-

'Humiliated': Combs's ex Cassie gives searing testimony of abuse

'Humiliated': Combs's ex Cassie gives searing testimony of abuse

-

Latin America mourns world's 'poorest president' Mujica, dead at 89

-

Masters champion McIlroy to headline Australian Open

Masters champion McIlroy to headline Australian Open

-

Sean Combs's ex Cassie says he coerced her into 'disgusting' sex ordeals

-

McIlroy, Scheffler and Schauffele together for rainy PGA battle

McIlroy, Scheffler and Schauffele together for rainy PGA battle

-

Uruguay's Mujica, world's 'poorest president,' dies aged 89

-

Lift-off at Eurovision as first qualifiers revealed

Lift-off at Eurovision as first qualifiers revealed

-

Forest striker Awoniyi placed in induced coma after surgery: reports

-

'Kramer vs Kramer' director Robert Benton dies: representative

'Kramer vs Kramer' director Robert Benton dies: representative

-

Tatum suffered ruptured right Achilles in playoff defeat: Celtics

-

US stocks mostly rise on better inflation data while dollar retreats

US stocks mostly rise on better inflation data while dollar retreats

-

Winning farewell for Orlando Pirates' Spanish coach Riveiro

-

Lift-off at Eurovision as first semi-final takes flight

Lift-off at Eurovision as first semi-final takes flight

-

UN relief chief urges action 'to prevent genocide' in Gaza

-

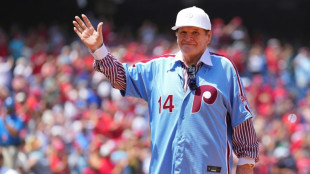

Baseball pariahs Rose, Jackson eligible for Hall of Fame after league ruling

Baseball pariahs Rose, Jackson eligible for Hall of Fame after league ruling

-

Scheffler excited for 1-2-3 group with McIlroy, Schauffele

-

Sean Combs's ex Cassie says he forced her into 'disgusting' sex ordeals

Sean Combs's ex Cassie says he forced her into 'disgusting' sex ordeals

-

Uruguay's 'poorest president' Mujica dies aged 89

-

Senior UN official urges action 'to prevent genocide' in Gaza

Senior UN official urges action 'to prevent genocide' in Gaza

-

'Kramer vs Kramer' director Robert Benton dies: report

-

Sinner moves through gears to reach Italian Open quarters

Sinner moves through gears to reach Italian Open quarters

-

Massages, chefs and trainers: Airbnb adds in-home services

-

Republicans eye key votes on Trump tax cuts mega-bill

Republicans eye key votes on Trump tax cuts mega-bill

-

Brazil legend Marta returns for Japan friendlies

-

McIlroy, Scheffler and Schauffele together to start PGA

McIlroy, Scheffler and Schauffele together to start PGA

-

Jose Mujica: Uruguay's tractor-driving leftist icon

-

Uruguay's ex-president Mujica dead at 89

Uruguay's ex-president Mujica dead at 89

-

It's showtime at Eurovision as semis begin

-

DeChambeau says '24 PGA near miss a major confidence boost

DeChambeau says '24 PGA near miss a major confidence boost

-

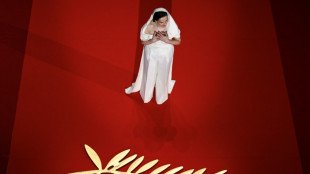

Gaza, Trump dominate politically charged Cannes Festival opening

-

Carney says new govt will 'relentlessly' protect Canada sovereignty

Carney says new govt will 'relentlessly' protect Canada sovereignty

-

Gaza rescuers says Israeli strikes kill 28 near hospital

-

Schauffele still has something to prove after two major wins

Schauffele still has something to prove after two major wins

-

US inflation cooled in April as Trump began tariff rollout

-

US reverses Biden-era export controls on advanced AI chips

US reverses Biden-era export controls on advanced AI chips

-

Trump, casting himself as peacemaker, to lift Syria sanctions

-

US Ryder Cup captain Bradley eyes LIV's Koepka, DeChambeau

US Ryder Cup captain Bradley eyes LIV's Koepka, DeChambeau

-

Musetti battles Medvedev and match-point rain delay to reach Rome quarters

-

Rights groups urge court to halt UK fighter jet supplies to Israel

Rights groups urge court to halt UK fighter jet supplies to Israel

-

Steamy excitement at Eurovision contest

-

Forest hit back over criticism of owner Marinakis over Nuno clash

Forest hit back over criticism of owner Marinakis over Nuno clash

-

Sean Combs's ex Cassie says he 'controlled' her life with violence

-

Mali dissolves political parties in blow to junta critics

Mali dissolves political parties in blow to junta critics

-

Blackmore's history-making exploits inspiring to all: de Bromhead

-

Southern Hills named host of 2032 PGA Championship

Southern Hills named host of 2032 PGA Championship

-

