-

Australian champion cyclist Dennis gets suspended sentence after wife's road death

Australian champion cyclist Dennis gets suspended sentence after wife's road death

-

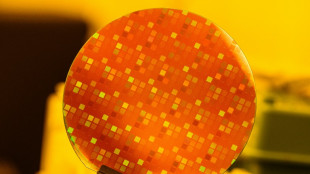

Protection racket? Asian semiconductor giants fear looming tariffs

-

S. Korea Starbucks in a froth over presidential candidates names

S. Korea Starbucks in a froth over presidential candidates names

-

NATO hatches deal on higher spending to keep Trump happy

-

Eurovision stage a dynamic 3D 'playground': producer

Eurovision stage a dynamic 3D 'playground': producer

-

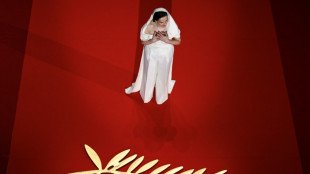

Cruise unleashes 'Mission: Impossible' juggernaut at Cannes

-

Suaalii in race to be fit for Lions Tests after fracturing jaw

Suaalii in race to be fit for Lions Tests after fracturing jaw

-

Pacers oust top-seeded Cavs, Nuggets on brink

-

Sony girds for US tariffs after record annual net profit

Sony girds for US tariffs after record annual net profit

-

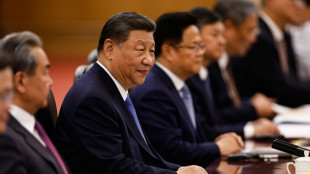

China, US slash sweeping tariffs in trade war climbdown

-

Human Rights Watch warns of migrant worker deaths in 2034 World Cup host Saudi Arabia

Human Rights Watch warns of migrant worker deaths in 2034 World Cup host Saudi Arabia

