-

'Magic' Jalibert guides Bordeaux-Begles past Scarlets

'Magic' Jalibert guides Bordeaux-Begles past Scarlets

-

Teenage pair Ndjantou and Mbaye star as PSG beat Metz to go top

-

Anglo-French star Jane Birkin gets name on bridge over Paris canal

Anglo-French star Jane Birkin gets name on bridge over Paris canal

-

Jalibert masterclass guides Bordeaux-Begles past Scarlets

-

M23 marches on in east DR Congo as US vows action against Rwanda

M23 marches on in east DR Congo as US vows action against Rwanda

-

Raphinha double stretches Barca's Liga lead in Osasuna win

-

Terrific Terrier returns Leverkusen to fourth

Terrific Terrier returns Leverkusen to fourth

-

Colts activate 44-year-old Rivers for NFL game at Seattle

-

US troops in Syria killed in IS ambush attack

US troops in Syria killed in IS ambush attack

-

Liverpool's Slot says 'no issue to resolve' with Salah after outburst

-

'Stop the slaughter': French farmers block roads over cow disease cull

'Stop the slaughter': French farmers block roads over cow disease cull

-

Stormers see off La Rochelle, Sale stun Clermont in Champions Cup

-

Maresca hails Palmer as Chelsea return to winning ways against Everton

Maresca hails Palmer as Chelsea return to winning ways against Everton

-

Hungarian protesters demand Orban quits over abuse cases

-

Belarus frees protest leader Kolesnikova, Nobel winner Bialiatski

Belarus frees protest leader Kolesnikova, Nobel winner Bialiatski

-

Salah sets up goal on return to Liverpool action

-

Palmer strikes as Chelsea return to winning ways against Everton

Palmer strikes as Chelsea return to winning ways against Everton

-

Pogacar targets Tour de France Paris-Roubaix and Milan-San Remo in 2026

-

Salah back in action for Liverpool after outburst

Salah back in action for Liverpool after outburst

-

Atletico recover Liga momentum with battling win over Valencia

-

Meillard leads 'perfect' Swiss sweep in Val d'Isere giant slalom

Meillard leads 'perfect' Swiss sweep in Val d'Isere giant slalom

-

Salah on Liverpool bench for Brighton match

-

Meillard leads Swiss sweep in Val d'Isere giant slalom

Meillard leads Swiss sweep in Val d'Isere giant slalom

-

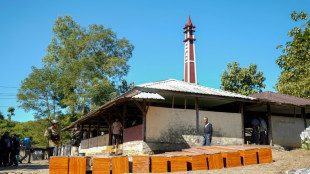

Indonesia flood death toll passes 1,000 as authorities ramp up aid

-

First urban cable car unveiled outside Paris

First urban cable car unveiled outside Paris

-

Vonn second behind Aicher in World Cup downhill at St Moritz

-

Aicher pips Vonn to downhill win at St Moritz

Aicher pips Vonn to downhill win at St Moritz

-

Thailand says 4 soldiers killed in Cambodia conflict, denies Trump truce claim

-

Fans vandalise India stadium after Messi's abrupt exit

Fans vandalise India stadium after Messi's abrupt exit

-

Women sommeliers are cracking male-dominated wine world open

-

Exhibition of Franco-Chinese print master Zao Wou-Ki opens in Hong Kong

Exhibition of Franco-Chinese print master Zao Wou-Ki opens in Hong Kong

-

Myanmar junta denies killing civilians in hospital strike

-

Why SpaceX IPO plan is generating so much buzz

Why SpaceX IPO plan is generating so much buzz

-

Thailand continues Cambodia strikes despite Trump truce calls

-

US envoy to meet Zelensky, Europe leaders in Berlin this weekend

US envoy to meet Zelensky, Europe leaders in Berlin this weekend

-

North Korea acknowledges its troops cleared mines for Russia

-

US unseals warrant for tanker seized off Venezuelan coast

US unseals warrant for tanker seized off Venezuelan coast

-

Cambodia says Thailand still bombing hours after Trump truce call

-

Machado urges pressure so Maduro understands 'he has to go'

Machado urges pressure so Maduro understands 'he has to go'