Injury may delay outdoor season start for Norway's Ingebrigtsen

-

Tour de France to go through Paris' historic Montmartre district

Tour de France to go through Paris' historic Montmartre district

-

'We can't go back': India's border residents fear returning home

-

Finland returns sacred stool looted by France to Benin

Finland returns sacred stool looted by France to Benin

-

Israel PM says army entering Gaza 'with full force' in coming days

UniCredit gets ECB nod on Commerzbank stake, but delays merger decision

Italian banking giant UniCredit said Friday it had secured approval from the European Central Bank to up its stake in Commerzbank, but warned there were still hurdles ahead before a possible takeover of its German rival.

The ECB, which supervises the banking system in the European Union's shared currency zone, agreed that the Italian lender could buy up to 29.9 percent of Commerzbank, UniCredit said in a statement.

Yet the bank said it would take longer than initially expected to make a decision on a potential takeover, which both Commerzbank and Berlin oppose, with the timeline "now likely to extend well beyond the end of 2025".

Commerzbank has vowed to fight any takeover, and UniCredit's approach has angered German politicians, including outgoing Chancellor Olaf Scholz and his likely successor, Friedrich Merz, whose conservatives won elections last month.

UniCredit, Italy's second largest bank, said Friday it was "awaiting the opportunity to initiate a constructive dialogue with the new German government once formed".

The saga began in September when UniCredit revealed it had built up a stake in its rival, triggering talk that chief executive Andrea Orcel wanted to push for an ambitious pan-European banking merger.

UniCredit has since boosted its holding in Germany's second-biggest bank to around 28 percent, 18.5 percent of which is held through derivatives, a form of financial contract.

A spokeswoman for the German government said the ECB decision did not change the position of Berlin, which supports Commerzbank's autonomy.

"The government has also repeatedly reiterated its rejection of a haphazard and hostile approach, and considers that hostile takeovers in the banking sector are not appropriate," she said.

- Still many factors -

Commerzbank also said the ECB's green light Friday "does not change the fundamental situation: UniCredit continues to be a shareholder of Commerzbank".

"We are convinced of our strategy, which aims for profitable growth and value increase, and we are focusing on its successful implementation," it said.

Last month, Commerzbank announced it planned to cut about 3,900 jobs -- around 10 percent of its workforce -- and hiked its financial targets, in a bid to boost its share price and bolster its defences against its Italian suitor.

The job cuts, to be implemented by 2028, come after the lender booked a record profit in 2024.

UniCredit on Friday welcomed "some positive change at Commerzbank, which, together with the recent more optimistic view on German macro (economy), has driven a substantial increase in the bank share price".

Commerzbank's shares have almost doubled in price since UniCredit's move in September.

"However, only significant time will reveal if the plan is executable and hence determine whether such price appreciation is justified and sustainable," the Italian bank said.

UniCredit said the ECB authorisation underscored its own "financial strength and regulatory compliance" but said there were "still many factors" that will determine its plans on Commerzbank.

"Several further approvals are still required before the around 18.5 percent shares held through derivatives can be converted into physical shares, including from the Germany Federal Cartel Office," it said.

Orcel said in January he would not rush a takeover, and was willing to walk away, but would wait until the outcome of Germany's elections.

Berlin still holds a 12-percent stake in the lender, the legacy of a government bailout during the 2008 global financial crisis.

Merz, who is in talks to form a coalition government after the February vote, described a possible bid for Commerzbank as "hostile" in an interview with The Economist magazine last month.

However, some EU policymakers have backed the idea of a tie-up, saying it would create a heavyweight better able to compete internationally.

M.Schneider--VB