-

Monaco squeeze past 10-man Auxerre to climb to third

Monaco squeeze past 10-man Auxerre to climb to third

-

Former Aspiration exec denies Leonard had 'no-show' deal

-

IndyCar drops bid for '26 Mexico race due to World Cup impact

IndyCar drops bid for '26 Mexico race due to World Cup impact

-

Ogier makes a splash at Rally of Chile

-

Arsenal spoil Ange return, Chelsea held by Brentford

Arsenal spoil Ange return, Chelsea held by Brentford

-

Chelsea blow chance to top Premier League at Brentford

-

Atletico beat Villarreal for first Liga win

Atletico beat Villarreal for first Liga win

-

Last-gasp Juve beat Inter to keep pace with leaders Napoli

-

England's Hull leads Jeeno by one at LPGA Queen City event

England's Hull leads Jeeno by one at LPGA Queen City event

-

Clashes with police after up to 150,000 gather at far-right UK rally

-

Romania, Poland, scramble aircraft as drones strike Ukraine

Romania, Poland, scramble aircraft as drones strike Ukraine

-

Netanayhu says killing Hamas leaders is route to ending Gaza war

-

New Zealand and Canada to face off in Women's Rugby World Cup semi-final

New Zealand and Canada to face off in Women's Rugby World Cup semi-final

-

France's new PM courts the left a day after ratings downgrade

-

Last-gasp Juve beat Inter to maintain perfect Serie A start

Last-gasp Juve beat Inter to maintain perfect Serie A start

-

Kane hits brace as Bayern thump Hamburg again

-

Arsenal spoil Ange return, Spurs win at West Ham

Arsenal spoil Ange return, Spurs win at West Ham

-

Sri Lanka cruise to six-wicket win over Bangladesh in Asia Cup T20

-

Spurs beat woeful West Ham to pile pressure on Potter

Spurs beat woeful West Ham to pile pressure on Potter

-

Rubio says Qatar strike 'not going to change' US-Israel ties

-

Toulouse turn on Top 14 power despite sub-par performance

Toulouse turn on Top 14 power despite sub-par performance

-

Canada cruise past Australia into semi-finals of Women's Rugby World Cup

-

Vienna wins on home turf as it hosts first tram driver world cup

Vienna wins on home turf as it hosts first tram driver world cup

-

Who is Tyler Robinson, alleged killer of Charlie Kirk?

-

London police arrest nine after clashes at 110,000-strong far-right rally

London police arrest nine after clashes at 110,000-strong far-right rally

-

Mbappe shines as 10-man Real Madrid defeat Real Sociedad

-

Kenyan officials, athletes call for fast action on doping

Kenyan officials, athletes call for fast action on doping

-

Arsenal spoil Ange return, Woltemade earns Newcastle win

-

Guirassy extends streak as Dortmund cruise past 10-man Heidenheim

Guirassy extends streak as Dortmund cruise past 10-man Heidenheim

-

Vingegaard touching Vuelta glory with stage 20 triumph as protests continue

-

'World's fastest anime fan' Lyles in element at Tokyo worlds

'World's fastest anime fan' Lyles in element at Tokyo worlds

-

De Minaur's Australia trail as Germany, Argentina into Davis Cup finals

-

Airstrikes, drones, tariffs: being US friend not what it used to be

Airstrikes, drones, tariffs: being US friend not what it used to be

-

Cyclists swerve protest group in road during Vuelta stage 20

-

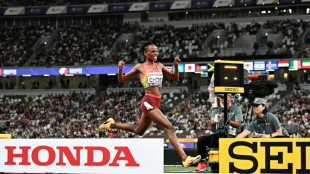

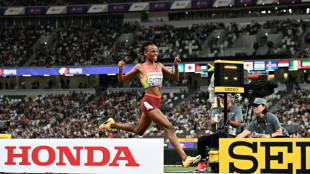

A Tokyo full house revels in Chebet and sprinters at world athletics champs

A Tokyo full house revels in Chebet and sprinters at world athletics champs

-

Holders New Zealand fight past South Africa into Women's Rugby World Cup semis

-

Ex-Olympic champion Rissveds overcomes depression to win world mountain bike gold

Ex-Olympic champion Rissveds overcomes depression to win world mountain bike gold

