-

Ex-Premier League star Li Tie loses appeal in 20-year bribery sentence

Ex-Premier League star Li Tie loses appeal in 20-year bribery sentence

-

Belgium's green light for red light workers

-

Haliburton leads comeback as Pacers advance, Celtics clinch

Haliburton leads comeback as Pacers advance, Celtics clinch

-

Rahm out to break 2025 win drought ahead of US PGA Championship

-

Japan tariff envoy departs for round two of US talks

Japan tariff envoy departs for round two of US talks

-

Djurgarden eyeing Chelsea upset in historic Conference League semi-final

-

Haliburton leads comeback as Pacers advance, Pistons stay alive

Haliburton leads comeback as Pacers advance, Pistons stay alive

-

Bunker-cafe on Korean border paints image of peace

-

Tunics & turbans: Afghan students don Taliban-imposed uniforms

Tunics & turbans: Afghan students don Taliban-imposed uniforms

-

Asian markets struggle as trade war hits China factory activity

-

Norwegian success story: Bodo/Glimt's historic run to a European semi-final

Norwegian success story: Bodo/Glimt's historic run to a European semi-final

-

Spurs attempt to grasp Europa League lifeline to save dismal season

-

Thawing permafrost dots Siberia with rash of mounds

Thawing permafrost dots Siberia with rash of mounds

-

S. Korea prosecutors raid ex-president's house over shaman probe: Yonhap

-

Filipino cardinal, the 'Asian Francis', is papal contender

Filipino cardinal, the 'Asian Francis', is papal contender

-

Samsung Electronics posts 22% jump in Q1 net profit

-

Pietro Parolin, career diplomat leading race to be pope

Pietro Parolin, career diplomat leading race to be pope

-

Nuclear submarine deal lurks below surface of Australian election

-

China's manufacturing shrinks in April as trade war bites

China's manufacturing shrinks in April as trade war bites

-

Financial markets may be the last guardrail on Trump

-

Swedish journalist's trial opens in Turkey

Swedish journalist's trial opens in Turkey

-

Kiss says 'honour of a lifetime' to coach Wallabies at home World Cup

-

US growth figure expected to make for tough reading for Trump

US growth figure expected to make for tough reading for Trump

-

Opposition leader confirmed winner of Trinidad elections

-

Snedeker, Ogilvy to skipper Presidents Cup teams: PGA Tour

Snedeker, Ogilvy to skipper Presidents Cup teams: PGA Tour

-

Win or bust in Europa League for Amorim's Man Utd

-

Trump celebrates 100 days in office with campaign-style rally

Trump celebrates 100 days in office with campaign-style rally

-

Top Cuban dissidents detained after court revokes parole

-

Arteta urges Arsenal to deliver 'special' fightback against PSG

Arteta urges Arsenal to deliver 'special' fightback against PSG

-

Trump fires Kamala Harris's husband from Holocaust board

-

Pakistan says India planning strike as tensions soar over Kashmir attack

Pakistan says India planning strike as tensions soar over Kashmir attack

-

Weinstein sex attack accuser tells court he 'humiliated' her

-

France accuses Russian military intelligence over cyberattacks

France accuses Russian military intelligence over cyberattacks

-

Global stocks mostly rise as Trump grants auto tariff relief

-

Grand Vietnam parade 50 years after the fall of Saigon

Grand Vietnam parade 50 years after the fall of Saigon

-

Trump fires ex first gentleman Emhoff from Holocaust board

-

PSG 'not getting carried away' despite holding edge against Arsenal

PSG 'not getting carried away' despite holding edge against Arsenal

-

Cuban dissidents detained after court revokes parole

-

Sweden stunned by new deadly gun attack

Sweden stunned by new deadly gun attack

-

BRICS blast 'resurgence of protectionism' in Trump era

-

Trump tempers auto tariffs, winning cautious praise from industry

Trump tempers auto tariffs, winning cautious praise from industry

-

'Cruel measure': Dominican crackdown on Haitian hospitals

-

'It's only half-time': Defiant Raya says Arsenal can overturn PSG deficit

'It's only half-time': Defiant Raya says Arsenal can overturn PSG deficit

-

Dembele sinks Arsenal as PSG seize edge in Champions League semi-final

-

Les Kiss to take over Wallabies coach role from mid-2026

Les Kiss to take over Wallabies coach role from mid-2026

-

Real Madrid's Rudiger, Mendy and Alaba out injured until end of season

-

US threatens to quit Russia-Ukraine effort unless 'concrete proposals'

