-

Slot thanks Everton for solidarity after Jota tragedy

Slot thanks Everton for solidarity after Jota tragedy

-

Turkey singer faces criminal probe for 'obscene' song

-

Tariff uncertainty delays World Cup orders for China's merch makers

Tariff uncertainty delays World Cup orders for China's merch makers

-

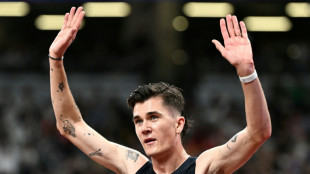

Defending champion Ingebrigtsen into world 5,000m final

-

Maresca defends Chelsea exile for Sterling and Disasi

Maresca defends Chelsea exile for Sterling and Disasi

-

Taliban release detained elderly British couple

-

Arsenal to face Lyon in Women's Champions League

Arsenal to face Lyon in Women's Champions League

-

Everton must bridge 'gulf' to rivals Liverpool, says Moyes

-

India and Pakistan meet again at Asia Cup after handshake row

India and Pakistan meet again at Asia Cup after handshake row

-

Israel army says will use 'unprecedented force' in Gaza City

-

Sri Lanka's Wellalage told of dad's death moments after win

Sri Lanka's Wellalage told of dad's death moments after win

-

Norris on top ahead of Piastri in opening Baku practice

-

Terland hat-trick fires Man Utd into Women's Champions League

Terland hat-trick fires Man Utd into Women's Champions League

-

Stars Tim Burton, Monica Bellucci announce separation

-

What to look for in China and Europe's climate plans

What to look for in China and Europe's climate plans

-

India target record Asian Games medal haul as LA 2028 beckons

-

Tracing the 'Green Sahara' in Chad's northern desert

Tracing the 'Green Sahara' in Chad's northern desert

-

Asian markets mostly drop ahead of Trump-Xi talks

-

US comics slam 'censorship' after Kimmel pulled

US comics slam 'censorship' after Kimmel pulled

-

China's Xiaomi to remotely fix assisted driving flaw in 110,000 SU7 cars

-

Brewing battle: coffee booms in tea-loving Kosovo

Brewing battle: coffee booms in tea-loving Kosovo

-

Dortmund on lookout for leaders as familiar cracks emerge

-

BoJ holds interest rates but to sell funds in shift from easing policy

BoJ holds interest rates but to sell funds in shift from easing policy

-

Real Madrid aiming to stay perfect against impressive Espanyol

-

Georgia's Niniashvili aims to stay 'crazy' at new club La Rochelle

Georgia's Niniashvili aims to stay 'crazy' at new club La Rochelle

-

Latinos, ex-military, retirees -- ICE hopefuls answer Uncle Sam's call

-

Trump hopes to settle TikTok's fate on Xi call

Trump hopes to settle TikTok's fate on Xi call

-

East Germany's empty towns try to lure people with 'trial living'

-

Liverpool crave easy win in Merseyside derby as Arsenal seek Man City hat-trick

Liverpool crave easy win in Merseyside derby as Arsenal seek Man City hat-trick

-

Australia skipper Cummins says 'hopeful' he'll take part in Ashes

-

China warns Papua New Guinea over Australian defence deal

China warns Papua New Guinea over Australian defence deal

-

Australian state bans testing of illicit drugs

-

Philippines 'ghost' flood projects leave residents stranded

Philippines 'ghost' flood projects leave residents stranded

-

Asian markets fluctuate as focus turns to Trump-Xi, BoJ

-

North Korea's Kim oversees drone test, orders AI development

North Korea's Kim oversees drone test, orders AI development

-

Kenya eye double gold on penultimate day of world championships

-

Canada, Mexico leaders agree to seek 'fairer' trade deal with US

Canada, Mexico leaders agree to seek 'fairer' trade deal with US

-

How did an Indian zoo get the world's most endangered great ape?

