-

Filipino cardinal, the 'Asian Francis', is papal contender

Filipino cardinal, the 'Asian Francis', is papal contender

-

Samsung Electronics posts 22% jump in Q1 net profit

-

Pietro Parolin, career diplomat leading race to be pope

Pietro Parolin, career diplomat leading race to be pope

-

Nuclear submarine deal lurks below surface of Australian election

-

China's manufacturing shrinks in April as trade war bites

China's manufacturing shrinks in April as trade war bites

-

Financial markets may be the last guardrail on Trump

-

Swedish journalist's trial opens in Turkey

Swedish journalist's trial opens in Turkey

-

Kiss says 'honour of a lifetime' to coach Wallabies at home World Cup

-

US growth figure expected to make for tough reading for Trump

US growth figure expected to make for tough reading for Trump

-

Opposition leader confirmed winner of Trinidad elections

-

Snedeker, Ogilvy to skipper Presidents Cup teams: PGA Tour

Snedeker, Ogilvy to skipper Presidents Cup teams: PGA Tour

-

Win or bust in Europa League for Amorim's Man Utd

-

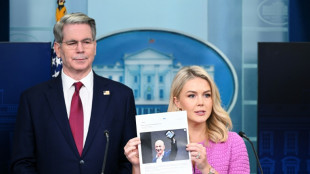

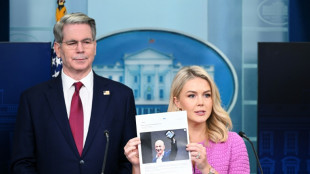

Trump celebrates 100 days in office with campaign-style rally

Trump celebrates 100 days in office with campaign-style rally

-

Top Cuban dissidents detained after court revokes parole

-

Arteta urges Arsenal to deliver 'special' fightback against PSG

Arteta urges Arsenal to deliver 'special' fightback against PSG

-

Trump fires Kamala Harris's husband from Holocaust board

-

Pakistan says India planning strike as tensions soar over Kashmir attack

Pakistan says India planning strike as tensions soar over Kashmir attack

-

Weinstein sex attack accuser tells court he 'humiliated' her

-

France accuses Russian military intelligence over cyberattacks

France accuses Russian military intelligence over cyberattacks

-

Global stocks mostly rise as Trump grants auto tariff relief

-

Grand Vietnam parade 50 years after the fall of Saigon

Grand Vietnam parade 50 years after the fall of Saigon

-

Trump fires ex first gentleman Emhoff from Holocaust board

-

PSG 'not getting carried away' despite holding edge against Arsenal

PSG 'not getting carried away' despite holding edge against Arsenal

-

Cuban dissidents detained after court revokes parole

-

Sweden stunned by new deadly gun attack

Sweden stunned by new deadly gun attack

-

BRICS blast 'resurgence of protectionism' in Trump era

-

Trump tempers auto tariffs, winning cautious praise from industry

Trump tempers auto tariffs, winning cautious praise from industry

-

'Cruel measure': Dominican crackdown on Haitian hospitals

-

'It's only half-time': Defiant Raya says Arsenal can overturn PSG deficit

'It's only half-time': Defiant Raya says Arsenal can overturn PSG deficit

-

Dembele sinks Arsenal as PSG seize edge in Champions League semi-final

-

Les Kiss to take over Wallabies coach role from mid-2026

Les Kiss to take over Wallabies coach role from mid-2026

-

Real Madrid's Rudiger, Mendy and Alaba out injured until end of season

-

US threatens to quit Russia-Ukraine effort unless 'concrete proposals'

US threatens to quit Russia-Ukraine effort unless 'concrete proposals'

-

Meta releases standalone AI app, competing with ChatGPT

-

Zverev crashes as Swiatek scrapes into Madrid Open quarter-finals

Zverev crashes as Swiatek scrapes into Madrid Open quarter-finals

-

BRICS members blast rise of 'trade protectionism'

