-

Barcola's winner sends PSG top despite lack of 'confidence'

Barcola's winner sends PSG top despite lack of 'confidence'

-

Inter fight back to thrash Pisa and extend Serie A lead to six points

-

Defiant protests over US immigration crackdown, child's detention

Defiant protests over US immigration crackdown, child's detention

-

Gold nears $5,000, silver shines as stocks churn to end turbulent week

-

Ukraine, Russia hold first direct talks on latest US peace plan

Ukraine, Russia hold first direct talks on latest US peace plan

-

Robbie Williams tops Beatles for most number one albums in UK

-

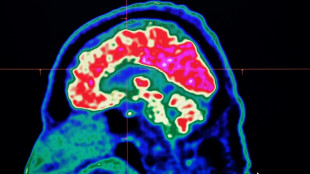

Final report casts doubt on existence of Canada mystery brain illness

Final report casts doubt on existence of Canada mystery brain illness

-

What's driving Guatemala's surge in gang violence?

-

Western powers warn Haiti against changing PM amid turmoil

Western powers warn Haiti against changing PM amid turmoil

-

Fury grows over five-year-old's detention in US immigration crackdown

-

TikTok in the US goes American, but questions remain

TikTok in the US goes American, but questions remain

-

France probes deaths of two babies after powdered milk recall

-

Across the globe, views vary about Trump's world vision

Across the globe, views vary about Trump's world vision

-

UN rights council decries 'unprecedented' crackdown in Iran, deepens scrutiny

-

Suryakumar, Kishan star as India thrash New Zealand in second T20

Suryakumar, Kishan star as India thrash New Zealand in second T20

-

Spanish prosecutors dismiss sex abuse case against Julio Iglesias

-

Suspected Russia 'shadow fleet' tanker bound for French port

Suspected Russia 'shadow fleet' tanker bound for French port

-

UK PM slams Trump for saying NATO troops avoided Afghan front line

-

Arteta tells Nwaneri to 'swim with sharks' on Marseille loan move

Arteta tells Nwaneri to 'swim with sharks' on Marseille loan move

-

Snow and ice storm set to sweep US

-

Palmer 'happy' at Chelsea despite homesick speculation: Rosenior

Palmer 'happy' at Chelsea despite homesick speculation: Rosenior

-

Ukraine-Russia-US talks open in Abu Dhabi as Moscow demands Donbas region

-

Ferrari unveil 2026 car with Hamilton ready for 'massive challenge'

Ferrari unveil 2026 car with Hamilton ready for 'massive challenge'

-

Welsh full-back Williams retires from international rugby

-

Gold nears $5,000, global stocks muted ending turbulent week

Gold nears $5,000, global stocks muted ending turbulent week

-

Ex-Canadian Olympian turned drug lord arrested: US media

-

A look back at Ukraine war talks

A look back at Ukraine war talks

-

France trolls US, Russia misinformation on X

-

Carrick keen for Man Utd to build around 'quality' Mainoo

Carrick keen for Man Utd to build around 'quality' Mainoo

-

Danish PM visits Greenland for talks after Trump climbdown

-

Reed seizes halfway lead at Dubai Desert Classic

Reed seizes halfway lead at Dubai Desert Classic

-

Europeans among 150 IS detainees transferred from Syria to Iraq

-

UN expert urges world to reject Myanmar 'sham' election

UN expert urges world to reject Myanmar 'sham' election

-

Sarajevo reels under 'extreme' pollution, alert issued

-

Williams to miss opening F1 test due to car delays

Williams to miss opening F1 test due to car delays

-

Ski chief confident of Olympic preparations

-

Man City chasing 'world's best' in Arsenal, says Guardiola

Man City chasing 'world's best' in Arsenal, says Guardiola

-

Outrage after Trump claims NATO troops avoided Afghan front line

-

German auto supplier ZF axes electric projects as demand stalls

German auto supplier ZF axes electric projects as demand stalls

-

ECB chief thanks Davos 'euro-bashers' as welcome wake-up call

-

UK woman felt 'violated, assaulted' by deepfake Grok images

UK woman felt 'violated, assaulted' by deepfake Grok images

-

France PM survives no-confidence vote over forced budget

-

McCall to step down after 15 years as director of rugby at Saracens

McCall to step down after 15 years as director of rugby at Saracens

-

Volatile security blocks UN from Syria IS-linked camp

-

Odermatt retains Kitzbuehel super-G in Olympic broadside

Odermatt retains Kitzbuehel super-G in Olympic broadside

-

Did Trump make Davos great again?

