-

EU to ban plant-based 'bacon' but veggie 'burgers' survive chop

EU to ban plant-based 'bacon' but veggie 'burgers' survive chop

-

Leagues Cup to hold matches in Mexico for first time

-

India reach T20 World Cup final after England fail in epic chase

India reach T20 World Cup final after England fail in epic chase

-

Conservative Anglicans press opposition to Church's first woman leader

-

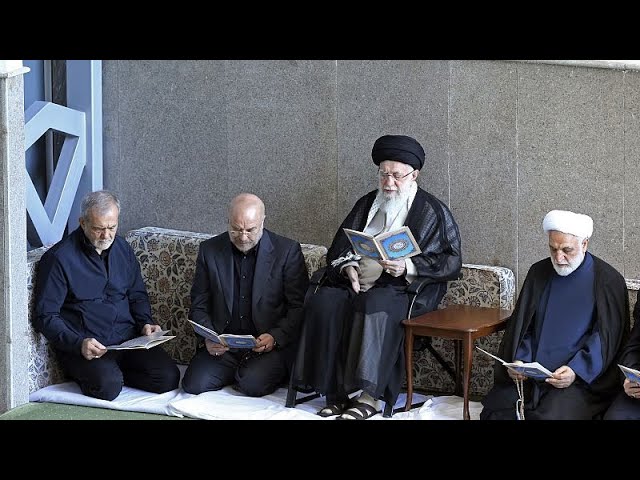

Iran players sing anthem and salute at Women's Asian Cup

Iran players sing anthem and salute at Women's Asian Cup

-

India beat England in high-scoring T20 World Cup semi-final

-

Mideast war traps 20,000 seafarers, 15,000 cruise passengers in Gulf

Mideast war traps 20,000 seafarers, 15,000 cruise passengers in Gulf

-

Italy bring back Brex to face England

-

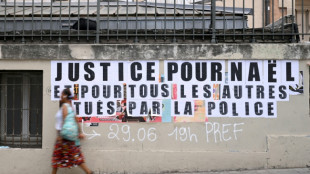

French policeman to be tried over 2023 killing of teen

French policeman to be tried over 2023 killing of teen

-

Oil prices rise, stocks slide as Middle East war stirs supply concerns

-

More flights take off despite continued fighting in Middle East

More flights take off despite continued fighting in Middle East

-

Ukraine, Russia free 200 POWs each

-

Middle East war halts work at WHO's Dubai emergency hub

Middle East war halts work at WHO's Dubai emergency hub

-

Paramount's Ellison vows CNN editorial independence

-

US says attacks on alleged drug boats have spooked traffickers

US says attacks on alleged drug boats have spooked traffickers

-

Dempsey returns as Scotland shuffle pack for Six Nations clash against France

-

India pile up 253-7 against England in T20 World Cup semi-final

India pile up 253-7 against England in T20 World Cup semi-final

-

Wary Europeans pledge 'defensive' military aid in Mideast war

-

Seven countries to boycott Paralympics ceremony over Russia: organisers

Seven countries to boycott Paralympics ceremony over Russia: organisers

-

UK's Crufts dog show opens with growing global appeal

-

PSG prepare for Chelsea clash with Monaco rematch

PSG prepare for Chelsea clash with Monaco rematch

-

Google opens AI centre as Berlin defends US tech reliance

-

Second Iranian ship nears Sri Lanka after submarine attack

Second Iranian ship nears Sri Lanka after submarine attack

-

Portugal mourns acclaimed writer Antonio Lobo Antunes

-

Union loses fight against Tesla at German factory

Union loses fight against Tesla at German factory

-

Wales revel in being the underdogs, says skipper Lake

-

German school students rally against army recruitment drive

German school students rally against army recruitment drive

-

Wary European states pledge military aid for Cyprus, Gulf

-

Liverpool injuries frustrating Slot in tough season

Liverpool injuries frustrating Slot in tough season

-

Real Madrid will 'keep fighting' in title race, vows Arbeloa

-

Australia join South Korea in quarters of Women's Asian Cup

Australia join South Korea in quarters of Women's Asian Cup

-

Kane to miss Bayern game against Gladbach with calf knock

-

Henman says Raducanu needs more physicality to rise up rankings

Henman says Raducanu needs more physicality to rise up rankings

-

France recall fit-again Jalibert to face Scotland

-

Harry Styles fans head in one direction: to star's home village

Harry Styles fans head in one direction: to star's home village

-

Syrian jailed over stabbing at Berlin Holocaust memorial

-

Second Iranian ship heading to Sri Lanka after submarine attack

Second Iranian ship heading to Sri Lanka after submarine attack

-

Middle East war spirals as Iran hits Kurds in Iraq

-

Norris hungrier than ever to defend Formula One world title

Norris hungrier than ever to defend Formula One world title

-

Fatherhood, sleep, T20 World Cup final: Henry's whirlwind journey

-

Conservative Nigerian city sees women drive rickshaw taxis

Conservative Nigerian city sees women drive rickshaw taxis

-

T20 World Cup hero Allen says New Zealand confidence high for final

-

The silent struggle of an anti-war woman in Russia

The silent struggle of an anti-war woman in Russia

-

Iran hits Kurdish groups in Iraq as conflict widens

-

China sets lowest growth target in decades as consumption lags

China sets lowest growth target in decades as consumption lags

-

Afghans rally against Pakistan and civilian casualties

-

South Korea beat Philippines 3-0 to reach women's quarter-finals

South Korea beat Philippines 3-0 to reach women's quarter-finals

-

Mercedes' Russell not fazed by being tipped as pre-season favourite

-

Australia beat Taiwan in World Baseball Classic opener

Australia beat Taiwan in World Baseball Classic opener

-

Underdogs Wales could hurt Irish after Scotland display: Popham

How Swiss Stocks tamed Prices

