-

Filipino cardinal, the 'Asian Francis', is papal contender

Filipino cardinal, the 'Asian Francis', is papal contender

-

Samsung Electronics posts 22% jump in Q1 net profit

-

Pietro Parolin, career diplomat leading race to be pope

Pietro Parolin, career diplomat leading race to be pope

-

Nuclear submarine deal lurks below surface of Australian election

-

China's manufacturing shrinks in April as trade war bites

China's manufacturing shrinks in April as trade war bites

-

Financial markets may be the last guardrail on Trump

-

Swedish journalist's trial opens in Turkey

Swedish journalist's trial opens in Turkey

-

Kiss says 'honour of a lifetime' to coach Wallabies at home World Cup

-

US growth figure expected to make for tough reading for Trump

US growth figure expected to make for tough reading for Trump

-

Opposition leader confirmed winner of Trinidad elections

-

Snedeker, Ogilvy to skipper Presidents Cup teams: PGA Tour

Snedeker, Ogilvy to skipper Presidents Cup teams: PGA Tour

-

Win or bust in Europa League for Amorim's Man Utd

-

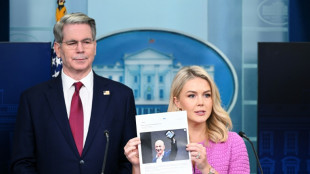

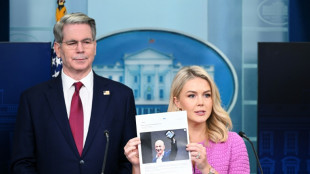

Trump celebrates 100 days in office with campaign-style rally

Trump celebrates 100 days in office with campaign-style rally

-

Top Cuban dissidents detained after court revokes parole

-

Arteta urges Arsenal to deliver 'special' fightback against PSG

Arteta urges Arsenal to deliver 'special' fightback against PSG

-

Trump fires Kamala Harris's husband from Holocaust board

-

Pakistan says India planning strike as tensions soar over Kashmir attack

Pakistan says India planning strike as tensions soar over Kashmir attack

-

Weinstein sex attack accuser tells court he 'humiliated' her

-

France accuses Russian military intelligence over cyberattacks

France accuses Russian military intelligence over cyberattacks

-

Global stocks mostly rise as Trump grants auto tariff relief

-

Grand Vietnam parade 50 years after the fall of Saigon

Grand Vietnam parade 50 years after the fall of Saigon

-

Trump fires ex first gentleman Emhoff from Holocaust board

-

PSG 'not getting carried away' despite holding edge against Arsenal

PSG 'not getting carried away' despite holding edge against Arsenal

-

Cuban dissidents detained after court revokes parole

-

Sweden stunned by new deadly gun attack

Sweden stunned by new deadly gun attack

-

BRICS blast 'resurgence of protectionism' in Trump era

-

Trump tempers auto tariffs, winning cautious praise from industry

Trump tempers auto tariffs, winning cautious praise from industry

-

'Cruel measure': Dominican crackdown on Haitian hospitals

-

'It's only half-time': Defiant Raya says Arsenal can overturn PSG deficit

'It's only half-time': Defiant Raya says Arsenal can overturn PSG deficit

-

Dembele sinks Arsenal as PSG seize edge in Champions League semi-final

-

Les Kiss to take over Wallabies coach role from mid-2026

Les Kiss to take over Wallabies coach role from mid-2026

-

Real Madrid's Rudiger, Mendy and Alaba out injured until end of season

-

US threatens to quit Russia-Ukraine effort unless 'concrete proposals'

US threatens to quit Russia-Ukraine effort unless 'concrete proposals'

-

Meta releases standalone AI app, competing with ChatGPT

-

Zverev crashes as Swiatek scrapes into Madrid Open quarter-finals

Zverev crashes as Swiatek scrapes into Madrid Open quarter-finals

-

BRICS members blast rise of 'trade protectionism'

-

Trump praises Bezos as Amazon denies plan to display tariff cost

Trump praises Bezos as Amazon denies plan to display tariff cost

-

France to tax small parcels from China amid tariff fallout fears

-

Hong Kong releases former opposition lawmakers jailed for subversion

Hong Kong releases former opposition lawmakers jailed for subversion

-

Trump celebrates tumultuous 100 days in office

-

Sweden gun attack leaves three dead

Sweden gun attack leaves three dead

-

Real Madrid's Rudiger banned for six matches after Copa final red

-

Firmino, Toney fire Al Ahli into AFC Champions League final

Firmino, Toney fire Al Ahli into AFC Champions League final

-

Maximum respect for Barca but no fear: Inter's Inzaghi

-

Trump signals relief on auto tariffs as industry awaits details

Trump signals relief on auto tariffs as industry awaits details

-

Cuban court revokes parole of two prominent dissidents

-

Narine leads from the front as Kolkata trump Delhi in IPL

Narine leads from the front as Kolkata trump Delhi in IPL

-

Amazon says never planned to show tariff costs, after White House backlash

-

Djokovic to miss Italian Open

Djokovic to miss Italian Open

-

Trossard starts for Arsenal in Champions League semi against PSG

BP profit drops 70% amid pivot back to oil and gas

Britain's BP said on Tuesday net profit plunged in the first quarter as the struggling energy giant undergoes a major overhaul back to its fossil fuel business.

Profit after tax declined to $687 million, down from $2.3 billion in the first three months of 2024, driven by weaker gas sales and lower refining margins, BP said in a statement.

Total revenue fell four percent to slightly under $48 billion.

BP and other oil majors have been hit by a recent slump in crude prices on fears that US President Donald Trump's tariffs could cause a recession, impacting demand.

"We continue to monitor market volatility and changes and remain focused on moving at pace," chief executive Murray Auchincloss said in an earnings statement.

Under pressure from investors, BP is in the midst of a major reset that saw it shelve its once industry-leading carbon-reduction targets to focus on fossil fuel output deemed more profitable.

The recent retreat in oil prices has cast doubt over this, however, according to analysts.

BP also announced that the head of sustainability strategy Giulia Chierchia will step down from her role in June and will not be replaced.

Auchincloss said he remains "confident" in the reset, adding that BP has "already made significant progress."

To the dismay of environmentalists, the new strategy includes cutting cleaner energy investment by more than $5 billion annually.

Shares in the company fell over four percent in early deals on London's top-tier FTSE 100 index which was trading flat overall.

The company on Tuesday also reduced its quarterly share buyback to $750 million, at the lower end of expectations.

- Investor pressure -

The strategy overhaul followed a difficult trading year for BP, which is under pressure from investors to boost its share price as countries look to slash emissions.

The company confirmed last week that US activist investment fund Elliott Investment Management has taken a stake of just over five percent in BP.

The fund is known for forcing through corporate changes within groups it invests in, according to analysts.

BP at the start of April said chairman Helge Lund, who assumed the role in 2019, would depart the company next year.

"Geopolitics and trade tensions are more complex today than for a long time. This uncertainty has had an impact on BP," Lund told shareholders at the company's annual general meeting in April.

The Norwegian national worked with three CEOs at BP, which included helping guide the company through the turbulent Covid years when demand for energy collapsed.

"BP's making the best it can of a sticky situation," said Derren Nathan, head of equity research at Hargreaves Lansdown.

The group is ramping up its global exploration programme, with around 40 wells planned over the next three years, including as many as 15 to be drilled this year.

It recently announced it had made a new oil discovery off the US Gulf coast.

"But going into the second quarter weaker oil prices means management will be under more pressure than ever to meet the expectations of its biggest shareholder," Nathan added.

T.Suter--VB