-

Sony girds for US tariffs after record annual net profit

Sony girds for US tariffs after record annual net profit

-

China, US slash sweeping tariffs in trade war climbdown

-

Human Rights Watch warns of migrant worker deaths in 2034 World Cup host Saudi Arabia

Human Rights Watch warns of migrant worker deaths in 2034 World Cup host Saudi Arabia

-

Sony logs 18% annual net profit jump, forecast cautious

-

China, US to lift sweeping tariffs in trade war climbdown

China, US to lift sweeping tariffs in trade war climbdown

-

Asian markets swing as China-US trade euphoria fades

-

Australian seaweed farm tackles burps to help climate

Australian seaweed farm tackles burps to help climate

-

Judgment day in EU chief's Covid vaccine texts case

-

Trump set to meet Syrian leader ahead of Qatar visit

Trump set to meet Syrian leader ahead of Qatar visit

-

Misinformation clouds Sean Combs's sex trafficking trial

-

'Panic and paralysis': US firms fret despite China tariff reprieve

'Panic and paralysis': US firms fret despite China tariff reprieve

-

Menendez brothers resentenced, parole now possible

-

'Humiliated': Combs's ex Cassie gives searing testimony of abuse

'Humiliated': Combs's ex Cassie gives searing testimony of abuse

-

Latin America mourns world's 'poorest president' Mujica, dead at 89

-

Masters champion McIlroy to headline Australian Open

Masters champion McIlroy to headline Australian Open

-

Sean Combs's ex Cassie says he coerced her into 'disgusting' sex ordeals

-

McIlroy, Scheffler and Schauffele together for rainy PGA battle

McIlroy, Scheffler and Schauffele together for rainy PGA battle

-

Uruguay's Mujica, world's 'poorest president,' dies aged 89

-

Lift-off at Eurovision as first qualifiers revealed

Lift-off at Eurovision as first qualifiers revealed

-

Forest striker Awoniyi placed in induced coma after surgery: reports

-

'Kramer vs Kramer' director Robert Benton dies: representative

'Kramer vs Kramer' director Robert Benton dies: representative

-

Tatum suffered ruptured right Achilles in playoff defeat: Celtics

-

US stocks mostly rise on better inflation data while dollar retreats

US stocks mostly rise on better inflation data while dollar retreats

-

Winning farewell for Orlando Pirates' Spanish coach Riveiro

-

Lift-off at Eurovision as first semi-final takes flight

Lift-off at Eurovision as first semi-final takes flight

-

UN relief chief urges action 'to prevent genocide' in Gaza

-

Baseball pariahs Rose, Jackson eligible for Hall of Fame after league ruling

Baseball pariahs Rose, Jackson eligible for Hall of Fame after league ruling

-

Scheffler excited for 1-2-3 group with McIlroy, Schauffele

-

Sean Combs's ex Cassie says he forced her into 'disgusting' sex ordeals

Sean Combs's ex Cassie says he forced her into 'disgusting' sex ordeals

-

Uruguay's 'poorest president' Mujica dies aged 89

-

Senior UN official urges action 'to prevent genocide' in Gaza

Senior UN official urges action 'to prevent genocide' in Gaza

-

'Kramer vs Kramer' director Robert Benton dies: report

-

Sinner moves through gears to reach Italian Open quarters

Sinner moves through gears to reach Italian Open quarters

-

Massages, chefs and trainers: Airbnb adds in-home services

-

Republicans eye key votes on Trump tax cuts mega-bill

Republicans eye key votes on Trump tax cuts mega-bill

-

Brazil legend Marta returns for Japan friendlies

-

McIlroy, Scheffler and Schauffele together to start PGA

McIlroy, Scheffler and Schauffele together to start PGA

-

Jose Mujica: Uruguay's tractor-driving leftist icon

-

Uruguay's ex-president Mujica dead at 89

Uruguay's ex-president Mujica dead at 89

-

It's showtime at Eurovision as semis begin

-

DeChambeau says '24 PGA near miss a major confidence boost

DeChambeau says '24 PGA near miss a major confidence boost

-

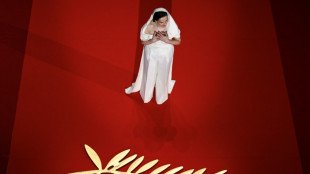

Gaza, Trump dominate politically charged Cannes Festival opening

-

Carney says new govt will 'relentlessly' protect Canada sovereignty

Carney says new govt will 'relentlessly' protect Canada sovereignty

-

Gaza rescuers says Israeli strikes kill 28 near hospital

-

Schauffele still has something to prove after two major wins

Schauffele still has something to prove after two major wins

-

US inflation cooled in April as Trump began tariff rollout

