-

Trump meets Democrats without breakthrough on imminent shutdown

Trump meets Democrats without breakthrough on imminent shutdown

-

Muslim states join EU powers in backing Trump Gaza plan

-

California enacts AI safety law targeting tech giants

California enacts AI safety law targeting tech giants

-

Creator says AI actress is 'piece of art' after backlash

-

Nuno makes his point as West Ham rescue Everton draw

Nuno makes his point as West Ham rescue Everton draw

-

Slot challenges Liverpool players to 'give their all' against Galatasaray

-

Dodgers eye rare repeat as MLB playoffs get under way

Dodgers eye rare repeat as MLB playoffs get under way

-

Solanke surgery leaves Spurs struggling for strikers

-

Trump's Gaza peace plan wins Netanyahu backing

Trump's Gaza peace plan wins Netanyahu backing

-

New-look Paris Fashion Week kicks off with Saint Laurent

-

Anthropic launches new AI model, touting coding supremacy

Anthropic launches new AI model, touting coding supremacy

-

Trump announces Gaza peace plan, with Netanyahu backing

-

'Better, stronger' Wembanyama can't wait for NBA return

'Better, stronger' Wembanyama can't wait for NBA return

-

LeBron relishing 23rd season as retirement draws near

-

'Always a blue': Mourinho expects Chelsea fans to show respect

'Always a blue': Mourinho expects Chelsea fans to show respect

-

Michigan governor asks to 'lower the temperature' after church attack

-

S. Africa lose World Cup qualifying points over ineligible player

S. Africa lose World Cup qualifying points over ineligible player

-

Rugby chiefs open to R360 role in women's game after World Cup success

-

Inter Milan announce 35.4 million euro profits ahead of San Siro vote

Inter Milan announce 35.4 million euro profits ahead of San Siro vote

-

Madagascar protests reignite, UN says at least 22 dead

-

Taliban shut down communications across Afghanistan

Taliban shut down communications across Afghanistan

-

Serbia arrests 11 accused of stirring Jewish-Muslim hate in France, Germany

-

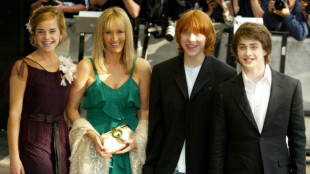

J.K. Rowling attacks 'ignorant' Harry Potter star Emma Watson

J.K. Rowling attacks 'ignorant' Harry Potter star Emma Watson

-

Electronic Arts to be bought by Saudi-led consortium for $55 bn

-

N.Korea vows at UN never to give up nuclear

N.Korea vows at UN never to give up nuclear

-

Hamilton reveals 'hardest decision' over dog's death

-

Springsteen denounces 'hatred' in America at biopic premiere

Springsteen denounces 'hatred' in America at biopic premiere

-

Stock markets shrug off US government shutdown fears

-

UK's Labour plans tougher rules on migrants to halt hard right

UK's Labour plans tougher rules on migrants to halt hard right

-

Trump 'very confident' of Gaza deal as he hosts Netanyahu

-

'High chance' of India winning Women's Cricket World Cup: captain Kaur

'High chance' of India winning Women's Cricket World Cup: captain Kaur

-

Trump meets Democrats in last-gasp talks before US government shutdown

-

No 'Angels': Bulgarians shake down Robbie Williams convoy

No 'Angels': Bulgarians shake down Robbie Williams convoy

-

German music body sues OpenAI alleging copyright breaches

-

Cannabis extract relieves chronic back pain: high-quality trial

Cannabis extract relieves chronic back pain: high-quality trial

-

African players in Europe: Sarr helps sink leaders Liverpool

-

Madagascar protests reignite as police launch tear gas

Madagascar protests reignite as police launch tear gas

-

German finds 15mn-euro winning lotto ticket in coat

-

Injury retirements hit China Open but Sinner reaches semis unscathed

Injury retirements hit China Open but Sinner reaches semis unscathed

-

TotalEnergies to boost output, cut $7.5 bn in costs

-

World Rugby unfazed over England dominance of women's game

World Rugby unfazed over England dominance of women's game

-

Bruised Real Madrid still defining spirit, personality: Alonso

-

Dolly Parton scraps Vegas shows over health issues

Dolly Parton scraps Vegas shows over health issues

