-

Mexico avoids recession despite tariff uncertainty

Mexico avoids recession despite tariff uncertainty

-

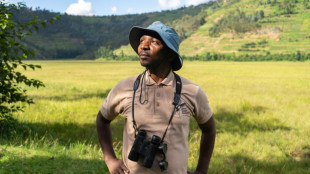

Rwandan awarded for saving grey crowned cranes

-

Spurs have 'unbelievable opportunity' for European glory: Postecoglou

Spurs have 'unbelievable opportunity' for European glory: Postecoglou

-

Microsoft president urges fast 'resolution' of transatlantic trade tensions

-

Poppies flourish at Tower of London for WWII anniversary

Poppies flourish at Tower of London for WWII anniversary

-

US economy unexpectedly shrinks on import surge before Trump tariffs

-

Stocks drop after US economy contracts amid tariffs turmoil

Stocks drop after US economy contracts amid tariffs turmoil

-

US economy unexpectedly shrinks on import surge ahead of Trump tariffs

-

Dravid says Suryavanshi, 14, needs support from fame

Dravid says Suryavanshi, 14, needs support from fame

-

Arsenal can win 'anywhere' says Merino after Champions League defeat by PSG

-

Bangladesh crush Zimbabwe by an innings in second Test

Bangladesh crush Zimbabwe by an innings in second Test

-

Swiatek recovers against Keys to reach Madrid Open semis

-

Spurs captain Son out of first leg of Europa League semi-final

Spurs captain Son out of first leg of Europa League semi-final

-

US economy unexpectedly shrinks in first three months of Trump presidency

-

India to ask caste status in next census for first time in decades

India to ask caste status in next census for first time in decades

-

Burkina junta rallies supporters after claimed coup 'plot'

-

Forest owner Marinakis steps back as European qualification looms

Forest owner Marinakis steps back as European qualification looms

-

US economy unexpectedly contracts in first three months of Trump presidency

-

Bilbao will give 'soul' to beat Man United: Nico Williams

Bilbao will give 'soul' to beat Man United: Nico Williams

-

Sweden arrests teen after triple killing

-

Pakistan says India planning strike after deadly Kashmir attack

Pakistan says India planning strike after deadly Kashmir attack

-

Cardinals lay groundwork for conclave, hope for quick vote

-

More automakers drop earnings guidance over tariffs

More automakers drop earnings guidance over tariffs

-

William and Kate release romantic image on low-key anniversary

-

Israel says strikes Syria to shield Druze as clashes spread

Israel says strikes Syria to shield Druze as clashes spread

-

Champions Cup format 'not perfect' says EPCR boss

-

Iran hangs man as Israeli spy after 'unfair' trial: activists

Iran hangs man as Israeli spy after 'unfair' trial: activists

-

Stock markets mostly rise ahead of US economic data, tech earnings

-

German growth better than expected but tariff turmoil looms

German growth better than expected but tariff turmoil looms

-

Sinner denies beneficial treatment in doping scandal ahead of Rome return

-

Eurozone economy grows more than expected despite US tariff turmoil

Eurozone economy grows more than expected despite US tariff turmoil

-

Toulouse hooker Mauvaka out of Champions Cup semi

-

Germany's next finance minister, 'bridge-builder' Lars Klingbeil

Germany's next finance minister, 'bridge-builder' Lars Klingbeil

-

Mehidy century puts Bangladesh in command against Zimbabwe

-

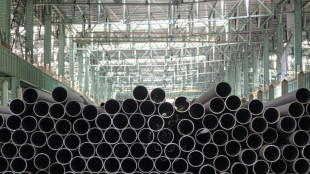

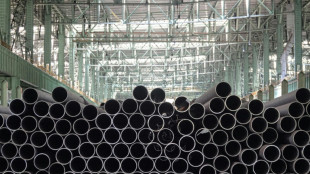

Steelmaker ArcelorMittal warns of uncertainty

Steelmaker ArcelorMittal warns of uncertainty

-

Vietnam's Gen-Z captivated by 50-year-old military victory

-

Moroccan-based cardinal says Church does not need Francis 'impersonator'

Moroccan-based cardinal says Church does not need Francis 'impersonator'

-

US official tells UN top court 'serious concerns' over UNRWA impartiality

-

Jeep owner Stellantis suspends outlook over tariffs

Jeep owner Stellantis suspends outlook over tariffs

-

New Zealand, Phillippines sign troops deal in 'deteriorating' strategic environment

