-

YouTube, platforms not cooperating enough on EU content disputes: report

YouTube, platforms not cooperating enough on EU content disputes: report

-

EU eyes higher steel tariffs, taking page from US

-

Slot faces reality check at Liverpool as problems mount

Slot faces reality check at Liverpool as problems mount

-

European stocks rise, Wall St futures drop as US shutdown begins

-

Survivors still carry burden as Bali marks 2005 bombings

Survivors still carry burden as Bali marks 2005 bombings

-

Thousands protest in Greece over 13-hour workday plans

-

Indigenous protest urges end to Colombia border violence

Indigenous protest urges end to Colombia border violence

-

Torrential downpours kill nine in Ukraine's Odesa

-

Australia ease to six-wicket win in first New Zealand T20

Australia ease to six-wicket win in first New Zealand T20

-

France's Monfils announces retirement at end of 2026

-

'Normal' Sinner thrashes Tien in Beijing for 21st title

'Normal' Sinner thrashes Tien in Beijing for 21st title

-

Survivor pulled from Indonesia school collapse as parents await news

-

Tennis schedule under renewed scrutiny as injuries, criticism mount

Tennis schedule under renewed scrutiny as injuries, criticism mount

-

New player load guidelines hailed as 'landmark moment' for rugby

-

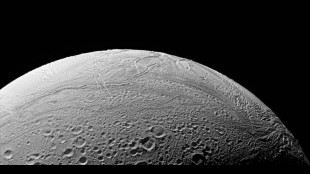

More ingredients for life discovered in ocean on Saturn moon

More ingredients for life discovered in ocean on Saturn moon

-

Germany's Oktoberfest closed by bomb threat

-

Spanish court opens 550-mn-euro Meta data protection trial

Spanish court opens 550-mn-euro Meta data protection trial

-

Jonathan Anderson to bring new twist to Dior women with Paris debut

-

Gold hits record, Wall St futures drop as US shutdown begins

Gold hits record, Wall St futures drop as US shutdown begins

-

Sinner thrashes Tien to win China Open for 21st title

-

Philippines quake toll rises to 69 as injured overwhelm hospitals

Philippines quake toll rises to 69 as injured overwhelm hospitals

-

Swiss glaciers shrank by a quarter in past decade: study

-

Indonesia's MotoGP project leaves evicted villagers in limbo

Indonesia's MotoGP project leaves evicted villagers in limbo

-

'The Summer I Turned Pretty' sells more Paris romantic escapism

-

Australia's Lyon tells England that no spinner would be Ashes error

Australia's Lyon tells England that no spinner would be Ashes error

-

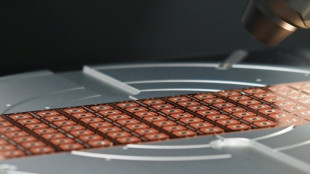

Taiwan says 'will not agree' to making 50% of its chips in US

-

Verstappen's late-season surge faces steamy Singapore examination

Verstappen's late-season surge faces steamy Singapore examination

-

Ohtani erupts as Dodgers down Reds, Red Sox stun Yankees in MLB playoffs

-

General strike in Greece over 13-hour workday plans

General strike in Greece over 13-hour workday plans

-

Georgia risks political turmoil over weekend vote

-

US government enters shutdown as Congress fails to reach funding deal

US government enters shutdown as Congress fails to reach funding deal

-

Spanish court to start hearing media case against Meta

-

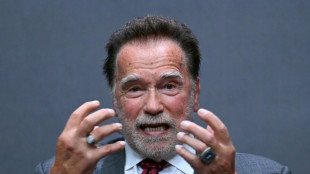

Pope, Schwarzenegger to rally Catholics to 'terminate' climate change

Pope, Schwarzenegger to rally Catholics to 'terminate' climate change

-

FBI director gave New Zealand officials illegal firearms: police

-

Gisele Pelicot back in French court for appeal trial 'ordeal'

Gisele Pelicot back in French court for appeal trial 'ordeal'