-

Maresca says 'no panic' at Chelsea despite mini-slump

-

FIFPro sounds alarm over 'extreme' conditions at 2026 World Cup

FIFPro sounds alarm over 'extreme' conditions at 2026 World Cup

-

Jaguar Land Rover to partly resume output after cyberattack

-

Springboks recall De Jager after Mostert withdraws

Springboks recall De Jager after Mostert withdraws

-

Alcaraz fights back in Tokyo to emulate Nadal with 10th final of season

-

England bowler Woakes retires from international cricket

England bowler Woakes retires from international cricket

-

UK plans tougher rules for migrants seeking to stay in country

Markets wobble as Trump-Xi talks offset by Musk row

Markets stuttered on Friday as optimism from "very positive" talks between presidents Donald Trump and Xi Jinping was wiped out by the stunning public row between the US leader and Elon Musk.

The much-anticipated discussions between the heads of the world's biggest economies fuelled hopes for an easing of tensions following Trump's "Liberation Day" global tariff blitz that targeted Beijing particularly hard.

However, investors remained wary after an extraordinary social media row between Trump and billionaire former aide Musk that saw the two trade insults and threats and sent Wall Street into the red.

Wall Street's three main indexes ended down as Musk's electric vehicle company Tesla tanked more than 14 percent and the president threatened his multibillion-dollar government contracts.

Asian equities fluctuated in early business, with some observers suggesting traders were positioning for what could be a volatile start to next week in light of the row and upcoming US jobs data.

Hong Kong dropped after three days of strong gains, while Sydney, Wellington, Taipei and Bangkok also retreated.

Mumbai led gainers after the Reserve Bank of India slashed interest rates more than expected.

Tokyo and Singapore rose, while Shanghai was also marginally higher.

London and Paris edged up at the open, although Frankfurt was down.

Chris Weston at Pepperstone said that while the call with Xi was "seen as a step in the right direction, (it) proved to offer nothing tangible for traders to work with and attention has quickly pushed back to the Trump-Musk war of words".

"It's all about US nonfarm payrolls from here and is an obvious risk that Asia-based traders need to consider pre-positioning for," he said.

Weston said there was a risk of Trump sparking market-moving headlines over the weekend given that he is "now fired up and the risk of him saying something through the weekend that moves markets on the Monday open is elevated".

The US jobs figures, which are due later Friday, will be closely followed after a below-par reading on private hiring this week raised worries about the labour market and the outlook for the world's top economy.

They come amid bets that the Federal Reserve is preparing to resume cutting interest rates from September, even as economists warn that Trump's tariffs could reignite inflation.

Stephen Innes at SPI Asset Management warned that while poor jobs figures could signal further weakness in the economy, a strong reading could deal a blow to the market.

"In this upside-down market regime, strength can be weakness. A hotter-than-expected (figure) could force traders to price out Fed cuts. That's the paradox in play -- where good news on Main Street turns into bad news on Wall Street."

- Key figures at around 0715 GMT -

Tokyo - Nikkei 225: UP 0.5 percent at 37,741.61 (close)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 23,860.39

Shanghai - Composite: FLAT at 3,385.36 (close)

London - FTSE 100: UP 0.1 percent at 8,817.43

Euro/dollar: DOWN at $1.1437 from $1.1444 on Thursday

Pound/dollar: DOWN at $1.3554 from $1.3571

Dollar/yen: UP at 144.00 yen from 143.58 yen

Euro/pound: UP at 84.38 pence from 84.31 pence

West Texas Intermediate: DOWN 0.2 percent at $63.25 per barrel

Brent North Sea Crude: DOWN 0.1 percent at $65.25 per barrel

New York - Dow: DOWN 0.3 percent at 42,319.74 (close)

C.Kreuzer--VB