-

Two pulled from Indonesia school collapse as rescuers race against time

Two pulled from Indonesia school collapse as rescuers race against time

-

Mobile and data networks return across Afghanistan: AFP journalists

-

Denmark warns EU over Russia 'hybrid war' as leaders talk defence

Denmark warns EU over Russia 'hybrid war' as leaders talk defence

-

UK's Labour govt plans permanent fracking ban

-

Russia says situation at Zaporizhzhia nuclear plant under control

Russia says situation at Zaporizhzhia nuclear plant under control

-

YouTube, platforms not cooperating enough on EU content disputes: report

-

EU eyes higher steel tariffs, taking page from US

EU eyes higher steel tariffs, taking page from US

-

Slot faces reality check at Liverpool as problems mount

-

European stocks rise, Wall St futures drop as US shutdown begins

European stocks rise, Wall St futures drop as US shutdown begins

-

Survivors still carry burden as Bali marks 2005 bombings

-

Thousands protest in Greece over 13-hour workday plans

Thousands protest in Greece over 13-hour workday plans

-

Indigenous protest urges end to Colombia border violence

-

Torrential downpours kill nine in Ukraine's Odesa

Torrential downpours kill nine in Ukraine's Odesa

-

Australia ease to six-wicket win in first New Zealand T20

-

France's Monfils announces retirement at end of 2026

France's Monfils announces retirement at end of 2026

-

'Normal' Sinner thrashes Tien in Beijing for 21st title

-

Survivor pulled from Indonesia school collapse as parents await news

Survivor pulled from Indonesia school collapse as parents await news

-

Tennis schedule under renewed scrutiny as injuries, criticism mount

-

New player load guidelines hailed as 'landmark moment' for rugby

New player load guidelines hailed as 'landmark moment' for rugby

-

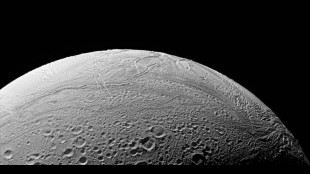

More ingredients for life discovered in ocean on Saturn moon

-

Germany's Oktoberfest closed by bomb threat

Germany's Oktoberfest closed by bomb threat

-

Spanish court opens 550-mn-euro Meta data protection trial

-

Jonathan Anderson to bring new twist to Dior women with Paris debut

Jonathan Anderson to bring new twist to Dior women with Paris debut

-

Gold hits record, Wall St futures drop as US shutdown begins

-

Sinner thrashes Tien to win China Open for 21st title

Sinner thrashes Tien to win China Open for 21st title

-

Philippines quake toll rises to 69 as injured overwhelm hospitals

-

Swiss glaciers shrank by a quarter in past decade: study

Swiss glaciers shrank by a quarter in past decade: study

-

Indonesia's MotoGP project leaves evicted villagers in limbo

-

'The Summer I Turned Pretty' sells more Paris romantic escapism

'The Summer I Turned Pretty' sells more Paris romantic escapism

-

Australia's Lyon tells England that no spinner would be Ashes error

-

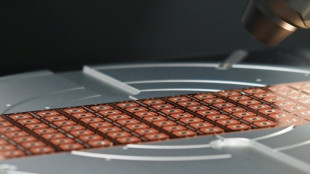

Taiwan says 'will not agree' to making 50% of its chips in US

Taiwan says 'will not agree' to making 50% of its chips in US

-

Verstappen's late-season surge faces steamy Singapore examination

-

Ohtani erupts as Dodgers down Reds, Red Sox stun Yankees in MLB playoffs

Ohtani erupts as Dodgers down Reds, Red Sox stun Yankees in MLB playoffs

-

General strike in Greece over 13-hour workday plans

-

Georgia risks political turmoil over weekend vote

Georgia risks political turmoil over weekend vote

-

US government enters shutdown as Congress fails to reach funding deal

-

Spanish court to start hearing media case against Meta

Spanish court to start hearing media case against Meta

-

Pope, Schwarzenegger to rally Catholics to 'terminate' climate change

-

FBI director gave New Zealand officials illegal firearms: police

FBI director gave New Zealand officials illegal firearms: police

-

Gisele Pelicot back in French court for appeal trial 'ordeal'

