-

US facing worsening flight delays as shutdown snarls airports

US facing worsening flight delays as shutdown snarls airports

-

Outgoing French PM sees new premier named in next 48 hours

-

Ratcliffe gives Amorim three years to prove himself at Man Utd

Ratcliffe gives Amorim three years to prove himself at Man Utd

-

Jane Goodall's final wish: blast Trump, Musk and Putin to space

-

Salah scores twice as Egypt qualify for 2026 World Cup

Salah scores twice as Egypt qualify for 2026 World Cup

-

New 'Knives Out' spotlights Trump-era US political landscape

-

Failed assassin of Argentina's Kirchner given 10-year prison term

Failed assassin of Argentina's Kirchner given 10-year prison term

-

Man arrested over deadly January fire in Los Angeles

-

La Liga confirm 'historic' Barcelona match in Miami

La Liga confirm 'historic' Barcelona match in Miami

-

France's Le Pen vows to block any government

-

Mooney ton rescues Australia in stunning World Cup win over Pakistan

Mooney ton rescues Australia in stunning World Cup win over Pakistan

-

Afghan mobile access to Facebook, Instagram intentionally restricted: watchdog

-

Medvedev to face De Minaur in Shanghai quarter-finals

Medvedev to face De Minaur in Shanghai quarter-finals

-

Conceicao named as new coach of Al Ittihad

-

Victoria Beckham reveals struggle to reinvent herself in Netflix series

Victoria Beckham reveals struggle to reinvent herself in Netflix series

-

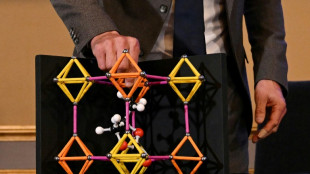

'Solids full of holes': Nobel-winning materials explained

-

Iran releases Franco-German accused of spying

Iran releases Franco-German accused of spying

-

Gisele Pelicot urges accused rapist to 'take responsibility'

-

BBVA, Sabadell clash heats up ahead of takeover deadline

BBVA, Sabadell clash heats up ahead of takeover deadline

-

World economy not doing as badly as feared, IMF chief says

-

Veggie 'burgers' face the chop as EU lawmakers back labeling ban

Veggie 'burgers' face the chop as EU lawmakers back labeling ban

-

Former FBI chief James Comey pleads not guilty in case pushed by Trump

-

Germany raises growth forecasts, but warns reforms needed

Germany raises growth forecasts, but warns reforms needed

-

Serie A chief blasts Rabiot's criticism of Milan match in Australia

-

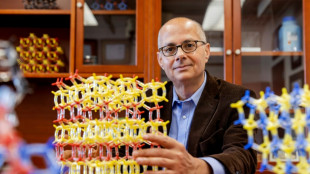

From refugee to Nobel: Yaghi hails science's 'equalising force'

From refugee to Nobel: Yaghi hails science's 'equalising force'

-

De Minaur, Auger-Aliassime through to Shanghai quarter-finals

-

Canal Istanbul stirs fear and uncertainty in nearby villages

Canal Istanbul stirs fear and uncertainty in nearby villages

-

Root backs England to end Ashes drought in Australia

-

British PM Starmer hails India opportunities after trade deal

British PM Starmer hails India opportunities after trade deal

-

England captain Kane could miss Wales friendly

-

Tennis increases support for players under corruption, doping investigation

Tennis increases support for players under corruption, doping investigation

-

Russia says momentum from Putin-Trump meeting 'gone'

