-

Depoortere stakes France claim as Bordeaux-Begles stumble past Lyon

Depoortere stakes France claim as Bordeaux-Begles stumble past Lyon

-

Vinicius double helps Real Madrid beat Villarreal

-

New museum examines family life of Mexican artist Frida Kahlo

New museum examines family life of Mexican artist Frida Kahlo

-

Piccioli sets new Balenciaga beat, with support from Meghan Markle

-

Lammens must be ready for 'massive' Man Utd scrutiny, says Amorim

Lammens must be ready for 'massive' Man Utd scrutiny, says Amorim

-

Arteta 'not positive' after Odegaard sets unwanted injury record

-

Slot struggles to solve Liverpool problems after third successive loss

Slot struggles to solve Liverpool problems after third successive loss

-

Netanyahu hopes to bring Gaza hostages home within days as negotiators head to Cairo

-

Ex-NFL QB Sanchez in hospital after reported stabbing

Ex-NFL QB Sanchez in hospital after reported stabbing

-

Liverpool lose again at Chelsea, Arsenal go top of Premier League

-

Liverpool suffer third successive loss as Estevao strikes late for Chelsea

Liverpool suffer third successive loss as Estevao strikes late for Chelsea

-

Diaz dazzles early and Kane strikes again as Bayern beat Frankfurt

-

De Zerbi living his best life as Marseille go top of Ligue 1

De Zerbi living his best life as Marseille go top of Ligue 1

-

US envoys head to Mideast as Trump warns Hamas against peace deal delay

-

In-form Inter sweep past Cremonese to join Serie A leaders

In-form Inter sweep past Cremonese to join Serie A leaders

-

Kolisi hopes Rugby Championship success makes South Africa 'walk tall' again

-

Ex-All Black Nonu rolls back the years again as Toulon cruise past Pau

Ex-All Black Nonu rolls back the years again as Toulon cruise past Pau

-

Hundreds of thousands turn out at pro-Palestinian marches in Europe

-

Vollering powers to European women's road race title

Vollering powers to European women's road race title

-

Struggling McLaren hit bump in the road on Singapore streets

-

'We were treated like animals', deported Gaza flotilla activists say

'We were treated like animals', deported Gaza flotilla activists say

-

Czech billionaire ex-PM's party tops parliamentary vote

-

Trump enovys head to Egypt as Hamas agrees to free hostages

Trump enovys head to Egypt as Hamas agrees to free hostages

-

Arsenal go top of Premier League as Man Utd ease pressure on Amorim

-

Thousands attend banned Pride march in Hungarian city Pecs

Thousands attend banned Pride march in Hungarian city Pecs

-

Consent gives Morris and Prescott another memorable Arc weekend

-

Georgian police fire tear gas as protesters try to enter presidential palace

Georgian police fire tear gas as protesters try to enter presidential palace

-

Vollering powers to European road race title

-

Reinach and Marx star as Springboks beat Argentina to retain Rugby Championship

Reinach and Marx star as Springboks beat Argentina to retain Rugby Championship

-

Russell celebrates 'amazing' Singapore pole as McLarens struggle

-

Czech billionaire ex-PM's party leads in parliamentary vote

Czech billionaire ex-PM's party leads in parliamentary vote

-

South Africa edge Argentina to retain Rugby Championship

-

'Everyone's older brother': Slipper bows out in Wallabies loss

'Everyone's older brother': Slipper bows out in Wallabies loss

-

Thousands rally in Georgia election-day protest

-

Sinner starts Shanghai defence in style as Zverev defies toe trouble

Sinner starts Shanghai defence in style as Zverev defies toe trouble

-

Russell takes pole position for Singapore Grand Prix as McLaren struggle

-

Robertson praises All Blacks 'grit' in Australia win

Robertson praises All Blacks 'grit' in Australia win

-

Government, protesters reach deal to end unrest in Pakistan's Kashmir

-

Kudus fires Spurs into second with win at Leeds

Kudus fires Spurs into second with win at Leeds

-

Rival rallies in Madagascar after deadly Gen Z protests

-

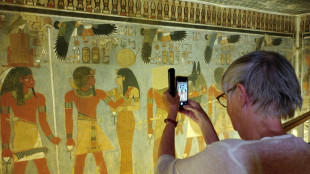

Egypt opens one of Valley of the Kings' largest tombs to public

Egypt opens one of Valley of the Kings' largest tombs to public

-

Ethiopia hits back at 'false' Egyptian claims over mega-dam

-

Sinner breezes past Altmaier to launch Shanghai title defence

Sinner breezes past Altmaier to launch Shanghai title defence

-

Czech ex-PM set to win vote, putting Ukraine aid in doubt

-

All Blacks down Wallabies to stay in Rugby Championship title hunt

All Blacks down Wallabies to stay in Rugby Championship title hunt

-

Gazans hail Trump ceasefire call as Hamas agrees to free hostages

-

Zverev echoes Federer over tournaments 'favouring Sinner, Alcaraz'

