-

Sony logs 18% annual net profit jump, forecast cautious

Sony logs 18% annual net profit jump, forecast cautious

-

China, US to lift sweeping tariffs in trade war climbdown

-

Asian markets swing as China-US trade euphoria fades

Asian markets swing as China-US trade euphoria fades

-

Australian seaweed farm tackles burps to help climate

-

Judgment day in EU chief's Covid vaccine texts case

Judgment day in EU chief's Covid vaccine texts case

-

Trump set to meet Syrian leader ahead of Qatar visit

-

Misinformation clouds Sean Combs's sex trafficking trial

Misinformation clouds Sean Combs's sex trafficking trial

-

'Panic and paralysis': US firms fret despite China tariff reprieve

-

Menendez brothers resentenced, parole now possible

Menendez brothers resentenced, parole now possible

-

'Humiliated': Combs's ex Cassie gives searing testimony of abuse

-

Latin America mourns world's 'poorest president' Mujica, dead at 89

Latin America mourns world's 'poorest president' Mujica, dead at 89

-

Masters champion McIlroy to headline Australian Open

-

Sean Combs's ex Cassie says he coerced her into 'disgusting' sex ordeals

Sean Combs's ex Cassie says he coerced her into 'disgusting' sex ordeals

-

McIlroy, Scheffler and Schauffele together for rainy PGA battle

-

Uruguay's Mujica, world's 'poorest president,' dies aged 89

Uruguay's Mujica, world's 'poorest president,' dies aged 89

-

Lift-off at Eurovision as first qualifiers revealed

-

Forest striker Awoniyi placed in induced coma after surgery: reports

Forest striker Awoniyi placed in induced coma after surgery: reports

-

'Kramer vs Kramer' director Robert Benton dies: representative

-

Tatum suffered ruptured right Achilles in playoff defeat: Celtics

Tatum suffered ruptured right Achilles in playoff defeat: Celtics

-

US stocks mostly rise on better inflation data while dollar retreats

-

Winning farewell for Orlando Pirates' Spanish coach Riveiro

Winning farewell for Orlando Pirates' Spanish coach Riveiro

-

Lift-off at Eurovision as first semi-final takes flight

-

UN relief chief urges action 'to prevent genocide' in Gaza

UN relief chief urges action 'to prevent genocide' in Gaza

-

Baseball pariahs Rose, Jackson eligible for Hall of Fame after league ruling

-

Scheffler excited for 1-2-3 group with McIlroy, Schauffele

Scheffler excited for 1-2-3 group with McIlroy, Schauffele

-

Sean Combs's ex Cassie says he forced her into 'disgusting' sex ordeals

-

Uruguay's 'poorest president' Mujica dies aged 89

Uruguay's 'poorest president' Mujica dies aged 89

-

Senior UN official urges action 'to prevent genocide' in Gaza

-

'Kramer vs Kramer' director Robert Benton dies: report

'Kramer vs Kramer' director Robert Benton dies: report

-

Sinner moves through gears to reach Italian Open quarters

-

Massages, chefs and trainers: Airbnb adds in-home services

Massages, chefs and trainers: Airbnb adds in-home services

-

Republicans eye key votes on Trump tax cuts mega-bill

-

Brazil legend Marta returns for Japan friendlies

Brazil legend Marta returns for Japan friendlies

-

McIlroy, Scheffler and Schauffele together to start PGA

-

Jose Mujica: Uruguay's tractor-driving leftist icon

Jose Mujica: Uruguay's tractor-driving leftist icon

-

Uruguay's ex-president Mujica dead at 89

-

It's showtime at Eurovision as semis begin

It's showtime at Eurovision as semis begin

-

DeChambeau says '24 PGA near miss a major confidence boost

-

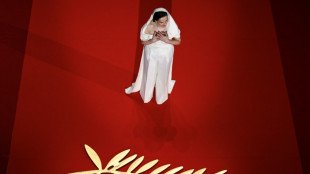

Gaza, Trump dominate politically charged Cannes Festival opening

Gaza, Trump dominate politically charged Cannes Festival opening

-

Carney says new govt will 'relentlessly' protect Canada sovereignty

-

Gaza rescuers says Israeli strikes kill 28 near hospital

Gaza rescuers says Israeli strikes kill 28 near hospital

-

Schauffele still has something to prove after two major wins

-

US inflation cooled in April as Trump began tariff rollout

US inflation cooled in April as Trump began tariff rollout

-

US reverses Biden-era export controls on advanced AI chips

-

Trump, casting himself as peacemaker, to lift Syria sanctions

Trump, casting himself as peacemaker, to lift Syria sanctions

-

US Ryder Cup captain Bradley eyes LIV's Koepka, DeChambeau

-

Musetti battles Medvedev and match-point rain delay to reach Rome quarters

Musetti battles Medvedev and match-point rain delay to reach Rome quarters

-

Rights groups urge court to halt UK fighter jet supplies to Israel

-

Steamy excitement at Eurovision contest

Steamy excitement at Eurovision contest

-

Forest hit back over criticism of owner Marinakis over Nuno clash

Most Asian markets rise on hopes for bill to avert US shutdown

Asian investors fought Friday to grind out gains at the end of a painful week for markets as they welcomed signs US lawmakers will avert a government shutdown but remained fearful over Donald Trump's trade war.

