-

'Superhuman' Salah unhappy after being dropped, says Liverpool's Slot

'Superhuman' Salah unhappy after being dropped, says Liverpool's Slot

-

Major sports anti-doping conference opens with call for unity

-

Tens of thousands flock to pope's Beirut mass

Tens of thousands flock to pope's Beirut mass

-

Formula One title showdown: the road to Abu Dhabi

-

Pope Leo holds Beirut mass, visits port blast site

Pope Leo holds Beirut mass, visits port blast site

-

Hong Kong leader says independent committee to probe fire

-

How deforestation turbocharged Indonesia's deadly floods

How deforestation turbocharged Indonesia's deadly floods

-

New Zealand 231-9 as 'old school' West Indies exploit pace-friendly wicket

-

England spinner Jacks replaces injured Wood for second Ashes Test

England spinner Jacks replaces injured Wood for second Ashes Test

-

Pope Leo to hold Beirut mass, visit port blast site

-

Australia opener Khawaja out of second Ashes Test with injury

Australia opener Khawaja out of second Ashes Test with injury

-

Concern as India orders phone manufacturers to preload govt app

-

French talent Kroupi 'ready to suffer' to realise Premier League dream

French talent Kroupi 'ready to suffer' to realise Premier League dream

-

New Zealand 231-9 as West Indies exploit bowler-friendly wicket

-

US Republicans sweat toss-up election in traditional stronghold

US Republicans sweat toss-up election in traditional stronghold

-

'Rescued my soul': Hong Kong firefighters save beloved pets

-

Suns eclipse shoddy Lakers, Mavs upset Nuggets

Suns eclipse shoddy Lakers, Mavs upset Nuggets

-

Seven footballers in Malaysia eligibility scandal 'victims': union

-

Patriots on brink of playoffs after Giants rout

Patriots on brink of playoffs after Giants rout

-

Survivors, families seek answers to deadly Hong Kong ferry disaster

-

Race to get aid to Asia flood survivors as toll nears 1,200

Race to get aid to Asia flood survivors as toll nears 1,200

-

Rugby World Cup draw: who, how and when?

-

Williamson falls for 52 as NZ reach 128-5 in West Indies Test

Williamson falls for 52 as NZ reach 128-5 in West Indies Test

-

Hong Kong leader announces 'independent committee' to probe fire

-

South Korean leader calls for penalties over e-commerce data leak

South Korean leader calls for penalties over e-commerce data leak

-

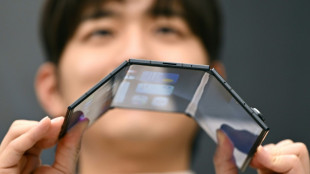

Samsung unveils first 'special edition' triple-folding phone

-

Apple AI chief leaving as iPhone maker plays catch-up

Apple AI chief leaving as iPhone maker plays catch-up

-

Asian markets rise as US rate cut bets temper Japan bond unease

-

Weight of history against England in pink-ball Gabba Ashes Test

Weight of history against England in pink-ball Gabba Ashes Test

-

How South Korea's brief martial law upended lives

-

VR headsets take war-scarred children to world away from Gaza

VR headsets take war-scarred children to world away from Gaza

-

'We chose it': PKK fighters cherish life in Iraq's mountains

-

US envoy to meet Russia's Putin for talks on ending Ukraine war

US envoy to meet Russia's Putin for talks on ending Ukraine war

-

Pope Leo holds Beirut mass and visits site of port blast

-

'Quad God' Malinin ramps up Olympic preparations at Grand Prix Final

'Quad God' Malinin ramps up Olympic preparations at Grand Prix Final

-

New Zealand 17-1 at lunch in rain-hit West Indies Test

-

Pacific island office enabling sanctions-busting 'shadow fleets'

Pacific island office enabling sanctions-busting 'shadow fleets'

-

White House gets scaled-down Christmas display amid ballroom work

-

GEN Announces New Positive Phase 1 Trial Data of the Investigational Drug SUL-238 for Alzheimer's and Other Neurodegenerative Diseases

GEN Announces New Positive Phase 1 Trial Data of the Investigational Drug SUL-238 for Alzheimer's and Other Neurodegenerative Diseases

-

White House confirms admiral ordered 2nd strike on alleged drug boat

-

Nigeria's defence minister resigns amid security crisis: presidency

Nigeria's defence minister resigns amid security crisis: presidency

-

From Honduras to Poland, Trump meddles in elections as never before

-

Trump holds Venezuela meeting as Maduro rejects 'slave's peace'

