-

Filipino cardinal, the 'Asian Francis', is papal contender

Filipino cardinal, the 'Asian Francis', is papal contender

-

Samsung Electronics posts 22% jump in Q1 net profit

-

Pietro Parolin, career diplomat leading race to be pope

Pietro Parolin, career diplomat leading race to be pope

-

Nuclear submarine deal lurks below surface of Australian election

-

China's manufacturing shrinks in April as trade war bites

China's manufacturing shrinks in April as trade war bites

-

Financial markets may be the last guardrail on Trump

-

Swedish journalist's trial opens in Turkey

Swedish journalist's trial opens in Turkey

-

Kiss says 'honour of a lifetime' to coach Wallabies at home World Cup

-

US growth figure expected to make for tough reading for Trump

US growth figure expected to make for tough reading for Trump

-

Opposition leader confirmed winner of Trinidad elections

-

Snedeker, Ogilvy to skipper Presidents Cup teams: PGA Tour

Snedeker, Ogilvy to skipper Presidents Cup teams: PGA Tour

-

Win or bust in Europa League for Amorim's Man Utd

-

Trump celebrates 100 days in office with campaign-style rally

Trump celebrates 100 days in office with campaign-style rally

-

Top Cuban dissidents detained after court revokes parole

-

Arteta urges Arsenal to deliver 'special' fightback against PSG

Arteta urges Arsenal to deliver 'special' fightback against PSG

-

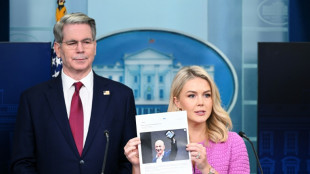

Trump fires Kamala Harris's husband from Holocaust board

-

Pakistan says India planning strike as tensions soar over Kashmir attack

Pakistan says India planning strike as tensions soar over Kashmir attack

-

Weinstein sex attack accuser tells court he 'humiliated' her

-

France accuses Russian military intelligence over cyberattacks

France accuses Russian military intelligence over cyberattacks

-

Global stocks mostly rise as Trump grants auto tariff relief

-

Grand Vietnam parade 50 years after the fall of Saigon

Grand Vietnam parade 50 years after the fall of Saigon

-

Trump fires ex first gentleman Emhoff from Holocaust board

-

PSG 'not getting carried away' despite holding edge against Arsenal

PSG 'not getting carried away' despite holding edge against Arsenal

-

Cuban dissidents detained after court revokes parole

-

Sweden stunned by new deadly gun attack

Sweden stunned by new deadly gun attack

-

BRICS blast 'resurgence of protectionism' in Trump era

-

Trump tempers auto tariffs, winning cautious praise from industry

Trump tempers auto tariffs, winning cautious praise from industry

-

'Cruel measure': Dominican crackdown on Haitian hospitals

-

'It's only half-time': Defiant Raya says Arsenal can overturn PSG deficit

'It's only half-time': Defiant Raya says Arsenal can overturn PSG deficit

-

Dembele sinks Arsenal as PSG seize edge in Champions League semi-final

-

Les Kiss to take over Wallabies coach role from mid-2026

Les Kiss to take over Wallabies coach role from mid-2026

-

Real Madrid's Rudiger, Mendy and Alaba out injured until end of season

-

US threatens to quit Russia-Ukraine effort unless 'concrete proposals'

US threatens to quit Russia-Ukraine effort unless 'concrete proposals'

-

Meta releases standalone AI app, competing with ChatGPT

-

Zverev crashes as Swiatek scrapes into Madrid Open quarter-finals

Zverev crashes as Swiatek scrapes into Madrid Open quarter-finals

-

BRICS members blast rise of 'trade protectionism'

