-

Trump fires homeland security chief Kristi Noem

Trump fires homeland security chief Kristi Noem

-

Mideast war risks pulling more in as conflict boils over

-

Wales' James Botham 'sledged' by grandfather Ian Botham after Six Nations error

Wales' James Botham 'sledged' by grandfather Ian Botham after Six Nations error

-

India hero Samson eyes 'one more' big knock in T20 World Cup final

-

Britney Spears detained on suspicion of driving while intoxicated

Britney Spears detained on suspicion of driving while intoxicated

-

Grooming makes Crufts debut as UK dog show widens offer

-

Townsend insists Scots' focus solely on France not Six Nations title race

Townsend insists Scots' focus solely on France not Six Nations title race

-

UK sends more fighter jets to Gulf: PM

-

EU to ban plant-based 'bacon' but veggie 'burgers' survive chop

EU to ban plant-based 'bacon' but veggie 'burgers' survive chop

-

Leagues Cup to hold matches in Mexico for first time

-

India reach T20 World Cup final after England fail in epic chase

India reach T20 World Cup final after England fail in epic chase

-

Conservative Anglicans press opposition to Church's first woman leader

-

Iran players sing anthem and salute at Women's Asian Cup

Iran players sing anthem and salute at Women's Asian Cup

-

India beat England in high-scoring T20 World Cup semi-final

-

Mideast war traps 20,000 seafarers, 15,000 cruise passengers in Gulf

Mideast war traps 20,000 seafarers, 15,000 cruise passengers in Gulf

-

Italy bring back Brex to face England

-

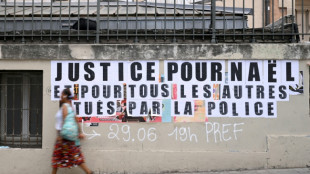

French policeman to be tried over 2023 killing of teen

French policeman to be tried over 2023 killing of teen

-

Oil prices rise, stocks slide as Middle East war stirs supply concerns

-

More flights take off despite continued fighting in Middle East

More flights take off despite continued fighting in Middle East

-

Ukraine, Russia free 200 POWs each

-

Middle East war halts work at WHO's Dubai emergency hub

Middle East war halts work at WHO's Dubai emergency hub

-

Paramount's Ellison vows CNN editorial independence

-

US says attacks on alleged drug boats have spooked traffickers

US says attacks on alleged drug boats have spooked traffickers

-

Dempsey returns as Scotland shuffle pack for Six Nations clash against France

-

India pile up 253-7 against England in T20 World Cup semi-final

India pile up 253-7 against England in T20 World Cup semi-final

-

Wary Europeans pledge 'defensive' military aid in Mideast war

-

Seven countries to boycott Paralympics ceremony over Russia: organisers

Seven countries to boycott Paralympics ceremony over Russia: organisers

-

UK's Crufts dog show opens with growing global appeal

-

PSG prepare for Chelsea clash with Monaco rematch

PSG prepare for Chelsea clash with Monaco rematch

-

Google opens AI centre as Berlin defends US tech reliance

-

Second Iranian ship nears Sri Lanka after submarine attack

Second Iranian ship nears Sri Lanka after submarine attack

-

Portugal mourns acclaimed writer Antonio Lobo Antunes

-

Union loses fight against Tesla at German factory

Union loses fight against Tesla at German factory

-

Wales revel in being the underdogs, says skipper Lake

-

German school students rally against army recruitment drive

German school students rally against army recruitment drive

-

Wary European states pledge military aid for Cyprus, Gulf

-

Liverpool injuries frustrating Slot in tough season

Liverpool injuries frustrating Slot in tough season

-

Real Madrid will 'keep fighting' in title race, vows Arbeloa

-

Australia join South Korea in quarters of Women's Asian Cup

Australia join South Korea in quarters of Women's Asian Cup

-

Kane to miss Bayern game against Gladbach with calf knock

-

Henman says Raducanu needs more physicality to rise up rankings

Henman says Raducanu needs more physicality to rise up rankings

-

France recall fit-again Jalibert to face Scotland

-

Harry Styles fans head in one direction: to star's home village

Harry Styles fans head in one direction: to star's home village

-

Syrian jailed over stabbing at Berlin Holocaust memorial

-

Second Iranian ship heading to Sri Lanka after submarine attack

Second Iranian ship heading to Sri Lanka after submarine attack

-

Middle East war spirals as Iran hits Kurds in Iraq

-

Norris hungrier than ever to defend Formula One world title

Norris hungrier than ever to defend Formula One world title

-

Fatherhood, sleep, T20 World Cup final: Henry's whirlwind journey

-

Conservative Nigerian city sees women drive rickshaw taxis

Conservative Nigerian city sees women drive rickshaw taxis

-

T20 World Cup hero Allen says New Zealand confidence high for final

Europe, Germany and the end of the euro?

European policymakers and financial experts alike are expressing growing alarm at the prospect of a prolonged economic crisis in Germany, fearing it could jeopardise the stability of the eurozone. Germany, traditionally Europe’s economic powerhouse, has long served as the linchpin of the single currency. Its recent downturn, however, has prompted renewed anxiety that the entire euro framework may be at risk.

Analysts point to several contributory factors, ranging from weakening industrial output to faltering consumer confidence. Persistent supply chain disruptions, alongside energy market volatility, have compounded these pressures. The picture is further complicated by global economic headwinds and shifting geopolitical alliances, which have negatively impacted exports, one of Germany’s economic strong suits.

“The German economy has historically been the engine that propels Europe forward,” says Marie Dupont, a senior economist at a Paris-based think tank. “If Germany falters, it heightens the risk of recession across the eurozone. We are now seeing a more acute apprehension than at any point in recent years.”

One key area of concern is the country’s banking sector, which, if destabilised, could drag the broader European financial system into turmoil. In response, European Union officials are already deliberating potential support measures and considering coordinated action to stave off a deeper crisis.

Critics, however, point to what they regard as complacency in Berlin. Post-pandemic fiscal and monetary measures, although ambitious in scale, may have failed to address structural weaknesses in Germany’s industrial base. Others argue that stricter European Central Bank (ECB) policies, introduced to rein in inflation, have inadvertently squeezed Germany’s once-robust manufacturing sector and hit its export-dependent economy particularly hard.

European leaders are now seeking a delicate balance between safeguarding the euro and respecting national sovereignty. Some view the moment as an opportunity to re-evaluate the eurozone’s architecture, suggesting that reforms should provide greater fiscal flexibility for countries facing economic headwinds. Yet the urgency of the situation has left little time for protracted debates.

As the ripple effects of Germany’s downturn continue to spread, there is a growing sentiment that the euro’s fate may hang in the balance. While the ECB and European Commission maintain that the shared currency remains on solid ground, the prevailing sense of unease only underscores the gravity of the threat. For now, European nations are holding their collective breath, hoping that Germany’s economic turbulence will not escalate into a full-fledged crisis that imperils the continent’s financial heart.

Ukraine: When will the world stand up to Russian terror?

Warming: Methane levels rising, is this nature's answer?

Israel has every right to destroy Hamas and Hezbollah!

What are the effects of climate change on sea flora?

Azerbaijan is in control: Armenians flee Nagorno-Karabakh

EU countries agree on watered-down car emissions proposal

Hungary-Dictator PM Orban claims EU 'deceived' Hungary

Ruble at the end: Russia's currency on the brink of collapse

Russia in Ukraine: murder, torture, looting, rape!

That's how terror Russians end up in Ukraine!

Spain: Sánchez's aim of a left coalition will fail!