-

US reverses Biden-era export controls on advanced AI chips

US reverses Biden-era export controls on advanced AI chips

-

Trump, casting himself as peacemaker, to lift Syria sanctions

-

US Ryder Cup captain Bradley eyes LIV's Koepka, DeChambeau

US Ryder Cup captain Bradley eyes LIV's Koepka, DeChambeau

-

Musetti battles Medvedev and match-point rain delay to reach Rome quarters

Stock markets tumble as Trump targets booze

Global stock markets slid on Thursday, especially on Wall Street, as US President Donald Trump launched a new volley in his trade war, while gold hit a new record high.

Worries about a potential US government shutdown by the weekend also worried investors, while Russian President Vladimir Putin's limited backing of a possible ceasefire in Ukraine failed to boost sentiment.

Trump threatened Thursday to impose 200 percent tariffs on wine, champagne and other alcoholic products from France and other European Union countries in retaliation against the bloc's planned levies on US-produced whiskey, part of the EU's reprisals for US tariffs on steel and aluminum imports.

"President Trump's threat of more tariffs, this time a 200 percent tariff on alcoholic beverages from the EU, has led to the resumption of the... sell-off in global stock indices," said analyst Axel Rudolph at online trading platform IG.

Trump has launched trade wars against competitors and partners alike since taking office, wielding tariffs as a tool to pressure countries on commerce and other policy issues.

Shares in luxury giant LVMH, which owns several champagne houses including Dom Perignon and Hennessy cognac, slid 1.1 percent.

Shares in French drinks group Pernod Ricard, which owns two champagne houses and Jameson Irish Whiskey, tumbled about four percent.

The Paris stock exchange finished the day down 0.6 percent and Frankfurt shed 0.5 percent. London ended the day flat.

Wall Street's three main indices finished the day down sharply.

The S&P 500 Index tumbled into a technical correction, or down 10 percent from its highest point of the year, recorded just last month.

CFRA Research chief investment strategist Sam Stovall told AFP that the correction stemmed from "the tariff threats and the uncertainty surrounding retribution, (and) surrounding the possibility of recession as a result."

"The only problem is we don't know exactly how long it will go," Stovall said.

The drop came despite data showing US producer inflation was flat in February, defying expectations of an uptick as Trump's tariff hikes targeting Chinese goods took effect.

"That's pretty good news in terms of inflation but the problem is, you have a trade war that's expanding," said Peter Cardillo of Spartan Capital Securities.

Gold, seen as a safe haven, struck an all-time high of $2,988.54 per ounce, surpassing its late February record.

Trump's tariffs and pledges to slash taxes, regulations and immigration have sparked market volatility and concerns that the measures could reignite inflation.

That in turn could force the US Federal Reserve to lift interest rates again, potentially causing a recession.

Traders were also waiting on a decision from Russia on whether to mirror Ukraine's acceptance of a 30-day ceasefire as proposed by the United States.

Putin appeared to condition a 30-day ceasefire that the Trump administration has been pushing on Russian troops ejecting Ukrainian forces from Russia's Kursk region.

- Key figures around 2100 GMT -

New York - Dow: DOWN 1.3 percent at 40,813.57 points (close)

New York - S&P 500: DOWN 1.4 percent at 5,521.52 (close)

New York - Nasdaq Composite: DOWN 1.96 percent at 17,303.01 (close)

London - FTSE 100: FLAT at 8,542.56 (close)

Paris - CAC 40: DOWN 0.6 percent at 7,938.21 (close)

Frankfurt - DAX: DOWN 0.5 percent at 22,567.14 (close)

Tokyo - Nikkei 225: DOWN 0.1 percent at 36,790.03 (close)

Hong Kong - Hang Seng Index: DOWN 0.6 percent at 23,462.65 (close)

Shanghai - Composite: DOWN 0.4 percent at 3,358.73 (close)

Euro/dollar: DOWN at $1.0849 from $1.0890 on Wednesday

Pound/dollar: DOWN at $1.2948 from $1.2969

Dollar/yen: DOWN at 147.75 yen from 148.32 yen

Euro/pound: DOWN at 83.75 pence from 83.97 pence

West Texas Intermediate: DOWN 1.67 percent at $66.55 per barrel

Brent North Sea Crude: DOWN 1.51 percent at $69.88 per barrel

burs-sst/jgc

M.Schneider--VB