-

US tariffs on lumber imports set for October 14

US tariffs on lumber imports set for October 14

-

Australia lose Maxwell for New Zealand T20s after freak net blow

-

India plans mega-dam to counter China water fears

India plans mega-dam to counter China water fears

-

Colombia manufactures its first rifles to replace Israeli weapons

-

Stocks rise, gold hits record as rate cuts and shutdown loom

Stocks rise, gold hits record as rate cuts and shutdown loom

-

Dolphins star Hill suffers gruesome injury in Jets clash

-

Paralympics' vote to lift Russian suspension 'bold step' as conflict rages: ex-IOC executive

Paralympics' vote to lift Russian suspension 'bold step' as conflict rages: ex-IOC executive

-

Gazans say Trump's peace plan a 'farce'

-

UN Security Council to vote on future of foreign Haiti force

UN Security Council to vote on future of foreign Haiti force

-

Far-right German MP's ex-aide faces verdict in China spy case

-

YouTube to pay $22 million in settlement with Trump

YouTube to pay $22 million in settlement with Trump

-

Internet outrage over Trump's AI conspiracy video

-

Coalition of states vows to protect access to abortion pill under Trump review

Coalition of states vows to protect access to abortion pill under Trump review

-

Trump meets Democrats without breakthrough on imminent shutdown

-

Muslim states join EU powers in backing Trump Gaza plan

Muslim states join EU powers in backing Trump Gaza plan

-

California enacts AI safety law targeting tech giants

-

Creator says AI actress is 'piece of art' after backlash

Creator says AI actress is 'piece of art' after backlash

-

Nuno makes his point as West Ham rescue Everton draw

-

Slot challenges Liverpool players to 'give their all' against Galatasaray

Slot challenges Liverpool players to 'give their all' against Galatasaray

-

Dodgers eye rare repeat as MLB playoffs get under way

-

Solanke surgery leaves Spurs struggling for strikers

Solanke surgery leaves Spurs struggling for strikers

-

Trump's Gaza peace plan wins Netanyahu backing

-

New-look Paris Fashion Week kicks off with Saint Laurent

New-look Paris Fashion Week kicks off with Saint Laurent

-

Anthropic launches new AI model, touting coding supremacy

-

Trump announces Gaza peace plan, with Netanyahu backing

Trump announces Gaza peace plan, with Netanyahu backing

-

'Better, stronger' Wembanyama can't wait for NBA return

-

LeBron relishing 23rd season as retirement draws near

LeBron relishing 23rd season as retirement draws near

-

'Always a blue': Mourinho expects Chelsea fans to show respect

-

Michigan governor asks to 'lower the temperature' after church attack

Michigan governor asks to 'lower the temperature' after church attack

-

S. Africa lose World Cup qualifying points over ineligible player

-

Rugby chiefs open to R360 role in women's game after World Cup success

Rugby chiefs open to R360 role in women's game after World Cup success

-

Inter Milan announce 35.4 million euro profits ahead of San Siro vote

-

Madagascar protests reignite, UN says at least 22 dead

Madagascar protests reignite, UN says at least 22 dead

-

Taliban shut down communications across Afghanistan

-

Serbia arrests 11 accused of stirring Jewish-Muslim hate in France, Germany

Serbia arrests 11 accused of stirring Jewish-Muslim hate in France, Germany

-

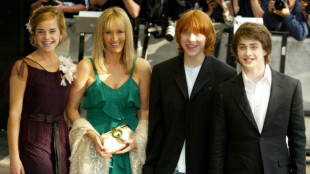

J.K. Rowling attacks 'ignorant' Harry Potter star Emma Watson

-

Electronic Arts to be bought by Saudi-led consortium for $55 bn

Electronic Arts to be bought by Saudi-led consortium for $55 bn

-

N.Korea vows at UN never to give up nuclear

-

Hamilton reveals 'hardest decision' over dog's death

Hamilton reveals 'hardest decision' over dog's death

-

Springsteen denounces 'hatred' in America at biopic premiere

-

Stock markets shrug off US government shutdown fears

Stock markets shrug off US government shutdown fears

-

UK's Labour plans tougher rules on migrants to halt hard right

-

Trump 'very confident' of Gaza deal as he hosts Netanyahu

Trump 'very confident' of Gaza deal as he hosts Netanyahu

-

'High chance' of India winning Women's Cricket World Cup: captain Kaur

-

Trump meets Democrats in last-gasp talks before US government shutdown

Trump meets Democrats in last-gasp talks before US government shutdown

-

No 'Angels': Bulgarians shake down Robbie Williams convoy

-

German music body sues OpenAI alleging copyright breaches

