-

Swiatek survives roller coaster to reach Australian Open last 16

Swiatek survives roller coaster to reach Australian Open last 16

-

Wawrinka, 40, out in third round on fond Australian Open farewell

-

'Heartbroken' Osaka pulls out of Australian Open injured

'Heartbroken' Osaka pulls out of Australian Open injured

-

China says top military official under investigation

-

Threatened Ugandan opposition leader needs UN help: lawyer

Threatened Ugandan opposition leader needs UN help: lawyer

-

'I got lucky' - Cramping Sinner drops set on way to Melbourne last 16

-

Extreme heat triggers Melbourne suspension rule as Sinner battles on

Extreme heat triggers Melbourne suspension rule as Sinner battles on

-

'Zap you': Top players wrestle with scorching Melbourne heat

-

Lula revived Brazilian cinema, says 'The Secret Agent' director

Lula revived Brazilian cinema, says 'The Secret Agent' director

-

Wall Street intends to stay open around the clock

-

Struggling Sinner drops set before making Melbourne last 16

Struggling Sinner drops set before making Melbourne last 16

-

Ukraine, Russia to hold second day of direct talks on US plan

-

Pacers outlast Thunder in NBA Finals rematch

Pacers outlast Thunder in NBA Finals rematch

-

Vernon avoids crashes to win Tour Down Under stage in brutal heat

-

NSW Waratahs forward banned for punching teammate

NSW Waratahs forward banned for punching teammate

-

'One in a Million': Syrian refugee tale wows Sundance

-

Extreme heat triggers suspension rule at baking Australian Open

Extreme heat triggers suspension rule at baking Australian Open

-

US military to prioritize homeland and curbing China, limit support for allies

-

Europe and India seek closer ties with 'mother of all deals'

Europe and India seek closer ties with 'mother of all deals'

-

Bangladesh readies for polls, worry among Hasina supporters

-

Greenland, Denmark set aside troubled history to face down Trump

Greenland, Denmark set aside troubled history to face down Trump

-

Paris fashion doyenne Nichanian bows out at Hermes after 37 years

-

Anisimova ramps up Melbourne title bid with imperious win

Anisimova ramps up Melbourne title bid with imperious win

-

Keys revels in Melbourne heat as Djokovic steps up history bid

-

Nepal skipper eyes new summit with 'nothing to lose' at T20 World Cup

Nepal skipper eyes new summit with 'nothing to lose' at T20 World Cup

-

Defending champion Keys surges into Australian Open last 16

-

Pegula beats heat to sweep into last 16 at Australian Open

Pegula beats heat to sweep into last 16 at Australian Open

-

Teenage giantkiller Jovic gets help from 'kind' Djokovic in Melbourne

-

Venezuela says over 600 prisoners released; families' patience wanes

Venezuela says over 600 prisoners released; families' patience wanes

-

Teen Blades Brown shoots 60 to share PGA La Quinta lead with Scheffler

-

Icy storm threatens Americans with power outages, extreme cold

Icy storm threatens Americans with power outages, extreme cold

-

FBI probes death of Colts owner Jim Irsay

-

Barcola's winner sends PSG top despite lack of 'confidence'

Barcola's winner sends PSG top despite lack of 'confidence'

-

Inter fight back to thrash Pisa and extend Serie A lead to six points

-

Defiant protests over US immigration crackdown, child's detention

Defiant protests over US immigration crackdown, child's detention

-

Gold nears $5,000, silver shines as stocks churn to end turbulent week

-

Ukraine, Russia hold first direct talks on latest US peace plan

Ukraine, Russia hold first direct talks on latest US peace plan

-

Robbie Williams tops Beatles for most number one albums in UK

-

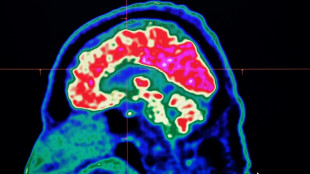

Final report casts doubt on existence of Canada mystery brain illness

Final report casts doubt on existence of Canada mystery brain illness

-

What's driving Guatemala's surge in gang violence?