Trump holds Venezuela meeting as Maduro rejects 'slave's peace'

-

12 dead, dozens missing as landslide submerges boats in Peru port

-

Vardy's first Serie A double fires Cremonese past high-flying Bologna

Vardy's first Serie A double fires Cremonese past high-flying Bologna

-

Rich art: French pastry chefs auction chocolate sculptures

-

Cameroon sack coach Brys, drop goalkeeper Onana for AFCON

Cameroon sack coach Brys, drop goalkeeper Onana for AFCON

-

Son of Mexican crime lord 'El Chapo' pleads guilty in drug case: US media

-

Right-wing rivals for Honduras presidency in 'technical tie'

Right-wing rivals for Honduras presidency in 'technical tie'

-

US upbeat on pushing Ukraine deal as envoy heads to Russia

| RBGPF | 1.54% | 79 | $ | |

| RYCEF | -2.68% | 13.83 | $ | |

| JRI | -0.15% | 13.78 | $ | |

| CMSC | -0.39% | 23.32 | $ | |

| SCS | 0.55% | 16.38 | $ | |

| RIO | 0.03% | 71.97 | $ | |

| AZN | -2.44% | 90.52 | $ | |

| GSK | -1.42% | 47.19 | $ | |

| NGG | -0.61% | 75.65 | $ | |

| BCC | -1.18% | 75.13 | $ | |

| RELX | -1.23% | 39.72 | $ | |

| VOD | -2.8% | 12.13 | $ | |

| CMSD | -0.13% | 23.29 | $ | |

| BTI | -0.91% | 58.13 | $ | |

| BCE | -0.09% | 23.49 | $ | |

| BP | 1.12% | 36.51 | $ |

Most Asian markets build on week's rally

Most markets squeezed out gains Friday at the end of a strong week for equities fuelled by growing expectations that the Federal Reserve will cut interest rates again next month.

Traders took silence from New York's Thanksgiving break as a reason to have a breather and take stock of a healthy rebound from November's swoon that was sparked by AI bubble fears.

But while there is much debate on whether valuations in the tech sector are overstretched, focus this week has been firmly on the prospect of more rate cuts.

A string of top Fed officials have lined up to back a third straight reduction, mostly saying that worries over a weakening labour market trumped still elevated inflation.

Attention now turns to a range of data releases over the next week or so that could play a role in the bank's final decision, with private hiring, services activity and personal consumption expenditure -- the Fed's preferred gauge of inflation.

With the government shutdown postponing or cancelling the release of some key data, closely watched non-farm payrolls figures are now due in mid-December, after the Fed's policy decision.

"This delay places much greater scrutiny on the latest November ADP (private) payrolls report," wrote Market Insights' Michael Hewson. He said there would likely be a Thanksgiving-linked spike in hiring "that is not entirely representative of recent slower trends in the US labour market".

"While a big jump in payrolls in November could be construed as a positive signal for the US labour market it might not be enough to stop the Fed from cutting rates again with another close decision expected on 10th December," he added.

Markets see around an 85 percent chance of a cut next month and three more in 2026.

With no catalyst from New York, Asian investor excitement was limited but most markets managed to rise.

Tokyo, Shanghai, Singapore, Wellington, Taipei, Manila, Mumbai and Bangkok all advanced, though Hong Kong, Sydney, Seoul and Jakarta reversed.

The yen swung against the dollar after data showed inflation in Tokyo, seen as a bellwether for Japan, came in a little higher than expected, reigniting talk on whether the central bank will hike interest rates in the coming months.

The yen remains under pressure against the greenback amid concerns about Japan's fiscal outlook and pledges for more borrowing, but it has pulled back from the levels near 158 per dollar seen earlier this week.

- Key figures at around 0705 GMT -

Tokyo - Nikkei 225: UP 0.2 percent at 50,253.91 (close)

Hong Kong - Hang Seng Index: DOWN 0.3 percent at 25,869.80

Shanghai - Composite: UP 0.3 percent at 3888.60 (close)

Euro/dollar: DOWN at $1.1582 from $1.1602 on Thursday

Pound/dollar: DOWN at $1.3220 from $1.3252

Dollar/yen: UP at 156.42 yen from 156.30 yen

Euro/pound: UP at 87.63 pence from 87.56 pence

West Texas Intermediate: UP 0.7 percent at $59.08 per barrel

Brent North Sea Crude: UP 0.5 percent at $63.63 per barrel

New York - Dow: Closed for a public holiday

London - FTSE 100: FLAT at 9,693.93 (close)

R.Braegger--VB