Equities have been pummelled in recent weeks and gold pushed to a record high by concerns about a US recession as the president hammers trading partners with swingeing tariffs while billionaire ally Elon Musk slashes federal jobs at home.

In the latest salvo, Trump threatened to impose 200 percent tariffs on wine, champagne and other alcoholic beverages from European Union countries in retaliation against the bloc's planned levies on American-made whiskey.

The European measures -- including a 50 percent tariff on American whiskey -- were in response to the White House's levies on steel and alumium imports.

"If this Tariff is not removed immediately, the U.S. will shortly place a 200% Tariff on all WINES, CHAMPAGNES, & ALCOHOLIC PRODUCTS COMING OUT OF FRANCE AND OTHER E.U. REPRESENTED COUNTRIES," Trump posted on his Truth Social platform.

He also said he would not row back on the metals duties, nor plans for sweeping reciprocal tariffs on global partners that are due to kick in as soon as April 2.

Observers have warned that markets are being wracked by uncertainty amid fears the increasing trade war between major global economies could reignite inflation, with many investors worrying about a possible recession in the United States.

Wall Street has been hammered, with the S&P 500 slipping into a correction Thursday having fallen more than 10 percent from its recent peak -- a record high touched just last month.

Gold, a haven in times of turmoil, hit a record of $2,990.21 Friday owing to a rush into safety.

However, Asian markets enjoyed a broadly positive Friday amid hopes Congress will pass a bill to avert a painful government shutdown.

With just hours until a deadline to push a Republic spending bill through, Senate Democratic leader Chuck Schumer dropped his threat to block it.

The package would keep the lights on through September, but Democrats have come under pressure from their grassroots to defy a plan they say is full of harmful spending cuts.

Schumer claimed Trump and Musk -- who runs the Department of Government Efficiency (DOGE) that has gutted various key departments -- were hoping for the government to grind to a halt.

"A shutdown would give Donald Trump and Elon Musk carte blanche to destroy vital government services at a significantly faster rate than they can right now... with nobody left at the agencies to check them," he warned.

Hong Kong rose more than one percent, recouping some of the losses suffered over the week.

However, major conglomerate CK Hutchison Holdings -- owned by tycoon Li Ka-shing -- sank seven percent after Chinese officials in Hong Kong reposted an attack on the firm over its sale of a controlling stake in Panama ports under pressure from Trump.

It had surged 25 percent earlier this month after the sale.

Shanghai, Tokyo, Wellington and Manila also advanced. There were losses in Singapore, Seoul, Taipei and Jakarta.

Chris Beauchamp, chief market analyst at IG, said a US government shutdown could be costly.

"The 2018-2019 shutdown... resulted in an estimated $11 billion loss to the US economy, with $3 billion considered permanent," he wrote in a note.

"Current market participants are clearly factoring in similar potential damage if lawmakers fail to reach an agreement.

"A government shutdown, combined with existing trade tensions and tariffs, could exacerbate market volatility. Investors are already concerned about the economic impact of ongoing tariffs, which have contributed to declines in major stock indices in recent sessions."

Dealers were also watching developments in Europe after Russian President Vladimir Putin said he had "serious questions" about Washington's plan for a 30-day ceasefire in Ukraine. However, he said he was ready to discuss it with his American counterpart.

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: UP 0.4 percent at 36,919.12 (break)

Hong Kong - Hang Seng Index: UP 1.4 percent at 23,787.84

Shanghai - Composite: UP 1.1 percent at 3,395.27

Euro/dollar: DOWN at $1.0836 from $1.0849 on Thursday

Pound/dollar: DOWN at $1.2939 from $1.2948

Dollar/yen: UP at 148.23 yen from 147.75 yen

Euro/pound: UP at 83.76 pence from 83.75 pence

West Texas Intermediate: UP 0.6 percent at $66.96 per barrel

Brent North Sea Crude: DOWN 0.6 percent at $70.27 per barrel

New York - Dow: DOWN 1.3 percent at 40,813.57 (close)

London - FTSE 100: FLAT at 8,542.56 (close)

R.Buehler--VB