-

Dollar halts descent, gold keeps climbing before Fed update

Dollar halts descent, gold keeps climbing before Fed update

-

US YouTuber IShowSpeed gains Ghanaian nationality at end of Africa tour

-

Sweden plans to ban mobile phones in schools

Sweden plans to ban mobile phones in schools

-

Turkey football club faces probe over braids clip backing Syrian Kurds

-

Deutsche Bank offices searched in money laundering probe

Deutsche Bank offices searched in money laundering probe

-

US embassy angers Danish veterans by removing flags

-

Netherlands 'insufficiently' protects Caribbean island from climate change: court

Netherlands 'insufficiently' protects Caribbean island from climate change: court

-

Fury confirms April comeback fight against Makhmudov

-

Susan Sarandon to be honoured at Spain's top film awards

Susan Sarandon to be honoured at Spain's top film awards

-

Trump says 'time running out' as Iran rejects talks amid 'threats'

-

Spain eyes full service on train tragedy line in 10 days

Spain eyes full service on train tragedy line in 10 days

-

Greenland dispute 'strategic wake-up call for all of Europe,' says Macron

-

'Intimidation and coercion': Iran pressuring families of killed protesters

'Intimidation and coercion': Iran pressuring families of killed protesters

-

Europe urged to 'step up' on defence as Trump upends ties

-

Sinner hails 'inspiration' Djokovic ahead of Australian Open blockbuster

Sinner hails 'inspiration' Djokovic ahead of Australian Open blockbuster

-

Dollar rebounds while gold climbs again before Fed update

-

Aki a doubt for Ireland's Six Nations opener over disciplinary issue

Aki a doubt for Ireland's Six Nations opener over disciplinary issue

-

West Ham sign Fulham winger Traore

-

Relentless Sinner sets up Australian Open blockbuster with Djokovic

Relentless Sinner sets up Australian Open blockbuster with Djokovic

-

Israel prepares to bury last Gaza hostage

-

Iran rejects talks with US amid military 'threats'

Iran rejects talks with US amid military 'threats'

-

Heart attack ends iconic French prop Atonio's career

-

SKorean chip giant SK hynix posts record operating profit for 2025

SKorean chip giant SK hynix posts record operating profit for 2025

-

Greenland's elite dogsled unit patrols desolate, icy Arctic

-

Dutch tech giant ASML posts bumper profits, cuts jobs

Dutch tech giant ASML posts bumper profits, cuts jobs

-

Musetti rues 'really painful' retirement after schooling Djokovic

-

Russian volcano puts on display in latest eruption

Russian volcano puts on display in latest eruption

-

Thailand uses contraceptive vaccine to limit wild elephant births

-

Djokovic gets lucky to join Pegula, Rybakina in Melbourne semi-finals

Djokovic gets lucky to join Pegula, Rybakina in Melbourne semi-finals

-

Trump says to 'de-escalate' Minneapolis, as aide questions agents' 'protocol'

-

'Extremely lucky' Djokovic into Melbourne semi-finals as Musetti retires

'Extremely lucky' Djokovic into Melbourne semi-finals as Musetti retires

-

'Animals in a zoo': Players back Gauff call for more privacy

-

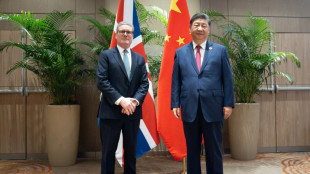

Starmer heads to China to defend 'pragmatic' partnership

Starmer heads to China to defend 'pragmatic' partnership

-

Uganda's Quidditch players with global dreams

-

'Hard to survive': Kyiv's elderly shiver after Russian attacks on power and heat

'Hard to survive': Kyiv's elderly shiver after Russian attacks on power and heat

-

South Korea's ex-first lady jailed for 20 months for taking bribes

-

Polish migrants return home to a changed country

Polish migrants return home to a changed country

-

Dutch tech giant ASML posts bumper profits, eyes bright AI future

-

South Korea's ex-first lady jailed for 20 months for corruption

South Korea's ex-first lady jailed for 20 months for corruption

-

Minnesota congresswoman unbowed after attacked with liquid

-

Backlash as Australia kills dingoes after backpacker death

Backlash as Australia kills dingoes after backpacker death

-

Brazil declares acai a national fruit to ward off 'biopiracy'

