-

Massive crowd, chaos preceded deadly India rally stampede

Massive crowd, chaos preceded deadly India rally stampede

-

Russian missile and drone barrage kills four: Kyiv

-

Iran denounces 'unjustifiable' return of UN sanctions

Iran denounces 'unjustifiable' return of UN sanctions

-

Emotional Marquez in tears after winning seventh MotoGP title

-

Emotional Marquez win seventh MotoGP world championship

Emotional Marquez win seventh MotoGP world championship

-

Russia pounds Ukraine with 'hundreds' of drones and missiles: Kyiv

-

Wallabies record-holder Slipper hints Perth could be final Test

Wallabies record-holder Slipper hints Perth could be final Test

-

Son brace fuels LAFC as Messi frustrated in Miami draw

-

US actress-singer Selena Gomez weds music producer Benny Blanco

US actress-singer Selena Gomez weds music producer Benny Blanco

-

Pakistani parents rebuff HPV vaccine over infertility fears

-

Women's cricket set for 'seismic' breakthrough at World Cup

Women's cricket set for 'seismic' breakthrough at World Cup

-

New Zealand fly-half Barrett out of Australia rematch

-

Moldovans torn between pro-EU and pro-Russia vote in tense polls

Moldovans torn between pro-EU and pro-Russia vote in tense polls

-

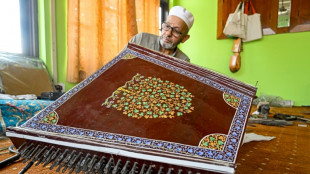

Strings of identity: Kashmir's fading music endures

-

'Clog the toilet' trolls hit Indian visa holders rushing to US

'Clog the toilet' trolls hit Indian visa holders rushing to US

-

Bradley: USA Ryder Cup disaster part of why crowds angry

-

Europe used 'anti-fragile mentality' to cope with Cup hecklers

Europe used 'anti-fragile mentality' to cope with Cup hecklers

-

Unbeaten McIlroy faces winless Scheffler in Ryder Cup singles

-

Sweeping UN sanctions return to hit Iran after nuclear talks fail

Sweeping UN sanctions return to hit Iran after nuclear talks fail

-

Messi, Miami frustrated in Toronto stalemate

-

Argentina protesters march for victims of live-streamed femicide

Argentina protesters march for victims of live-streamed femicide

-

Europe shrugs off intense abuse to reach brink of Ryder Cup win

-

Injury-hit PSG reclaim Ligue 1 top spot ahead of Barcelona clash

Injury-hit PSG reclaim Ligue 1 top spot ahead of Barcelona clash

-

Understrength PSG reclaim Ligue 1 top spot ahead of Barcelona clash

-

Argentina protesters seek justice for victims of live-streamed femicide

Argentina protesters seek justice for victims of live-streamed femicide

-

Palhinha rescues point for Tottenham against winless Wolves

-

Springbok Feinberg-Mngomezulu an 'incredible talent' - Erasmus

Springbok Feinberg-Mngomezulu an 'incredible talent' - Erasmus

-

Mitchell backs England to sustain dominance after World Cup triumph

-

Zaporizhzhia nuclear plant off grid; Russia, Ukraine trade blame

Zaporizhzhia nuclear plant off grid; Russia, Ukraine trade blame

-

McIlroy fires back at hecklers in intense Ryder Cup atmosphere

-

Two women die trying to cross Channel from France

Two women die trying to cross Channel from France

-

Huge Berlin protest urges end to Gaza war

-

Liverpool 'deserved' defeat to Crystal Palace, says Slot

Liverpool 'deserved' defeat to Crystal Palace, says Slot

-

Bottega Veneta shows off 'soft functionality' in Milan

-

Maresca blasts careless Chelsea after Brighton defeat

Maresca blasts careless Chelsea after Brighton defeat

-

Juve miss out on Serie A summmit with Atalanta draw

-

Guardiola salutes dynamic Doku as Man City run riot

Guardiola salutes dynamic Doku as Man City run riot

-

Russia warns West as Ukraine secures Patriot defenses

-

Ten-man Monaco miss chance to retake top spot in Ligue 1

Ten-man Monaco miss chance to retake top spot in Ligue 1

-

Feinberg-Mngomezulu scores 37 points as Springboks top table

-

Trump authorizes 'full force' troop deployment in Portland

Trump authorizes 'full force' troop deployment in Portland

-

Matthews at the double as England beat Canada to win Women's Rugby World Cup

-

Real Madrid 'hurting', deserved to lose derby: Alonso

Real Madrid 'hurting', deserved to lose derby: Alonso

-

Handshake spat bad for cricket, says Pakistan captain ahead of India final

-

England beat Canada in Women's Rugby World Cup final

England beat Canada in Women's Rugby World Cup final

-

Hezbollah says it refuses to be disarmed one year after leader's killing