-

Western powers warn Haiti against changing PM amid turmoil

Western powers warn Haiti against changing PM amid turmoil

-

Fury grows over five-year-old's detention in US immigration crackdown

-

TikTok in the US goes American, but questions remain

TikTok in the US goes American, but questions remain

-

France probes deaths of two babies after powdered milk recall

-

Across the globe, views vary about Trump's world vision

Across the globe, views vary about Trump's world vision

-

UN rights council decries 'unprecedented' crackdown in Iran, deepens scrutiny

-

Suryakumar, Kishan star as India thrash New Zealand in second T20

Suryakumar, Kishan star as India thrash New Zealand in second T20

-

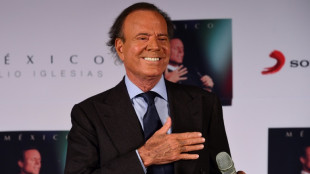

Spanish prosecutors dismiss sex abuse case against Julio Iglesias

-

Suspected Russia 'shadow fleet' tanker bound for French port

Suspected Russia 'shadow fleet' tanker bound for French port

-

UK PM slams Trump for saying NATO troops avoided Afghan front line

Volatile Oracle shares a proxy for Wall Street's AI jitters

For a reading of Wall Street's shifting mood on the artificial intelligence investment boom, take a look at the daily fluctuations of Oracle stock, analysts say.

Shares of the software giant slumped more than five percent Wednesday following a news report of financing troubles with one of the company's giant AI projects.

But they recovered on Thursday and finished up around one percent at $180.03 as tech companies rallied following blowout results from Micron Technology, another big AI player.

"Oracle is probably the poster child" for the AI investment boom, said B. Riley Wealth Management's Art Hogan, who points to questions about "circular financing" arrangements that have made Oracle and OpenAI dependent on each other for billions of dollars in business.

On Thursday, Oracle -- along with Silver Lake and Abu Dhabi-based MGX -- was also named in a new deal with TikTok, according to an internal memo seen by AFP from the social media company's CEO Shou Chew.

"The US joint venture will be responsible for US data protection, algorithm security, content moderation, and software assurance," Chew said in the memo. The deal would allow TikTok to maintain US operations and avoid a ban threat over its Chinese ownership.

Oracle stock rose more than five percent to $190.81 in after-hours trading on Thursday.

The firm's stock peaked at $345.72 in September after it unveiled a massive inventory of AI work, a surge that briefly vaulted co-founder Larry Ellison above Tesla CEO Elon Musk as the world's wealthiest person.

But its shares have since fallen more than 45 percent as investors have begun to question the risk of AI infrastructure overbuilding and scrutinized the financing of individual projects.

Ellison, a close ally of President Donald Trump, is currently fifth on the Forbes real-time billionaire list with $230 billion.

- Michigan project 'limbo' -

This week's gyrations in Oracle shares followed a Financial Times story Wednesday that described a $10 billion AI data center project in Michigan as "in limbo" after a key partner declined to join the project.

The company, Blue Owl Capital, a backer of other major Oracle projects, pulled back after other lenders pushed for stricter terms "amid shifting market sentiment around enormous AI spending," said the FT, which cited people familiar with the matter.

Oracle, which is taking on billions of dollars of debt in the building spree, described the FT story as "incorrect."

"Our development partner, Related Digital, selected the best equity partner from a competitive group of options, which in this instance was not Blue Owl," said Oracle spokesperson Michael Egbert.

"Final negotiations for their equity deal are moving forward on schedule and according to plan."

OpenAI CEO Sam Altman has said the Chat GPT-maker has committed to some $1.4 trillion in investments in AI computing, with some $300 billion reportedly going to Oracle.

But AI stocks have been volatile in recent weeks as the market scrutinizes the profit outlook for the data centers.

"Investors are starting to ask questions about the sustainability of the AI trade and the profitability," said Steve Sosnick of Interactive Brokers.

The enthusiasm for AI "makes sense" when considering that manufacturing and services companies could see profits enhanced by the technology, Sosnick said, before pointing to doubts over lofty AI equity valuations.

Oracle's price drop on Wednesday followed a selloff last week after the firm's quarterly results sparked worry over its massive capital spending.

Analysts bullish on the stock have emphasized its huge growth potential with the AI boom.

On Thursday, Morningstar trimmed its price target on Oracle to $277 from $286, pointing to greater uncertainty around the projects.

Oracle's elevated debt "leaves little room for error, meaning the new data centers have to generate cash flow as soon as possible to service debt and lease obligations," Morningstar said in a note.

"However, we view recent events, including delays in some data centers' completion dates, as minor setbacks that should not alter Oracle's overall capacity ramp-up."

D.Bachmann--VB