-

Leinster stutter before beating Leicester in Champions Cup

-

Crypto firm Tether bids for Juventus, is quickly rebuffed

Crypto firm Tether bids for Juventus, is quickly rebuffed

-

Union sink second-placed Leipzig to climb in Bundesliga

-

US Treasury lifts sanctions on Brazil Supreme Court justice

US Treasury lifts sanctions on Brazil Supreme Court justice

-

UK king shares 'good news' that cancer treatment will be reduced in 2026

-

Wembanyama expected to return for Spurs in NBA Cup clash with Thunder

Wembanyama expected to return for Spurs in NBA Cup clash with Thunder

-

Five takeaways from Luigi Mangione evidence hearings

-

UK's king shares 'good news' that cancer treatment will be reduced in 2026

UK's king shares 'good news' that cancer treatment will be reduced in 2026

-

Steelers' Watt undergoes surgery to repair collapsed lung

-

Iran detains Nobel-prize winner in 'brutal' arrest

Iran detains Nobel-prize winner in 'brutal' arrest

-

NBA Cup goes from 'outside the box' idea to smash hit

Asian traders cheer US rate cut but gains tempered by outlook

Most Asian markets rose Thursday as traders welcomed the Federal Reserve's third straight interest rate cut, though the euphoria was tempered by an indication officials could hold off another reduction any time soon.

While the move had been priced in for several weeks, investors were cheered by the fact that bank boss Jerome Powell was "less hawkish" in his post-meeting remarks.

The latest cut in borrowing costs -- to their lowest level in three years -- comes as monetary policymakers try to support the US jobs market, which has been showing signs of weakness for much of the year.

Concern about the labour market has offset persistently high inflation, with some decision-makers confident the impact of Donald Trump's tariffs on prices will ease over time.

After a positive lead from Wall Street, most of Asia pushed higher.

Hong Kong, Sydney, Seoul, Singapore, Wellington, Manila and Jakarta were all up, while Tokyo, Shanghai and Taipei dipped.

However, traders have lowered their expectations for a string of further cuts in 2026 after the bank's statement used language used in late-2024 to signal a pause in more rate cuts.

Two members voted against the 25-basis-point cut, though one -- Donald Trump appointee Stephen Miran -- voted for a 50 points cut.

Powell said officials were in a good position to determine the "extent and timing of additional adjustments based on the incoming data, the evolving outlook and the balance of risks".

He also said: "This further normalisation of our policy stance should help stabilise the labour market while allowing inflation to resume its downward trend toward two percent once the effects of tariffs have passed through."

Matthias Scheiber and Rushabh Amin at Allspring Global Investments wrote: "As 2026 begins, we believe the makeup of the board's voting members will come into greater focus and that, while the market is relatively optimistic (pricing in two more rate cuts by the end of 2026), we expect cuts will come after June."

Still, there was plenty of optimism about the outlook for equities, with Axel Rudolph, market analyst at IG, writing ahead of Wednesday's announcement: "The Fed... has room to ease policy without reigniting inflation concerns.

"Disinflation is sufficiently entrenched that rate cuts can proceed at a measured pace, providing a tailwind for risk assets without requiring an economic crisis to justify them.

"This 'Goldilocks' scenario of growth with easing financial conditions is exactly what equity markets need."

And CFRA Research's Sam Stovall said Powell's remarks were "less hawkish than a lot of investors had anticipated" and that he "did sound very supportive of cutting rates more if need be".

Earnings from US software giant Oracle provided a jolt to investors as it revealed a surge in spending on data centres to boost its artificial intelligence capacity.

The news comes as investors grow increasingly worried that the vast sums splashed out on the AI sector will not see the returns as early as hoped.

And shares in Jingdong Industrials -- the supply chain unit of Chinese ecommerce titan JD.com -- briefly slipped as much as 10 percent on the firm's Hong Kong debut, having raised more than US$380 million in an initial public offering.

The dollar extended losses against its main peers, while gold -- a go-to asset as US rates fall -- pushed around one percent higher to sit above $4,200.

Silver hit a fresh record high of $62.8863, having broken $60 for the first time this week on rising demand and supply constraints.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: DOWN 0.6 percent at 50,308.89 (break)

Hong Kong - Hang Seng Index: UP 0.5 percent at 25,665.26

Shanghai - Composite: DOWN 0.2 percent at 3,893.86

Dollar/yen: DOWN at 155.63 yen from 155.92 yen on Wednesday

Euro/dollar: UP at $1.1703 from $1.1693

Pound/dollar: UP at $1.3386 from $1.3384

Euro/pound: UP at 87.43 pence from 87.36 pence

West Texas Intermediate: UP 0.7 percent at $58.85 per barrel

Brent North Sea Crude: UP 0.6 percent at $62.55 per barrel

A.Ammann--VB