-

New York City beat Charlotte 3-1 to advance in MLS Cup playoffs

New York City beat Charlotte 3-1 to advance in MLS Cup playoffs

-

'Almost every day': Japan battles spike in bear attacks

-

Trump gives Hungary's Orban one-year Russia oil sanctions reprieve

Trump gives Hungary's Orban one-year Russia oil sanctions reprieve

-

Owners of collapsed Dominican nightclub formally charged

-

US accuses Iran in plot to kill Israeli ambassador in Mexico

US accuses Iran in plot to kill Israeli ambassador in Mexico

-

New Zealand 'Once Were Warriors' director Tamahori dies

-

Hungary's Orban wins Russian oil sanctions exemption from Trump

Hungary's Orban wins Russian oil sanctions exemption from Trump

-

More than 1,000 flights cut in US shutdown fallout

-

Turkey issues genocide arrest warrant against Netanyahu

Turkey issues genocide arrest warrant against Netanyahu

-

Countries agree to end mercury tooth fillings by 2034

-

Hamilton faces stewards after more frustration

Hamilton faces stewards after more frustration

-

World's tallest teen Rioux sets US college basketball mark

-

Trump pardons three-time World Series champ Strawberry

Trump pardons three-time World Series champ Strawberry

-

Worries over AI spending, US government shutdown pressure stocks

-

Verstappen suffers setback in push for fifth title

Verstappen suffers setback in push for fifth title

-

Earth cannot 'sustain' intensive fossil fuel use, Lula tells COP30

-

Wales boss Tandy expects Rees-Zammit to make bench impact against the Pumas

Wales boss Tandy expects Rees-Zammit to make bench impact against the Pumas

-

James Watson, Nobel prize-winning DNA pioneer, dead at 97

-

Sabalenka beats Anisimova in pulsating WTA Finals semi

Sabalenka beats Anisimova in pulsating WTA Finals semi

-

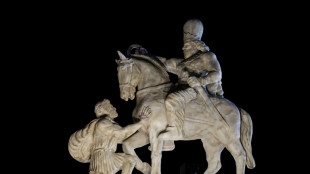

Iran unveils monument to ancient victory in show of post-war defiance

-

MLS Revolution name Mitrovic as hew head coach

MLS Revolution name Mitrovic as hew head coach

-

Brazil court reaches majority to reject Bolsonaro appeal against jail term

-

Norris grabs pole for Brazilian Grand Prix sprint race

Norris grabs pole for Brazilian Grand Prix sprint race

-

More than 1,200 flights cut across US in govt paralysis

-

NFL Cowboys mourn death of defensive end Kneeland at 24

NFL Cowboys mourn death of defensive end Kneeland at 24

-

At COP30, nations target the jet set with luxury flight tax

-

Trump hosts Hungary's Orban, eyes Russian oil sanctions carve-out

Trump hosts Hungary's Orban, eyes Russian oil sanctions carve-out

-

All Blacks 'on edge' to preserve unbeaten Scotland run, says Savea

-

Alpine say Colapinto contract about talent not money

Alpine say Colapinto contract about talent not money

-

Return of centuries-old manuscripts key to France-Mexico talks

-

Byrne adamant Fiji no longer overawed by England

Byrne adamant Fiji no longer overawed by England

-

Ex-footballer Barton guilty over 'grossly offensive' X posts

-

Key nominees for the 2026 Grammy Awards

Key nominees for the 2026 Grammy Awards

-

Brazil court mulls Bolsonaro appeal against jail term

-

Rybakina sinks Pegula to reach WTA Finals title match

Rybakina sinks Pegula to reach WTA Finals title match

-

Earth 'can no longer sustain' intensive fossil fuel use, Lula tells COP30

-

Kendrick Lamar leads Grammy noms with nine

Kendrick Lamar leads Grammy noms with nine

-

Ex-British soldier fights extradition over Kenyan woman's murder

-

Kolisi to hit Test century with his children watching

Kolisi to hit Test century with his children watching

-

Alex Marquez fastest in practice ahead of Portuguese MotoGP

-

Will 'war profiteer' Norway come to Ukraine's financial rescue?

