-

Dortmund keep heat on Bayern with Mainz win

Dortmund keep heat on Bayern with Mainz win

-

Under-fire Amorim accepts criticism as Man Utd crash at Brentford

-

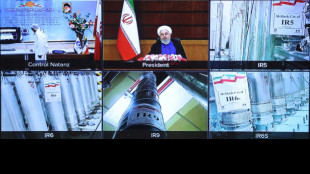

Sweeping UN sanctions loom for Iran after nuclear talks fail

Sweeping UN sanctions loom for Iran after nuclear talks fail

-

Canadian Vallieres pulls off cycling world title surprise in Kigali hills

-

Dakuwaqa outshines Bielle-Biarrey as Stade Francais beat Bordeaux-Begles

Dakuwaqa outshines Bielle-Biarrey as Stade Francais beat Bordeaux-Begles

-

West Ham hire Nuno to replace sacked Potter

-

Amorim under pressure as Brentford stun Man Utd

Amorim under pressure as Brentford stun Man Utd

-

New Zealand too strong for France in Women's Rugby World Cup bronze final

-

West Ham sack Potter, Nuno tipped to take over

West Ham sack Potter, Nuno tipped to take over

-

Barca's Flick backs 'fantastic' Szczesny, confirms Yamal return

-

US to revoke Colombian president's visa over 'incendiary actions'

US to revoke Colombian president's visa over 'incendiary actions'

-

Europe goes back to dominant duos as Ryder Cup resumes

-

West Ham sack Potter, Espirito Santo tipped to take over

West Ham sack Potter, Espirito Santo tipped to take over

-

Sinner survives to sink qualifier as Swiatek launches Beijing bid

-

West Ham sack head coach Graham Potter: club

West Ham sack head coach Graham Potter: club

-

Alcaraz dispels injury fears to reach Tokyo quarter-finals

-

Musetti apologises for outburst at 'coughing' China Open fans

Musetti apologises for outburst at 'coughing' China Open fans

-

Relieved All Blacks restore pride with battling win over Wallabies

-

International Paralympic Committee lifts partial suspensions of Russia, Belarus

International Paralympic Committee lifts partial suspensions of Russia, Belarus

-

All Blacks hold off Wallabies to extend remarkable Eden Park record

-

After Armani, Italian fashion houses are in flux

After Armani, Italian fashion houses are in flux

-

Marc Marquez on brink of MotoGP title as Bagnaia wins Japan sprint

-

In-form Swiatek cruises past wildcard to start China Open title bid

In-form Swiatek cruises past wildcard to start China Open title bid

-

Protesters demand answers 11 years after Mexican students vanished

-

Paris Fashion Week to showcase industry makeover with string of debuts

Paris Fashion Week to showcase industry makeover with string of debuts

-

'Snapback': What sanctions will be reimposed on Iran?

