-

TikTok in the US goes American, but questions remain

TikTok in the US goes American, but questions remain

-

France probes deaths of two babies after powdered milk recall

-

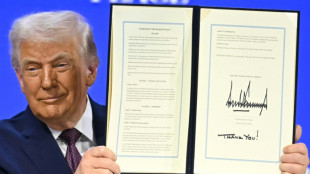

Across the globe, views vary about Trump's world vision

Across the globe, views vary about Trump's world vision

-

UN rights council decries 'unprecedented' crackdown in Iran, deepens scrutiny

-

Suryakumar, Kishan star as India thrash New Zealand in second T20

Suryakumar, Kishan star as India thrash New Zealand in second T20

-

Spanish prosecutors dismiss sex abuse case against Julio Iglesias

-

Suspected Russia 'shadow fleet' tanker bound for French port

Suspected Russia 'shadow fleet' tanker bound for French port

-

UK PM slams Trump for saying NATO troops avoided Afghan front line

-

Arteta tells Nwaneri to 'swim with sharks' on Marseille loan move

Arteta tells Nwaneri to 'swim with sharks' on Marseille loan move

-

Snow and ice storm set to sweep US

-

Palmer 'happy' at Chelsea despite homesick speculation: Rosenior

Palmer 'happy' at Chelsea despite homesick speculation: Rosenior

-

Ukraine-Russia-US talks open in Abu Dhabi as Moscow demands Donbas region

-

Ferrari unveil 2026 car with Hamilton ready for 'massive challenge'

Ferrari unveil 2026 car with Hamilton ready for 'massive challenge'

-

Welsh full-back Williams retires from international rugby

-

Gold nears $5,000, global stocks muted ending turbulent week

Gold nears $5,000, global stocks muted ending turbulent week

-

Ex-Canadian Olympian turned drug lord arrested: US media

-

A look back at Ukraine war talks

A look back at Ukraine war talks

-

France trolls US, Russia misinformation on X

-

Carrick keen for Man Utd to build around 'quality' Mainoo

Carrick keen for Man Utd to build around 'quality' Mainoo

-

Danish PM visits Greenland for talks after Trump climbdown

-

Reed seizes halfway lead at Dubai Desert Classic

Reed seizes halfway lead at Dubai Desert Classic

-

Europeans among 150 IS detainees transferred from Syria to Iraq

-

UN expert urges world to reject Myanmar 'sham' election

UN expert urges world to reject Myanmar 'sham' election

-

Sarajevo reels under 'extreme' pollution, alert issued

-

Williams to miss opening F1 test due to car delays

Williams to miss opening F1 test due to car delays

-

Ski chief confident of Olympic preparations

-

Man City chasing 'world's best' in Arsenal, says Guardiola

Man City chasing 'world's best' in Arsenal, says Guardiola

-

Outrage after Trump claims NATO troops avoided Afghan front line

-

German auto supplier ZF axes electric projects as demand stalls

German auto supplier ZF axes electric projects as demand stalls

-

ECB chief thanks Davos 'euro-bashers' as welcome wake-up call

-

UK woman felt 'violated, assaulted' by deepfake Grok images

UK woman felt 'violated, assaulted' by deepfake Grok images

-

France PM survives no-confidence vote over forced budget

-

McCall to step down after 15 years as director of rugby at Saracens

McCall to step down after 15 years as director of rugby at Saracens

-

Volatile security blocks UN from Syria IS-linked camp

-

Odermatt retains Kitzbuehel super-G in Olympic broadside

Odermatt retains Kitzbuehel super-G in Olympic broadside

-

Did Trump make Davos great again?