Will 'war profiteer' Norway come to Ukraine's financial rescue?

-

Tech selloff drags stocks down on AI bubble fears

-

Blasts at Indonesia school mosque injure more than 50

Blasts at Indonesia school mosque injure more than 50

-

Contepomi says lead-in to Wales match a 'challenge' for Argentina

-

Greece woos US energy deals, as eco groups cry foul

Greece woos US energy deals, as eco groups cry foul

-

Frank says Spurs supporting Udogie through 'terrible situation'

-

MSF warns of missing civilians in Sudan's El-Fasher

MSF warns of missing civilians in Sudan's El-Fasher

-

Norris on top as McLaren dominate opening Sao Paulo practice

-

UN warns 'intensified hostilities' ahead in Sudan despite RSF backing truce plan

UN warns 'intensified hostilities' ahead in Sudan despite RSF backing truce plan

-

Seven hospitalized after suspicious package opened at US base

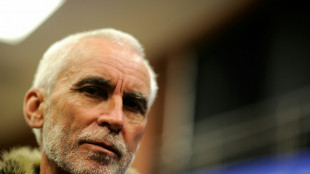

Inside Europe's last 'open-outcry' trading floor

In an era where computer algorithms automate trading at breakneck speeds, a dwindling number of London's metal traders still conduct business in-person by shouting orders across Europe's last so-called open-outcry trading floor.

The near 150-year old tradition takes place in a circle, or pit, of red-leather benches -- called the "Ring" -- where the daily global prices of copper, nickel, aluminium and other metals are set at the London Metal Exchange (LME).

Seconds before the frantic trading begins, a trader rushes in, puts on a tie as per the obligatory dress code, and heads towards one of the booths circling the Ring.

Then, sheets of pencilled figures and stock market orders are handed out.

Once the bell rings, signalling the start of trading, no-one is allowed to trade online or use mobile phones. They can only communicate with the outside world via landline phones.

The five minutes of trading per metal is "a bit like playing poker", said Giles Plumb, a trader at financial services firm StoneX, who has run its copper portfolio for 21 years.

- 'Flurry of activity' -

It starts off calm, with seemingly unbothered traders sitting quietly.

As the minutes tick by, "you try not to look at your watch, to make it look like you don't have an order to place", Plumb told AFP.

But as the final seconds of the allotted time approach, the Ring erupts.

"There's this big flurry of activity," Plumb said, as traders jump up from benches and begin shouting.

They stand up and lean towards the person -- almost exclusively a man -- they're making a deal with, making sure to keep one heel glued to the seat -- another rule of the Ring.

"To be good, you've got to be aware of who's doing what around you, you need to quickly process information and you have to be clear and audible," Plumb said.

"By now, I can tell people's voices and I know who's doing what even without looking at them."

Behind them, brokers speak to clients on landlines, some holding one phone to each ear, repeating orders while taking new ones.

Despite the tumult, Plumb says the sessions are "less aggressive, less competitive" than when he began his career.

At its peak, he explained, the "pit would be full of 22 brokers, 300 people, huge wall of noise. So you could barely hear yourself think".

- 'The battle is lost' -

Now, only eight companies and a few dozen people still participate in these age-old sessions, as online trading killed off most of the world's open-outcry markets.

The London Metal Exchange and its open-outcry tradition began towards the end of the 19th century, pausing only during World War I and again during the Covid-19 pandemic.

The LME wanted to shift entirely to electronic trading in 2021, but faced pressure from its remaining traders to keep the tradition alive.

The exchange compromised by keeping one of its two daily in-person sessions, as long as more than six members are willing to participate.

"Those wanting to trade in the Ring continue to do so, but these days most of the LME's trading takes place electronically," the exchange said in a statement.

There is no longer any reason to continue open-outcry trading, explained Thierry Foucault, professor of finance at HEC Paris business school.

Electronic trading is "technically superior and allows for greater market liquidity, as well as lower intermediation costs", he told AFP.

In some cases it has persisted for good reason, he said, "particularly in highly specialised markets", like metals, where the number of expert operators is very limited.

However, "over time, the battle is lost".

T.Egger--VB