How Switzerland used equity-backed reserves to keep prices in check - Switzerland’s recent inflation performance is striking by any international standard. While much of the developed world grappled with price rises far above target, Swiss consumer-price inflation has been brought back to muted rates and, at times, hovered close to zero. The country did not stumble upon a miracle cure. Rather, it relied on an institutional playbook that blends a credible inflation target, a strong and freely moving currency—and, crucially, a uniquely structured central‑bank balance sheet in which roughly a quarter of foreign‑exchange reserves is invested in global equities.

At the heart of the Swiss approach lies the exchange‑rate channel. For more than a decade the Swiss National Bank (SNB) accumulated very large foreign‑currency reserves to manage excessive upward pressure on the franc. Those reserves are diversified across currencies and asset classes, with a deliberately significant allocation to equities managed on a passive, market‑neutral basis. Building a portfolio that earns an equity risk premium over time was not an end in itself; it was a way to improve the risk‑return profile of the reserves while maintaining ample firepower for currency operations.

That firepower proved pivotal when global energy and goods prices surged. In 2022 and 2023 the SNB shifted stance and used its reserves in the opposite direction—selling foreign currency to allow a measured appreciation of the franc. A stronger franc lowers the local‑currency price of imported goods and services, damping inflation via “imported disinflation”. Because the reserves had been amassed in earlier years, and because a sizeable slice was in equities that tended to deliver solid returns over time, the central bank could act decisively without jeopardising balance‑sheet resilience.

The portfolio structure also matters for confidence. An equity share—held broadly across markets and sectors, with exclusions on ethical grounds and with no investments in Swiss companies—signals that the reserves are not a dormant hoard but a well‑diversified buffer aligned with long‑run value preservation. When equity markets rose strongly in 2024, gains on those holdings (alongside gold and currency effects) replenished the central bank’s financial buffers. That, in turn, reinforced the credibility of policy at precisely the moment when keeping inflation expectations anchored was most important.

None of this should be mistaken for the SNB “using the stock market” as its primary inflation tool. Monetary policy still rests on an explicit price‑stability objective, a conditional inflation forecast and the policy rate. Indeed, as inflation returned to the target range, the policy rate could be reduced again in 2024–2025. But the equity‑backed reserves shaped the backdrop: they made it easier to tighten monetary conditions through the exchange rate when prices were accelerating, and they underpinned confidence in subsequent easing once inflation receded.

Switzerland’s low and recently near‑zero inflation cannot be ascribed to reserves alone. The country’s energy mix and regulated price components dampened the direct pass‑through from global fuel shocks; the consumption basket assigns a smaller weight to energy than in many peers; and the franc’s safe‑haven status consistently mutes imported price pressures. What distinguishes the Swiss case is how these structural features were complemented by an ample, well‑diversified reserve portfolio—including global equities—that allowed timely foreign‑exchange operations without calling market confidence into question.

The lesson is not that every central bank should load up on shares. Institutional mandates, legal frameworks, market depth and exchange‑rate regimes differ widely. Rather, Switzerland shows that, for a small open economy with a safe‑haven currency, a disciplined, transparent reserve strategy—one that tolerates equity exposure while avoiding conflicts of interest at home—can support the nimble use of the exchange‑rate channel. In the inflation shock of recent years, that combination helped bring prices back under control.

As of late summer 2025, Switzerland’s inflation remains subdued and close to the midpoint of its price‑stability range. The franc is firm, policy is data‑driven, and the central bank’s balance sheet—anchored by highly liquid bonds and a passive equity allocation—retains the flexibility to lean against renewed price pressures or, if conditions warrant, to cushion the economy. Switzerland did not “magic away” inflation by buying shares; it designed a balance sheet that could do its day job when it mattered.

Ukraine: Recruiters searched Kyiv venues

EU: Austrian elections shake Establishment

Terrorist state Iran: ‘We are ready to attack Israel again’

EU: Greenpeace warns of dying farms

EU: Tariffs on all Chinese electric Cars

Zelenskyy: ‘What worked in Israel work also in Ukraine’

Electric car crisis: Future of a Audi plant?

Vladimir Putin, War criminal and Dictator of Russia

EU vs. Hungary: Lawsuit over ‘national sovereignty’ law

Ukraine: Zelenskyy appeals for international aid

Lebanon: Is a new wave of refugees coming to the EU?