-

Fisilau among new faces in England Six Nations squad

Fisilau among new faces in England Six Nations squad

-

Long-awaited first snowfall brings relief to water-scarce Kabul

-

Danish, Greenland PMs to meet after Trump climbdown

Danish, Greenland PMs to meet after Trump climbdown

-

Gold nears $5,000, stocks muted after turbulent week

-

Liverpool on the up as new signings hit form, says Slot

Liverpool on the up as new signings hit form, says Slot

-

Stars turn out for Valentino's funeral in Rome

-

Israeli Bedouin say hope for better life crushed after deadly crackdown

Israeli Bedouin say hope for better life crushed after deadly crackdown

-

Russia demands Ukraine's Donbas region ahead of Abu Dhabi talks

-

Iran lambasts Zelensky after Davos 'bully' warning

Iran lambasts Zelensky after Davos 'bully' warning

-

Gauff hopes to copy 'insane' Osaka fashion statement, but not yet

-

Australian Open to start earlier Saturday over forecast 40C heat

Australian Open to start earlier Saturday over forecast 40C heat

-

Vietnam's To Lam 'unanimously' re-elected party chief

-

Teenager Jovic dumps seventh seed Paolini out of Australian Open

Teenager Jovic dumps seventh seed Paolini out of Australian Open

-

'He must hate me': Medvedev renews Tien rivalry at Australian Open

Delayed US data expected to show solid growth in 3rd quarter

The US economy is expected to post another solid economic growth reading Tuesday, but the much-delayed figures likely will not settle debate on the labor market, AI and other variables.

Forecasters expect Tuesday's third-quarter gross domestic product (GDP) report to show 3.2 percent growth, according to consensus estimates from MarketWatch and Trading Economics.

That represents a bit of a moderation from the 3.8 percent second-quarter gain following a first-quarter with negative growth. Tuesday's release comes nearly two months after it was originally scheduled due to the US government shutdown.

The report reflects a much improved US macroeconomic outlook compared with earlier in 2025, when worries about President Donald Trump's aggressive trade policy changes weighed on sentiment.

But by the latter stages of 2025, Trump's administration had negotiated agreements with China and other major economies that prevented enactment of the most onerous tariffs.

Meanwhile, an AI investment boom by Chat GPT-maker OpenAI, Google and other tech giants continued to pick up momentum, keeping the US stock market near record levels.

Pantheon Macroeconomics estimates that US growth in the third quarter came in at a "brisk-looking" 3.5 percent that nonetheless "will overstate the economy's true condition," the research firm said in a note.

A slowing job market and muted retail sales trends are among the factors consistent with "steady but unspectacular GDP growth" looking ahead to 2026, said Pantheon, which predicted the Federal Reserve would cut interest rates further in the new year.

"The risks remain skewed towards a faster cadence or larger decline in rates," said Pantheon, pointing to the Fed's impending leadership change with the 2026 departure of Chair Jerome Powell.

- Consumer caution? -

The US central bank on December 10 announced an interest rate cut for the third straight meeting.

While inflation remains well above the Fed's two percent target, Powell and other policymakers have described the weakening employment market as the greater concern at the moment.

The Fed's median 2026 GDP forecast is 2.3 percent, up from 1.7 percent projected in 2025, according to a summary of the central bank's outlook.

White House officials have said Trump could nominate Powell's successor in January.

Polling shows declining support for Trump as consumer prices have stayed at an elevated level.

But Kevin Hassett, a White House economic advisor considered the favorite for the Fed post, told Fox News over the weekend that consumers would soon see better times.

"I think that the American people are going to see it in their wallets... they're going to see that President Trump's policies are making them better," said Hassett, who mentioned an expected boost from higher tax refunds in 2026.

But Pantheon argued the economic benefit from tax refunds may be contained, noting that "the relatively low level of consumer confidence suggests many households will save a high share of the windfall."

A December 18 outlook piece from S&P Global Ratings said AI investment would likely buoy the economy but could be offset by political uncertainty under Trump.

"US trade policy uncertainty has settled down, but not US policy drama overall," S&P said.

"Statutory US tariff rates may not move much in 2026, but uncertainty around laws, norms, investment rules, military actions and geopolitics more generally will remain elevated," S&P said. "This uncertainty will likely dampen investment and discretionary consumption."

B.Wyler--VB