-

Marc Marquez on brink of MotoGP title as Bagnaia wins Japan sprint

Marc Marquez on brink of MotoGP title as Bagnaia wins Japan sprint

-

In-form Swiatek cruises past wildcard to start China Open title bid

-

Protesters demand answers 11 years after Mexican students vanished

Protesters demand answers 11 years after Mexican students vanished

-

Paris Fashion Week to showcase industry makeover with string of debuts

-

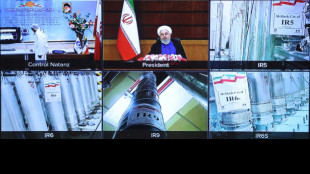

'Snapback': What sanctions will be reimposed on Iran?

'Snapback': What sanctions will be reimposed on Iran?

-

UN sanctions on Iran set to return as nuclear diplomacy fades

-

King Charles III to visit Vatican in October

King Charles III to visit Vatican in October

-

Marc Marquez third on grid at Japan MotoGP as Bagnaia takes pole

-

Philippines death toll rises to 11 as storm Bualoi bears down on Vietnam

Philippines death toll rises to 11 as storm Bualoi bears down on Vietnam

-

Donald excited Europe handled raucous crowd well at Ryder Cup

-

Goals, guns and narcos: Hitmen plague Ecuador's beautiful game

Goals, guns and narcos: Hitmen plague Ecuador's beautiful game

-

Argentine victims of live-streamed murder laid to rest on eve of protest

-

No USA Ryder Cup panic as fightback enters Bradley's plan

No USA Ryder Cup panic as fightback enters Bradley's plan

-

USA turns to Scheffler, DeChambeau in Saturday foursomes

-

Trump can't spark US comeback in visit to Ryder Cup

Trump can't spark US comeback in visit to Ryder Cup

-

Trump urges Microsoft to fire ex-Biden administration official

-

Europe takes three-point Ryder Cup lead as US gets no Trump boost

Europe takes three-point Ryder Cup lead as US gets no Trump boost

-

Three talking points ahead of the Women's Rugby World Cup final

-

Murillo sends Marseille top in Ligue 1 with late win in Strasbourg

Murillo sends Marseille top in Ligue 1 with late win in Strasbourg

-

Kimmel boycott ends as US TV companies put him back on air

-

Kane scores twice to reach 100 Bayern goals in record time

Kane scores twice to reach 100 Bayern goals in record time

-

'Almost impossible': Brazilian skater Sandro Dias makes history on mega ramp

-

Trump targets more opponents after 'dirty cop' Comey

Trump targets more opponents after 'dirty cop' Comey

-

Sixers' Embiid eyes consistency after injury-plagued NBA season

-

More questions than answers surround Trump's TikTok deal

More questions than answers surround Trump's TikTok deal

-

Iran sanctions look set to return as last-ditch UN push fails

-

Sitting ducks: Venezuelan fishermen wary of US warships

Sitting ducks: Venezuelan fishermen wary of US warships

-

Nissanka ton in vain as India edge Sri Lanka in Super Over

-

An Aussie tycoon bets billions on cleaning up iron ore giant

An Aussie tycoon bets billions on cleaning up iron ore giant

-

Civil defence says 50 killed in Gaza as Netanyahu vows to 'finish job' against Hamas

-

Canada's Corrigan leans on Olympic experience in quest for Women's Rugby World Cup gold

Canada's Corrigan leans on Olympic experience in quest for Women's Rugby World Cup gold

-

Kolisi warns 'resilient' Boks are braced for Puma mauling

-

Fearing US invasion, Venezuela to hold emergency drills

Fearing US invasion, Venezuela to hold emergency drills

-

Greek PM warns Israel risks losing friends

-

Pakistani PM appeals for India talks, hails Trump role

Pakistani PM appeals for India talks, hails Trump role

-

Trump aims to make America great again amid Ryder Cup woes

-

Trump arrives at Ryder Cup with US seeking comeback

Trump arrives at Ryder Cup with US seeking comeback

-

Europe grabs 3-1 lead as US seeks Trump boost at Ryder Cup

-

Lufthansa planning thousands of job cuts: sources

Lufthansa planning thousands of job cuts: sources

-

China at UN warns of return to 'Cold War mentality'