German music body sues OpenAI alleging copyright breaches

-

Cannabis extract relieves chronic back pain: high-quality trial

-

African players in Europe: Sarr helps sink leaders Liverpool

African players in Europe: Sarr helps sink leaders Liverpool

-

Madagascar protests reignite as police launch tear gas

ECB cuts rate again facing growth, tariff woes

The European Central Bank's easing cycle reached the one-year mark Thursday when policymakers delivered another interest rate cut as concerns mount about the struggling eurozone economy and global trade tensions.

The ECB cut its key deposit rate a quarter point to two percent, as widely expected, its seventh consecutive reduction and eighth since June last year when it began lowering borrowing costs.

It also lowered its inflation forecast for 2025, with consumer price increases now expected to hit the central bank's two-percent target this year.

With inflation under control following a post-pandemic surge, the ECB has shifted its focus to dialling back borrowing costs to boosting the beleaguered economies of the 20 countries that use the euro.

US President Donald Trump's tariffs have added to an already uncertain outlook for the single-currency area, with Europe firmly in his crosshairs, fuelling fears about a heavy hit to the continent's exporters.

Announcing the rate decision, the ECB struck a measured tone about the US levies and the potential for retaliation.

It noted that the "uncertainty surrounding trade policies is expected to weigh on business investment and exports" but added that "rising government investment in defence and infrastructure will increasingly support growth over the medium term.

"Higher real incomes and a robust labour market will allow households to spend more. Together with more favourable financing conditions, this should make the economy more resilient to global shocks."

It left its growth forecast for 2025 unchanged at 0.9 percent.

It also said inflation was now around target -- dropping previous language that it was "on track". Eurozone inflation came in at 1.9 percent in May.

All eyes will now be on ECB President Christine Lagarde's post-meeting press conference for any hints that the Frankfurt-based institution might be gearing up to pause its cuts in July to take stock of developments, as some expect.

The ECB's series of cuts stands in contrast to the US Federal Reserve, which has kept rates on hold recently amid fears that Trump's levies could stoke inflation in the world's top economy.

Lagarde may also face questions on her own future after the Financial Times last week reported she had discussed leaving the ECB early to take the helm of the World Economic Forum, which organises the annual Davos gathering.

The ECB has insisted that Lagarde is "determined" to finish her term, which ends in 2027.

- Tariff blitz -

Trump, who argues his tariffs will bring manufacturing jobs back to the United States, has already hit the EU with multiple waves of levies.

The bloc currently faces a 10-percent "baseline" tariff as well as higher duties on specific sectors.

He has paused even higher rates on the EU and other trading partners to allow for talks, but he continues to launch fresh salvos that are keeping the world on edge.

This week he doubled tariffs on aluminium and steel from 25 to 50 percent and last month threatened the EU with an escalation if it did not negotiate a swift deal.

For the ECB, it is a tricky task to protect the eurozone from the mercurial US president's trade policies while keeping inflation stable.

Trump's tariffs are expected to exert downward pressure on eurozone inflation.

This is due to factors including tariff-hit China redirecting inexpensive manufactured goods to Europe, recent strengthening of the euro and potentially lower energy prices.

Lower inflation and slower growth should push the ECB to make further rate cuts.

As a result, ING analyst Carsten Brzeski predicted Thursday's cut "will not be the last".

"Not only did US President Donald Trump make the European economy great again -- for one quarter, as frontloading of exports and industrial production boosted economic activity -- he also made inflation almost disappear," he said.

There are some factors that make this uncertain though.

These include signs of resilience in the eurozone economy at the start of the year and a potentially inflationary spending blitz planned by the new German government.

I.Stoeckli--VB