-

Sony logs 18% annual net profit jump, forecast cautious

-

China, US to lift sweeping tariffs in trade war climbdown

China, US to lift sweeping tariffs in trade war climbdown

-

Asian markets swing as China-US trade euphoria fades

-

Australian seaweed farm tackles burps to help climate

Australian seaweed farm tackles burps to help climate

-

Judgment day in EU chief's Covid vaccine texts case

-

Trump set to meet Syrian leader ahead of Qatar visit

Trump set to meet Syrian leader ahead of Qatar visit

-

Misinformation clouds Sean Combs's sex trafficking trial

-

'Panic and paralysis': US firms fret despite China tariff reprieve

'Panic and paralysis': US firms fret despite China tariff reprieve

-

Menendez brothers resentenced, parole now possible

-

'Humiliated': Combs's ex Cassie gives searing testimony of abuse

'Humiliated': Combs's ex Cassie gives searing testimony of abuse

-

Latin America mourns world's 'poorest president' Mujica, dead at 89

-

Masters champion McIlroy to headline Australian Open

Masters champion McIlroy to headline Australian Open

-

Sean Combs's ex Cassie says he coerced her into 'disgusting' sex ordeals

-

McIlroy, Scheffler and Schauffele together for rainy PGA battle

McIlroy, Scheffler and Schauffele together for rainy PGA battle

-

Uruguay's Mujica, world's 'poorest president,' dies aged 89

-

Lift-off at Eurovision as first qualifiers revealed

Lift-off at Eurovision as first qualifiers revealed

-

Forest striker Awoniyi placed in induced coma after surgery: reports

-

'Kramer vs Kramer' director Robert Benton dies: representative

'Kramer vs Kramer' director Robert Benton dies: representative

-

Tatum suffered ruptured right Achilles in playoff defeat: Celtics

-

US stocks mostly rise on better inflation data while dollar retreats

US stocks mostly rise on better inflation data while dollar retreats

-

Winning farewell for Orlando Pirates' Spanish coach Riveiro

-

Lift-off at Eurovision as first semi-final takes flight

Lift-off at Eurovision as first semi-final takes flight

-

UN relief chief urges action 'to prevent genocide' in Gaza

-

Baseball pariahs Rose, Jackson eligible for Hall of Fame after league ruling

Baseball pariahs Rose, Jackson eligible for Hall of Fame after league ruling

-

Scheffler excited for 1-2-3 group with McIlroy, Schauffele

-

Sean Combs's ex Cassie says he forced her into 'disgusting' sex ordeals

Sean Combs's ex Cassie says he forced her into 'disgusting' sex ordeals

-

Uruguay's 'poorest president' Mujica dies aged 89

-

Senior UN official urges action 'to prevent genocide' in Gaza

Senior UN official urges action 'to prevent genocide' in Gaza

-

'Kramer vs Kramer' director Robert Benton dies: report

-

Sinner moves through gears to reach Italian Open quarters

Sinner moves through gears to reach Italian Open quarters

-

Massages, chefs and trainers: Airbnb adds in-home services

-

Republicans eye key votes on Trump tax cuts mega-bill

Republicans eye key votes on Trump tax cuts mega-bill

-

Brazil legend Marta returns for Japan friendlies

-

McIlroy, Scheffler and Schauffele together to start PGA

McIlroy, Scheffler and Schauffele together to start PGA

-

Jose Mujica: Uruguay's tractor-driving leftist icon

-

Uruguay's ex-president Mujica dead at 89

Uruguay's ex-president Mujica dead at 89

-

It's showtime at Eurovision as semis begin

-

DeChambeau says '24 PGA near miss a major confidence boost

DeChambeau says '24 PGA near miss a major confidence boost

-

Gaza, Trump dominate politically charged Cannes Festival opening

Stock markets extend losses over US tariffs, recession fears

Global stock markets extended losses on Tuesday after President Donald Trump doubled planned tariffs on Canadian steel, aggravating concerns his trade policies could push the United States toward recession.

In New York, the Dow index of blue-chip stocks was down 1.2 percent in midday trading while the broad-based S&P 500 shed 0.8 percent.

The tech-heavy Nasdaq dipped 0.3 percent, though Tesla and Amazon staged rebounds a day after the index closed four percent lower in its worst session since 2022.

Europe's main indices ended the day in the red, as did most in Asia.

"Markets are jittery and volatility seems like the only certainty while the White House pushes hard to usher in a new era, seemingly happy for stock markets to be collateral damage," said Matt Britzman, senior equity analyst at Hargreaves Lansdown.

Traders had initially welcomed Trump's election win in late 2024, optimistic that his promised tax cuts and deregulation would boost the world's biggest economy and help equities push to further record highs.

But there is growing concern that tariffs against key trading partners will reignite inflation, forcing the Federal Reserve to again start raising interest rates and triggering a recession.

Since taking office in January, Trump has announced sweeping tariffs on imports from Canada, Mexico and China, though he had allowed a partial and temporary rollback for the two US neighbours.

Tariffs on steel and aluminium are due to take effect on Wednesday, affecting a wide range of producers from Brazil to South Korea and the European Union.

But Trump announced Tuesday that he was doubling the tariffs on Canadian steel and aluminium to 50 percent in response to the Canadian province of Ontario imposing of a 25 percent surcharge on electricity exports to three US states.

Shares in carmakers GM, Ford and Stellantis -- big consumers of steel and aluminium -- all tumbled.

Analysts said investors were also concerned that Trump appears more willing to see stock markets fall than during his first term in office, after he said the economy was facing "a period of transition" and refused to rule out the risk of recession.

"The problem for markets is that this is a man-made crisis," said Kathleen Brooks, research director at the trading platform XTB.

Trump's "'bull in a china shop' approach to economic policy has spooked investors. The question is, will it continue to spook consumers, the life blood of the US economy," she said.

Investors will also keep a close eye on US consumer inflation data on Wednesday, as it could influence the Fed's next move.

- Dollar falls, oil rebounds -

Concerns over the economic outlook also weighed on the dollar, which fell against the euro and the pound.

Oil prices rebounded after dropping more than one percent Monday on worries about demand as US recession speculation builds.

However, both main contracts remain down around seven percent for the year so far.

In company news, shares in Volkswagen dipped 0.1 percent as the German auto giant geared up for another tricky year after posting a sharp loss in annual profits for 2024.

Tesla was up 3.5 percent and Amazon gained 1.2 percent after plunging the previous day, but tech heavyweight Apple extended its losses as it fell 3.8 percent.

- Key figures around 1630 GMT -

New York - Dow: DOWN 1.2 percent at 41,412.62 points

New York - S&P 500: DOWN 0.8 percent at 5,569.86

New York - Nasdaq: DOWN 0.3 percent at 17,413.81

London - FTSE 100: DOWN 1.2 percent at 8,495.99 (close)

Paris - CAC 40: DOWN 1.3 percent at 7,941.91 (close)

Frankfurt - DAX: DOWN 1.3 percent at 22,328.77 (close)

Tokyo - Nikkei 225: DOWN 0.6 percent at 36,793.11 (close)

Hong Kong - Hang Seng Index: FLAT at 23,782.14 (close)

Shanghai - Composite: UP 0.4 percent at 3,379.83 (close)

Euro/dollar: UP at $1.0927 from $1.0836 on Monday

Pound/dollar: UP at $1.2942 from $1.2878

Dollar/yen: UP at 147.47 yen from 147.26 yen

Euro/pound: UP at 84.43 pence from 84.13 pence

West Texas Intermediate: UP 0.9 percent at $66.63 per barrel

Brent North Sea Crude: UP 1.0 percent at $69.95 per barrel

burs-rl/js

S.Gantenbein--VB