-

England great Alphonsi expects Canada to shine in Women's Rugby World Cup final

England great Alphonsi expects Canada to shine in Women's Rugby World Cup final

-

Tottenham reject interest in reported record £4.5bn sale

-

Man Utd boss Amorim admits uncertainty ahead of Brentford clash

Man Utd boss Amorim admits uncertainty ahead of Brentford clash

-

Zverev wins Beijing opener as Gauff launches title defence

-

Barca duo Raphinha, Joan Garcia injured, out for PSG clash

Barca duo Raphinha, Joan Garcia injured, out for PSG clash

-

Trump hopes more opponents to be charged after 'dirty cop' Comey

-

US Fed's preferred inflation gauge rises, with more cost pressures expected

US Fed's preferred inflation gauge rises, with more cost pressures expected

-

Facebook, Instagram to offer paid ad-free UK subscriptions

-

Former UK PM Blair could lead transitional authority in Gaza: reports

Former UK PM Blair could lead transitional authority in Gaza: reports

-

Netanyahu says Palestinian state would be 'national suicide' for Israel

Bank of Japan holds rates, will slow bond purchase taper

The Bank of Japan kept interest rates unchanged Tuesday and said it would taper its purchase of government bonds at a slower pace, as trade uncertainty threatens to weigh on the world's number four economy.

The central bank has spent many years buying up Japanese Government Bonds (JGBs) to keep yields low as part of an ultra-loose monetary policy aimed at banishing stagnation and harmful deflation.

But it began moving away from that easing programme last year, as inflation began to pick up and the yen weakened.

After hiking interest rates for the first time since 2007, the bank began winding down its JGB purchases.

It has since lifted borrowing costs several times to 0.5 percent, their highest in 17 years, and continued to buy fewer bonds.

However, analysts say uncertainty sparked by US President Donald Trump's trade war has led bank officials to hold off on more hikes -- and on Tuesday they held rates again, while saying they would slow the pace of JGB reductions.

"This measure was taken in order to avoid the possibility of an abnormal volatility in government bond yields, which would have a negative impact on the economy," bank governor Kazuo Ueda told reporters.

"We believe that it is appropriate for the Bank of Japan to reduce its JGB purchases in a predictable manner, while ensuring flexibility," he added.

Bond purchases will be cut in principle "by about 200 billion yen each calendar quarter from April-June 2026" -- from around 400 billion yen ($2.8 billion) per quarter, the bank's policy statement said.

- Next rate hike? -

The BoJ's main rate is still much lower than the US Federal Reserve's 4.25-4.5 percent.

"Japan's economic growth is likely to moderate, as trade and other policies in each jurisdiction lead to a slowdown in overseas economies and to a decline in domestic corporate profits," the bank said.

However, "factors such as accommodative financial conditions are expected to provide support".

"We still believe the Bank may hike rates in the second half of the year as it remains committed to normalising monetary policy," Katsutoshi Inadome of SuMi TRUST said ahead of the policy decision.

Carol Kong, an analyst at the Commonwealth Bank of Australia, told AFP the BoJ "will likely hold off on rate hikes until there is further clarity on US trade policy".

"While wage growth and consumer price inflation are solid, there are questions over whether domestic demand can withstand additional tightening," she added.

Japan, a key US ally and its biggest investor, is subject to the same 10 percent baseline tariffs imposed on most nations plus steeper levies on cars, steel and aluminium.

Trump also announced an additional 24 percent "reciprocal" tariff on the country's goods in April but later paused it along with similar measures on other trading partners.

Prime Minister Shigeru Ishiba said Monday there had been no breakthrough on a trade deal after talks with Trump on the sidelines of the G7 summit in Canada.

Ueda said policymakers would closely watch the economic impact of the conflict between Israel and Iran, which has buoyed oil prices.

At the same time, "the impact of various trade policies will start to become more pronounced from now on," he said. "It may weigh on corporate earnings, especially manufacturers."

Such a trend, if continues, could impact wages and prices in Japan, he said. "We wish to monitor both factors carefully."

F.Fehr--VB