-

Filipino cardinal, the 'Asian Francis', is papal contender

Filipino cardinal, the 'Asian Francis', is papal contender

-

Samsung Electronics posts 22% jump in Q1 net profit

-

Pietro Parolin, career diplomat leading race to be pope

Pietro Parolin, career diplomat leading race to be pope

-

Nuclear submarine deal lurks below surface of Australian election

-

China's manufacturing shrinks in April as trade war bites

China's manufacturing shrinks in April as trade war bites

-

Financial markets may be the last guardrail on Trump

-

Swedish journalist's trial opens in Turkey

Swedish journalist's trial opens in Turkey

-

Kiss says 'honour of a lifetime' to coach Wallabies at home World Cup

-

US growth figure expected to make for tough reading for Trump

US growth figure expected to make for tough reading for Trump

-

Opposition leader confirmed winner of Trinidad elections

-

Snedeker, Ogilvy to skipper Presidents Cup teams: PGA Tour

Snedeker, Ogilvy to skipper Presidents Cup teams: PGA Tour

-

Win or bust in Europa League for Amorim's Man Utd

-

Trump celebrates 100 days in office with campaign-style rally

Trump celebrates 100 days in office with campaign-style rally

-

Top Cuban dissidents detained after court revokes parole

-

Arteta urges Arsenal to deliver 'special' fightback against PSG

Arteta urges Arsenal to deliver 'special' fightback against PSG

-

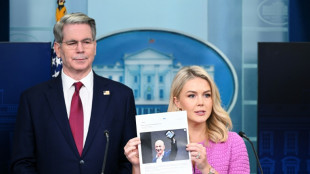

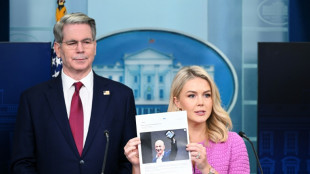

Trump fires Kamala Harris's husband from Holocaust board

-

Pakistan says India planning strike as tensions soar over Kashmir attack

Pakistan says India planning strike as tensions soar over Kashmir attack

-

Weinstein sex attack accuser tells court he 'humiliated' her

-

France accuses Russian military intelligence over cyberattacks

France accuses Russian military intelligence over cyberattacks

-

Global stocks mostly rise as Trump grants auto tariff relief

-

Grand Vietnam parade 50 years after the fall of Saigon

Grand Vietnam parade 50 years after the fall of Saigon

-

Trump fires ex first gentleman Emhoff from Holocaust board

-

PSG 'not getting carried away' despite holding edge against Arsenal

PSG 'not getting carried away' despite holding edge against Arsenal

-

Cuban dissidents detained after court revokes parole

-

Sweden stunned by new deadly gun attack

Sweden stunned by new deadly gun attack

-

BRICS blast 'resurgence of protectionism' in Trump era

-

Trump tempers auto tariffs, winning cautious praise from industry

Trump tempers auto tariffs, winning cautious praise from industry

-

'Cruel measure': Dominican crackdown on Haitian hospitals

-

'It's only half-time': Defiant Raya says Arsenal can overturn PSG deficit

'It's only half-time': Defiant Raya says Arsenal can overturn PSG deficit

-

Dembele sinks Arsenal as PSG seize edge in Champions League semi-final

-

Les Kiss to take over Wallabies coach role from mid-2026

Les Kiss to take over Wallabies coach role from mid-2026

-

Real Madrid's Rudiger, Mendy and Alaba out injured until end of season

-

US threatens to quit Russia-Ukraine effort unless 'concrete proposals'

US threatens to quit Russia-Ukraine effort unless 'concrete proposals'

-

Meta releases standalone AI app, competing with ChatGPT

-

Zverev crashes as Swiatek scrapes into Madrid Open quarter-finals

Zverev crashes as Swiatek scrapes into Madrid Open quarter-finals

-

BRICS members blast rise of 'trade protectionism'