-

EU leaders plot defence boost in shadow of Denmark drones

EU leaders plot defence boost in shadow of Denmark drones

-

Wallabies' most-capped player James Slipper announces retirement

-

India ready to rev up chipmaking, industry pioneer says

India ready to rev up chipmaking, industry pioneer says

-

Australian Rules axes 'centre bounce' after 130 years

-

Rangers searching for Europa League respite, Villa visit Feyenoord

Rangers searching for Europa League respite, Villa visit Feyenoord

-

Crystal Palace soaring under Glasner ahead of European bow

-

Asian stocks mixed, Wall St futures drop as US heads for shutdown

Asian stocks mixed, Wall St futures drop as US heads for shutdown

-

Suarez double in vain as Chicago sink Miami to clinch playoff berth

-

England's 'outsiders' aim to break trophy drought at Women's Cricket World Cup

England's 'outsiders' aim to break trophy drought at Women's Cricket World Cup

-

Indigenous survivors recount past horrors at Canada residential school

Silicon Valley VCs navigate uncertain AI future

For Silicon Valley venture capitalists, the world has split into two camps: those with deep enough pockets to invest in artificial intelligence behemoths, and everyone else waiting to see where the AI revolution leads.

The generative AI frenzy unleashed by ChatGPT in 2022 has propelled a handful of venture-backed companies to eye-watering valuations.

Leading the pack is OpenAI, which raised $40 billion in its latest funding round at a $300 billion valuation -- unprecedented largesse in Silicon Valley's history.

Other AI giants are following suit. Anthropic now commands a $61.5 billion valuation, while Elon Musk's xAI is reportedly in talks to raise $20 billion at a $120 billion price tag.

The stakes have grown so high that even major venture capital firms -- the same ones that helped birth the internet revolution -- can no longer compete.

Mostly, only the deepest pockets remain in the game: big tech companies, Japan's SoftBank, and Middle Eastern investment funds betting big on a post-fossil fuel future.

"There's a really clear split between the haves and the have-nots," says Emily Zheng, senior analyst at PitchBook, told AFP at the Web Summit in Vancouver.

"Even though the top-line figures are very high, it's not necessarily representative of venture overall, because there's just a few elite startups and a lot of them happen to be AI."

Given Silicon Valley's confidence that AI represents an era-defining shift, venture capitalists face a crucial challenge: finding viable opportunities in an excruciatingly expensive market that is rife with disruption.

Simon Wu of Cathay Innovation sees clear customer demand for AI improvements, even if most spending flows to the biggest players.

"AI across the board, if you're selling a product that makes you more efficient, that's flying off the shelves," Wu explained. "People will find money to spend on OpenAI" and the big players.

The real challenge, according to Andy McLoughlin, managing partner at San Francisco-based Uncork Capital, is determining "where the opportunities are against the mega platforms."

"If you're OpenAI or Anthropic, the amount that you can do is huge. So where are the places that those companies cannot play?"

Finding that answer isn't easy. In an industry where large language models behind ChatGPT, Claude and Google's Gemini seem to have limitless potential, everything moves at breakneck speed.

AI giants including Google, Microsoft, and Amazon are releasing tools and products at a furious pace.

ChatGPT and its rivals now handle search, translation, and coding all within one chatbot -- raising doubts among investors about what new ideas could possibly survive the competition.

Generative AI has also democratized software development, allowing non-professionals to code new applications from simple prompts. This completely disrupts traditional startup organization models.

"Every day I think, what am I going to wake up to today in terms of something that has changed or (was) announced geopolitically or within our world as tech investors," reflected Christine Tsai, founding partner and CEO at 500 Global.

- The 'moat' problem -

In Silicon Valley parlance, companies are struggling to find a "moat" -- that unique feature or breakthrough like Microsoft Windows in the 1990s or Google Search in the 2000s that's so successful it takes competitors years to catch up, if ever.

When it comes to business software, AI is "shaking up the topology of what makes sense and what's investable," noted Brett Gibson, managing partner at Initialized Capital.

The risks seem particularly acute given that generative AI's economics remain unproven. Even the biggest players see a very uncertain path to profitability given the massive sums involved.

The huge valuations for OpenAI and others are causing "a lot of squinting of the eyes, with people wondering 'is this really going to replace labor costs'" at the levels needed to justify the investments, Wu observed.

Despite AI's importance, "I think everyone's starting to see how this might fall short of the magical" even if its early days, he added.

Still, only the rare contrarians believe generative AI isn't here to stay.

In five years, "we won't be talking about AI the same way we're talking about it now, the same way we don't talk about mobile or cloud," predicted McLoughlin.

"It'll become a fabric of how everything gets built."

But who will be building remains an open question.

L.Meier--VB