-

Kenya's Chebet wins 10,000m gold, suggests no tilt at world double

-

Arsenal ruin Postecoglou's Forest debut as Zubimendi bags brace

Arsenal ruin Postecoglou's Forest debut as Zubimendi bags brace

-

Shot put legend Crouser wins third successive world title

-

Bezzecchi wins San Marino MotoGP sprint as Marc Marquez crashes out

Bezzecchi wins San Marino MotoGP sprint as Marc Marquez crashes out

-

Kenya's Chebet wins 10,000m gold to set up tilt at world double

-

Lyles, Thompson and Tebogo cruise through world 100m heats

Lyles, Thompson and Tebogo cruise through world 100m heats

-

Vuelta final stage shortened amid protest fears

-

Collignon stuns De Minaur as Belgium take Davis Cup lead over Australia

Collignon stuns De Minaur as Belgium take Davis Cup lead over Australia

-

Nepal returns to calm as first woman PM takes charge, visits wounded

-

Olympic champion Alfred eases through 100m heats at Tokyo worlds

Olympic champion Alfred eases through 100m heats at Tokyo worlds

-

Winning coach Erasmus 'emotional' at death of former Springboks

-

Barca's Flick blasts Spain over Yamal injury issue

Barca's Flick blasts Spain over Yamal injury issue

-

Rampant Springboks inflict record 43-10 defeat to humble All Blacks

US Fed poised to hold off on rate cuts, defying Trump pressure

The US central bank is widely expected to hold off slashing interest rates again at its upcoming meeting, as officials gather under the cloud of an intensifying pressure campaign by President Donald Trump.

Policymakers at the independent Federal Reserve have kept the benchmark lending rate steady since the start of the year as they monitor how Trump's sweeping tariffs are impacting the world's biggest economy.

With Trump's on-again, off-again tariff approach -- and the levies' lagged effects on inflation -- Fed officials want to see economic data from this summer to gauge how prices are being affected.

When mulling changes to interest rates, the central bank -- which meets on Tuesday and Wednesday -- seeks a balance between reining in inflation and the health of the jobs market.

But the bank's data-dependent approach has enraged the Republican president, who has repeatedly criticized Fed Chair Jerome Powell for not slashing rates further, calling him a "numbskull" and "moron."

Most recently, Trump signaled he could use the Fed's $2.5 billion renovation project as an avenue to oust Powell, before backing off and saying that would be unlikely.

Trump visited the Fed construction site on Thursday, making a tense appearance with Powell in which the Fed chair disputed Trump's characterization of the total cost of the refurbishment in front of the cameras.

But economists expect the Fed to look past the political pressure at its policy meeting.

"We're just now beginning to see the evidence of tariffs' impact on inflation," said Ryan Sweet, chief US economist at Oxford Economics.

"We’re going to see it (too) in July and August, and we think that's going to give the Fed reason to remain on the sidelines," he told AFP.

- 'Trial balloon' -

Since returning to the presidency in January, Trump has imposed a 10 percent tariff on goods from almost all countries, as well as steeper rates on steel, aluminum and autos.

The effect on inflation has so far been limited, prompting the US leader to use this as grounds for calling for interest rates to be lowered by three percentage points.

Currently, the benchmark lending rate stands at a range between 4.25 percent and 4.50 percent.

Trump also argues that lower rates would save the government money on interest payments, and floated the idea of firing Powell. The comments roiled financial markets.

"Powell can see that the administration floated this trial balloon" of ousting him before walking it back on the market's reaction, Sweet said.

"It showed that markets value an independent central bank," the Oxford Economics analyst added, anticipating Powell will be instead more influenced by labor market concerns.

Powell's term as Fed chair ends in May 2026.

- Jobs market 'fissures' -

Analysts expect to see a couple of members break ranks if the Fed's rate-setting committee decides for a fifth straight meeting to keep interest rates unchanged.

Sweet cautioned that some observers may spin dissents as pushback on Powell but argued this is not necessarily the case.

"It's not out-of-line or unusual to see, at times when there's a high degree of uncertainty, or maybe a turning point in policy, that you get one or two people dissenting," said Nationwide chief economist Kathy Bostjancic.

Fed Governor Christopher Waller and Vice Chair for Supervision Michelle Bowman have both signaled openness to rate cuts as early as July, meaning their disagreement with a decision to hold rates steady would not surprise markets.

Bostjancic said that too many dissents could be "eyebrow-raising," and lead some to question if Powell is losing control of the board, but added: "I don't anticipate that to be the case."

For Sweet, "the big wild card is the labor market."

There has been weakness in the private sector, while the hiring rate has been below average and the number of permanent job losers is rising.

"There are some fissures in the labor market, but they haven't turned into fault lines yet," Sweet said.

If the labor market suddenly weakened, he said he would expect the Fed to start cutting interest rates sooner.

F.Mueller--VB