-

Sinner survives to sink qualifier as Swiatek launches Beijing bid

Sinner survives to sink qualifier as Swiatek launches Beijing bid

-

West Ham sack head coach Graham Potter: club

-

Alcaraz dispels injury fears to reach Tokyo quarter-finals

Alcaraz dispels injury fears to reach Tokyo quarter-finals

-

Musetti apologises for outburst at 'coughing' China Open fans

-

Relieved All Blacks restore pride with battling win over Wallabies

Relieved All Blacks restore pride with battling win over Wallabies

-

International Paralympic Committee lifts partial suspensions of Russia, Belarus

-

All Blacks hold off Wallabies to extend remarkable Eden Park record

All Blacks hold off Wallabies to extend remarkable Eden Park record

-

After Armani, Italian fashion houses are in flux

-

Marc Marquez on brink of MotoGP title as Bagnaia wins Japan sprint

Marc Marquez on brink of MotoGP title as Bagnaia wins Japan sprint

-

In-form Swiatek cruises past wildcard to start China Open title bid

-

Protesters demand answers 11 years after Mexican students vanished

Protesters demand answers 11 years after Mexican students vanished

-

Paris Fashion Week to showcase industry makeover with string of debuts

-

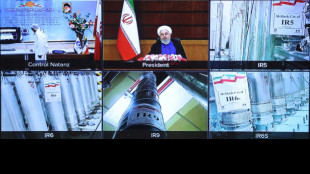

'Snapback': What sanctions will be reimposed on Iran?

'Snapback': What sanctions will be reimposed on Iran?

-

UN sanctions on Iran set to return as nuclear diplomacy fades

-

King Charles III to visit Vatican in October

King Charles III to visit Vatican in October

-

Marc Marquez third on grid at Japan MotoGP as Bagnaia takes pole

-

Philippines death toll rises to 11 as storm Bualoi bears down on Vietnam

Philippines death toll rises to 11 as storm Bualoi bears down on Vietnam

-

Donald excited Europe handled raucous crowd well at Ryder Cup

-

Goals, guns and narcos: Hitmen plague Ecuador's beautiful game

Goals, guns and narcos: Hitmen plague Ecuador's beautiful game

-

Argentine victims of live-streamed murder laid to rest on eve of protest

-

No USA Ryder Cup panic as fightback enters Bradley's plan

No USA Ryder Cup panic as fightback enters Bradley's plan

-

USA turns to Scheffler, DeChambeau in Saturday foursomes

-

Trump can't spark US comeback in visit to Ryder Cup

Trump can't spark US comeback in visit to Ryder Cup

-

Trump urges Microsoft to fire ex-Biden administration official

-

Europe takes three-point Ryder Cup lead as US gets no Trump boost

Europe takes three-point Ryder Cup lead as US gets no Trump boost

-

Three talking points ahead of the Women's Rugby World Cup final

-

Murillo sends Marseille top in Ligue 1 with late win in Strasbourg

Murillo sends Marseille top in Ligue 1 with late win in Strasbourg

-

Kimmel boycott ends as US TV companies put him back on air

-

Kane scores twice to reach 100 Bayern goals in record time

Kane scores twice to reach 100 Bayern goals in record time

-

'Almost impossible': Brazilian skater Sandro Dias makes history on mega ramp

-

Trump targets more opponents after 'dirty cop' Comey

Trump targets more opponents after 'dirty cop' Comey

-

Sixers' Embiid eyes consistency after injury-plagued NBA season

-

More questions than answers surround Trump's TikTok deal

More questions than answers surround Trump's TikTok deal

-

Iran sanctions look set to return as last-ditch UN push fails

-

Sitting ducks: Venezuelan fishermen wary of US warships

Sitting ducks: Venezuelan fishermen wary of US warships

-

Nissanka ton in vain as India edge Sri Lanka in Super Over

-

An Aussie tycoon bets billions on cleaning up iron ore giant

An Aussie tycoon bets billions on cleaning up iron ore giant

-

Civil defence says 50 killed in Gaza as Netanyahu vows to 'finish job' against Hamas

-

Canada's Corrigan leans on Olympic experience in quest for Women's Rugby World Cup gold

Canada's Corrigan leans on Olympic experience in quest for Women's Rugby World Cup gold

-

Kolisi warns 'resilient' Boks are braced for Puma mauling

-

Fearing US invasion, Venezuela to hold emergency drills

Fearing US invasion, Venezuela to hold emergency drills

-

Greek PM warns Israel risks losing friends

-

Pakistani PM appeals for India talks, hails Trump role

Pakistani PM appeals for India talks, hails Trump role

-

Trump aims to make America great again amid Ryder Cup woes

-

Trump arrives at Ryder Cup with US seeking comeback

Trump arrives at Ryder Cup with US seeking comeback

-

Europe grabs 3-1 lead as US seeks Trump boost at Ryder Cup

-

Lufthansa planning thousands of job cuts: sources

Lufthansa planning thousands of job cuts: sources

-

China at UN warns of return to 'Cold War mentality'

