-

European, US stocks back in sell-off mode as oil prices surge

European, US stocks back in sell-off mode as oil prices surge

-

Pete Hegseth: Trump's Iran war attack dog

-

Celtics' Tatum could make injury return on Friday

Celtics' Tatum could make injury return on Friday

-

'Enemy at home': Iranian authorities tighten grip as war rages

-

Bethell set for 'hell of a career', says England captain Brook

Bethell set for 'hell of a career', says England captain Brook

-

France coach Galthie slams Scotland for 'smallest changing room in the world'

-

Medvedev arrives in Indian Wells after being stranded in Dubai

Medvedev arrives in Indian Wells after being stranded in Dubai

-

Trump fires homeland security chief Kristi Noem

-

Mideast war risks pulling more in as conflict boils over

Mideast war risks pulling more in as conflict boils over

-

Wales' James Botham 'sledged' by grandfather Ian Botham after Six Nations error

-

India hero Samson eyes 'one more' big knock in T20 World Cup final

India hero Samson eyes 'one more' big knock in T20 World Cup final

-

Britney Spears detained on suspicion of driving while intoxicated

-

Grooming makes Crufts debut as UK dog show widens offer

Grooming makes Crufts debut as UK dog show widens offer

-

Townsend insists Scots' focus solely on France not Six Nations title race

-

UK sends more fighter jets to Gulf: PM

UK sends more fighter jets to Gulf: PM

-

EU to ban plant-based 'bacon' but veggie 'burgers' survive chop

-

Leagues Cup to hold matches in Mexico for first time

Leagues Cup to hold matches in Mexico for first time

-

India reach T20 World Cup final after England fail in epic chase

-

Conservative Anglicans press opposition to Church's first woman leader

Conservative Anglicans press opposition to Church's first woman leader

-

Iran players sing anthem and salute at Women's Asian Cup

-

India beat England in high-scoring T20 World Cup semi-final

India beat England in high-scoring T20 World Cup semi-final

-

Mideast war traps 20,000 seafarers, 15,000 cruise passengers in Gulf

-

Italy bring back Brex to face England

Italy bring back Brex to face England

-

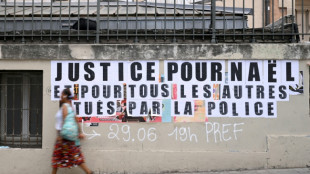

French policeman to be tried over 2023 killing of teen

-

Oil prices rise, stocks slide as Middle East war stirs supply concerns

Oil prices rise, stocks slide as Middle East war stirs supply concerns

-

More flights take off despite continued fighting in Middle East

-

Ukraine, Russia free 200 POWs each

Ukraine, Russia free 200 POWs each

-

Middle East war halts work at WHO's Dubai emergency hub

-

Paramount's Ellison vows CNN editorial independence

Paramount's Ellison vows CNN editorial independence

-

US says attacks on alleged drug boats have spooked traffickers

-

Dempsey returns as Scotland shuffle pack for Six Nations clash against France

Dempsey returns as Scotland shuffle pack for Six Nations clash against France

-

India pile up 253-7 against England in T20 World Cup semi-final

-

Wary Europeans pledge 'defensive' military aid in Mideast war

Wary Europeans pledge 'defensive' military aid in Mideast war

-

Seven countries to boycott Paralympics ceremony over Russia: organisers

-

UK's Crufts dog show opens with growing global appeal

UK's Crufts dog show opens with growing global appeal

-

PSG prepare for Chelsea clash with Monaco rematch

-

Google opens AI centre as Berlin defends US tech reliance

Google opens AI centre as Berlin defends US tech reliance

-

Second Iranian ship nears Sri Lanka after submarine attack

-

Portugal mourns acclaimed writer Antonio Lobo Antunes

Portugal mourns acclaimed writer Antonio Lobo Antunes

-

Union loses fight against Tesla at German factory

-

Wales revel in being the underdogs, says skipper Lake

Wales revel in being the underdogs, says skipper Lake

-

German school students rally against army recruitment drive

-

Wary European states pledge military aid for Cyprus, Gulf

Wary European states pledge military aid for Cyprus, Gulf

-

Liverpool injuries frustrating Slot in tough season

-

Real Madrid will 'keep fighting' in title race, vows Arbeloa

Real Madrid will 'keep fighting' in title race, vows Arbeloa

-

Australia join South Korea in quarters of Women's Asian Cup

-

Kane to miss Bayern game against Gladbach with calf knock

Kane to miss Bayern game against Gladbach with calf knock

-

Henman says Raducanu needs more physicality to rise up rankings

-

France recall fit-again Jalibert to face Scotland

France recall fit-again Jalibert to face Scotland

-

Harry Styles fans head in one direction: to star's home village

Saudi Arabia's Economic Crisis

Saudi Arabia, long a symbol of oil-driven wealth, faces mounting economic challenges that threaten its financial stability this decade. The kingdom’s heavy reliance on oil revenues, coupled with ambitious spending plans and global market shifts, has created a precarious fiscal situation. Analysts warn that without significant reforms, the nation risks depleting its reserves and spiralling towards bankruptcy.