Zverev echoes Federer over tournaments 'favouring Sinner, Alcaraz'

-

Yamal injury complicated, return date uncertain: Barca coach Flick

-

Conservative Takaichi set to be Japan's first woman PM

Conservative Takaichi set to be Japan's first woman PM

-

Marsh ton powers Australia to T20 series win over New Zealand

Stock markets fall as Trump threatens tariffs on EU, Apple

Stock markets fell back Friday after US President Donald Trump ended a lull in his trade war with threats of massive tariffs on Apple products and imports from the European Union.

Wall Street's main indexes were all down around one percent two hours into trading, with the tech-heavy Nasdaq at one stage losing 1.5 percent before rallying while Apple shares sank 2.5 percent.

Paris and Frankfurt ended with losses of around 1.5 percent, paring slightly earlier losses, with shares in luxury and car companies taking a hit after Trump suggested he would hit the EU with 50-percent tariffs.

London's FTSE 100, which initially rose, also ended in the red.

Germany's DAX had also been higher earlier in the day as German economic growth data was revised up.

"What is somewhat of a surprise is the fact that the EU will now face a considerably higher tariff rate than China, an almost unthinkable scenario just a matter of weeks ago," said Lindsay James, investment strategist at Quilter.

"It is highlighting that much of this policy is designed to be punitive, rather than having any economic credibility to it."

Oil prices rebounded, meanwhile, having earlier dropped by around one percent, while the dollar remained under pressure.

Trump's new threats revived investor concerns about his trade policies after a recent deal with Britain and a tariffs truce with China.

"All the optimism over trade deals wiped out in minutes –- seconds, even," said Fawad Razaqzada, market analyst at StoneX.

Trump said on his Truth Social platform that he was "recommending a straight 50% Tariff on the European Union" from June 1 as "discussions with them are going nowhere!"

"The EU is one of Trump's least favourite regions, and he does not seem to have good relations with its leaders, which increases the chance of a prolonged trade war between the two," said Kathleen Brooks, research director at trading platform XTB.

The US president had announced 20-percent tariffs on EU goods last month but suspended the measure to give space for negotiations.

Trump, however, maintained a 10-percent levy on imports from the 27-nation bloc and nearly every other nation around the world, along with 25-percent duties on the car, steel and aluminium industries.

He also threatened on Friday to hit Apple with a 25-percent tariff if its iPhones are not manufactured in the United States.

"Trump's attack on Apple looks like one of his negotiating tactics to us," Brooks said, noting that the threat comes as his tax-cut plan faces Senate debate after passing the lower house of Congress.

Trump's social media outburst rocked stock markets which had steadied following losses over concerns about the ballooning US debt and rising US borrowing costs.

Investors were already on edge after Moody's stripped the United States of its top-tier credit rating and the House of Representatives approved Trump's tax cut plan, which critics say would add to the country's debt pile.

The yield -- or borrowing cost -- on 10-year and 30-year US government bonds surged this week as investors worried about the fiscal health of the world's biggest economy.

The yields eased late Thursday.

Trump's tax package, which now goes to the Senate, had faced scepticism from fiscal hawks who fear the country is headed for bankruptcy.

Independent analysts warn it would increase the deficit by as much as $4 trillion over a decade, although the White House insists it will spur growth of up to 5.2 percent, projections well outside the mainstream consensus.

- Key figures at around 1545 GMT -

New York - Dow: DOWN 1.0 percent at 41,600.26 points

New York - S&P 500: DOWN 0.7 percent at 5,801.69

New York - Nasdaq Composite: DOWN 1.0 percent at 18,745.66

London - FTSE 100: DOWN 0.4 percent at 8,717.97 (close)

Paris - CAC 40: DOWN 1.7 percent at 7,734.40 (close)

Frankfurt - DAX: DOWN 1.5 percent at 23,612.46 (close)

Tokyo - Nikkei 225: UP 0.5 percent at 37,160.47 (close)

Hong Kong - Hang Seng Index: UP 0.2 percent at 23,601.26 (close)

Shanghai - Composite: DOWN 0.9 percent at 3,348.37 (close)

Euro/dollar: UP at $1.1333 from $1.1281 on Thursday

Pound/dollar: UP at $1.3498 from $1.3419

Dollar/yen: DOWN at 142.77 yen from 143.99 yen

Euro/pound: DOWN at 83.98 pence from 84.07 pence

Brent North Sea Crude: UP 0.5 percent at $64.76 per barrel

West Texas Intermediate: UP 0.6 percent at $61.60 per barrel

T.Ziegler--VB