-

Amid emotional retirement reveal, Kershaw focused on beating Giants

Amid emotional retirement reveal, Kershaw focused on beating Giants

-

Dodgers pitching icon Kershaw to retire after 18th MLB season

-

Netflix seeks 'Money Heist' successor in Spanish hub

Netflix seeks 'Money Heist' successor in Spanish hub

-

Taiwan running out of time for satellite communications, space chief tells AFP

-

Gaza, Palestinian future to dominate UN gathering

Gaza, Palestinian future to dominate UN gathering

-

Young plaintiffs stand tall after taking on Trump climate agenda in court

-

Kirk killing sparks fierce US free speech debate

Kirk killing sparks fierce US free speech debate

-

Eying bottom line, US media giants bow to Trump

-

Indie studio bets on new game after buying freedom from Sega

Indie studio bets on new game after buying freedom from Sega

-

Marseille hoping to catch PSG at the right time in Ligue 1

-

Japan inflation slows in August, rice price surges ease

Japan inflation slows in August, rice price surges ease

-

Court seizes assets of Maradona's lawyer, sisters in fraud case

Global stocks mostly up despite new Trump tariffs, Nasdaq at record

The Nasdaq powered to a fresh record and major European markets closed in the green Wednesday, brushing off US President Donald Trump's growing array of tariff targets.

After releasing tariff warning letters to seven additional countries early Wednesday afternoon, Trump followed up late in the afternoon with a threatened 50 percent levy on Brazil.

Trump tied the levy -- which is more severe than those facing dozens of other countries -- to Brazil's prosecution of former president Jair Bolsonaro over an alleged attempted coup following the 2022 election, when Bolsonaro was defeated by President Luiz Inacio Lula da Silva.

Trump, who spent last week successfully lobbying Congress for his sweeping fiscal legislation, has returned to tariffs with a vengeance this week.

On Monday, Trump sent letters to Japan and South Korea, among other countries. On Tuesday, the US president announced a potential 50 percent toll on copper imports, and said he was looking at 200 percent tariffs on pharmaceuticals.

The news sent the price of copper -- with a wide range of uses including in cars, construction and telecoms -- to a record high Tuesday.

But Kathleen Brooks, research director at XTB, said Wednesday "the market is not taking Trump at his word when it comes to tariffs, and the market impact has been limited so far."

The tech-rich Nasdaq Composite Index vaulted nearly one percent higher to a fresh all-time high, while artificial intelligence giant Nvidia touched $4 trillion in market value before falling back slightly.

"The market is certainly not acting as if it's fearing the tariffs," said Briefing.com analyst Patrick O'Hare. "Obviously, there's been a lot of attention on the tariff letters that have gone out this week, but the market is operating on the assumption that they are just negotiating tools and that, ultimately, better terms will be reached."

European markets were also shrugging off risks of a trade war.

Germany's Dax hit a new high as it posted a 1.4 percent gain, matched by the CAC 40 in Paris. London could only manage a gain of just under 0.2 percent.

But Chris Beauchamp, chief market analyst at online trading platform IG, urged caution as "reports suggesting that Trump relishes the actual dealmaking process more than an actual resolution seem to suggest that a further delay to tariffs will be forthcoming, although this is an approach fraught with risk."

Earlier in Asia, Tokyo gains were tempered by losses in Hong Kong and Shanghai.

- Key figures at around 2130 GMT -

New York - Dow: UP 0.5 percent at 44,458.30 (close)

New York - S&P 500: UP 0.6 percent at 6,263.26 (close)

New York - Nasdaq Composite: UP 0.9 percent at 20,611.34 (close)

London - FTSE 100: UP 0.2 percent at 8,867.02 points (close)

Paris - CAC 40: UP 1.4 percent at 7,878.46 (close)

Frankfurt - DAX: UP 1.4 percent at 24,549.56 (close)

Tokyo - Nikkei 225: UP 0.3 percent at 39,821.28 (close)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 23,892.32 (close)

Shanghai - Composite: DOWN 0.1 percent at 3,493.05 (close)

Euro/dollar: DOWN at $1.1719 from $1.1725 on Tuesday

Pound/dollar: DOWN at $1.3590 from $1.3659

Dollar/yen: DOWN at 146.30 yen from 146.58 yen

Euro/pound: DOWN at 86.21 pence from 86.26 pence

Brent North Sea Crude: UP 0.1 percent at $70.41 per barrel

West Texas Intermediate: UP 0.1 percent at $68.38 per barrel

K.Hofmann--VB