-

Atletico thrash Liga leaders Real Madrid in gripping derby

Atletico thrash Liga leaders Real Madrid in gripping derby

-

Liverpool's perfect start ended by Crystal Palace, Man Utd beaten at Brentford

-

Unbeaten Rahm sparks Europe to historic five-point Ryder Cup lead

Unbeaten Rahm sparks Europe to historic five-point Ryder Cup lead

-

Dortmund keep heat on Bayern with Mainz win

Oil surges, stocks fall on Middle East fears as Israel strikes Iran

Oil prices soared and stocks sank Friday after Israel launched "preemptive" strikes on Iran's nuclear and military sites and warned of more to come, stoking fears of a full-blown war.

Investors ran for the hills on news of the attacks and a warning that retaliatory action from Tehran was possible, after US President Donald Trump said a "massive conflict" in the region was possible.

While Tel Aviv said it had struck military and nuclear targets Iran said residential buildings had been hit.

Israeli Prime Minister Benjamin Netanyahu said in a video statement: "This operation will continue for as many days as it takes to remove this threat.

"We struck at the heart of Iran's nuclear enrichment programme. We targeted Iran's main enrichment facility at Natanz. We also struck at the heart of Iran's ballistic missile programme," he added.

Iranian nuclear scientists "working on the Iranian bomb" had also been hit, he said.

Israeli Defence Minister Israel Katz cautioned that "a missile and drone attack against the State of Israel and its civilian population is expected in the immediate future".

Trump had previously warned that an attack could be on the cards, telling reporters at the White House: "I don't want to say imminent, but it looks like it's something that could very well happen."

The US leader said he believed a "pretty good" deal on Iran's nuclear programme was "fairly close", but that an Israeli strike on the country could wreck the chances of an agreement.

A US official said there had been no US involvement in the operation.

Still there are worries the United States could be sucked into the crisis after Iran threatened this week to target US military bases in the region if a regional conflict broke out.

Both main oil contracts, which had rallied earlier in the week on rising tensions, spiked more than eight percent amid fears about supplies of the commodity.

The rush from risk assets to safe havens saw equity markets across Asia tumble and bonds rally with gold. US and European equity futures were deep in the red.

"The Middle East powder keg just blew the lid off global markets," said Stephen Innes at SPI Asset Management.

"Equity futures are plummeting. Bond yields are sinking. Gold and oil are skyrocketing," he added.

"Brent crude futures are racing toward the mid-$70s range -- but if the Strait of Hormuz, which accounts for 20 percent of global oil flows, finds itself in the blast radius, you can add another $15 to the bid.

"If Iran holds back, we get a relief bounce. But if missiles start raining down on Tel Aviv or Tehran retaliates with real teeth, we're staring down a scenario that could redefine the macro narrative for the rest of 2025."

Banking giant JPMorgan Chase had warned just this week that prices could top $130 if the worst-case scenario developed.

Market sentiment had already been low after Trump sounded his trade war klaxon again by saying he would be sending letters within the next two weeks to other countries' governments to announce unilateral levies on their exports to the United States.

The "take it or leave it" deal spurred fears he would reimpose the eye-watering tolls announced on April 2 that tanked markets before he announced a 90-day pause.

- Key figures at around 0200 GMT -

West Texas Intermediate: UP 8.6 percent at $73.86 per barrel

Brent North Sea Crude: UP 8.2 percent $75.03 per barrel

Tokyo - Nikkei 225: DOWN 1.5 percent at 37,606.72

Hong Kong - Hang Seng Index: DOWN 0.3 percent at 23,959.81

Shanghai - Composite: DOWN 0.2 percent at 3,39748

Dollar/yen: DOWN at 143.18 yen from 143.56 yen on Thursday

Euro/dollar: DOWN at $1.1543 from $1.1583

Pound/dollar: DOWN at $1.3557 from $1.3605

Euro/pound: UP at 85.12 pence from 85.11 pence

New York - Dow: UP 0.2 percent at 42,967.62 (close)

London - FTSE 100: UP 0.2 percent at 8,884.92 (close)

A.Kunz--VB