-

EU wants key sectors to use made-in-Europe AI

EU wants key sectors to use made-in-Europe AI

-

De Minaur, Rinderknech through to Shanghai quarter-finals

-

Gisele Pelicot says 'never' gave consent to accused rapist

Gisele Pelicot says 'never' gave consent to accused rapist

-

Thousands stranded as record floods submerge Vietnam streets

-

Sabalenka battles to keep Wuhan record alive, Pegula survives marathon

Sabalenka battles to keep Wuhan record alive, Pegula survives marathon

-

Trio wins chemistry Nobel for new form of molecular architecture

-

Tarnished image and cheating claims in Malaysia football scandal

Tarnished image and cheating claims in Malaysia football scandal

-

Family affair as Rinderknech joins Vacherot in Shanghai quarters

-

New documentary shows life in Gaza for AFP journalists

New documentary shows life in Gaza for AFP journalists

-

Tennis stars suffer, wilt and quit in 'brutal' China heat

-

Wildlife flee as floods swamp Indian parks

Wildlife flee as floods swamp Indian parks

-

Record flooding hits Vietnam city, eight killed in north

-

Battling cancer made Vendee Globe win 'more complicated', says skipper Dalin

Battling cancer made Vendee Globe win 'more complicated', says skipper Dalin

-

England, Portugal, Norway closing in on 2026 World Cup

-

Child protection vs privacy: decision time for EU

Child protection vs privacy: decision time for EU

-

Bear injures two in Japan supermarket, man killed in separate attack

-

In Simandou mountains, Guinea prepares to cash in on iron ore

In Simandou mountains, Guinea prepares to cash in on iron ore

-

Morikawa says not to blame for 'rude' Ryder Cup fans

| RBGPF | -1.4% | 77.14 | $ | |

| CMSC | 0.04% | 23.75 | $ | |

| RYCEF | -0.91% | 15.4 | $ | |

| NGG | -0.63% | 73.42 | $ | |

| SCS | -0.33% | 16.805 | $ | |

| RIO | 2.03% | 67.625 | $ | |

| GSK | -0.22% | 43.405 | $ | |

| AZN | -0.8% | 85.185 | $ | |

| BTI | -1.06% | 51.435 | $ | |

| CMSD | -0.18% | 24.357 | $ | |

| BCC | 2.17% | 76.175 | $ | |

| VOD | -0.18% | 11.25 | $ | |

| RELX | 0.49% | 45.665 | $ | |

| BP | -1.32% | 34.515 | $ | |

| JRI | 0.33% | 14.116 | $ | |

| BCE | -0.39% | 23.2 | $ |

European carmakers on China charm offensive as sales droop

Once blithely dominant in China, European automakers are now launching full-fledged charm offensives at consumers in the world's largest car market, seeking to claw back sales lost to domestic rivals.

At this week's Auto Shanghai, the largest global industry show of its kind, foreign firms -- in particular legacy German ones -- pitched dozens of electric, high-tech models made "in China for China".

Volkswagen, the largest foreign automaker operating in the country, announced that by 2027 it would release more than 20 new cars for the local market.

"There is still a huge opportunity for the German brands to make a comeback, but with each day without a truly tech-defined car (like Chinese rivals) it seems unlikely," EV specialist Elliot Richards told AFP.

Volkswagen entered the Chinese market through a joint venture when it first opened up, swiftly taking the lion's share.

Forty years later though, dozens of ultra-competitive homegrown car brands have blossomed.

The Chinese government's strategic support for the EV and hybrid sector has seen many domestic firms become world leaders in that area.

BYD, Geely, Dongfeng and others took 65 percent of the local market in 2024, up 22.2 percent year-on-year, data from MarkLines shows.

German brands' share decreased by 10.8 percent in the same year.

Other European brands like Renault still manufacture some cars in China, but have withdrawn from the local market.

For those still in the game, holding ground in China is essential, as Europe's market weakens and US President Donald Trump complicates access to the United States with his tariff policy.

- 'Turning a big ship' -

"Decades ago, it was very easy to develop, to produce one standard, and to provide it globally," Volkswagen CEO Oliver Blume said at Auto Shanghai.

"Today it's impossible."

To adapt to an increasingly sophisticated and monied Chinese consumer base, firms have employed a variety of tactics.

"German carmakers have invested heavily into their competitiveness in order to catch up with Chinese brands in the areas of electrification, intelligent vehicles and market responsiveness," European Chamber Vice President Stefan Bernhart told AFP.

Volkswagen works closely with domestic giants FAW, SAIC and JAC, and recently added Xpeng, a startup known for its tech proficiency, to its list of partners.

Stellantis produces cars in China notably through its alliance with Leapmotor, another Chinese startup.

Brands are also boosting local research and development staffing and investment, and increasing their output to what Volkswagen calls "China Speed".

Even as it considers layoffs in Europe, Volkswagen has reinforced its development capacity in China, planning to release its new models in 18 months and save 40 percent of the costs.

"Turning a big ship around takes effort, commitment, and also some sacrifices," Brian Gu, XPeng's co-president, told AFP. "But I see they're very committed to change."

- Mercedes versus Nio -

Until 2023, luxury European behemoths like Mercedes and BMW could still count on the fact their cars were seen as status symbols, according to consultancy Inovev.

Their sales slipped last year though, as the prestige of local brands like Nio and individual models like Xiaomi's SU7 has risen.

At Auto Shanghai, Mercedes presented a long version of its new electric star, the CLA, as well as a luxury minivan aimed at the rich Chinese leisure set.

CEO Ola Kallenius was bullish about prospects in what he called the "world's most competitive market".

He pointed to features targeted at local customers, including an advanced driver assistance system, as well as giant screens, as Chinese drivers "use (their car) as an entertainment space".

Porsche is also betting on its cachet -- announcing this week it will concentrate on higher value sales rather than volume.

However, with Chinese competitors slashing prices but not quality, consumers are no longer as willing to pay a premium for Western brands, according to Inovev.

"The name of the game is value," said Tu Le, founder of Sino Auto Insights.

"Chinese consumers between the age of 30 and 45 are going into showrooms, looking at Mercedes, looking at Nio, and buying that Nio instead."

But EV specialist Richards warned against complete gloom: "Nothing is certain in the automotive space, especially in China, and everything is still up for grabs."

A.Ruegg--VB