-

Aston Martin limits US car imports due to tariffs

Aston Martin limits US car imports due to tariffs

-

Pakistan says India planning strike as tensions soar over Kashmir

-

Australian triple-murder suspect allegedly cooked 'special' mushroom meal

Australian triple-murder suspect allegedly cooked 'special' mushroom meal

-

Most stock markets rise despite China data, eyes on US reports

-

TotalEnergies profits drop as prices slide

TotalEnergies profits drop as prices slide

-

Volkswagen says tariffs will dampen business as profit plunges

-

Jeep owner Stellantis suspends 2025 earnings forecast over tariffs

Jeep owner Stellantis suspends 2025 earnings forecast over tariffs

-

China's Shenzhou-19 astronauts return to Earth

-

French economy returns to thin growth in first quarter

French economy returns to thin growth in first quarter

-

Ex-Premier League star Li Tie loses appeal in 20-year bribery sentence

Dollar slides, stocks diverge as US-China trade war escalates

The dollar tumbled, gold hit a fresh record high and stock markets seesawed Friday as China again retaliated against US tariffs, deepening a trade war between the world's two biggest economies.

Wall Street opened in the red but quickly rose to cap a highly volatile week as investors grapple with President Donald Trump's unpredictable tariffs policy.

European markets wobbled as China said it would raise its tariffs on US goods to 125 percent but suggested it would not retaliate against any further US increases.

Frankfurt fell and Paris was flat in afternoon deals, while London rose as data showed the UK economy grew far more than expected in February.

"The main driver of the renewed market pressure was an increased focus on the US-China escalation," said Jim Reid, managing director at Deutsche Bank.

"Neither the US nor China are showing signs of backing down, with President Trump expressing confidence in his tariff plans," Reid added.

The dollar pared back some losses against major currencies after plunging to the lowest level against the euro in more than three years as investors fled what is typically considered a key safe-haven currency.

US bonds were also under pressure amid speculation that China was offloading some of its vast holdings in retaliation for Trump's measures.

With treasuries being sold off, sending their yields higher and making US debt more expensive, there is a fear of a bigger exodus from American assets down the line.

The weaker dollar and the rush for safety sent gold to a fresh record high above $3,220 an ounce.

Oil prices rose slightly after huge falls on Thursday.

"There remains considerable uncertainty around the impact of tariffs on economies and company earnings, and that could keep markets volatile for some time," noted Russ Mould, investment director at AJ Bell.

Investors were also turning to more routine economic and business data, with the release of inflation data and corporate earnings.

Official figures showed US producer inflation fell sharply last month before the tariffs took effect.

US banking giant JPMorgan Chase reported first-quarter profits of $14.6 billion, up nine percent from the same period last year.

But CEO Jamie Dimon warned of "considerable turbulence" for the economy, due to tariffs, sticky inflation, fiscal deficits and volatility.

In Asia, the Tokyo stock market shed three percent -- a day after surging more than nine percent -- while Sydney, Seoul, Singapore, Wellington and Bangkok were also in the red.

However, Hong Kong and Shanghai rose as traders focused on possible Chinese stimulus measures.

There were gains in Taipei and Ho Chi Minh City stocks as the leaders of Taiwan and Vietnam said they would hold talks with Trump.

- Key figures around 1355 GMT -

New York - Dow: UP 0.4 percent at 39,735.69 points

New York - S&P 500: UP 0.5 percent at 5,296.55

New York - Nasdaq: UP 0.8 percent at 16,525.28

London - FTSE 100: UP 0.8 percent at 7,976.03

Paris - CAC 40: FLAT at 7,125.73

Frankfurt - DAX: DOWN 0.7 percent at 20,411.34

Tokyo - Nikkei 225: DOWN 3.0 percent at 33,585.58 (close)

Hong Kong - Hang Seng Index: UP 1.1 percent at 20,914.69 (close)

Shanghai - Composite: UP 0.5 percent at 3,238.23 (close)

Euro/dollar: UP at $1.1342 from $1.1183 on Thursday

Pound/dollar: UP at $1.3071 from $1.2954

Dollar/yen: DOWN at 143.26 yen from 144.79 yen

Euro/pound: UP at 86.73 pence from 86.33 pence

Brent North Sea Crude: UP 0.5 percent at $63.62 per barrel

West Texas Intermediate: UP 0.5 percent at $60.36 per barrel

burs-lth/kjm

J.Marty--VB