-

Trump praises Bezos as Amazon denies plan to display tariff cost

Trump praises Bezos as Amazon denies plan to display tariff cost

-

France to tax small parcels from China amid tariff fallout fears

-

Hong Kong releases former opposition lawmakers jailed for subversion

Hong Kong releases former opposition lawmakers jailed for subversion

-

Trump celebrates tumultuous 100 days in office

-

Sweden gun attack leaves three dead

Sweden gun attack leaves three dead

-

Real Madrid's Rudiger banned for six matches after Copa final red

-

Firmino, Toney fire Al Ahli into AFC Champions League final

Firmino, Toney fire Al Ahli into AFC Champions League final

-

Maximum respect for Barca but no fear: Inter's Inzaghi

-

Trump signals relief on auto tariffs as industry awaits details

Trump signals relief on auto tariffs as industry awaits details

-

Cuban court revokes parole of two prominent dissidents

-

Narine leads from the front as Kolkata trump Delhi in IPL

Narine leads from the front as Kolkata trump Delhi in IPL

-

Amazon says never planned to show tariff costs, after White House backlash

-

Djokovic to miss Italian Open

Djokovic to miss Italian Open

-

Trossard starts for Arsenal in Champions League semi against PSG

Global stocks mixed amid trade hopes as markets await tech earnings

Global stocks were steady on Monday as investors welcomed the absence of further trade war escalation over the weekend and as countries seek to temper US President Donald Trump's tariffs.

Major bourses avoided big swings on a comparatively news-light day ahead of heavily anticipated economic releases and earnings later in the week.

Both the Dow and S&P 500 notched modest gains while the tech-rich Nasdaq finished the day slightly lower.

"A weekend light on drama was just what the doctor ordered for financial markets," said AJ Bell investment director Russ Mould.

Analysts said that market sentiment has calmed since Trump dialed down pressure on Federal Reserve boss Jerome Powell and hinted at progress in trade talks with economic partners.

"While last week's market action and today's early session suggest calmer waters, any sense of security is precarious," said City Index and FOREX.com analyst Fawad Razaqzada.

"Underneath the surface, key risks persist -- trade tensions, recession worries, and monetary policy uncertainties are very much alive."

US giants Amazon, Apple, Meta and Microsoft all report their first-quarter earnings this week, with investors looking to assess the impact of tariffs on businesses.

Eyes will also be on the release of several closely watched US economic indicators which "may either dampen or revive concerns about recession in the world's largest economy," Mould added.

Crude prices fell as investors worried about the impact of the trade war on the US economy.

Bjarne Schieldrop of SEB Research said oil demand was "at risk as US consumers soon will face hard tariff realities."

Analysts are concerned that the punitive tariff levels that the US and Chinese governments have imposed could lead to shortages of certain goods.

US Treasury Secretary Scott Bessent said Monday he was not concerned "at present" about American stores potentially running out of items due to Trump's tariffs.

Traders are hoping governments can hammer out deals with Trump to soften the impact of his sweeping tariffs, with reports last week saying China was considering exempting some US goods from its hefty retaliatory measures.

Beijing has said there are no active negotiations between the economic superpowers and on Monday an official denied Trump's claims to have spoken with Xi by phone.

In Beijing, senior economic planner Zhao Chenxin said China was on the "right side of history" in its grueling trade war with the United States.

Japanese media reported that a second round of trade talks in Washington was set for Thursday.

The discussions will be closely watched as a barometer for efforts by other countries seeking tariff relief.

Bessent said earlier a trade "understanding" between South Korea and the United States could be reached by this week.

- Key figures at 2030 GMT -

New York - Dow: UP 0.3 percent at 40,227.59 (close)

New York - S&P 500: UP 0.1 percent at 5,528.75 (close)

New York - Nasdaq: DOWN 0.1 percent at 17,366.13 (close)

London - FTSE 100: FLAT at 8,417.34 (close)

Paris - CAC 40: UP 0.5 percent at 7,573.76 (close)

Frankfurt - DAX: UP 0.1 percent at 22,271.67 (close)

Tokyo - Nikkei 225: UP 0.4 percent at 35,839.99 (close)

Hong Kong - Hang Seng Index: FLAT at 21,971.96 (close)

Shanghai - Composite: DOWN 0.2 percent at 3,288.41 (close)

Euro/dollar: UP at $1.1424 from $1.1365 on Friday

Pound/dollar: UP at $1.3441 from $1.3315

Dollar/yen: DOWN at 142.04 yen from 143.67 yen

Euro/pound: DOWN at 84.99 pence from 85.35 pence

West Texas Intermediate: DOWN 1.5 percent at $62.05 per barrel

Brent North Sea Crude: DOWN 1.5 percent at $65.86 per barrel

burs-jmb/aha

R.Kloeti--VB