-

WHO urges Sudan ceasefire after alleged massacres in El-Fasher

WHO urges Sudan ceasefire after alleged massacres in El-Fasher

-

Under-fire UK govt deports migrant sex offender with £500

-

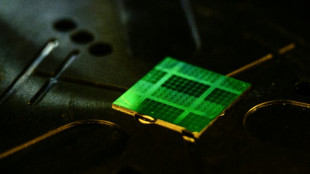

AI chip giant Nvidia becomes world's first $5 trillion company

AI chip giant Nvidia becomes world's first $5 trillion company

-

Arsenal depth fuels Saka's belief in Premier League title charge

-

Startup Character.AI to ban direct chat for minors after teen suicide

Startup Character.AI to ban direct chat for minors after teen suicide

-

132 killed in massive Rio police crackdown on gang: public defender

-

Pedri joins growing Barcelona sickbay

Pedri joins growing Barcelona sickbay

-

Zambia and former Chelsea manager Grant part ways

-

Russia sends teen who performed anti-war songs back to jail

Russia sends teen who performed anti-war songs back to jail

-

Caribbean reels from hurricane as homes, streets destroyed

-

Boeing reports $5.4-bn loss on large hit from 777X aircraft delays

Boeing reports $5.4-bn loss on large hit from 777X aircraft delays

-

Real Madrid's Vinicius says sorry for Clasico substitution huff

-

Dutch vote in snap election seen as test for Europe's far-right

Dutch vote in snap election seen as test for Europe's far-right

-

Jihadist fuel blockade makes daily life a struggle for Bamako residents

-

De Bruyne goes under the knife for hamstring injury

De Bruyne goes under the knife for hamstring injury

-

Wolvaardt's 169 fires South Africa to 319-7 in World Cup semis

-

EU seeks 'urgent solutions' with China over chipmaker Nexperia

EU seeks 'urgent solutions' with China over chipmaker Nexperia

-

Paris prosecutor promises update in Louvre heist probe

-

Funds for climate adaptation 'lifeline' far off track: UN

Funds for climate adaptation 'lifeline' far off track: UN

-

Record Vietnam rains kill seven and flood 100,000 homes

-

Markets extend record run as trade dominates

Markets extend record run as trade dominates

-

Sudan govt accuses RSF of attacking mosques in El-Fasher takeover

-

Rain washes out 1st Australia-India T20 match

Rain washes out 1st Australia-India T20 match

-

Spain's Santander bank posts record profit

-

FIA taken to court to block Ben Sulayem's uncontested candidacy

FIA taken to court to block Ben Sulayem's uncontested candidacy

-

Chemicals firm BASF urges EU to cut red tape as profit dips

-

Romania says US will cut some troops in Europe

Romania says US will cut some troops in Europe

-

Israel hits dozens of targets as Gaza sees deadliest night since truce

-

Mercedes-Benz reassures on Nexperia chips as profit plunges

Mercedes-Benz reassures on Nexperia chips as profit plunges

-

France tries Bulgarians over defacing memorial in Russia-linked case

-

BBC says journalist questioned and blocked from leaving Vietnam

BBC says journalist questioned and blocked from leaving Vietnam

-

UK drugmaker GSK lifts 2025 guidance despite US tariffs

-

Mercedes-Benz profit plunges on China slump and US tariffs

Mercedes-Benz profit plunges on China slump and US tariffs

-

South Korea gifts Trump replica of ancient golden crown

-

Record Vietnam rains kill four and flood 100,000 homes

Record Vietnam rains kill four and flood 100,000 homes

-

Norway's energy giant Equinor falls into loss

-

Asia stocks join Wall Street records as tech bull run quickens

Asia stocks join Wall Street records as tech bull run quickens

-

New Zealand hammer reckless England despite Archer's brilliance

-

Record potato harvest is no boon in fries-mad Belgium

Record potato harvest is no boon in fries-mad Belgium

-

Deutsche Bank posts record profit on strong trading

-

UBS beats expectations as claws backs provisions

UBS beats expectations as claws backs provisions

-

German neo-Nazi rappers push hate speech, disinfo on TikTok

-

US aid flows to Nigeria anti-landmine efforts - for now

US aid flows to Nigeria anti-landmine efforts - for now

-

Low turnout as Tanzania votes without an opposition

-

Monarch-loving Trump gifted golden crown once worn by South Korean kings

Monarch-loving Trump gifted golden crown once worn by South Korean kings

-

Dutch vote in test for Europe's far right

-

Fugitive ex-PM says Bangladesh vote risks deepening divide

Fugitive ex-PM says Bangladesh vote risks deepening divide

-

On board the Cold War-style sealed train from Moscow to Kaliningrad

-

Spain to hold memorial on first anniversary of deadly floods

Spain to hold memorial on first anniversary of deadly floods

-

Trump said 'not allowed' to run for third term, 'too bad'

