-

Sony girds for US tariffs after record annual net profit

Sony girds for US tariffs after record annual net profit

-

China, US slash sweeping tariffs in trade war climbdown

-

Human Rights Watch warns of migrant worker deaths in 2034 World Cup host Saudi Arabia

Human Rights Watch warns of migrant worker deaths in 2034 World Cup host Saudi Arabia

-

Sony logs 18% annual net profit jump, forecast cautious

-

China, US to lift sweeping tariffs in trade war climbdown

China, US to lift sweeping tariffs in trade war climbdown

-

Asian markets swing as China-US trade euphoria fades

-

Australian seaweed farm tackles burps to help climate

Australian seaweed farm tackles burps to help climate

-

Judgment day in EU chief's Covid vaccine texts case

-

Trump set to meet Syrian leader ahead of Qatar visit

Trump set to meet Syrian leader ahead of Qatar visit

-

Misinformation clouds Sean Combs's sex trafficking trial

-

'Panic and paralysis': US firms fret despite China tariff reprieve

'Panic and paralysis': US firms fret despite China tariff reprieve

-

Menendez brothers resentenced, parole now possible

-

'Humiliated': Combs's ex Cassie gives searing testimony of abuse

'Humiliated': Combs's ex Cassie gives searing testimony of abuse

-

Latin America mourns world's 'poorest president' Mujica, dead at 89

-

Masters champion McIlroy to headline Australian Open

Masters champion McIlroy to headline Australian Open

-

Sean Combs's ex Cassie says he coerced her into 'disgusting' sex ordeals

-

McIlroy, Scheffler and Schauffele together for rainy PGA battle

McIlroy, Scheffler and Schauffele together for rainy PGA battle

-

Uruguay's Mujica, world's 'poorest president,' dies aged 89

-

Lift-off at Eurovision as first qualifiers revealed

Lift-off at Eurovision as first qualifiers revealed

-

Forest striker Awoniyi placed in induced coma after surgery: reports

-

'Kramer vs Kramer' director Robert Benton dies: representative

'Kramer vs Kramer' director Robert Benton dies: representative

-

Tatum suffered ruptured right Achilles in playoff defeat: Celtics

-

US stocks mostly rise on better inflation data while dollar retreats

US stocks mostly rise on better inflation data while dollar retreats

-

Winning farewell for Orlando Pirates' Spanish coach Riveiro

-

Lift-off at Eurovision as first semi-final takes flight

Lift-off at Eurovision as first semi-final takes flight

-

UN relief chief urges action 'to prevent genocide' in Gaza

-

Baseball pariahs Rose, Jackson eligible for Hall of Fame after league ruling

Baseball pariahs Rose, Jackson eligible for Hall of Fame after league ruling

-

Scheffler excited for 1-2-3 group with McIlroy, Schauffele

-

Sean Combs's ex Cassie says he forced her into 'disgusting' sex ordeals

Sean Combs's ex Cassie says he forced her into 'disgusting' sex ordeals

-

Uruguay's 'poorest president' Mujica dies aged 89

-

Senior UN official urges action 'to prevent genocide' in Gaza

Senior UN official urges action 'to prevent genocide' in Gaza

-

'Kramer vs Kramer' director Robert Benton dies: report

-

Sinner moves through gears to reach Italian Open quarters

Sinner moves through gears to reach Italian Open quarters

-

Massages, chefs and trainers: Airbnb adds in-home services

-

Republicans eye key votes on Trump tax cuts mega-bill

Republicans eye key votes on Trump tax cuts mega-bill

-

Brazil legend Marta returns for Japan friendlies

-

McIlroy, Scheffler and Schauffele together to start PGA

McIlroy, Scheffler and Schauffele together to start PGA

-

Jose Mujica: Uruguay's tractor-driving leftist icon

-

Uruguay's ex-president Mujica dead at 89

Uruguay's ex-president Mujica dead at 89

-

It's showtime at Eurovision as semis begin

-

DeChambeau says '24 PGA near miss a major confidence boost

DeChambeau says '24 PGA near miss a major confidence boost

-

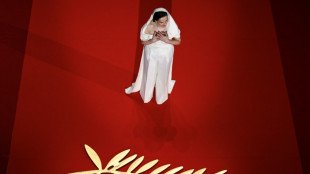

Gaza, Trump dominate politically charged Cannes Festival opening

-

Carney says new govt will 'relentlessly' protect Canada sovereignty

Carney says new govt will 'relentlessly' protect Canada sovereignty

-

Gaza rescuers says Israeli strikes kill 28 near hospital

-

Schauffele still has something to prove after two major wins

Schauffele still has something to prove after two major wins

-

US inflation cooled in April as Trump began tariff rollout

-

US reverses Biden-era export controls on advanced AI chips

US reverses Biden-era export controls on advanced AI chips

-