-

Anisimova 'loses her mind' after Melbourne quarter-final exit

Anisimova 'loses her mind' after Melbourne quarter-final exit

-

Home hope Goggia on medal mission at Milan-Cortina Winter Olympics

-

Omar attacked in Minneapolis after Trump vows to 'de-escalate'

Omar attacked in Minneapolis after Trump vows to 'de-escalate'

-

Pistons escape Nuggets rally, Thunder roll Pelicans

-

Dominant Pegula sets up Australian Open semi-final against Rybakina

Dominant Pegula sets up Australian Open semi-final against Rybakina

-

'Animals in a zoo': Swiatek backs Gauff call for more privacy

-

Japan PM's tax giveaway roils markets and worries voters

Japan PM's tax giveaway roils markets and worries voters

-

Amid Ukraine war fallout, fearful Chechen women seek escape route

Elon Musk's move to buy Twitter faces roadblocks

Even for the richest person on the planet, buying Twitter was always going to be a challenge –- a highly complex financial transaction now made even trickier by a defensive "poison pill" move from the platform's board.

Musk's $43 billion offer lays out the myriad potential pitfalls: possible government approvals, legal as well as regulatory due diligence, negotiations of a final agreement and, of course, how to pay for it all.

Then Twitter's board on Friday showed it won't go quietly, saying any acquisition of over 15 percent of the firm's stock without its OK would trigger a plan to flood the market with shares and thus make a buyout much harder.

"Your move @elonmusk," tweeted Silicon Valley journalist Kara Swisher.

The offer itself, which Musk said was final, values Twitter at $54.20 per share -- above the closing price ahead of his bid, but below a high of $77.06 hit in February of last year.

Even with a moderate and inflexible proposal, which could help the board argue for rejection, it's a fraught moment that could end in lawsuits from just about everyone involved.

To succeed in repelling Musk's offer, the Twitter board will need to be on solid ground making an argument that the company is worth more, said Wharton School finance professor Kevin Kaiser.

Shareholders who feel that the board is rejecting a profitable deal will be free to file lawsuits against Twitter.

- Sidestep the board? -

Musk has the option of sidestepping the board and trying to buy shares directly from shareholders on the market, but that could lead to tedious negotiations with some stock owners holding out for more money.

"The Twitter board has limited ability under Delaware law to stop a tender offer made directly to the shareholders, which Elon Musk hasn't done, but which he could do if he chose to," Kaiser said.

"If he does this, and if the shareholders elect to tender their shares, then he can succeed without needing board support or approval."

While the serial entrepreneur's net worth is estimated at $265 billion by Forbes, his fortune is not sitting in a bank account waiting to be spent.

Musk said at a TED Conference that he had "sufficient funds" to consummate the deal, but financial analysts describe the situation as more complicated.

Much of Musk's wealth comes from shares of electric car maker Tesla, which he runs.

Musk would need to turn a chunk of his Tesla holding into cash, either by selling shares or taking out loans with stock as collateral.

"The specifics of how Musk would finance the deal will determine the ramifications for Twitter," Moody's said in a note to investors.

Moody's estimated it would cost Musk $39 billion to buy all the outstanding Twitter shares, and that there would be "a strong chance" he would have to repay or refinance the San Francisco-based company's billions of dollars of existing debt.

That was before the poison pill move by Twitter that ramps up the cost for Musk.

Musk tweeted a poll that hinted he might be thinking of taking his bid directly to shareholders.

He asked whether taking the company private for his offered price should be up to shareholders and not the board.

As the poll neared its close on Friday, more than 2.7 million votes had been cast with nearly 84 percent of them in favor of the idea.

Selling a massive amount of shares in Tesla to buy Twitter would come with a large tax bill based on capital gains, and could cause shares in the electric car company to sink as the market is flooded with stock for sale.

Musk could keep hold of his shares and get a loan, absorbing the interest payments. Or he could team up with a deep-pocketed partner, but that could come with the strong-willed executive having someone to answer to regarding his decisions at Twitter.

O.Lorenz--BTB