US threatens to quit Russia-Ukraine effort unless 'concrete proposals'

-

Meta releases standalone AI app, competing with ChatGPT

-

Zverev crashes as Swiatek scrapes into Madrid Open quarter-finals

Zverev crashes as Swiatek scrapes into Madrid Open quarter-finals

-

BRICS members blast rise of 'trade protectionism'

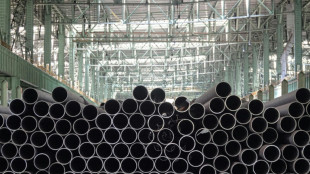

Trump trade war pushes firms to consider stockpiling

Stockpiling is the reflex response by firms to the imposition of tariffs, but with the rapidly-changing position of the Trump administration, companies are finding that it isn't so straightforward this time around.

Whether it's the luxury, electronics or pharmaceutical sectors, US President Donald Trump's unpredictability complicates the calculations of firms.

Some companies didn't wait for Trump's April 2 announcement of massive "reciprocal" trade tariffs: they had already begun shipping more of their goods to the United States.

In the end, Trump backed down quickly on the "reciprocal" tariffs, pausing them for 90 days except for China.

That still left the global 10 percent tariff in place, as well as the 25 percent tariffs on European steel, aluminium and cars.

French cosmetics firm Clarins didn't hesitate and stepped up shipments to the United States at the beginning of the year.

"We've built up three months of stocks, which represents $2 million in goods," said Lionel Uzan, the head of Clarins's US operations.

With all of its products made in France, Clarins had few other options to mitigate the tariffs.

- Discreet stockpiling -

Even if they don't all acknowledge it so openly, firms in many different sectors are stockpiling their products in the United States.

In March, exports of Swiss watches to the United States jumped nearly 14 percent compared to the same month last year.

More striking is Ireland, which plays host to a number of international pharmaceutical firms.

Its exports to the United States jumped 210 percent in February to nearly 13 billion euros ($14.8 billion), with 90 percent of those being pharmaceutical products and chemical ingredients.

Fermob, a French manufacturer of metal garden furniture that sells around 10 percent of its products in the United States, said it began planning for US tariffs once the result of the presidential election became known in November.

It stepped up production in January and February.

"We've sent around 30 percent of our extra stock to the United States," said the company's chief executive, Baptiste Reybier.

That extra production has benefitted transportation firms.

Lufthansa Cargo said it has seen in recent weeks "an increase in demand for shipments to the United States".

The trade war "has incited companies to accelerate certain stages in their supply chains", it told AFP.

"A similar trend was seen for the delivery of cars from the EU to the United States," it said.

The phenomenon also concerns US-made goods.

The Japanese newspaper Nikkei reported recently that Chinese tech firms were snapping up billions of dollars of artificial intelligence chips made by US firm Nvidia in anticipation of Washington imposing export restrictions.

- 'Short-term approach' -

Stockpiling is not a solution, however, said analysts.

Matt Jochim, a partner at consulting firm McKinsey who helps companies with supply chain issues, called stockpiling "a very short-term opportunistic" move.

He said the practice has limits as tariffs are constantly changing and it isn't always practicable.

"In a lot of the electronics space, it's also hard to do, because the technology changes so quickly, you don't want to get stuck with inventory of chipsets or devices that are the prior version," he said.

Fermob said it was taking a measured approach to stockpiling.

"Otherwise you're replacing one risk with another," the manufacturer's Reybier said.

"You have to finance stocks and there is also the risk of not having sent the right product."

Having a local subsidiary with warehouses also helped, Reybier added.

"It's too early to say whether we should have sent more or not."

R.Buehler--VB