-

Trump praises Bezos as Amazon denies plan to display tariff cost

Trump praises Bezos as Amazon denies plan to display tariff cost

-

France to tax small parcels from China amid tariff fallout fears

-

Hong Kong releases former opposition lawmakers jailed for subversion

Hong Kong releases former opposition lawmakers jailed for subversion

-

Trump celebrates tumultuous 100 days in office

-

Sweden gun attack leaves three dead

Sweden gun attack leaves three dead

-

Real Madrid's Rudiger banned for six matches after Copa final red

-

Firmino, Toney fire Al Ahli into AFC Champions League final

Firmino, Toney fire Al Ahli into AFC Champions League final

-

Maximum respect for Barca but no fear: Inter's Inzaghi

-

Trump signals relief on auto tariffs as industry awaits details

Trump signals relief on auto tariffs as industry awaits details

-

Cuban court revokes parole of two prominent dissidents

-

Narine leads from the front as Kolkata trump Delhi in IPL

Narine leads from the front as Kolkata trump Delhi in IPL

-

Amazon says never planned to show tariff costs, after White House backlash

-

Djokovic to miss Italian Open

Djokovic to miss Italian Open

-

Trossard starts for Arsenal in Champions League semi against PSG

Markets boosted as Trump softens tariff pain for auto firms

Markets rose Tuesday following news that Donald Trump is set to let auto makers off some of his wide-ranging tariffs, boosting hopes of a less combative approach to his trade war.

A month that started with the explosion of Washington's "Liberation Day" tariffs on April 2 was on course for a more positive close as governments line up to cut deals to avert the full force of the measures.

The White House said foreign auto firms paying tariffs of 25 percent for their US car and parts shipments would not face other levies such as those on steel and aluminium, the Wall Street Journal said. Companies will also be reimbursed for fees already paid.

The move is aimed at making sure the various tariffs Trump has unveiled do not stack up on top of each other.

Commerce Secretary Howard Lutnick said the deal was "a major victory for the president's trade policy".

He said it rewarded firms "who manufacture domestically while providing runway to manufacturers who have expressed their commitment to invest in America and expand their domestic manufacturing".

Stephen Innes at SPI Asset Management said the move was able to "reinforce the market's hope that, even if the US-China heavyweights are still circling each other, there's still room for incremental detente elsewhere".

While there is a hope that the president's other sweeping measures on trade partners can be tempered before a 90-day stay of execution comes to an end in July, there appears to be little movement with China.

The White House has imposed 10 percent tariffs on most US trading partners and a separate 145 percent levy on many products from China. Beijing has responded with 125 percent tariffs of its own.

Reports last week said China was considering exempting some US goods from its retaliatory tariffs but officials have said there are no active negotiations between the economic superpowers.

On Monday a Chinese official denied Trump's claims he had spoken recently with President Xi Jinping.

The chance of a deal between the two for now seems remote, with US Treasury Secretary Scott Bessent telling CNBC that negotiations were ongoing but the ball was in China's court.

"As I've repeatedly said, I believe it's up to China to de-escalate, because they sell five times more to us than we sell to them. So these 125 percent tariffs are unsustainable," he said in an interview aired Monday.

While uncertainty rules on trading floors, most Asian markets pushed higher on Tuesday, with Hong Kong, Sydney, Singapore, Taipei, Mumbai and Manila in positive territory.

Seoul also rose as auto makers Hyundai and Kia were boosted by the auto tariff news.

London, Paris and Frankfurt opened with gains.

Shanghai dipped and Tokyo was closed for a holiday.

Data this week could give an idea about the impact of Trump's measures on companies, with tech titans Amazon, Apple, Meta and Microsoft all reporting their earnings.

Also on the agenda are key economic data, including jobs creation and the Federal Reserve's preferred gauge of inflation amid warnings the tariffs could reignite prices.

"While consumer and business survey data continue to plunge, the hard data has shown resilience, a trend likely to persist for a month or two until the effects of the Liberation tariffs become evident mid-year," said Tony Sycamore, a market analyst at IG.

"If President Trump's tariffs are reduced, weaker hard data will be looked through, allowing the US economy and stock markets to muddle through the end of the year."

However, he added that if tariffs stayed elevated, stock markets could resume their losses and the chances of a recession rose.

On currency markets Canada's dollar weakened against its US counterpart as speculation swirled over whether Prime Minister Mark Carney's Liberal Party would win an outright majority in national elections.

- Key figures at 0715 GMT -

Hong Kong - Hang Seng Index: UP 0.1 percent at 21,992.79

Shanghai - Composite: DOWN 0.1 percent at 3,286.65 (close)

London - FTSE 100: UP 0.1 percent at 8,423.41

Tokyo - Nikkei 225: Closed for a holiday

Euro/dollar: DOWN at $1.1389 from $1.1424 on Monday

Pound/dollar: DOWN at $1.3408 from $1.3441

Dollar/yen: UP at 142.50 yen from 142.04 yen

Euro/pound: DOWN at 84.90 pence from 84.99 pence

West Texas Intermediate: DOWN 0.9 percent at $61.51 per barrel

Brent North Sea Crude: DOWN 0.8 percent at $64.28 per barrel

New York - Dow: UP 0.3 percent at 40,227.59 (close)

W.Huber--VB