-

England great Alphonsi expects Canada to shine in Women's Rugby World Cup final

England great Alphonsi expects Canada to shine in Women's Rugby World Cup final

-

Tottenham reject interest in reported record £4.5bn sale

Oil prices fall even as Israel-Iran strikes extend into fourth day

Oil prices retreated on Monday as fears of a wider Middle East conflict eased even as Israel and Iran pounded each other with missiles for a fourth day and threatened further attacks.

Gold prices rose back towards a record high thanks to a rush into safe havens but equities were mixed amid hopes that the conflict does not spread.

Investors were also gearing up for key central bank meetings this week, with a particular eye on the US Federal Reserve and Bank of Japan, as well as talks with Washington aimed at avoiding Donald Trump's sky-high tariffs.

Israel's surprise strike against Iranian military and nuclear sites on Friday -- killing top commanders and scientists -- sent crude prices soaring as much as 13 percent at one point on fears about supplies from the region. However, concerns over the conflict spreading appeared to have eased, with prices retreating in Asian trade.

Analysts had warned that the spike could send inflation surging globally again, dealing a blow to long-running efforts by governments and central banks to get it under control and fanning concerns about the impact on already fragile economies.

"The knock-on impact of higher energy prices is that they will slow growth and cause headline inflation to rise," said Tony Sycamore, a market analyst at IG.

"While central banks would prefer to overlook a temporary spike in energy prices, if they remain elevated for a long period, it may feed through into higher core inflation as businesses pass on higher transport and production costs.

"This would hamper central banks' ability to cut interest rates to cushion the anticipated growth slowdown from President Trump's tariffs, which adds another variable for the Fed to consider when it meets to discuss interest rates this week."

Both main oil contracts were down, giving up earlier gains in Asian trade.

- Fed, BoJ in focus -

"Oil markets remain amply supplied with OPEC set on increasing production and demand soft. US production growth has been slowing, but could rebound in the face of sustained higher prices," Morningstar director of equity research Allen Good said.

"Meanwhile, a larger war is unlikely. The Trump administration has already stated it remains committed to talks with Iran.

"Ultimately, fundamentals will dictate price, and they do not suggest much higher prices are necessary. Although the global risk premium could rise, keeping prices moderately higher than where they've been much of the year."

Tokyo closed 1.3 percent higher, boosted by a weaker yen, while Hong Kong reversed early losses and Shanghai, Seoul and Wellington also advanced.

Taipei, Jakarta, Bangkok and Manila retreated while Sydney was flat.

London, Paris and Frankfurt were all higher.

Gold, a go-to asset in times of uncertainty and volatility, rose to around $3,450 an ounce and close to its all-time high of $3,500.

There was little major reaction to data showing China's factory output grew slower than expected last month as trade war pressures bit, while retail sales topped forecasts.

Also in focus is the Group of Seven summit in the Canadian Rockies, which kicked off on Sunday, where the Middle East crisis will be discussed along with trade after Trump's tariff blitz.

Investors are also awaiting bank policy meetings, with the Fed and BoJ the standouts.

Both are expected to stand pat for now but traders will be keeping a close watch on their statements for an idea about the plans for interest rates, with US officials under pressure from Trump to cut.

The Fed meeting "will naturally get the greatest degree of market focus", said Chris Weston at Pepperstone.

"The Fed should remain sufficiently constrained by the many uncertainties to offer anything truly market-moving and the statement should stress that policy is in a sound place for now," he said.

In corporate news, Nippon Steel rose more than three percent after Trump signed an executive order on Friday approving its $14.9 billion merger with US Steel, bringing an end to the long-running saga.

- Key figures at around 0820 GMT -

West Texas Intermediate: DOWN 0.2 percent at $72.82 per barrel

Brent North Sea Crude: DOWN 0.4 percent at $73.95 per barrel

Tokyo - Nikkei 225: UP 1.3 percent at 38,311.33 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 24,060.99 (close)

Shanghai - Composite: UP 0.4 percent at 3,388.73 (close)

London - FTSE 100: UP 0.3 percent at 8,874.0

Euro/dollar: UP at $1.1581 from $1.1540 on Friday

Pound/dollar: UP at $1.3583 from $1.3560

Dollar/yen: UP at 144.26 yen from 144.04 yen

Euro/pound: UP at 85.26 pence from 85.11 pence

New York - Dow: DOWN 1.8 percent at 42,197.79 (close)

I.Stoeckli--VB