-

Kiss faces little time to set Wallabies on path to home World Cup glory

Kiss faces little time to set Wallabies on path to home World Cup glory

-

Serbian students, unions join forces for anti-corruption protest

-

Slow and easily beaten -- Messi's Miami project risks global embarrassment

Slow and easily beaten -- Messi's Miami project risks global embarrassment

-

Fan in hospital after falling to field at Pirates game

-

Nuclear power sparks Australian election battle

Nuclear power sparks Australian election battle

-

Tokyo stocks rise as BoJ holds rates steady

-

Bank of Japan holds rates, lowers growth forecasts

Bank of Japan holds rates, lowers growth forecasts

-

'Sleeping giants' Bordeaux-Begles awaken before Champions Cup semis

-

Napoli eye Scudetto as Inter hope for post-Barca bounce-back

Napoli eye Scudetto as Inter hope for post-Barca bounce-back

-

Germany's 'absolutely insane' second tier rivalling Europe's best

-

PSG minds on Arsenal return as French clubs scrap for Champions League places

PSG minds on Arsenal return as French clubs scrap for Champions League places

-

UK WWII veteran remembers joy of war's end, 80 years on

-

Myanmar junta lets post-quake truce expire

Myanmar junta lets post-quake truce expire

-

Rockets romp past Warriors to extend NBA playoff series

-

Messi, Inter Miami CONCACAF Cup dream over as Vancouver advance

Messi, Inter Miami CONCACAF Cup dream over as Vancouver advance

-

UN body warns over Trump's deep-sea mining order

-

UK local elections test big two parties

UK local elections test big two parties

-

US judge says Apple defied order in App Store case

-

Seventeen years later, Brood XIV cicadas emerge in US

Seventeen years later, Brood XIV cicadas emerge in US

-

Scorching 1,500m return for Olympic great Ledecky in Florida

-

Israel's Netanyahu warns wildfires could reach Jerusalem

Israel's Netanyahu warns wildfires could reach Jerusalem

-

Istanbul lockdown aims to prevent May Day marches

-

Australian guard Daniels of Hawks named NBA's most improved

Australian guard Daniels of Hawks named NBA's most improved

-

Mexico City to host F1 races until 2028

-

Morales vows no surrender in bid to reclaim Bolivian presidency

Morales vows no surrender in bid to reclaim Bolivian presidency

-

Ukraine, US sign minerals deal, tying Trump to Kyiv

-

Phenomenons like Yamal born every 50 years: Inter's Inzaghi

Phenomenons like Yamal born every 50 years: Inter's Inzaghi

-

Ukraine, US say minerals deal ready as Kyiv hails sharing

-

Global stocks mostly rise following mixed economic data

Global stocks mostly rise following mixed economic data

-

O'Sullivan says he must play better to win eighth snooker world title after seeing off Si Jiahui