-

Fisilau among new faces in England Six Nations squad

Fisilau among new faces in England Six Nations squad

-

Long-awaited first snowfall brings relief to water-scarce Kabul

-

Danish, Greenland PMs to meet after Trump climbdown

Danish, Greenland PMs to meet after Trump climbdown

-

Gold nears $5,000, stocks muted after turbulent week

Tech stocks lead Wall Street higher, gold hits fresh record

Wall Street and Asian stock markets advanced on Monday, with tech stocks leading the way.

Gold and silver also struck fresh record highs, while oil prices climbed on rising geopolitical tensions.

"The stock market... is feeling some holiday cheer as it works to keep the Scrooges of the world at the door," said Briefing.com analyst Patrick O'Hare.

Tech stocks pushed higher as concerns about a bubble in AI stocks receded, with the so-called Magnificent Seven tech stocks rising 0.5 percent as trading got underway.

"There is a stir in the market thanks to a Reuters report that Nvidia is looking to start H200 (chip) shipments to China by mid-February," he added.

The Trump administration earlier this month gave the go-ahead to ship the chips to China, reversing US export policy for the advanced AI chips.

Shares in Nvidia added 1.3 percent as trading opened in New York.

O'Hare also pointed to a report that OpenAI had boosted its margin on paid products as boosting sentiment.

Wall Street's tech-heavy Nasdaq rose 0.6 percent as trading got underway.

Tech firms also led the rally in Asia, with South Korea's Samsung Electronics, Taiwan's TSMC and Japan's Renesas among the best performers.

Tokyo was the standout, piling on 1.8 percent thanks to a weaker yen.

Hong Kong, Shanghai, Sydney, Seoul, Singapore, Mumbai, Bangkok, Wellington, Taipei and Manila stock markets all saw healthy advances.

However, London, Paris and Frankfurt fell.

"Tech stocks are leading this 'Santa Rally' and Europe is tech-light, so it may be a laggard as we start a new week," said Kathleen Brooks, research director at trading group XTB.

The tech bounce came after a bout of selling fuelled by concerns that valuations had been stretched and questions were being asked about the vast sums invested in artificial intelligence that some warn could take time to see returns.

Gold, which benefits from expectations of lower US interest rates, hit a fresh record of $4,429.12, while silver also struck a new peak.

The precious metals, which are go-to assets in times of crisis, also benefited from geopolitical worries as Washington steps up its oil blockade against Venezuela and after Ukraine hit a tanker from Russia's shadow fleet in the Mediterranean.

Oil prices rose more than two percent amid the geopolitical tensions.

Forex traders are keeping tabs on Tokyo after Japan's top currency official said he was concerned about the yen's recent weakness, which came after the central bank hiked interest rates to a 30-year high on Friday.

The comments stoked speculation that officials could intervene in currency markets to support the yen, which fell more than one percent against the dollar Friday after bank boss Kazuo Ueda chose not to signal more increases early in the new year.

Market sentiment was boosted last week by the latest US economic data reinforcing expectations the Federal Reserve would cut interest rates further in 2026.

- Key figures at around 1430 GMT -

New York - Dow: UP 0.2 percent at 48,223.85 points

New York - S&P 500: UP 0.4 percent at 6,864.57

New York - Nasdaq Composite: UP 0.6 percent at 23,450.53

London - FTSE 100: DOWN 0.7 percent at 9,829.47

Paris - CAC 40: DOWN 0.5 percent at 8,108.55

Frankfurt - DAX: DOWN 0.1 percent at 24,261.70

Tokyo - Nikkei 225: UP 1.8 percent at 50,402.39 (close)

Hong Kong - Hang Seng Index: UP 0.4 percent at 25,801.77 (close)

Shanghai - Composite: UP 0.7 percent at 3,917.36 (close)

Dollar/yen: DOWN at 156.97 yen from 157.59 yen on Friday

Euro/dollar: UP at $1.1758 from $1.1719

Pound/dollar: UP at $1.3447 from $1.3386

Euro/pound: DOWN at 87.44 pence from 87.55 pence

West Texas Intermediate: UP 2.3 percent at $57.81 per barrel

Brent North Sea Crude: UP 2.3 percent at $61.83 per barrel

burs-rl/rmb

A.Zbinden--VB