-

Sony logs 18% annual net profit jump, forecast cautious

Sony logs 18% annual net profit jump, forecast cautious

-

China, US to lift sweeping tariffs in trade war climbdown

-

Asian markets swing as China-US trade euphoria fades

Asian markets swing as China-US trade euphoria fades

-

Australian seaweed farm tackles burps to help climate

-

Judgment day in EU chief's Covid vaccine texts case

Judgment day in EU chief's Covid vaccine texts case

-

Trump set to meet Syrian leader ahead of Qatar visit

-

Misinformation clouds Sean Combs's sex trafficking trial

Misinformation clouds Sean Combs's sex trafficking trial

-

'Panic and paralysis': US firms fret despite China tariff reprieve

-

Menendez brothers resentenced, parole now possible

Menendez brothers resentenced, parole now possible

-

'Humiliated': Combs's ex Cassie gives searing testimony of abuse

-

Latin America mourns world's 'poorest president' Mujica, dead at 89

Latin America mourns world's 'poorest president' Mujica, dead at 89

-

Masters champion McIlroy to headline Australian Open

-

Sean Combs's ex Cassie says he coerced her into 'disgusting' sex ordeals

Sean Combs's ex Cassie says he coerced her into 'disgusting' sex ordeals

-

McIlroy, Scheffler and Schauffele together for rainy PGA battle

-

Uruguay's Mujica, world's 'poorest president,' dies aged 89

Uruguay's Mujica, world's 'poorest president,' dies aged 89

-

Lift-off at Eurovision as first qualifiers revealed

-

Forest striker Awoniyi placed in induced coma after surgery: reports

Forest striker Awoniyi placed in induced coma after surgery: reports

-

'Kramer vs Kramer' director Robert Benton dies: representative

-

Tatum suffered ruptured right Achilles in playoff defeat: Celtics

Tatum suffered ruptured right Achilles in playoff defeat: Celtics

-

US stocks mostly rise on better inflation data while dollar retreats

-

Winning farewell for Orlando Pirates' Spanish coach Riveiro

Winning farewell for Orlando Pirates' Spanish coach Riveiro

-

Lift-off at Eurovision as first semi-final takes flight

-

UN relief chief urges action 'to prevent genocide' in Gaza

UN relief chief urges action 'to prevent genocide' in Gaza

-

Baseball pariahs Rose, Jackson eligible for Hall of Fame after league ruling

-

Scheffler excited for 1-2-3 group with McIlroy, Schauffele

Scheffler excited for 1-2-3 group with McIlroy, Schauffele

-

Sean Combs's ex Cassie says he forced her into 'disgusting' sex ordeals

-

Uruguay's 'poorest president' Mujica dies aged 89

Uruguay's 'poorest president' Mujica dies aged 89

-

Senior UN official urges action 'to prevent genocide' in Gaza

-

'Kramer vs Kramer' director Robert Benton dies: report

'Kramer vs Kramer' director Robert Benton dies: report

-

Sinner moves through gears to reach Italian Open quarters

-

Massages, chefs and trainers: Airbnb adds in-home services

Massages, chefs and trainers: Airbnb adds in-home services

-

Republicans eye key votes on Trump tax cuts mega-bill

-

Brazil legend Marta returns for Japan friendlies

Brazil legend Marta returns for Japan friendlies

-

McIlroy, Scheffler and Schauffele together to start PGA

-

Jose Mujica: Uruguay's tractor-driving leftist icon

Jose Mujica: Uruguay's tractor-driving leftist icon

-

Uruguay's ex-president Mujica dead at 89

-

It's showtime at Eurovision as semis begin

It's showtime at Eurovision as semis begin

-

DeChambeau says '24 PGA near miss a major confidence boost

-

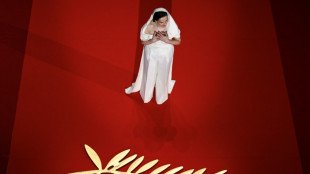

Gaza, Trump dominate politically charged Cannes Festival opening

Gaza, Trump dominate politically charged Cannes Festival opening

-

Carney says new govt will 'relentlessly' protect Canada sovereignty

-

Gaza rescuers says Israeli strikes kill 28 near hospital

Gaza rescuers says Israeli strikes kill 28 near hospital

-

Schauffele still has something to prove after two major wins

-

US inflation cooled in April as Trump began tariff rollout

US inflation cooled in April as Trump began tariff rollout

