-

French talent Kroupi 'ready to suffer' to realise Premier League dream

French talent Kroupi 'ready to suffer' to realise Premier League dream

-

New Zealand 231-9 as West Indies exploit bowler-friendly wicket

-

US Republicans sweat toss-up election in traditional stronghold

US Republicans sweat toss-up election in traditional stronghold

-

'Rescued my soul': Hong Kong firefighters save beloved pets

-

Suns eclipse shoddy Lakers, Mavs upset Nuggets

Suns eclipse shoddy Lakers, Mavs upset Nuggets

-

Seven footballers in Malaysia eligibility scandal 'victims': union

-

Patriots on brink of playoffs after Giants rout

Patriots on brink of playoffs after Giants rout

-

Survivors, families seek answers to deadly Hong Kong ferry disaster

-

Race to get aid to Asia flood survivors as toll nears 1,200

Race to get aid to Asia flood survivors as toll nears 1,200

-

Rugby World Cup draw: who, how and when?

-

Williamson falls for 52 as NZ reach 128-5 in West Indies Test

Williamson falls for 52 as NZ reach 128-5 in West Indies Test

-

Hong Kong leader announces 'independent committee' to probe fire

-

South Korean leader calls for penalties over e-commerce data leak

South Korean leader calls for penalties over e-commerce data leak

-

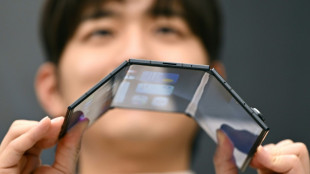

Samsung unveils first 'special edition' triple-folding phone

-

Apple AI chief leaving as iPhone maker plays catch-up

Apple AI chief leaving as iPhone maker plays catch-up

-

Asian markets rise as US rate cut bets temper Japan bond unease

-

Weight of history against England in pink-ball Gabba Ashes Test

Weight of history against England in pink-ball Gabba Ashes Test

-

How South Korea's brief martial law upended lives

-

VR headsets take war-scarred children to world away from Gaza

VR headsets take war-scarred children to world away from Gaza

-

'We chose it': PKK fighters cherish life in Iraq's mountains

-

US envoy to meet Russia's Putin for talks on ending Ukraine war

US envoy to meet Russia's Putin for talks on ending Ukraine war

-

Pope Leo holds Beirut mass and visits site of port blast

-

'Quad God' Malinin ramps up Olympic preparations at Grand Prix Final

'Quad God' Malinin ramps up Olympic preparations at Grand Prix Final

-

New Zealand 17-1 at lunch in rain-hit West Indies Test

-

Pacific island office enabling sanctions-busting 'shadow fleets'

Pacific island office enabling sanctions-busting 'shadow fleets'

-

White House gets scaled-down Christmas display amid ballroom work

-

GEN Announces New Positive Phase 1 Trial Data of the Investigational Drug SUL-238 for Alzheimer's and Other Neurodegenerative Diseases

GEN Announces New Positive Phase 1 Trial Data of the Investigational Drug SUL-238 for Alzheimer's and Other Neurodegenerative Diseases

-

White House confirms admiral ordered 2nd strike on alleged drug boat

-

Nigeria's defence minister resigns amid security crisis: presidency

Nigeria's defence minister resigns amid security crisis: presidency

-

From Honduras to Poland, Trump meddles in elections as never before

-

Trump holds Venezuela meeting as Maduro rejects 'slave's peace'

Trump holds Venezuela meeting as Maduro rejects 'slave's peace'

-

12 dead, dozens missing as landslide submerges boats in Peru port

-

Vardy's first Serie A double fires Cremonese past high-flying Bologna

Vardy's first Serie A double fires Cremonese past high-flying Bologna

-

Rich art: French pastry chefs auction chocolate sculptures

-

Cameroon sack coach Brys, drop goalkeeper Onana for AFCON

Cameroon sack coach Brys, drop goalkeeper Onana for AFCON

-

Son of Mexican crime lord 'El Chapo' pleads guilty in drug case: US media

-

Right-wing rivals for Honduras presidency in 'technical tie'

Right-wing rivals for Honduras presidency in 'technical tie'