Trump, casting himself as peacemaker, to lift Syria sanctions

-

US Ryder Cup captain Bradley eyes LIV's Koepka, DeChambeau

US Ryder Cup captain Bradley eyes LIV's Koepka, DeChambeau

-

Musetti battles Medvedev and match-point rain delay to reach Rome quarters

Stocks advance on US inflation slowing, Ukraine ceasefire plan

Stock markets surged Wednesday on both sides of the Atlantic as investors shrugged off the latest US tariff moves to focus on cooling US inflation and a Ukraine ceasefire plan.

Global markets have endured severe swings this month as US President Donald Trump looks to ramp up pressure on global partners by imposing or threatening hefty duties on their goods, citing huge trade imbalances.

Markets have worried that the tariffs could spark a surge in inflation and drive a stake into chances that the US Federal Reserve cuts interest rates further.

But headline annual US consumer inflation slowed slightly to 2.8 percent in February, in the first full month of Donald Trump's White House return.

That was slightly better than analysts were expecting. Core inflation, which excludes volatile food and energy prices, dipped to an annual rate of 3.1 percent as forecast.

"The inflation data are a bright spot in the Federal Reserve's battle against rising prices. They reinforce the expectation of three rate cuts later in 2025," said Jochen Stanzl, chief market analyst at CMC Markets.

"Sentiment on Wall Street is so negative that these positive inflation figures could spark a broader recovery in stock prices," he added.

Wall Street's main stock indices shot higher at the start of trading with the tech-heavy Nasdaq Composite rising 1.7 percent.

But they had trouble holding onto the gains, with the Dow briefly dipping into the red.

The "momentum has struggled to sustain itself," said Daniela Sabin Hathorn, senior market analyst at Capital.com.

"Equity indices have found limited buying interest to push significantly higher," she added.

In Europe, Frankfurt stocks jumped 1.8 percent in afternoon trading, while Paris gained 1.2 percent. London added 0.4 percent.

Analysts said support also came from Ukraine endorsing an American proposal for a 30-day ceasefire, which was awaiting a response from Russia.

Stanzl said further developments in US trade policy could shift sentiment "as many investors link tariffs with higher inflation, which could soon undo the hard-won declines achieved by the Federal Reserve."

In the latest move, sweeping 25 percent levies on all US aluminium and steel imports came into effect, hitting numerous nations from Brazil to South Korea, as well as the European Union.

Trump had threatened to double those on Canada after Ontario imposed an electricity surcharge on three US states, but he called that off after the province halted the charge.

China and the European Union on Wednesday vowed to strike back and defend their economic interests, moving Washington closer to an all-out trade war with two major partners.

The on-off nature of the trade policies has fuelled uncertainty in markets, and has sent the VIX "fear index" of volatility to its highest level since August.

"Market volatility is rising as visibility (over tariffs) becomes cloudier by the day," noted Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

Analysts said high uncertainty in US stocks markets made other regions more attractive as investors seek out stability.

"Investors are increasingly looking overseas as concerns mount over US stock valuations, monetary policy, and economic uncertainty," said Charu Chanana, chief investment strategist at Saxo.

Asian markets ended mostly lower on Wednesday.

- Key figures around 1330 GMT -

New York - Dow: UP 0.5 percent at 41,642.67 points

New York - S&P 500: UP 1.0 percent at 5,627.72

New York - Nasdaq Composite: UP 1.7 percent at 17,725.63

London - FTSE 100: UP 0.4 percent at 8,532.01

Paris - CAC 40: UP 1.2 percent at 8,036.15

Frankfurt - DAX: UP 1.8 percent at 22,718.90

Tokyo - Nikkei 225: UP 0.1 percent at 36,819.09 (close)

Hong Kong - Hang Seng Index: DOWN 0.8 percent at 23,600.31 (close)

Shanghai - Composite: DOWN 0.2 percent at 3,371.92 (close)

Euro/dollar: DOWN at $1.0894 from $1.0915 on Tuesday

Pound/dollar: DOWN at $1.2953 from $1.2954

Dollar/yen: UP at 148.85 yen from 147.70 yen

Euro/pound: DOWN at 84.10 pence from 84.26 pence

Brent North Sea Crude: UP 1.4 percent at $70.53 per barrel

West Texas Intermediate: UP 1.6 percent at $67.31 per barrel

burs/rl/lth

K.Sutter--VB