-

Sabalenka eases past Kostyuk into Madrid Open semis

Sabalenka eases past Kostyuk into Madrid Open semis

-

Netflix's 'The Eternaut' echoes fight against tyranny: actor Ricardo Darin

-

US economy unexpectedly shrinks, Trump blames Biden

US economy unexpectedly shrinks, Trump blames Biden

-

Barca fight back against Inter in sensational semi-final draw

-

Meta quarterly profit climbs despite big cloud spending

Meta quarterly profit climbs despite big cloud spending

-

US Supreme Court weighs public funding of religious charter school

-

Climate change made fire conditions twice as likely in South Korea blazes: study

Climate change made fire conditions twice as likely in South Korea blazes: study

-

Amorim says not even Europa League glory can save Man Utd's season

-

Syria reports Israeli strikes as clashes with Druze spread

Syria reports Israeli strikes as clashes with Druze spread

-

Ukraine, US say minerals deal ready as suspense lingers

-

Everything is fine: Trump's cabinet shrugs off shrinking economy

Everything is fine: Trump's cabinet shrugs off shrinking economy

-

Chelsea boss Maresca adamant money no guarantee of success

-

Wood warns England cricketers against 'dumb' public comments

Wood warns England cricketers against 'dumb' public comments

-

US economy shrinks, Trump blames Biden

-

Caterpillar so far not hiking prices to offset tariff hit

Caterpillar so far not hiking prices to offset tariff hit

-

Japan's Kawasaki down Ronaldo's Al Nassr to reach Asian Champions League final

-

Trump praises Musk as chief disruptor eyes exit

Trump praises Musk as chief disruptor eyes exit

-

Chahal hat-trick helps Punjab eliminate Chennai from IPL playoff race

-

Pope Francis saw clergy's lack of humility as a 'cancer': author

Pope Francis saw clergy's lack of humility as a 'cancer': author

-

Weinstein accuser recounts alleged rape at assault retrial in NY

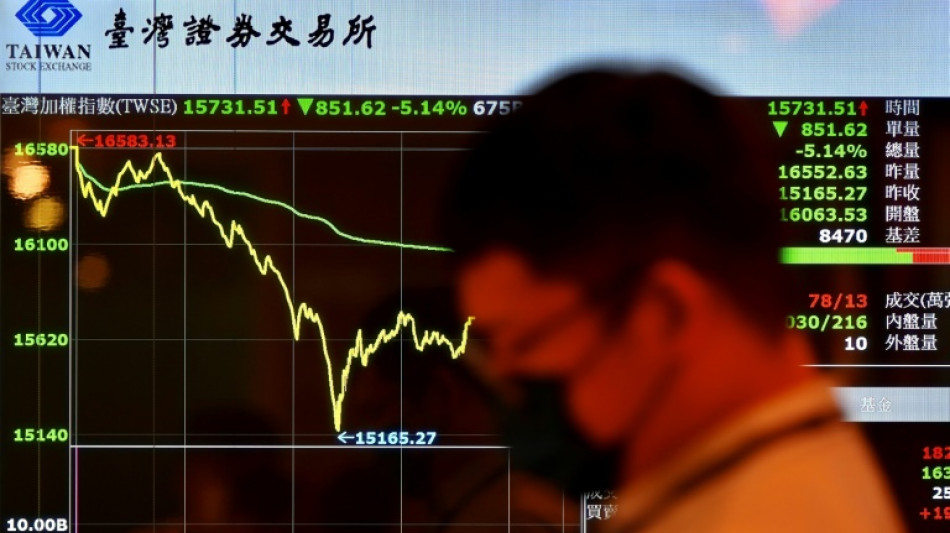

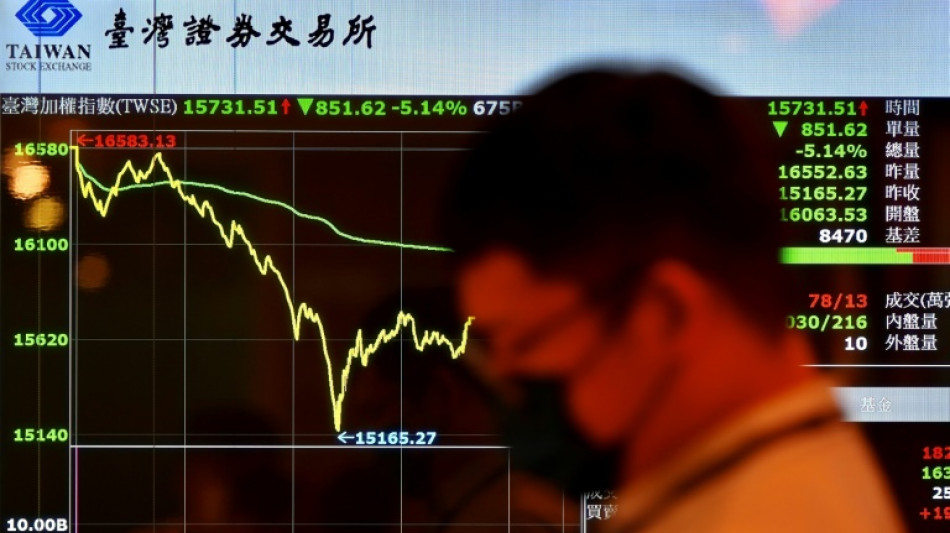

Stocks savaged as China retaliation to Trump tariffs fans trade war

Asian equities collapsed on a black Monday for markets after China hammered the United States with its own hefty tariffs, ramping up a trade war many fear could spark a recession.

Trading floors were overcome by a wave of selling as investors fled to the hills, with Hong Kong's loss of 12 percent its worst in more than 16 years, while Taipei tanked more than nine percent and Tokyo more than seven percent.

Futures for Wall Street's markets were also taking another drubbing, while concerns about the impact on demand also saw commodities slump.