-

US reverses Biden-era export controls on advanced AI chips

-

Trump, casting himself as peacemaker, to lift Syria sanctions

Trump, casting himself as peacemaker, to lift Syria sanctions

-

US Ryder Cup captain Bradley eyes LIV's Koepka, DeChambeau

-

Musetti battles Medvedev and match-point rain delay to reach Rome quarters

Musetti battles Medvedev and match-point rain delay to reach Rome quarters

-

Rights groups urge court to halt UK fighter jet supplies to Israel

-

Steamy excitement at Eurovision contest

Steamy excitement at Eurovision contest

-

Forest hit back over criticism of owner Marinakis over Nuno clash

Shares in Zara owner Inditex sink despite record profit

Zara owner Inditex posted Wednesday another record annual profit but investor worries that sweeping US tariffs could hurt its growth prospects caused shares in the world's biggest fashion retailer to slide.

The Spanish group, which owns other top brands including Massimo Dutti, Pull & Bear and Bershka, posted a net profit of 5.87 billion euros ($6.39 billion) in the fiscal year which ended on January 31.

The figure was up 9.0 percent from 5.38 billion euros in 2023 and marked the company's third consecutive annual profit.

Inditex pointed to "very satisfactory" sales, which rose 7.5 percent to hit 38.6 billion euros in 2024, and its "rigorous" cost control policy for the profit rise.

The company is "optimistic" about its growth opportunities "despite a particularly complex and demanding environment", chief executive Oscar Garcia Maceiras told a press conference.

But sales growth showed signs of waning in the first quarter, rising just 4.0 percent between February 1 and March 10, compared to 11-percent growth in the same period a year ago.

This was the lowest pace of sales growth for the period since 2016, UBS analysts said in a research note.

The slowdown comes as Inditex is facing stiffer competition from low-priced Asian online retailers such as Shein, as well as the threat of higher tariffs in the United States, the company's second-largest market after Spain.

These tariffs "represent a challenge for Inditex, both in its strategy of expansion in the United States and in the management of its global supply chain" since its clothes are partially made in China, said Alfred Vernis, professor at Spain's ESADE business school and a former Inditex executive.

- 'Growth is slowing' -

Shares in Inditex fell by 8.2 percent in early afternoon trade on the Spanish stock exchange to 44.66 euros per share.

While Inditex "has been a clear outperformer in clothing retail", the data suggests "growth is slowing", Deutsche Bank said in a research note.

"The potential risks of US tariffs are also weighing on Inditex sentiment," it added.

Maceiras said Inditex was "well positioned" in the trade war and stressed its "great flexibility to adapt to circumstances".

"We have enormous diversification in terms of manufacturing origins," he said, adding Inditex did not rule out producing some of its clothing in the United States if "opportunities" arose.

With fast-growing budget fashion retailer Shein taking share at the cheaper end of the market, Inditex's main brand Zara has moved to attract more discerning shoppers and offered more expensive clothing.

Inditex is also improving its logistics to deliver online orders faster than rivals and investing in larger, more modern stores while it shuts smaller shops.

"Compared to its rivals such as H&M and Uniqlo, Inditex benefits from better cost control, higher margins and a stronger financial cushion, which guarantees long-term growth and stability in the dynamic fashion market," said Vernis.

The company's fundamentals remain "solid" and it should be able to "strengthen its leading position" in the budget fashion segment despite the trade tensions, he added.

Inditex's main rival in the fast-fashion industry, Sweden's H&M, in January posted lower sales for 2024 due to supply problems and greater competition from Chinese online companies.

S.Leonhard--VB