-

UN sanctions on Iran set to return as nuclear diplomacy fades

UN sanctions on Iran set to return as nuclear diplomacy fades

-

King Charles III to visit Vatican in October

-

Marc Marquez third on grid at Japan MotoGP as Bagnaia takes pole

Marc Marquez third on grid at Japan MotoGP as Bagnaia takes pole

-

Philippines death toll rises to 11 as storm Bualoi bears down on Vietnam

-

Donald excited Europe handled raucous crowd well at Ryder Cup

Donald excited Europe handled raucous crowd well at Ryder Cup

-

Goals, guns and narcos: Hitmen plague Ecuador's beautiful game

-

Argentine victims of live-streamed murder laid to rest on eve of protest

Argentine victims of live-streamed murder laid to rest on eve of protest

-

No USA Ryder Cup panic as fightback enters Bradley's plan

-

USA turns to Scheffler, DeChambeau in Saturday foursomes

USA turns to Scheffler, DeChambeau in Saturday foursomes

-

Trump can't spark US comeback in visit to Ryder Cup

-

Trump urges Microsoft to fire ex-Biden administration official

Trump urges Microsoft to fire ex-Biden administration official

-

Europe takes three-point Ryder Cup lead as US gets no Trump boost

-

Three talking points ahead of the Women's Rugby World Cup final

Three talking points ahead of the Women's Rugby World Cup final

-

Murillo sends Marseille top in Ligue 1 with late win in Strasbourg

-

Kimmel boycott ends as US TV companies put him back on air

Kimmel boycott ends as US TV companies put him back on air

-

Kane scores twice to reach 100 Bayern goals in record time

-

'Almost impossible': Brazilian skater Sandro Dias makes history on mega ramp

'Almost impossible': Brazilian skater Sandro Dias makes history on mega ramp

-

Trump targets more opponents after 'dirty cop' Comey

-

Sixers' Embiid eyes consistency after injury-plagued NBA season

Sixers' Embiid eyes consistency after injury-plagued NBA season

-

More questions than answers surround Trump's TikTok deal

-

Iran sanctions look set to return as last-ditch UN push fails

Iran sanctions look set to return as last-ditch UN push fails

-

Sitting ducks: Venezuelan fishermen wary of US warships

-

Nissanka ton in vain as India edge Sri Lanka in Super Over

Nissanka ton in vain as India edge Sri Lanka in Super Over

-

An Aussie tycoon bets billions on cleaning up iron ore giant

US Fed set to hold rates steady in the face of Trump pressure

The US central bank is expected to keep interest rates unchanged for a fourth straight policy meeting this week, despite President Donald Trump's push for rate cuts, as officials contend with uncertainty sparked by the Republican's tariffs.

While the independent Federal Reserve has started lowering rates from recent highs, officials have held the level steady this year as Trump's tariffs began rippling through the world's biggest economy.

The Fed has kept interest rates between 4.25 percent and 4.50 percent since December, while it monitors the health of the jobs market and inflation.

"The hope is to stay below the radar screen at this meeting," KPMG chief economist Diane Swonk told AFP. "Uncertainty is still very high."

"Until they know sufficiently, and convincingly that inflation is not going to pick up" either in response to tariffs or related threats, "they just can't move," she said.

Since returning to the presidency, Trump has slapped a 10 percent tariff on most US trading partners. Higher rates on dozens of economies are due to take effect in July, unless an existing pause is extended.

Trump has also engaged in a tit-for-tat tariff war with China and imposed levies on imports of steel, aluminum and automobiles, rattling financial markets and tanking consumer sentiment.

But economists expect it will take three to four months for tariff effects to show up in consumer prices.

Although hiring has cooled slightly and there was some shrinking of the labor force according to government data, the unemployment rate has stayed unchanged.

Inflation has been muted too, even as analysts noted signs of smaller business margins -- meaning companies are bearing the brunt of tariffs for now.

At the end of the Fed's two-day meeting Wednesday, analysts will be parsing through its economic projections for changes to growth and unemployment expectations -- and for signs of the number of rate cuts to come.

The Fed faces growing pressure from Trump -- citing benign inflation data -- to lower rates more quickly, a move the president argues will help the country "pay much less interest on debt coming due."

On Wednesday, Trump urged Fed Chair Jerome Powell to slash interest rates by a full percentage point, and on Thursday, he called Powell a "numbskull" for not doing so.

He said Powell could raise rates again if inflation picked up then.

But Powell has defended US central bank independence over interest rates when engaging with Trump.

- 'Cautious patience' -

For their part, Fed policymakers have signaled "little urgency" to adjust rates, said EY chief economist Gregory Daco.

He believes they are unwilling to get ahead of the net effects from Trump's trade, tax, immigration and regulation policy changes.

Powell "will likely strike a tone of cautious patience, reiterating that policy remains data dependent," Daco said.

While economists have warned that Trump's tariffs would fuel inflation and weigh on economic growth, supporters of Trump's policies argue the president's plans for tax cuts next year will boost the economy.

On the Fed's path ahead, HSBC Global Research said: "Weak labor market data could lead to larger cuts, while elevated inflation would tend to imply the opposite."

For now, analysts expect the central bank to slash rates two more times this year, beginning in September.

The Fed is likely to be eyeing data over the summer for inflationary pressures from tariffs, said Ryan Sweet, chief US economist at Oxford Economics.

"They want to make sure that they're reading the tea leaves correctly," he said.

Swonk warned the US economy is in a different place than during the Covid-19 pandemic, which could change how consumers react to price increases.

During the pandemic, government stimulus payments helped households cushion the blow from higher costs, allowing them to keep spending.

It is unclear if consumers, a key driver of the economy, will keep their dollars flowing this time, meaning demand could collapse and complicate the Fed's calculus.

"If this had been a world without tariffs, the Fed would be cutting right now. There's no question," Swonk said.

A.Zbinden--VB