President Donald Trump sparked a market meltdown last week when he unveiled sweeping tariffs against US trading partners for what he said was years of being ripped off and claimed that governments were lining up to cut deals with Washington.

But after Asian markets closed on Friday, China said it would impose retaliatory levies of 34 percent on all US goods from April 10.

Beijing also imposed export controls on seven rare earth elements, including gadolinium -- commonly used in MRIs -- and yttrium, utilised in consumer electronics.

On Sunday, vice commerce minister Ling Ji told representatives of US firms its tariffs "firmly protect the legitimate rights and interests of enterprises, including American companies".

Hopes that the US president would rethink his policy in light of the turmoil were dashed Sunday when he said he would not make a deal with other countries unless trade deficits were solved.

Trump denied that he was intentionally engineering a selloff and insisted he could not foresee market reactions.

"Sometimes you have to take medicine to fix something," he said of the ructions that have wiped trillions of dollars off company valuations.

- No sector spared -

The savage selling in Asia was across the board, with no sector unharmed -- tech firms, car makers, banks, casinos and energy firms all felt the pain as investors abandoned riskier assets.

Among the biggest losers, Chinese ecommerce titans Alibaba tanked more than 17 percent and rival JD.com shed 14 percent, while Japanese tech investment giant SoftBank dived more than 11 percent and Sony gave up nine percent.

Hong Kong's 12 percent loss marked its worst day since October 2008 during the global financial crisis.

Shanghai shed more than seven percent and Singapore eight percent, while Seoul gave up more than five percent triggering a so-called sidecar mechanism -- for the first time in eight months -- that briefly halted some trading.

Sydney, Wellington, Manila and Mumbai were also deep in the red.

"We could see a recession happen very quickly in the US, and it could last through the year or so, it could be rather lengthy," said Steve Cochrane, chief Asia-Pacific economist at Moody's Analytics.

"If there's a recession in the US, of course, China will feel it as well because demand for its goods will be hit even harder. Harder than they would have been hit just because of the tariffs," he added.

Concerns about demand saw oil prices sink more than three percent at one point Monday, having dropped around seven percent Friday. Both main contracts are now sitting at their lowest levels since 2021.

Copper -- a vital component for energy storage, electric vehicles, solar panels and wind turbines -- also extended losses.

- Carnage on Wall Street -

The losses followed another day of carnage on Wall Street on Friday, where all three main indexes fell almost six percent.

That came after Federal Reserve boss Jerome Powell said US tariffs will likely cause inflation to rise and growth to slow and warned of an "elevated" risk of higher unemployment.

The measures by Trump are likely to give US central bankers a headache as they try to balance the need for interest rate cuts to support the economy with the need to keep a lid on prices.

His comments came after Trump had insisted "my policies will never change" and urged the Fed to cut rates.

"Powell's hands are tied," said Stephen Innes at SPI Asset Management. "He's acknowledged the obvious -- that tariffs are inflationary and recessionary -- but he's not signalling a rescue.

"And that's the problem. This time, the Fed's inflation mandate is forcing it to keep the safety net rolled up while asset prices get torched."

While Powell has so far refused to announce any rate cuts, markets are betting he will do soon.

"A first-rate cut is fully priced for June, with markets betting that the Fed will be forced to look through a tariff-induced boost to inflation to prevent the US economy from slipping into a rather needless recession," said IG's Tony Sycamore.

Tim Waterer, chief market analyst at KCM Trade, said traders fear that both Washington and Beijing "could receive knockout blows from a prolonged economic fight".

- Key figures around 0600 GMT -

Tokyo - Nikkei 225: DOWN 7.8 percent at 31,136.58 (close)

Hong Kong - Hang Seng Index: DOWN 12.2 percent at 20,068.62

Shanghai - Composite: DOWN 7.4 percent at 3,093.84

West Texas Intermediate: DOWN 2.8 percent at $60.24 per barrel

Brent North Sea Crude: DOWN 2.7 percent at $63.76 per barrel

Dollar/yen: DOWN at 145.72 yen from 146.98 yen on Friday

Euro/dollar: UP at $1.1015 from $1.0962

Pound/dollar: UP at $1.2925 from $1.2893

Euro/pound: UP at 85.23 pence from 85.01 pence

New York - Dow: DOWN 5.5 percent at 38,314.86 (close)

London - FTSE 100: DOWN 5.0 percent at 8,054.98 (close)

J.Sauter--VB