US speed star Lindsey Vonn: Olympic timeline

-

Legends of Winter Olympics: heroes of the slopes

-

Cheesy apple pie for Keys as victor Pegula dodges Chiefs jersey

Cheesy apple pie for Keys as victor Pegula dodges Chiefs jersey

-

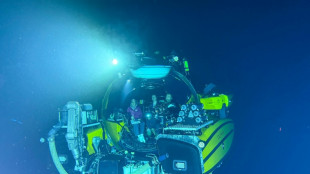

OceanXplorer: a 'one-stop shop' for marine research

-

'So little we know': in submersibles revealing the deep sea

'So little we know': in submersibles revealing the deep sea

-

Keys 'proud' as Australian Open reign ends to good friend Pegula

-

Communities aid police after Nepal's deadly uprising

Communities aid police after Nepal's deadly uprising

-

Patriots, Seahawks set up Super Bowl rematch

-

Curry leads Warriors over 'suffering' T'Wolves, Raptors silence Thunder

Curry leads Warriors over 'suffering' T'Wolves, Raptors silence Thunder

-

Darnold, Seahawks defeat Rams 31-27 to reach Super Bowl

-

Named after teacher mum, Learner Tien makes Grand Slam milestone

Named after teacher mum, Learner Tien makes Grand Slam milestone

-

Dollar sinks on yen intervention talk, gold breaks $5,000

-

Melbourne champion Keys exits as Sinner bids to avoid same fate

Melbourne champion Keys exits as Sinner bids to avoid same fate

-

Minneapolis locals pay respects to man killed by US agents

-

Clinical Pegula dumps defending champion Keys out of Australian Open

Clinical Pegula dumps defending champion Keys out of Australian Open

-

Lindsey Vonn defies the odds to chase Olympic dream

Dollar sinks on yen intervention talk, gold breaks $5,100

The dollar fell and gold hit fresh high on Monday amid uncertainty over domestic US policies and speculation of US-Japanese coordination to support the yen.

Equity markets were mostly lower, with most major European indices in the red after a weak lead from Asia.

The price of safe-haven asset gold pushed above $5,100 an ounce after surpassing $5,000 on Sunday, amid rising global uncertainty and turmoil set off by US President Donald Trump's policies.

Silver broke $100 Friday and spiked above $110 Monday.

"The relentless quest for hard assets continued amid yet more talk of tariffs and US government shutdowns," said Neil Wilson, investor strategist at Saxo UK.

Multiple US senators have said they would vote against upcoming government spending bills after federal agents killed a second American citizen in Minneapolis, significantly increasing the chances of a government shutdown next week.

The dollar was also weighed down by a surge in the yen on speculation that authorities may intervene to prop up the Japanese currency.

"The FX (foreign exchange) market is front and centre at the start of this week and the focus is on the huge move higher in the yen," said Kathleen Brooks, research director at XTB trading group.

"Reports suggest that Japanese officials were joined by the Federal Reserve Bank of New York who bought yen to support the beleaguered currency," she added.

The yen has been sliding amid worries about Japan's fiscal position, the central bank's decision not to hike interest rates further and expectations that the US Fed will hold off cutting its own borrowing costs this week.

Tokyo's stock market sank 1.8 percent owing to the stronger yen, which weighs on Japanese exporters.

The prospect of authorities stepping into financial markets saw the dollar retreat across the board, with the euro, pound and South Korean won also well up while the Singapore dollar hit an 11-year high.

The US Federal Reserve is expected to hold interest rates this week, despite Trump's pressure to slash levels as it guards against threats to its independence.

Trump has made no secret of his disdain for Federal Reserve boss Jerome Powell, claiming there is "no inflation" and repeatedly questioning the Fed chair's competence and integrity.

Oil prices extended Friday gains that came after Trump said a US "armada" was heading towards the Gulf and that Washington was watching Iran closely.

The president has repeatedly left open the option of new military action against Tehran after Washington backed and joined Israel's 12-day war in June aimed at degrading Iranian nuclear and ballistic missile programmes.

- Key figures at around 1120 GMT -

London - FTSE 100: UP 0.1 percent at 10,148.13 points

Paris - CAC 40: DOWN 0.4 percent at 8,112.25

Frankfurt - DAX: DOWN 0.4 percent at 24,806.68

Tokyo - Nikkei 225: DOWN 1.8 percent at 52,885.25 (close)

Hong Kong - Hang Seng Index: UP 0.1 percent at 26,765.52 (close)

Shanghai - Composite: DOWN 0.1 percent at 4,132.61 (close)

New York - Dow: DOWN 0.6 percent at 49,098.71 (close)

Dollar/yen: DOWN at 153.77 yen from 157.00 yen on Friday

Euro/dollar: UP at $1.1849 from $1.1823

Pound/dollar: UP at $1.3666 from $1.3636

Euro/pound: FLAT at 86.70 pence

Brent North Sea Crude: UP 0.2 percent at $66.02 per barrel

West Texas Intermediate: UP 0.2 percent at $61.16 per barrel

P.Keller--VB