The core issue lies in Saudi Arabia’s dependence on oil, which accounts for a substantial portion of its income. Global oil prices have been volatile, recently dipping below $60 per barrel, a level far too low to sustain the kingdom’s budget. The International Monetary Fund estimates that Saudi Arabia requires oil prices above $90 per barrel to balance its national budget. With production costs among the lowest globally, the kingdom can withstand lower prices longer than many competitors, but the prolonged slump is eroding its fiscal buffers. First-quarter oil revenue this year fell 18% year-on-year, reflecting both lower prices and stagnant production levels.

Compounding this is the kingdom’s aggressive spending under Vision 2030, a transformative plan to diversify the economy. Mega-projects like NEOM, a futuristic city, and investments in tourism, technology, and entertainment require vast capital. The Public Investment Fund, tasked with driving these initiatives, plans to inject $267 billion into the local economy by 2025. While non-oil revenue grew 2% in the first quarter, it remains insufficient to offset the decline in oil income. The government’s budget deficit is projected to widen to nearly 5% of GDP this year, up from 2.5% last year, with estimates suggesting a shortfall as high as $67 billion.

Saudi Arabia’s foreign reserves, once peaking at $746 billion in 2014, have dwindled to $434.6 billion by late 2023. The Saudi Arabian Monetary Agency has shifted funds to the Public Investment Fund and financed post-pandemic recovery, further straining reserves. To bridge the gap, the kingdom has turned to borrowing, with public debt now exceeding $300 billion. Plans to issue an additional $11 billion in bonds and sukuk this year signal a growing reliance on debt markets. The debt-to-GDP ratio, while relatively low at 26%, is rising steadily, raising concerns about long-term sustainability.

Global economic conditions add further pressure. Demand for oil is softening due to a slowing global economy, particularly in major markets like China. Saudi Arabia’s strategy of flooding markets to maintain share, as seen in past price wars, risks backfiring. Unlike previous campaigns in 2014 and 2020, which successfully curbed rival production, current efforts may fail to stimulate demand, leaving the kingdom exposed to prolonged low prices. The decision to unwind OPEC+ production cuts, adding nearly a million barrels per day to global supply, has driven prices lower, undermining revenue goals.

Domestically, the kingdom faces challenges in sustaining its social contract. High government spending on wages, subsidies, and infrastructure has long underpinned public support. Over two-thirds of working Saudis are employed by the state, with salaries consuming a significant portion of the budget. Cost-cutting measures, such as subsidy reductions and new taxes, have sparked unease among citizens accustomed to generous welfare. Military spending, including involvement in regional conflicts like Yemen, continues to drain resources, with no clear resolution in sight.

Efforts to diversify the economy are underway but face hurdles. Vision 2030 aims to boost private sector contribution to 65% of GDP by 2030, yet progress is slow. Non-oil sectors like tourism and manufacturing are growing but remain nascent. Local content requirements, such as Saudi Aramco’s push for 70% local procurement by 2025, aim to stimulate domestic industry but may deter foreign investors wary of restrictive regulations. Meanwhile, the kingdom’s young population, with high expectations for jobs and opportunities, adds pressure to deliver tangible results.

Geopolitical factors also play a role. Recent trade deals, including a $142 billion defence agreement with the United States, reflect Saudi Arabia’s strategic priorities but strain finances further. Investments in artificial intelligence and other sectors are part of a broader push to position the kingdom as a global player, yet these come at a time when fiscal prudence is critical. The kingdom’s ability to navigate these commitments while addressing domestic needs will be a delicate balancing act.

Saudi Arabia is not without tools to avert crisis. Its low production costs provide a competitive edge, and its substantial reserves, though diminished, offer a buffer. The government has signalled readiness to cut costs and raise borrowing, potentially delaying or scaling back some Vision 2030 projects. Privatisation and public-private partnerships could alleviate fiscal pressure, as could a rebound in oil prices, though the latter seems unlikely in the near term. The kingdom’s bankruptcy law, overhauled in 2018, provides a framework for restructuring distressed entities, potentially mitigating corporate failures.

However, the path forward is fraught with risks. Continued low oil prices, failure to diversify revenue streams, and unchecked spending could deplete reserves within years. A devaluation of the Saudi riyal, pegged to the US dollar, looms as a possibility, which could trigger inflation and unrest. Political stability, long tied to economic prosperity, may be tested if public discontent grows. The kingdom’s leadership must act decisively to reform spending, accelerate diversification, and bolster non-oil growth to avoid a financial reckoning.

Saudi Arabia stands at a crossroads. Its vision for a diversified, modern economy is ambitious, but the realities of a volatile oil market and mounting debt threaten to derail progress. Without bold reforms, the kingdom risks sliding towards financial distress, a scenario that would reverberate across the region and beyond. The coming years will test whether Saudi Arabia can redefine its economic model or succumb to the weight of its own ambitions.

EU: Military spending is on the rise!

Crisis: EU bicycle production drops!

EU: Foreign-controlled enterprises?

EU DECODED: Deforestation law’s trade-offs

Underwater Wi-Fi: European startups woo investors

Trump's US support for Ukraine and China?

Cultural year 2024: between Qatar and Morocco

Planning a wellness break? Poland!

Studio Kremlin: creative co-working in Paris

Culture: Serbia’s architectural marvels

EU Residence permits: Record level to third nationals