| NGG | -0.76% | 76.07 | $ | |

| CMSC | 0.13% | 24.292 | $ | |

| RIO | 1.86% | 73.355 | $ | |

| RYCEF | -0.72% | 15.35 | $ | |

| SCS | -1.83% | 16.38 | $ | |

| RBGPF | -0.11% | 79 | $ | |

| BCC | -0.35% | 72.12 | $ | |

| JRI | -0.54% | 13.975 | $ | |

| BCE | -0.55% | 23.44 | $ | |

| BTI | -1.13% | 51.875 | $ | |

| CMSD | 0.04% | 24.65 | $ | |

| RELX | -2.85% | 44.95 | $ | |

| VOD | -2.09% | 11.985 | $ | |

| GSK | 5.76% | 46.37 | $ | |

| BP | 1.6% | 35.02 | $ | |

| AZN | 0.49% | 83.015 | $ |

ECB to hold interest rates steady with inflation subdued

The European Central Bank is expected to hold interest rates steady this week for its third straight meeting, with inflation under control and the long-struggling eurozone economy looking healthier.

Following a year-long series of cuts, the ECB has kept its key deposit rate on hold at two percent since July.

Inflation has settled around the central bank's two-percent target in recent months, as Europe has weathered US President Donald Trump's tariff onslaught better than initially feared.

ECB officials still face many headwinds: France's political crisis has pushed up borrowing costs in the eurozone's second-biggest economy, and the risk of a flare-up in trade tensions lingers.

But for now, the central bank is "in a good place", ECB President Christine Lagarde said in a September speech in Helsinki, bolstering expectations of no change to borrowing costs at Thursday's meeting.

"With policy rates now at two percent, we are well placed to respond if the risks to inflation shift, or if new shocks emerge that threaten our target," Lagarde said.

In contrast to the ECB, the US Federal Reserve is expected to make its second straight rate cut when it meets on Wednesday as concerns grow over the labour market amid layoffs and signs that businesses are reluctant to hire.

The eurozone economy has long been treading water, dragged down in particular by a poor performance in Germany, with growth rates lagging far behind those of China and the United States.

But the picture for the 20 countries that use the euro looks a little brighter than in the first half of the year.

The ECB raised eurozone growth forecasts for this year and next at their last meeting.

- More cuts to come? -

Rate-setters will gather in Florence, Italy, for this week's meeting, one of their regular tours away from the institution's Frankfurt headquarters.

Investors will be closely watching Lagarde's post-rate call press conference for clues about the path forward.

Thursday's decision seems a done deal, economist Michel Martinez of French bank Societe Generale told AFP, calling the meeting "a moment to take stock rather than to take action".

But debate is already brewing about whether to push on with cuts later.

Pointing to a strong euro that makes imports cheaper as well as slowing eurozone wage growth, Lithuania's Gediminas Simkus, a member of the ECB's governing council, made a case for a cut at the next meeting in December.

"From a risk-management perspective, it's better to cut than not," he said in a September interview with Bloomberg, warning of the risk that inflation rates could fall too far.

Carsten Brzeski of Dutch bank ING said there were "some valid dovish arguments that could still force the central bank to cut once again at the December meeting".

The risks range from a possible adverse impact of US tariffs down the line to delays to Germany's planned defence spending splurge and a deepening of France's political crisis, Brzeski said.

"If any of these downside risks materialise, we can expect the ECB to engage in one or two more rate cuts," he said.

Andrew Kenningham, an economist at Capital Economics, told AFP he expected the ECB to cut rates further in 2026 as inflation and wage growth cool.

"There are now very few reasons to fear a resurgence of inflation -- The economy remains so weak, the labour market is loosening," he said.

G.Schmid--VB