-

Trump praises Bezos as Amazon denies plan to display tariff cost

Trump praises Bezos as Amazon denies plan to display tariff cost

-

France to tax small parcels from China amid tariff fallout fears

-

Hong Kong releases former opposition lawmakers jailed for subversion

Hong Kong releases former opposition lawmakers jailed for subversion

-

Trump celebrates tumultuous 100 days in office

-

Sweden gun attack leaves three dead

Sweden gun attack leaves three dead

-

Real Madrid's Rudiger banned for six matches after Copa final red

-

Firmino, Toney fire Al Ahli into AFC Champions League final

Firmino, Toney fire Al Ahli into AFC Champions League final

-

Maximum respect for Barca but no fear: Inter's Inzaghi

-

Trump signals relief on auto tariffs as industry awaits details

Trump signals relief on auto tariffs as industry awaits details

-

Cuban court revokes parole of two prominent dissidents

-

Narine leads from the front as Kolkata trump Delhi in IPL

Narine leads from the front as Kolkata trump Delhi in IPL

-

Amazon says never planned to show tariff costs, after White House backlash

-

Djokovic to miss Italian Open

Djokovic to miss Italian Open

-

Trossard starts for Arsenal in Champions League semi against PSG

Markets rise as traders gear up for earnings, key jobs data

Markets edged up Tuesday after a largely positive day on Wall Street with investors eyeing a busy week of data and earnings releases that could provide clues about the effects of Donald Trump's trade policies.

A month that started with the explosion of the US president's "Liberation Day" tariffs on April 2 was on course for a somewhat calmer close as governments line up to cut deals to avert the full force of the measures.

But while there is a hope that the sweeping measures can be tempered before a 90-day stay of execution comes to an end in July, there appears to be little movement with the main focus of the levies -- China.

Reports last week said China was considering exempting some US goods from its retaliatory tariffs but Beijing has said there are no active negotiations between the economic superpowers.

On Monday an official denied Trump's claims to have spoken with President Xi Jinping.

The White House has imposed 10 percent tariffs on most US trading partners and a separate 145 percent levy on many products from China. Beijing has responded with 125 percent tariffs of its own.

The chance of a deal between the two for now seems remote, with US Treasury Secretary Scott Bessent telling CNBC that negotiations were ongoing but the ball was in China's court.

"We'll see where this goes," he said in an interview aired Monday.

"As I've repeatedly said, I believe it's up to China to de-escalate because they sell five times more to us than we sell to them, so these 125 percent tariffs are unsustainable."

While uncertainty rules on trading floors, Asian markets pushed higher on Tuesday, with Hong Kong, Shanghai, Sydney, Seoul, Singapore, Taipei, Manila in positive territory.

Tokyo was closed for a holiday.

Data this week could give an idea about the impact of Trump's measures on companies, with tech titans Amazon, Apple, Meta and Microsoft all reporting their first-quarter earnings this week,

Also on the agenda are key economic data, including jobs creation and the Federal Reserve's preferred gauge of inflation amid warnings the tariffs could reignite prices.

"While consumer and business survey data continue to plunge, the hard data has shown resilience, a trend likely to persist for a month or two until the effects of the Liberation tariffs become evident mid-year," said Tony Sycamore, a market analyst at IG.

"If President Trump's tariffs are reduced, weaker hard data will be looked through, allowing the US economy and stock markets to muddle through the end of the year."

However, he added that if tariffs stayed elevated, stock markets could resume their losses and the chances of a recession rose.

- Key figures at 0200 GMT -

Hong Kong - Hang Seng Index: UP 0.4 percent at 22,050.01

Shanghai - Composite: UP 0.1 percent at 3,291.03

Tokyo - Nikkei 225: Closed for a holiday

Euro/dollar: DOWN at $1.1392 from $1.1424 on Monday

Pound/dollar: DOWN at $1.3421 from $1.3441

Dollar/yen: UP at 142.41 yen from 142.04 yen

Euro/pound: DOWN at 84.89 pence from 84.99 pence

West Texas Intermediate: DOWN 0.2 percent at $61.91 per barrel

Brent North Sea Crude: DOWN 0.2 percent at $64.66 per barrel

New York - Dow: UP 0.3 percent at 40,227.59 (close)

London - FTSE 100: FLAT at 8,417.34 (close)

N.Schaad--VB