-

EU leaders plot defence boost in shadow of Denmark drones

-

Wallabies' most-capped player James Slipper announces retirement

Wallabies' most-capped player James Slipper announces retirement

-

India ready to rev up chipmaking, industry pioneer says

-

Australian Rules axes 'centre bounce' after 130 years

Australian Rules axes 'centre bounce' after 130 years

-

Rangers searching for Europa League respite, Villa visit Feyenoord

-

Crystal Palace soaring under Glasner ahead of European bow

Crystal Palace soaring under Glasner ahead of European bow

-

Asian stocks mixed, Wall St futures drop as US heads for shutdown

-

Suarez double in vain as Chicago sink Miami to clinch playoff berth

Suarez double in vain as Chicago sink Miami to clinch playoff berth

-

England's 'outsiders' aim to break trophy drought at Women's Cricket World Cup

-

Indigenous survivors recount past horrors at Canada residential school

Indigenous survivors recount past horrors at Canada residential school

-

Hitmaker Max Martin back with Taylor Swift for 'Showgirl'

-

'Showgirl' conquers showbusiness: Taylor Swift releases 12th album on Friday

'Showgirl' conquers showbusiness: Taylor Swift releases 12th album on Friday

-

Former Wallabies coach Cheika joins Sydney Roosters

-

South Korea posts record semiconductor exports in September

South Korea posts record semiconductor exports in September

-

Rugby World Cup draw set for December 3

Oil under $65 a boon for consumers, but a burden on producers

US President Donald Trump's tariffs, his call to "drill baby drill" and especially a decision by OPEC+ to hike crude output quotas have oil prices trading at lows not seen since the Covid pandemic.

That is good news for consumers but not so much for producers, analysts say.

A barrel of Brent North Sea crude, the international benchmark, stands below $65, a far cry from the more than the $120 reached in 2022 following the invasion of Ukraine by major oil producer Russia.

- Lower inflation -

The fall in oil prices has contributed to a global slowdown for inflation, while also boosting growth in countries reliant on importing crude, such as much of Europe.

The US consumer price index, for example, was down 11.8 percent year-on-year in April.

Cheaper crude "increases the level of disposable income" consumers have to be spending on "discretionary items" such as leisure and tourism, said Pushpin Singh, an economist at British research group Cebr.

The price of Brent has fallen by more than $10 compared with a year ago, reducing the cost of various fuel types derived directly from oil.

This is helping to push down transportation and manufacturing costs that may, in the medium term, help further cut prices of consumer goods, Singh told AFP.

But he noted that while the drop in crude prices is partly a consequence of Trump's trade policies, the net effect on inflation remains difficult to predict amid threatened surges to other input costs, such as metals.

At the same time, "cheaper oil can make renewable energy sources less competitive, potentially slowing investment in green technologies", Singh added.

- Oil producers -

As prices retreat however the undisputed losers are oil-producing countries, "especially high-cost producers who at current and lower prices are forced to scale back production in the coming months", said Ole Hansen, head of commodity strategy at Saxo Bank.

Oil trading close to or below $60 "will obviously not be great for shale producers" either, said Rystad Energy analyst Jorge Leon.

"Having lower oil prices is going to be the detriment to their development," he told AFP.

Some companies extracting oil and natural gas from shale rock have already announced reduced investment in the Permian Basin, located between Texas and New Mexico.

For the OPEC+ oil alliance, led by Saudi Arabia and Russia, tolerance for low prices varies greatly.

Saudi Arabia, the United Arab Emirates and Kuwait have monetary reserves allowing them to easily borrow to finance diversified economic projects, Leon said.

Hansen forecast that "the long-term winners are likely to be major OPEC+ producers, especially in the Middle East, as they reclaim market shares that were lost since 2022 when they embarked on voluntary production cuts".

The 22-nation group began a series of cuts in 2022 to prop up crude prices, but Saudi Arabia, Russia and six other members surprised markets recently by sharply raising output.

On Saturday, the countries announced a huge increase in crude production for July with an additional 411,000 barrels a day.

Analysts say the hikes have likely been aimed at punishing OPEC members that have failed to meet their quotas, but it also follows pressure from Trump to lower prices.

That is directly impacting the likes of Iran and Venezuela, whose economies depend heavily on oil revenues.

A lower-price environment also hurts Nigeria, which like other OPEC+ members possesses a more limited ability to borrow funds, according to experts.

Bit non-OPEC member Guyana, whose GDP growth has surged in recent years thanks to the discovery of oil, risks seeing its economy slow.

H.Weber--VB