-

US upbeat on pushing Ukraine deal as envoy heads to Russia

-

European rocket puts S.Korean satellite in orbit

European rocket puts S.Korean satellite in orbit

-

Trump to meet top national security team on Venezuela

-

US Supreme Court hears major online music piracy case

US Supreme Court hears major online music piracy case

-

Pope gets rockstar welcome as he delivers message of hope to Lebanese youth

-

Iran sentences director Jafar Panahi to year in prison: lawyer

Iran sentences director Jafar Panahi to year in prison: lawyer

-

ICC vows to stand firm amid US sanctions

-

US to zero out tariffs on UK pharma under trade deal

US to zero out tariffs on UK pharma under trade deal

-

Chelsea captain James says 10-man Blues 'dominated' Arsenal

-

In contrast to Europe, Tesla sets sales records in Norway

In contrast to Europe, Tesla sets sales records in Norway

-

Asia floods death toll tops 1,160 as troops aid survivors

-

DR Congo says latest Ebola outbreak is over

DR Congo says latest Ebola outbreak is over

-

South Africa coach Broos picks 17 local stars for AFCON

| RBGPF | 1.54% | 79 | $ | |

| JRI | -0.15% | 13.78 | $ | |

| BCC | -1.18% | 75.13 | $ | |

| CMSD | -0.13% | 23.29 | $ | |

| BCE | -0.09% | 23.49 | $ | |

| SCS | 0.55% | 16.38 | $ | |

| NGG | -0.61% | 75.65 | $ | |

| CMSC | -0.39% | 23.32 | $ | |

| RIO | 0.03% | 71.97 | $ | |

| RYCEF | -2.68% | 13.83 | $ | |

| RELX | -1.23% | 39.72 | $ | |

| VOD | -2.8% | 12.13 | $ | |

| GSK | -1.42% | 47.19 | $ | |

| AZN | -2.44% | 90.52 | $ | |

| BTI | -0.91% | 58.13 | $ | |

| BP | 1.12% | 36.51 | $ |

Asian markets mixed as traders eye US data ahead of Fed decision

Asian equities were mixed Monday with investors awaiting the release of key US data that could play a role in Federal Reserve deliberations ahead of an expected interest rate cut next week.

After November's end-of-month rebound across world markets, confidence remains high amid speculation the US central bank could continue easing monetary policy into the new year.

That has helped overcome lingering worries about an AI-fuelled tech bubble that some observers warn could pop and lead to a painful correction.

While the odds on a third successive rate reduction on December 10 are hovering around 90 percent, traders will keep a close eye on this week's batch of indicators to gauge the Fed's desire to keep on cutting.

Among the reports due for release are private jobs creation, services activity and personal consumption expenditure -- the Fed's preferred gauge of inflation.

Bets on a cut surged in late November after several of the bank's policymakers said they backed lower borrowing costs as they were more concerned about the flagging labour market than stubbornly high inflation.

That helped markets recover the losses sustained in the first half of the month, and analysts said they could be in store for an end-of-year rally.

"As the clouds of worry that cast an ominous shadow over markets through to mid-November gently dissipate, they give way to new emotions -- notably the fear of not participating and the risk of underperforming benchmark targets," said Pepperstone's Chris Weston.

However, he warned that "risk managers remain highly astute to the landmines that could still derail the improving risk backdrop through December".

He cited the possibility the Fed does not cut, or offers a "hawkish cut", the Supreme Court's possible decision on the legality of President Donald Trump's trade tariffs, and jobs and inflation data.

Meanwhile, reports that Trump's top economic adviser Kevin Hassett -- a proponent of rate cuts -- is the frontrunner to take the helm at the Fed next year added to the upbeat mood.

After last week's healthy gains and Wall Street's strong Thanksgiving rally, Asian equities were mixed.

Hong Kong, Shanghai, Singapore and Manila rose, but Sydney, Seoul, Wellington and Taipei dipped.

Tokyo sank more than one percent as the yen strengthened on expectations the Bank of Japan will lift interest rates this month.

Governor Kazuo Ueda said it would "consider the pros and cons of raising the policy interest rate and make decisions as appropriate", with Bloomberg saying traders saw a more than 60 percent chance of a move on December 19. That rose to 90 percent for a hike no later than January.

Oil prices surged more than one percent after OPEC+ confirmed it would not hike output in the first three months of 2026.

Oil jumped after OPEC+ confirmed it will stick with plans to pause production hikes during the first quarter, citing lower seasonal demand.

The decision comes amid uncertainty over the outlook for crude as traders look for indications of progress in Ukraine peace talks, which could lead to the return of Russian crude to markets.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: DOWN 1.7 percent at 49,407.31 (break)

Hong Kong - Hang Seng Index: UP 0.6 percent at 26,012.78

Shanghai - Composite: UP 0.2 percent at 3,896.72

Euro/dollar: DOWN at $1.1597 from $1.1604 on Friday

Pound/dollar: DOWN at $1.3230 from $1.3245

Dollar/yen: DOWN at 155.60 yen from 156.10 yen

Euro/pound: UP at 87.67 pence from 87.60 pence

West Texas Intermediate: UP 1.5 percent at $59.41 per barrel

Brent North Sea Crude: UP 1.4 percent at $63.25 per barrel

New York - Dow: UP 0.6 percent at 47,716.42 (close)

London - FTSE 100: UP 0.3 percent at 9,720.51 (close)

C.Stoecklin--VB